IVF Services Market Research, 2033

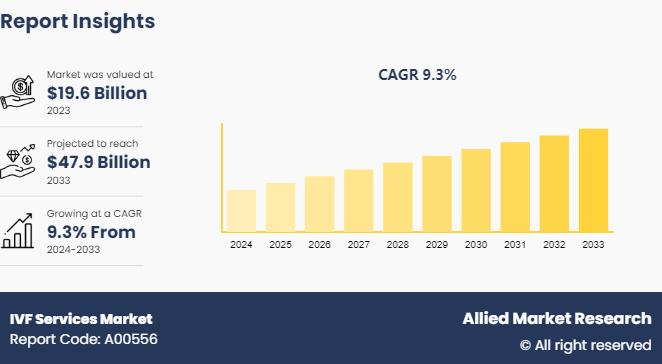

The global IVF services market size was valued at $19.6 billion in 2023, and is projected to reach $47.9 Billion by 2033, growing at a CAGR of 9.3% from 2024 to 2033. The global IVF services market is experiencing growth due to several factors such as increase in fertility rates, increase in awareness and acceptance of IVF among the general population and, rise in government initiatives, support and funding related to the IVF services.

Market Introduction and Definition

In vitro fertilization (IVF) services represent a revolutionary advancement in reproductive healthcare, offering hope and opportunities to individuals and couples struggling with infertility. IVF is a sophisticated assisted reproductive technology (ART) procedure that involves the fertilization of an egg with sperm outside the body in a laboratory setting. This process typically begins with ovarian stimulation to produce multiple eggs, which are then retrieved and combined with sperm in a controlled environment. After fertilization occurs, resulting embryos are monitored for quality before being transferred into the uterus to establish a pregnancy.

IVF services have transformed the landscape of fertility treatment by providing solutions for various reproductive challenges, including tubal factor infertility, male factor infertility, endometriosis, and unexplained infertility. In addition, IVF offers options for individuals and couples who may be facing genetic disorders or have a desire for preimplantation genetic testing to select embryos free of certain genetic conditions.

Key Takeaways

- The IVF services market size study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major IVF services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The factors propelling IVF services market growth include rise in the prevalence of infertility globally. Factors such as delayed parenthood due to career pursuits, lifestyle changes, and rise in incidence of conditions such as polycystic ovary syndrome (PCOS) contribute to the growing demand for assisted reproductive technologies (ART) , including IVF. In addition, advancements in IVF techniques such as preimplantation genetic testing (PGT) offer enhanced success rates, further fueling market expansion.

However, the market faces significant restraints, including high treatment costs and limited insurance coverage in many regions. The financial burden associated with multiple IVF cycles can deter prospective patients, leading to disparities in access to treatment. Moreover, ethical concerns and regulatory complexities surrounding practices such as embryo selection pose challenges to market growth. The market presents promising IVF services market opportunity driven by technological innovations and expanding healthcare infrastructure, particularly in emerging economies. For instance, the expanding trend of fertility tourism allows market participants to enter new geographic markets as patients choose IVF treatment overseas for more affordable options or access to cutting-edge methods.

Furthermore, rise in awareness campaigns and supportive government initiatives aimed at addressing infertility issues contribute to expansion during IVF services market forecast. Thus, while the IVF services market confronts barriers, strategic initiatives focusing on affordability, ethical practices, and innovation can unlock its full potential, catering to the evolving needs of individuals seeking fertility solutions worldwide.

Market Segmentation

The IVF services industry is segmented into cycle type, end user, and region. On the basis of cycle type, the market is divided into fresh IVF cycle, Thawed IVF cycle, and donor egg IVF cycle. By end user, the market is divided into fertility clinics, hospitals, surgical centers, and clinical research institutes. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America held the highest IVF services market share in terms of revenue in 2023, owing to rise in prevalence of infertility cases. In developing countries, several trends are shaping the landscape of the in vitro fertilization services market. One prominent trend is the increasing accessibility of fertility treatments driven by improving healthcare infrastructure and rise in awareness about assisted reproductive technologies (ART) . For instance, countries such as India and Brazil have witnessed surge in IVF clinics and fertility centers, offering affordable options for couples struggling with infertility. In addition, there is a growing emphasis on holistic approaches to fertility care, incorporating nutrition, lifestyle modifications, and psychological support alongside medical interventions.

Furthermore, collaborative efforts between public and private sectors, and supportive government policies, are fueling the in vitro fertilization services market growth by addressing regulatory challenges and promoting investment in fertility clinics and research initiatives. Overall, these trends signify a positive trajectory for the IVF services market in developing countries, promising greater inclusivity and improved outcomes for individuals seeking fertility solutions.

- In April 2023, The Health Ministry of India implemented stringent regulations for Assisted Reproductive Technology (ART) , particularly in vitro fertilization (IVF) , in a bid to curb the exponential growth of what is perceived as a profit-driven industry. These new regulations are being implemented in response to the concern about the growth of ART facilities that lack proper regulation, which raises moral and security problems. By tightening regulations, the government aims to ensure transparency, safety, and ethical standards within the ART sector, safeguarding the well-being of patients seeking fertility treatments.

- In November 2023, China approved health insurance coverage for in vitro fertilization (IVF) in a strategic move aimed at bolstering birth rates. With concerns over declining population growth, particularly exacerbated by China's aging demographic, this initiative seeks to incentivize couples to pursue fertility treatments by alleviating the financial burden associated with IVF. By extending health insurance coverage to cover IVF procedures, authorities aim to encourage more couples to consider assisted reproductive technologies, ultimately contributing to efforts to reverse declining birth rates.

- In November 2023, Japan's government revealed a proposal to tackle the country's declining birth rate. The plan entails introducing a new system incorporating a surcharge on medical insurance premiums. This surcharge will be adjusted according to individuals' financial circumstances.

- In March 2020, UK’s National Health Service (NHS) partnered with Microsoft, Amazon Web Services, Google, Faculty, and Palantir to build a digital platform based on big data, AI, and cloud computing technology.

- In March 2020, The Center for Systems Science and Engineering (CSSE) at Johns Hopkins University developed an interactive, web-based dashboard that tracks real-time data on confirmed coronavirus cases, deaths, and recoveries for all affected countries.

Industry Trends

- In April 2023, the federal government of the U.S. offered its employees median lifetime maximum benefit of $20, 000 for IVF. The employees can choose plans that cover several fertility services, including up to $25, 000 annually for in vitro fertilization (IVF) procedures and up to three artificial insemination cycles each year.

- In February 2024, the Alabama legislature took decisive steps to protect in vitro fertilization (IVF) procedures in response to a recent court ruling that cast uncertainty over the legality of reproductive technologies. This legislative action came in the wake of a controversial decision by the Alabama Supreme Court, which questioned the legal status of embryos, potentially categorizing them as persons under state law.

- In February 2024, Maharashtra (the Indian State) government launched a groundbreaking initiative to support couples battling infertility by offering free in vitro fertilization (IVF) treatments in government-run medical colleges and hospitals (GMCH) . Previously costing over $2, 400 (Rs 2 lakh) per cycle in private clinics, these high-priced procedures are now accessible at no cost, alleviating the financial burden for thousands of couples. The state government has provided substantial funding to equip GMCHs with the necessary infrastructure and expertise, marking a significant advancement in public healthcare and demonstrating Maharashtra's commitment to reproductive health.

- In March 2019, Seoul's mayor, Park Won-soon, committed to providing financial support for IVF treatment, expanding the number of health centers offering the treatment, providing information to the public about infertility treatment and government support, and taking measures to ensure those affected by infertility were able to receive support from mental health services.

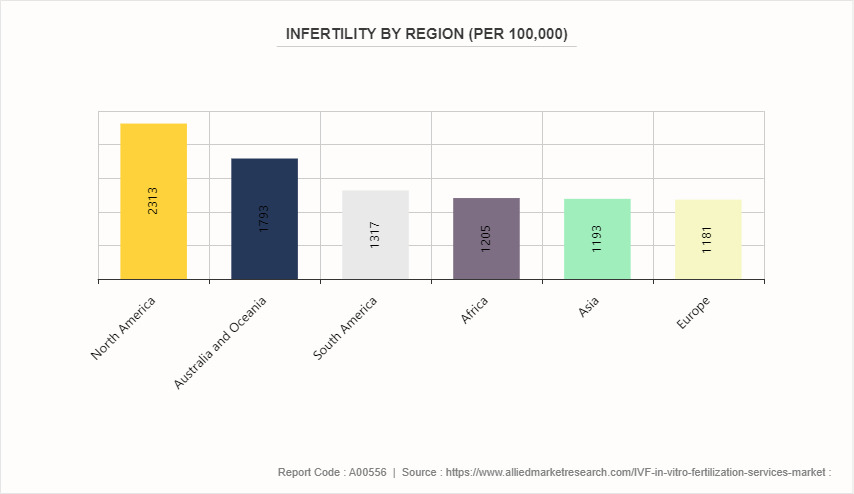

Patient Population, By Region & Country, 2015

North America has the highest IVF services market share due to highest infertility rate in the world, with about 2, 313 infertile male and female, followed by Australia and Oceania with about 1, 793 infertile male and female. In North America, the highest infertility rates are largely attributed to lifestyle factors, which significantly impact reproductive health. One of the primary medical reasons for infertility is the prevalence of obesity and metabolic disorders. Excessive body weight is closely linked to hormonal imbalances that can disrupt ovulation in women and impair sperm production in men. Conditions such as polycystic ovary syndrome (PCOS) , which is common in obese women, exacerbate fertility issues by causing irregular menstrual cycles and anovulation. In addition, high levels of stress, often associated with demanding work environments and modern urban living, contribute to infertility by affecting hormonal balance and reducing sexual activity. Furthermore, delayed childbearing, a trend increasingly observed due to career and personal aspirations, leads to a natural decline in fertility as women age.

Competitive Landscape

The major players operating in the IVF services market include Mayo Clinic Fertility Center, Shady Grove Fertility Center, Reproductive Medicine Associates (RMA) , Boston IVF, CCRM (Colorado Center for Reproductive Medicine) , Pacific Fertility Center, Houston Fertility Institute, Columbia University Fertility Center, Cleveland Clinic Fertility Center, Fertility Centers of Illinois. Other players in IVF services market includes Oregon Reproductive Medicine, Brigham and Women's Hospital Center for Infertility and Reproductive Surgery, Center for Reproductive Medicine (CRM) , New Hope Fertility Center, HRC Fertility, University of California San Francisco (UCSF) Center for Reproductive Health, Texas Fertility Center, Sher Fertility Institute, Dominion Fertility, Washington Fertility Center, Inc., and others.

Recent Key Strategies and Developments

- In January 2021, Nova IVF Fertility, India’s leading fertility chain, announced the expansion of its network in NCR through strategic partnership with Southend Fertility & IVF, a leading IVF player in Delhi NCR. Through this investment, the combined entity is expected to have a significant presence in Delhi NCR with a network of 4 comprehensive IVF centers including embryology labs, network of spoke centers, a team of senior IVF clinicians, and a capacity to perform more than 3500 IVF cycles annually in that region.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IVF services market analysis from 2024 to 2033 to identify the prevailing IVF services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the IVF services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global IVF services market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- Reproductive BioMedicine Online

- The Lancet

- National Perinatal Epidemiology and Statistics Unit (NPESU)

- Science Direct

- Reproductive Biology and Endocrinology

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

IVF Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 47.9 Billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Shady Grove Fertility Center, Colorado Center for Reproductive Medicine, Columbia University Fertility Center, Cleveland Clinic Fertility Center, Houston Fertility Institute, Fertility Centers of Illinois, Mayo Clinic Fertility Center, Boston IVF, LLC., pacific fertility center, Reproductive Medicine Associates |

Analyst Review

The adoption of IVF procedure is expected to increase due to rise in infertile population across the world and growth in fertility tourism in the developing countries. In addition, increase in success rate of IVF, surge in disposable income, and rise in trend of delayed pregnancies are expected to further drive the market growth in the coming future. However, complications associated with the use of IVF and increase in procedure cost are expected to hinder the market growth.

Asia-Pacific is expected to remain dominant during the forecast period, followed by Europe. Emerging fertility tourism destinations such as India, Thailand, Japan, and Australia are chiefly responsible for the growth of the Asia-Pacific region, mainly due to the availability of skilled workforce and rise in healthcare awareness across these nations. In addition, increase in support from the government, introduction of fertility programs, and implementation of favorable regulatory policies are projected to supplement the growth of the European IVF services market. Efforts of HFEA and the acceptance of three parent IVF methods in countries, such as the UK, are further anticipated to support the growth of the Europe IVF services market.

Japan, China, U.S., India, and France are the most prominent countries for IVF procedures. This is due to the affordability and reimbursements available for IVF cycles. Countries across Western Europe exhibit an alleviated response toward IVF procedures owing to favorable regulations and lesser ethical obligations. However, presence of ethical issues and lack of regulatory policies hamper the growth of the IVF services market in Latin America and some parts of Middle East.

The growth of the in-vitro fertilization (IVF) services market is attributed to increase in the prevalence of infertility cases, surge in technological advancements, and rise in adoption of IVF as a remedy for parenthood.

In vitro fertilization (IVF) services represent a revolutionary advancement in reproductive healthcare, offering hope and opportunities to individuals and couples struggling with infertility.

The Mayo Clinic Fertility Center, Shady Grove Fertility Center, Reproductive Medicine Associates (RMA) , Boston IVF held a high market position in 2023.

The base year is 2023 in IVF Services market.

The forecast period for IVF Services market is 2024 to 2033.

The market value of IVF Services market in 2033 is $47.9 billion.

The total market value of IVF Services market is $19.6 billion in 2023.

Loading Table Of Content...