5G Equipment Market Insights: 2032

The global 5g equipment market was valued at $6.4 billion in 2022, and is projected to reach $23.9 billion by 2032, growing at a CAGR of 14.5% from 2023 to 2032.

Increase in adoption of advanced technologies such as Internet of Things (IoT) across the globe and rise in digitalization, positively impact the growth of the market. In addition, rise in demand of 5G technology to enhance operation & productivity is anticipated to propel the growth of the 5g equipment market during the forecast period. For instance, in June 2023, Huawei Technologies proposed the concept of a "5.5G Era", based on an end-to-end solution that integrates comprehensive evolved technologies including 5.5G, F5.5G, and Net5.5G. This solution would protect operators' previous investment in 5G, while also improving network performance by 10 times.

Furthermore, increase in adoption of emerging technologies such as software-defined networking (SDN), network functions virtualization (NFV), and edge computing is anticipated to enhance the 5G equipment market trends in the upcoming years. However, security concern & costs budget and lack of standards hamper the 5G equipment market growth. Furthermore, growth in deployment of virtualized software among enterprises including data center and service provider drives the growth of the market. In addition, growing internet penetration and rise in government initiatives are expected to provide lucrative growth opportunities for the market expansion.

5G equipment refers to the network of macro and small-cell base stations with edge computing capabilities that are required for the functionality of the fifth-generation technology standard for cellular networks. 5G equipment provides low latency coverage for big data streams that empower applications such as IoT devices, semi-autonomous vehicles, and augmented reality (AR). Such benefits are expected to provide lucrative opportunities for 5g equipment market growth during the forecast period.

Top Impacting Factors:

Rise in demand for SDN and NFV

SDN and NFV represent transformative technologies that enable greater flexibility, scalability, and efficiency in network management. With the advent of 5G networks, characterized by their high data speeds and low latency, the need for agile and programmable infrastructure becomes paramount. SDN allows for centralized control of network resources, facilitating dynamic configuration and optimization to meet varying demands. NFV complements this by virtualizing traditional network functions, enabling operators to deploy and manage network services more efficiently.

As the 5G landscape evolves, the integration of SDN and NFV becomes crucial for delivering the diverse and customized services that 5G promises, from enhanced mobile broadband to massive machine-type communications and ultra-reliable low-latency communication. Thus, the 5G equipment industry is driven by the imperative to provide the hardware and solutions that seamlessly incorporate SDN and NFV, ensuring the deployment of agile, adaptable, and high-performance 5G networks to meet the demands for a digitally interconnected world.

Segment Review:

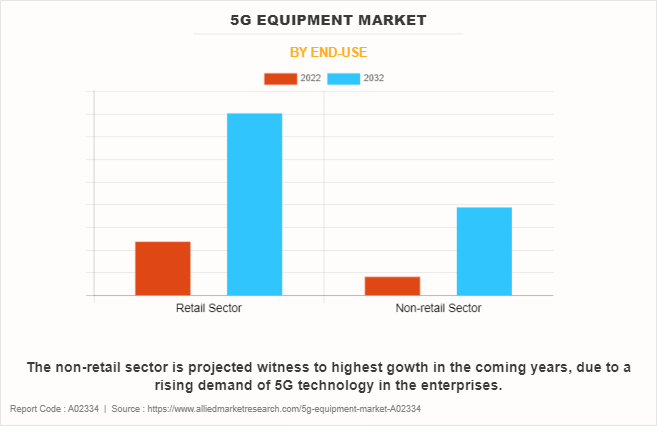

The 5G equipment market is segmented into product, end-use, and region. By product, the market is segregated into macro cell, small cell, and others. By end-use, the market is classified into retail sector and non-retail sector. Region-wise, the 5G equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By end-use, the retail sector dominated the 5G equipment market share in 2022 and is expected to maintain its dominance in the upcoming years. Rising demand of advanced and portable devices is expected to optimize the business capabilities of retail sector. However, the non-retail sector is expected to witness the highest growth in the upcoming years, owing to a rising demand for 5G technology in the enterprises.

By region, North America dominated the market share in 2022 for the 5G equipment market. Increasing investment in advanced technologies such as SDN, NFV and 5G devices to improve businesses and the customer experience is anticipated to propel the growth of the 5G equipment market forecast. For instance, in December 2023, AT&T announced plans to lead the U.S. in commercial scale open radio access network (Open RAN) deployment. This industry-leading move, in collaboration with Ericsson, will advance the efforts of the telecommunications industry and build a more robust ecosystem of network infrastructure providers and suppliers. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period, owing to the growth of digitalization and internet penetration in the region.

Competition Analysis

The market players operating in the 5G equipment market are Cisco Systems, Inc., Samsung Electronics, NEC Corporation, Huawei Technologies Co., Ltd., AT&T Inc., Verizon Communication, Qualcomm Technologies, Telefonaktiebolaget LM Ericsson, ZTE Corporation, and Nokia Corporation. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the 5G equipment market globally.

Recent Product Launch in the 5G Equipment Market:

In September 2023, Nokia Corporation launched an array of industrial 5G devices to keep enterprise teams and public safety workers safe, connected, and informed over private wireless networks in hazardous and industrial environments such as ports, mines, chemical plants, and offshore oil platforms.

In June 2023, Nokia Corporation enhanced its equipment portfolio with the global launch of Pandion Multiband Remote Radio Heads and Shikra outdoor and indoor small cells, 5G-advanced baseband control card Ponente, new baseband capacity card Levante and Lodos, as well as intelligent network management and optimization solutions range MantaRay.

In February 2023, Qualcomm Technologies introduced the world's first 5G NR-Light Modem-RF system to fuel a new wave of 5G devices. This new enhanced product will streamline architecture to achieve lower cost, reduced complexity, decreased power consumption, and smaller form factors.

Recent Expansion in the 5G Equipment Market:

In October 2023, Ericsson expanded its offerings with the opening of a 5G Core (5GC) Excellence Center dedicated to serving the dynamic region of Middle East and Africa. The state-of-the-art Excellence Center will serve as a focal point for innovation, collaboration, and the advancement of 5G technology.

Key Benefits for Stakeholders:

- The study provides an in-depth 5G equipment market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the 5G equipment market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the 5G equipment industry.

- The quantitative analysis of the global 5G equipment market for the period 2022–2032 is provided to determine the 5G equipment market potential.

5G Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23.9 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Product |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Telefonaktiebolaget LM Ericsson, Nokia Corporation, Verizon Communications, ZTE Corporation, Qualcomm Technologies, Inc. , NEC Corporation, AT&T Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd., Samsung Electronics |

Analyst Review

The industry is experiencing an unprecedented era of technological advancement. Resources such as the IoT, big data, and cloud computing and other technologies have revolutionized businesses and are anticipated to drive further innovation in the coming years. Moreover, numerous businesses have already transitioned to the state-of-the-art 5G technology, marking a significant stride for the modern industry. As a result, it is anticipated offer both considerable benefits and more opportunities to the business in the coming years.

Furthermore, the complexity of 5G technology and its capabilities has opened the door to new players in the telecommunications market that can develop network and user equipment like handsets, radios, small cells and customer premise equipment to make full use of the mobile network. For instance, in December 2023, AT&T’s and Ericsson’s announced multiyear joint commitment to Open RAN deployment to enhance the 5G innovation.. This moves to an open, agile, programmable wireless network positions AT&T to quickly capitalize on the next generation of wireless technology and spectrum when it becomes available. These innovative technologies will enable lower-power, sustainable networks with higher performance to deliver enhanced user experiences. Ericsson’s open architecture will provide a foundation and springboard for developers driving innovation through open and programmable networks and bringing new suppliers into the industry. This will foster modernization and competition in the U.S. 5G equipment market.

Moreover, 5G deployment progressed rapidly over the few years and is already yielding significant financial gains. According to several studies, there are more than 260 commercial 5G networks globally, serving over 1.2 billion users, and there are already 115 million gigabit F5G users. With service models and content continuously evolving, breakthroughs in technologies such as glasses-free 3D are creating unprecedented immersive experiences for users. However, these new services continue to require stronger 5G network capabilities. For instance, in June 2023, Huawei proposed the concept of a "5.5G Era", based on an end-to-end solution that integrates comprehensive evolved technologies including 5.5G, F5.5G, and Net5.5G. This solution would protect operators' previous investment in 5G, while also improving network performance by 10 times. Such advancements are expected to provide lucrative opportunities for the market growth during the forecast period.

Factors such as increase in adoption of advanced technologies such as Internet of Things (IoT) across the globe and rise in digitalization, positively impact the growth of the market.

The North America is the largest market for the 5G Equipment.

The key growth strategies for 5G Equipment include product portfolio expansion, acquisition, partnership, merger, and others.

5G Equipment Market is expected to reach $23,846.50 Million, by 2032.

The market players operating in the 5G equipment market are Cisco Systems, Inc., Samsung Electronics, NEC Corporation, Huawei Technologies Co., Ltd., AT&T Inc., Qualcomm Technologies, Telefonaktiebolaget LM Ericsson, and others.

Loading Table Of Content...

Loading Research Methodology...