3D Secure Pay Authentication Market Research, 2032

The Global 3D Secure Pay Authentication Market was valued at $1.29 billion in 2022, and is projected to reach $3.96 billion by 2032, growing at a CAGR of 11.8% from 2022 to 2032.

3D Secure (3-domain structure) Authentication, also known as a payer authentication, is a security protocol that helps to prevent fraud for online credit card and debit card transactions. It allows banks to request extra details from a card holder to verity a purchase. 3D secure is importantly implemented in the Europe, Australia, India, Brazil, Mexico, Singapore and other countries. The technology helps in reducing the risk in relation to fraud payments, thus making online shopping and e-commerce extremely protected.

The report focuses on growth prospects, restraints, and trends of the 3D secure pay authentication market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the 3D secure pay authentication market outlook.

Key Takeaways

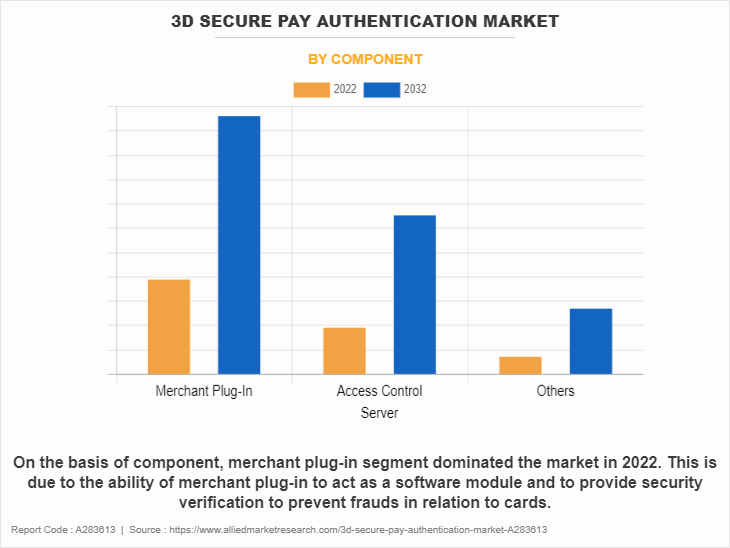

Based on component, the merchant plug-in segment held the largest market share in 3D secure pay authentication market in 2022.

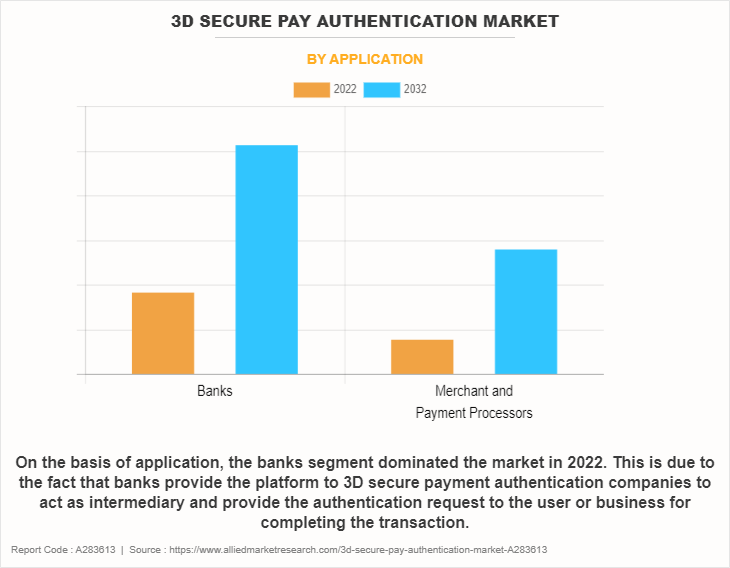

Based on application, the banks segment held the largest market share in 3D secure pay authentication market in 2022.

Based on region, the North America segment held the largest market share in 3D secure pay authentication market in 2022.

Segment Review

The global 3D secure pay authentication market is segmented into component, application, and region. By component, the 3D secure pay authentication market is divided into access control server, merchant plug-in, and others. By application, the 3D secure pay authentication market is divided into banks and, merchant and payment processors. Region-wise, the 3D secure pay authentication market is studied across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Based on component, the merchant plug-in segment held the largest share in 3D secure pay authentication market in 2022. This is due to the ability of merchant plug-in to act as a software module and to provide security verification to prevent frauds in relation to cards.

Based on application, the banks segment held the largest share in 3D secure pay authentication market in 2022. This is due to the fact that banks provide the platform to 3D secure payment authentication companies to act as intermediary and provide the authentication request to the user or business for completing the transaction.

Based on region, the North America segment held the largest share in 3D secure pay authentication market in 2022. This is due to the high presence of card payment companies in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the 3D secure pay authentication market include Visa Inc., Mastercard Inc., Broadcom Inc., Fiserv Inc., Marqeta Inc., Modrium, Entersekt, PayU (Naspers), The American Express Company, and Discover Financial Services. These players have adopted various strategies to increase their market penetration and strengthen their position in the 3D secure pay authentication industry.

Recent Product Launch in the 3D Secure Pay Authentication Market

In August 2020, Marqeta Inc. launched 3D secure solution to reduce payment fraud. The solution aims to offer flexible solution for issuers to create tailored cardholder authentication experiences that can help reduce online fraud. Marqeta’s 3D secure solution is one of the first solutions to be verified on the Visa 2.2. Standards and is designed to allow greater customization and control over fraud and authentication decisions.‐¯

In August 2020, Mastercard Inc. collaborated with Netcetera and launched 3Ds testing platform for retailers. The platform runs on the Netcetera 3DS Access Control Server (ACS) that is certified to the latest 3DS 2.2 standard. Merchants are able to test different transactions in the live system, directly in their online shop, with test cards from Mastercard. There are 19 different test cases including frictionless flows, challenge flows through different channels, or exemptions from SCA. With these tests, they can detect if their 3DS implementation complies with the EMV and Mastercard requirements. They can easily detect the reasons for errors and eliminate them where possible to improve the approved transaction rate.

In February 2023, PayU launched 3DS 2.0 SDK authentication services for Indian merchants. The solution offers a full native checkout and superior customer experience for all card transactions. PayU merchants can provide optimized customer experience while complying with major card network upgrades - including Visa and Mastercard while gaining better security and fraud protection. PayU's lightweight 3DS 2.0 SDK provides lowered latency and a 40% reduction in checkout time. This EMVCo certified offering has been developed by PayU in collaboration with Wibmo, a PayU owned full stack global PayTech company.

Market Landscape and Trends

Due to technological advancement and changes in consumer behavior and regulatory initiatives change is occurring in financial service industry. The transformation also involves the adoption of digital banking services, adoption of mobile payment, adoption of robo-advisor services, adoption of blockchain technology and others. Furthermore, open-banking initiatives are gaining popularity on a global basis, thus enabling third-party developers in building applications and services revolving around financial institution’s data and infrastructure. The trend helps in promoting innovation, competition, and collaboration inside the industry, thus resulting in the development of consumer and business products and services. Moreover, the financial offerings are getting disrupted by the evolution of fintech startups in areas such as payments, lending, insurance, wealth management and others. Fintech companies utilize the advantage of technology that helps in improving efficiency, enhancing customer experience and addressing unmet requirements in the market. Rapidly the family offices are advancing to global level, due to rich families expanding their investments and operations across different regions and asset classes. This trend is boosted by diversification search, new opportunity accessibility and the ambition to navigate regulatory environments effectively. Therefore all these factors are expected to drive the 3D secure pay authentication market opportunity during the forecast period.

Top Impacting Factors

Growing Mandatory Regulations and Consumer Expectations

Multiple drivers are working behind the growth of the 3D secure payment authentication market. These drivers have emerged from both regulatory mandatory requirements and evolving consumer expectations. In addition, regulatory requirements such as revised payment services directive in Europe are forcing businesses to implement tighter authentication measures to improve security and reduce fraud. Furthermore, the increasing importance of online transactions are driven by the expansion of e-commerce and digital payment platforms that helps in improving the importance for robust authentication solutions.

Moreover, increasing consumer awareness in relation to cyber thefts and the requirement for frictionless secure payment experience are forcing businesses to adopt 3D secure technologies to develop trust and confidence among the customer base. The confluence of regulatory pressures, technological advancements, and consumer preferences is forcing the family office market in the forward direction, with continuous growth anticipated as organizations seek to safeguard transactions and maintain customer trust in an increasing digital economy. Therefore all these factors are expected to drive the 3D secure pay authentication market growth during the forecast period.

Rising Friction and Compatibility Issues During the Payment Process

Due to adoption of 3D secure protocols that help enhance security for online transaction and add an additional layer of authentication protection is hampering the growth of 3D secure pay authentication market. In addition, increasing concern for user experience, increasing friction during the checkout process and increasing compatibility issues with different payment methods are other important factors that are hindering the growth of 3D secure pay authentication market. Furthermore, complexities in regulation and compliance requirements are creating challenges for merchant an payment service providers that are searching for implementing 3D secure solutions. Therefore all these factors are expected to hamper the growth of 3D secure pay authentication market share during the forecast period.

Increasing e-commerce Activities and Digital Transactions

E-commerce is creating important opportunities for the growth and innovation of 3D secure pay authentication market on a global scale. Due to increasing adoption of online shopping and digital transaction, there is an increasing demand for security payment solutions in order to mitigate fraud risks and enhance customer confidence. The evolution of 3D secure pay technology is offering advanced features such as biometric authentication, real-time risk assessment and seamless integration with mobile and IoT devices, that are supporting the requirements for modern consumers and merchants. Furthermore, the regulatory landscape is driving the adoption of strong customer authentication forcing the growth of 3D secure solutions. In addition, the businesses are making efforts to offer frictionless secure pay experience, and the 3D secure pay authentication technology is important for business expansion, offering opportunity for technology providers, financial institutions and merchants to innovate and capture larger share of the burgeoning digital commerce ecosystem. Therefore all these factors are expected to provide an opportunity for the growth of 3D secure pay authentication market size during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 3D secure pay authentication market analysis from 2022 to 2032 to identify the prevailing 3D secure pay authentication market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the 3D secure pay authentication market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global 3D secure pay authentication market trends, key players, market segments, application areas, and market growth strategies.

3D Secure Pay Authentication Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | PayU (Naspers), Fiserv, Inc., Modrium, Visa Inc., Broadcom, Inc., Marqeta, Inc., Entersekt, Discover Financial Services, The American Express Company, Mastercard, Inc. |

Analyst Review

3D secure is a security protocol used to authenticate users. This provides an extra layer of protection for payment card transactions in card-not-present scenarios. It is designed to allow a cardholder to authenticate its identity to?prevent payment fraud, stymie unauthorized transactions, and reduce chargebacks.

The primary function of 3D secure is to add an extra layer of verification for?online payments. While conventional transactions only require card details and a security code, a 3D secure transaction prompts the cardholder for an additional password or sends a one-off code to their mobile device. This step usually takes place in a pop-up window or an in-app interface.

Key players in the 3D secure pay authentication market adopted different strategies to sustain their growth in the market. For instance, in September 2021, Mastercard Inc. expands open banking reach with acquisition of Alia. Alia is a leading European open banking technology provider offering a direct connection to banks through a single API, allowing its customers to develop and launch new digital solutions that meet the needs of everyday life, work and play. Open banking ?is democratizing financial services by putting consumers at the center of where and how their data is used to provide the services they want and need. Fintechs and banks use this consumer permissioned data to provide easier and more inclusive access to credit, personal financial management, digital wallets and payments services. Mastercard plays a central role in this ecosystem as a trusted intermediary and secure data network. Furthermore, in April 2022, Marqeta Inc. launched risk management suite solution. The suite is designed to provide Marqeta’s customers with comprehensive risk, compliance, and fraud management capabilities across the cardholder lifecycle. Risk Control is a suite of four products: a Know Your Customer (KYC) identity verification system; a Real-Time Decisioning solution to manage payments fraud; a 3D secure tool to authenticate online transactions; and Disputes tool to manage disputes and chargebacks. These players have adopted product launch strategy and acquisition strategy to increase their market penetration and strengthen their position in the 3Dsecure pay authentication industry.

Due to technological advancement and changes in consumer behavior and regulatory initiatives, changes are occurring in financial service industry.

Banks is the leading application of 3D secure pay authentication market.

North America is the largest regional market for 3D secure pay authentication.

$1.29 billion is the estimated industry size of 3D secure pay authentication market.

Mastercard, and Visa Inc. are some of the top companies to hold the market share in the 3D secure pay authentication market.

Loading Table Of Content...

Loading Research Methodology...