IT Asset Disposition Market Insights, 2032

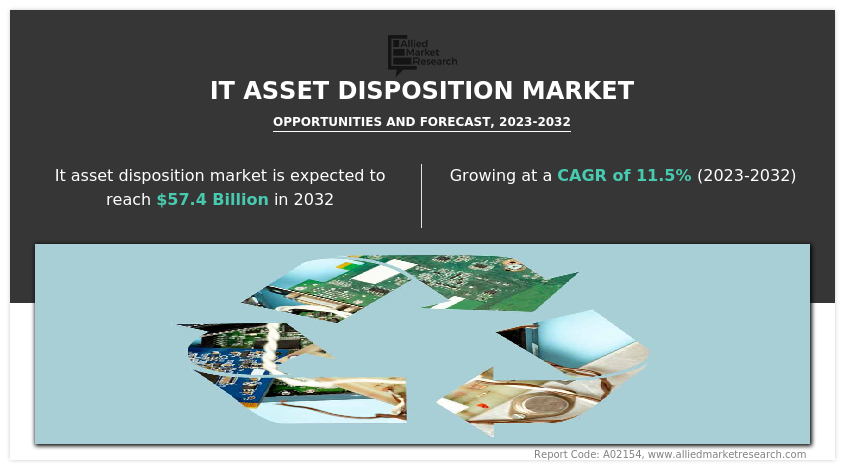

The global IT asset disposition market size was valued at USD 19.9 billion in 2022, and is projected to reach USD 57.4 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

Rise in awareness of the advantages of cloud-based computing, and consequently, the continued migration from on-premise to cloud-based Service are key drivers for the growth of IT asset disposition market. The surge in usage of cloud-based technologies is likely to continue to drive demand for ITAD Service in the future. As businesses increasingly rely on cloud-based technologies, they need to ensure that they are securely managing and disposing of their IT assets to protect sensitive information and comply with data protection regulations. In addition, the rise in adoption of bring your own device in organizations and the upsurge in awareness of environmental protection are major driving factors for market growth.

However, lack of awareness about ITAD solutions among businesses is a major factor that hampers the growth of the market as many companies may not fully understand the risks associated with improper disposal of IT assets or the potential benefits of using ITAD Service. This can lead to a lack of demand for ITAD Service, which can restrain the growth of the market. Contrarily, surge in green IT initiatives provide lucrative opportunities for the market. As awareness of environmental issues continues to grow, more organizations look forward to implementing green IT initiatives. These initiatives can help organizations reduce their carbon footprint, conserve natural resources, and promote sustainable practices, which are expected to provide an opportunity to scale up market during the forecast period.

IT asset disposition (ITAD) is the process of disposing of end-of-life or surplus IT assets in a secure, environmentally-friendly, and cost-effective manner. IT assets can include hardware components such as computers, servers, printers, and mobile devices, as well as software licenses. ITAD involves several steps, including data destruction to ensure that sensitive information is not accessible after disposal, as well as refurbishment, resale, donation, or recycling of the assets, depending on their condition and value.

Segment Review

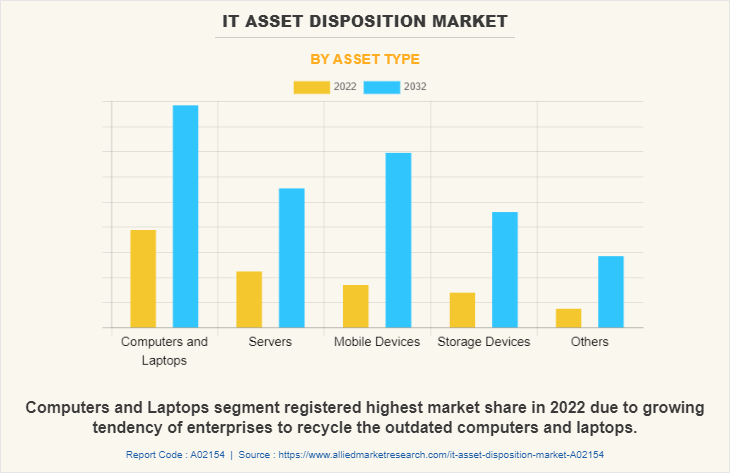

The market is segmented on the basis of service, asset type, enterprise size, industry vertical, and region. By service, the market is classified into de-manufacturing & recycling, remarketing & value recovery, data destruction/data sanitation, logistics management & reverse logistics, and others. By asset type, it is categorized into computers/laptops, servers, mobile devices, storage devices, and peripherals. By enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. On the basis of industry vertical, it is divided into BFSI, IT & telecom, education, healthcare, manufacturing, media & entertainment, government, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By asset type, the computers and laptops segment attained the highest growth in IT asset disposition market share in 2022. This is due to the fact that companies have become more environmentally conscious, and this is reflected in their ITAD practices. ITAD companies are increasingly focused on reducing their carbon footprint and promoting sustainable practices, such as using renewable energy sources in their facilities. In addition, as more organizations seek to dispose of their IT assets in an environmentally responsible way, the demand for ITAD Service has grown. The computers/laptops segment is a key part of this, as these devices are some of the most commonly retired assets in many organizations.

However, mobile devices segment is considered to be the fastest growing segment during the forecast period. This is because the demand for mobile devices is growing rapidly, particularly in emerging markets such as Asia-Pacific and Latin America. This trend has created opportunities for ITAD companies to expand their Service into these regions. In addition, mobile devices, such as smartphones and tablets, are evolving rapidly, and new models are being introduced frequently. This trend is leading to a higher rate of device retirement and the need for proper disposal and ITAD Service. Furthermore, the trend toward trade-in programs, where customers trade in their old devices for new ones, has created opportunities for ITAD companies to partner with mobile phone and tablet manufacturers to offer trade-in programs.

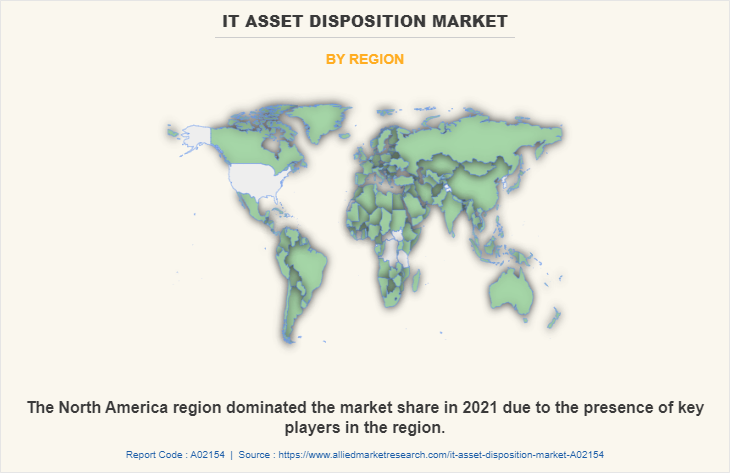

On the basis of region, North America dominated the market share in 2022. This is due to the adoption of new technologies, product innovation, high regulatory standards, and awareness of the conservation of the environment. Moreover, the presence of a booming IT market and the rise in number of cloud data centers within the region are expected to fuel the North American IT asset disposition market during the forecast period. In addition, the market is placing a growing emphasis on secure and compliant data destruction as companies have become more aware of the risks associated with data breaches.

However, Asia-Pacific attained the highest growth rate in market forecast. The growth witnessed in Asia-Pacific is primarily attributable to the development of new technologies and digitalization, which have resulted in the modernization of the existing infrastructure. The rapidly expanding information technology markets in countries such as China, Japan, and India have led to these nations' status as industry leaders in ITAD Service. Furthermore, according to the United Nations University, it is estimated that India generates approximately 3.2 million metric tons of e-waste annually, placing it in third place behind China and the U.S. Demand for IT asset disposal Service has increased over the past few years to effectively manage and ensure secure dumping of any e-waste or IT asset waste produced.

Top Impacting Factors

Growing E-waste Volume

Surge in awareness of environmental protection is one of the driving factors behind the increased demand for sustainable practices and responsible disposal of electronic waste (e-waste). As more people become aware of the environmental impact of e-waste and the potential harm it can cause to human health and the environment, there is a greater push for businesses to adopt more sustainable practices, including IT asset disposition (ITAD) Service. Moreover, consumers are increasingly seeking out products and Service that are environmentally friendly, and businesses are responding by incorporating sustainability into their operations. This includes taking steps to reduce waste, increase energy efficiency, and responsibly dispose of e-waste. By adopting sustainable practices, businesses can not only reduce their environmental impact, however, can also improve their brand reputation and attract environmentally conscious consumers.

In addition, rise in awareness of environmental protection drives government regulations and policies aimed at reducing the environmental impact of e-waste. This includes regulations around the disposal of hazardous materials and incentives for businesses to adopt sustainable practices, such as tax breaks for companies that use environmentally friendly technologies or engage in sustainable practices. Therefore, these factors are driving the growth of IT asset disposition industry.

The Rise in Adoption of Bring Your Own Device

Bring your own device (BYOD) is the practice of employees using their personal devices, such as smartphones, tablets, and laptops, for work purposes. This trend has gained popularity in recent years, as it allows employees to work remotely and increase their productivity. As a result, businesses are increasingly turning to ITAD service providers to help them manage the secure and responsible disposal of personal devices used for work purposes. These service providers can help businesses securely wipe data from personal devices and ensure compliance with data protection regulations. They can also help businesses extract value from personal devices through refurbishing, reselling, or recycling.

In addition, the rising adoption of BYOD is likely to continue to drive demand for ITAD Service in the future. As more employees use their personal devices for work purposes, businesses need to ensure that these devices are securely managed and disposed of when they are no longer needed. By working with a trusted ITAD service provider, businesses can ensure that they are meeting their data protection obligations and mitigating the risks associated with BYOD. Therefore, the surge in adoption of bring your own device in organizations is anticipated to support the market growth during forecast period.

Rise in Usage of Cloud-based Technologies

Rise in awareness of the advantages of cloud-based computing, and consequently, the continued migration from on-premise to cloud-based Service, is a significant driver of the IT asset disposition market's expansion. IT assets, such as storage devices, servers, and other peripherals and support infrastructures, such as networking gear, cables, uninterruptible power sources (UPS), physical security systems, and environmental controls, are used on-premise to be appropriately disposed of. The available data is sanitized before the company transitions from on-premise to cloud-based Service. Therefore, businesses are increasingly turning to IT asset disposition service providers to dispose of their unwanted or obsolete IT equipment secure and environmentally responsible.

In addition, businesses are increasingly turning to ITAD service providers to help them manage the secure and responsible disposal of their cloud-based assets. These service providers can help businesses securely wipe data from cloud-based assets, including servers, storage devices, and networking equipment. However, the adoption of cloud-based technologies poses several challenges for businesses when it comes to IT asset management and disposal. Since data is stored on remote servers, businesses may not have physical control over their IT assets, making it more challenging to track and manage them. Furthermore, the surge in usage of cloud-based technologies is likely to continue to drive demand for ITAD Service in the future. As businesses increasingly rely on cloud-based technologies, they need to ensure that they are securely managing and disposing of their IT assets to protect sensitive information and comply with data protection regulations.

Lack of Awareness about ITAD Solutions

One of the major restraining factors in the IT asset disposition market is the lack of awareness about ITAD solutions among businesses. Many companies may not fully understand the risks associated with improper disposal of IT assets or the potential benefits of using ITAD Service. This can lead to a lack of demand for ITAD Service, which can restrain the growth of the market. Moreover, this lack of awareness can be due to various reasons such as a lack of education, inadequate communication from ITAD service providers, and a lack of regulations governing the disposal of IT assets. As a result, businesses are not realizing the potential environmental and data security risks associated with improper IT asset disposal, and they are not considering the benefits of using ITAD Service.

Furthermore, some organizations delegate the disposal of their assets to third-party service providers, who frequently lack visibility into the command and accountability structure. Real-time tracking and accurate reporting of IT assets aid in preventing incorrect disposal. Due to a lack of awareness regarding device visibility and governance, businesses are unaware of the risks posed and how they can be mitigated. It is anticipated that organizations’ disposition of IT assets in violation of environmental and government regulations can be a barrier to market expansion.

The lack of comprehensive IT asset Disposition Policies and Unauthorized Standards

The lack of comprehensive IT asset disposition policies and unauthorized standards is another restraining factor for the market. Many businesses do not have a clear understanding of the importance of proper IT asset disposition policies and do not have implemented comprehensive policies for their organization. Without clear policies and standards, there is a risk of inconsistency in the disposal process, which can lead to increased risk of data breaches or environmental damage. Moreover, there may be unauthorized standards or practices that are not aligned with best practices or regulations, which can further increase the risk of data breaches or environmental harm. This can create confusion and uncertainty for businesses seeking ITAD Service, which can restrain the growth of the market.

However, to address this issue, businesses need to develop comprehensive ITAD policies that align with best practices and regulatory requirements. This can include creating clear guidelines for the disposal of different types of IT assets, establishing protocols for data security and environmental sustainability, and selecting qualified ITAD service providers. Furthermore, IT assets can be difficult to track and manage, especially for large organizations with complex IT infrastructure. This can make it challenging to ensure that all IT assets are disposed of properly. Therefore, all these factors can hamper the IT asset disposition market growth.

Importance of Green IT Initiatives to Provide Lucrative Opportunities

Green IT refers to the practice of designing, developing, using, and disposing of IT assets in an environmentally responsible manner. As awareness of environmental issues continues to grow, more organizations are looking to implement green IT initiatives. These initiatives can help organizations reduce their carbon footprint, conserve natural resources, and promote sustainable practices. In addition, ITAD service providers can help organizations implement sustainable practices throughout their IT asset lifecycle, from procurement to disposal. This can include providing guidance on the selection of energy-efficient IT assets, reducing e-waste through refurbishment and reuse, and implementing environmentally responsible disposal practices.

Furthermore, by offering comprehensive and sustainable IT asset disposal Service, ITAD service providers can differentiate themselves in the market and provide added value to their clients. Moreover, green IT initiatives can help ITAD service providers reduce costs and improve operational efficiency. By implementing sustainable practices throughout their operations, ITAD service providers can reduce waste, conserve resources, and promote environmental responsibility. Therefore, this is likely to provide lucrative growth opportunities for the ITAD market, as companies worldwide adopt environmentally friendly initiatives.

Market Landscape and Trends

The IT asset disposition industry is a growing industry that has seen increased demand in recent years due to surge in number of electronic devices used by businesses and consumers. With the increase in number of data breaches and cyber-attacks, companies have become more aware of the importance of data security. This trend drives the demand for ITAD services that offer secure data destruction, ensuring that sensitive data is properly disposed of and cannot be accessed by unauthorized parties. Moreover, environmental responsibility has become a top priority for many companies, and this is driving the demand for ITAD Service that focus on sustainability. This trend is leading to increased recycling and refurbishment of IT assets, reducing the amount of e-waste that ends up in landfills. In addition, the circular economy is a growing trend in which resources are kept in use for as long as possible, reducing waste and promoting sustainability. In the ITAD market, this trend is leading to increased refurbishment and resale of IT assets, extending their lifespan and reducing the need for new devices. Therefore, the market is constantly evolving, with new trends emerging as the technology advances.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IT asset disposition market analysis from 2023 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global IT asset disposition market trends, key players, market segments, application areas, and market growth strategies.

IT Asset Disposition Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 57.4 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 285 |

| By Service |

|

| By Asset Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Hewlett Packard Enterprise Development LP, UNDUIT LLC, CDW, LifeSpan International Inc., Sims Lifecycle Services, Ingram Micro, Apto Solutions Inc., Iron Mountain Incorporated, CompuCom Systems, Inc., TES |

Analyst Review

The IT asset disposition market has experienced significant growth in recent years, and the trend is expected to continue, primarily owing to an increase in investments, expansion of end-use industries, adoption of cloud-based technologies, and use of new technologies and BYOD trend. In addition, the market is further driven by the need for appropriate e-waste disposition methods, environmental policies to be followed by industries, and the huge amount of e-waste generated. Moreover, the rise in demand for IT asset disposition from small and medium-sized enterprises, and the increase in inclination toward the development of energy efficient products further influence the market. Furthermore, the increase in cloud-based computing has been another significant factor that has resulted in the high growth of the ITAD market. Companies are migrating from on-premises to cloud-based services owing to data security, environmental protection, and low cost. Cloud migration has resulted in high demand for the disposition of IT equipment such as storage devices, servers, network gears, and cables, among others. The transition towards cloud computing has also resulted in an increased number of data centers worldwide, which has increased the demand for ITAD solutions for data centers.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, In January 2022, Iron Mountain Incorporated, the leading information management company, had acquired ITRenew, a global leader in mission critical data center lifecycle management solutions. With the transaction, Iron Mountain acquired 80 percent of the outstanding shares of ITRenew on a cash- and debt-free basis for approximately $725 million in cash, with the remaining 20 percent acquired within three years of close for a minimum enterprise value of $925 million. Moreover, in April 202, Vyta Group, a leading secure IT recycling company based in Ireland, acquired FGD, an Essex- based IT Disposal Company. Through this deal, MML Growth Capital Partners Ireland bought a minority stake in Vyta Group for US$ 12.34 million.

Some of the key players profiled in the report include Apto Solutions Inc., CompuCom Systems, Inc., CDW, Hewlett Packard Enterprise Development LP, Ingram Micro Services, Iron Mountain Incorporated, LifeSpan International Inc., Sims Lifecycle Services, TES and UNDUIT LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the IT asset disposition market.

The global IT asset disposition market size was valued at USD 19.9 billion in 2022, and is projected to reach USD 57.4 billion by 2032

The IT Asset Disposition market is projected to grow at a compound annual growth rate of 11.5% from 2023 to 2032.

The key players operating in the IT asset disposition market are Apto Solutions Inc., CompuCom Systems, Inc., CDW, Hewlett Packard Enterprise Development LP, Ingram Micro Service, Iron Mountain Incorporated, LifeSpan International Inc., Sims Lifecycle Service, TES and UNDUIT LLC.

North America is the largest regional market for IT Asset Disposition.

The increase in cloud-based computing has been another significant factor that has resulted in the growth of the IT asset disposition market. In addition, IT asset disposition services can help businesses save costs by refurbishing and reselling IT assets that are still usable.

Loading Table Of Content...

Loading Research Methodology...