RFID Sensor Market Research, 2033

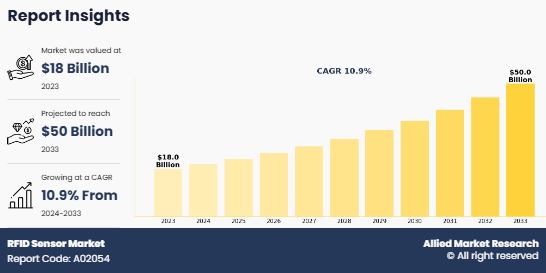

The Global RFID Sensor Market was valued at $18 billion in 2023, and is projected to reach $50 billion by 2033, growing at a CAGR of 10.9% from 2024 to 2033. RFID (Radio Frequency Identification) sensors are electronic devices that use radio waves to automatically identify and track tags attached to objects. Each RFID sensor contains a microchip with data and an antenna, allowing it to communicate with an RFID reader. The reader emits radio signals to detect nearby tags, facilitating real-time inventory management, access control, and asset tracking. RFID technology enhances efficiency in various industries, including retail, logistics, and healthcare, by streamlining processes and reducing human error. Its ability to operate without direct line-of-sight makes it a versatile solution for modern identification and tracking needs.

Key Takeaways

- The RFID sensor market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2024–2033.

- The study integrates high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The RFID sensor market is highly fragmented, with several players, including Zebra Technologies, STMicroelectronics, Impinj, Texas Instruments, GAO RFID, Smartrac, Symbol Technologies, Avery Dennison, Alien Technology, and NXP Semiconductors.

The RFID sensor market is driven by the increasing demand for automation and real-time data collection across industries such as retail, logistics, and healthcare. This technology enhances inventory management, improves supply chain visibility, and minimizes human error, making it essential for operational efficiency. However, the market faces challenges, including high initial costs of implementation and concerns over data privacy and security. Many organizations hesitate to adopt RFID due to these financial and ethical considerations, which can limit widespread use. Despite these restraints, there are significant opportunities for growth. The rise of IoT (Internet of Things) applications and advancements in RFID technology, such as passive tags and enhanced read ranges, present new possibilities for integration into smart systems. Additionally, expanding applications in emerging markets and industries, like agriculture and pharmaceuticals, offer avenues for market expansion and innovation.

Segment Overview

The global RFID sensor market is segmented into type, frequency range, and application. and region.

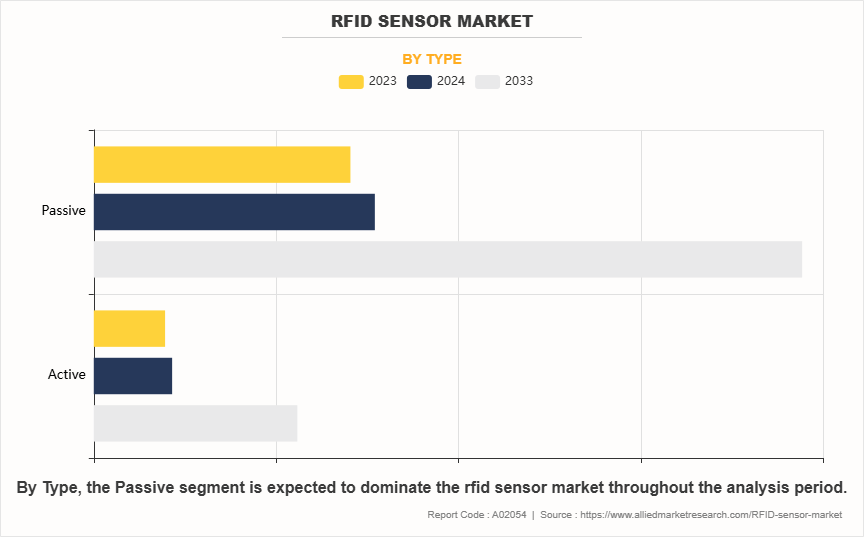

By type, the RFID sensor market is segmented into Active and Passive. In 2023, the Passive RFID segment leads the market due to its lower cost, smaller size, and ease of deployment compared to Active RFID systems. Passive tags, powered by the reader's radio waves, are widely used in retail and logistics for inventory management and tracking. Their affordability makes them accessible for various applications, driving mass adoption. Additionally, the increasing focus on supply chain efficiency and automation further propels the demand for Passive RFID solutions across multiple industries.

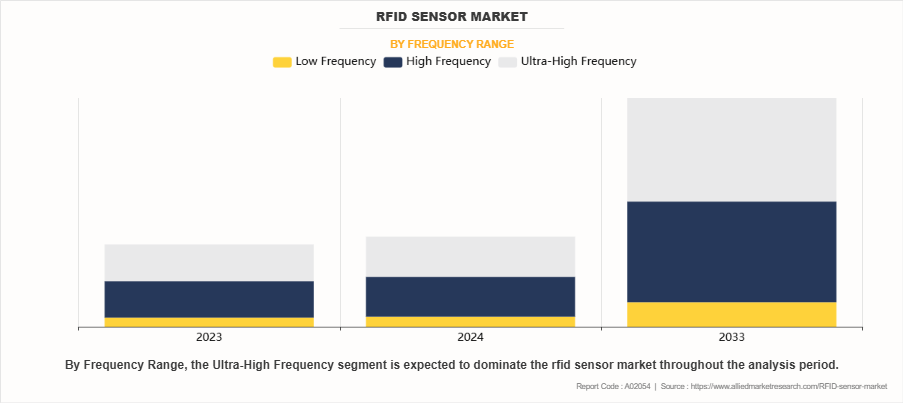

By frequency range, the RFID sensor market is classified into low frequency, high frequency, and ultra-high frequency. In 2023, the Ultra-High Frequency (UHF) segment leads the RFID sensor market due to its superior read range and faster data transfer rates compared to Low Frequency (LF) and High Frequency (HF) options. UHF RFID tags can be read from several meters away, making them ideal for applications in logistics, inventory management, and asset tracking. The increasing demand for efficient supply chain operations and the need for real-time visibility drive the adoption of UHF technology. Additionally, advancements in UHF tag design and reader technology enhance performance, further solidifying its dominance in various industries.

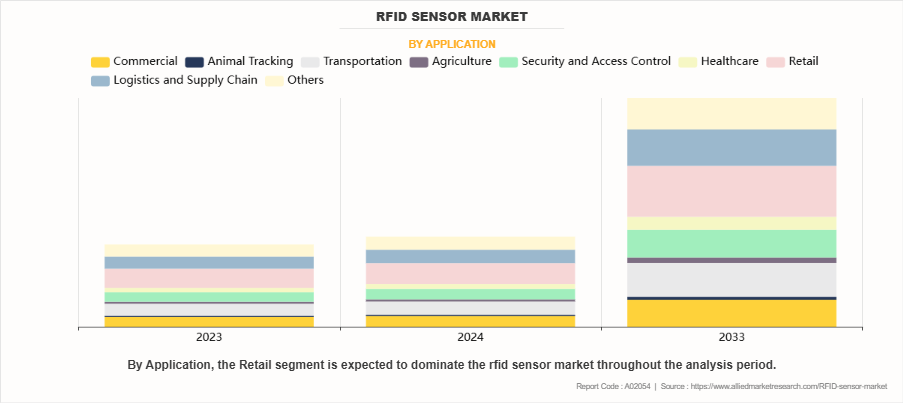

By application, the RFID sensor market is segmented into commercial, animal tracking, transportation, agriculture, security and access control, healthcare, retail, logistics and supply chain, and others. In 2023, the Logistics and Supply Chain segment leads the RFID sensor market due to the growing need for efficient inventory management and tracking solutions. Businesses increasingly adopt RFID technology to enhance visibility and streamline operations, reducing costs and improving accuracy. The ability to monitor goods in real-time and manage stock levels effectively is crucial in today’s fast-paced supply chain environments. Additionally, the rise of e-commerce and demand for faster delivery times amplify the importance of RFID systems, enabling companies to optimize their logistics processes and improve overall operational efficiency.

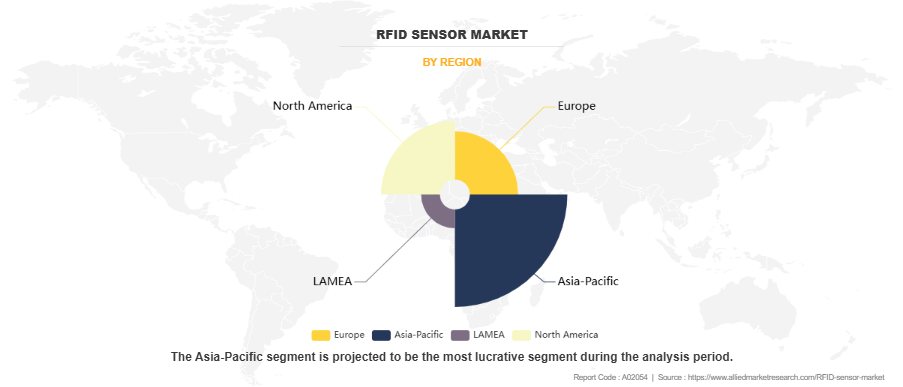

Based on region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

The North America region dominated the RFID sensor market in 2023 and is expected to continue its dominance during the forecast period. The region boasts a well-established technological infrastructure and high levels of investment in research and development, which foster innovation in RFID technology. Industries such as retail, healthcare, and logistics are rapidly adopting RFID solutions to enhance operational efficiency, inventory accuracy, and supply chain visibility. The presence of major players and a robust ecosystem of technology providers further accelerates market growth.

Moreover, stringent regulations around inventory tracking and asset management in sectors like healthcare are driving adoption. The region's early adopters have set a precedent for implementing RFID systems, showcasing their benefits and encouraging wider acceptance. Additionally, the increasing focus on automation and smart technologies, combined with a rising e-commerce sector, propels demand for advanced tracking solutions. Overall, North America's combination of technological readiness, industry demand, and regulatory support solidifies its leadership in the RFID sensor market.

Competitive Analysis

The players operating in the RFID sensor market include Zebra Technologies, STMicroelectronics, Impinj, Texas Instruments, GAO RFID, Smartrac, Symbol Technologies, Avery Dennison, Alien Technology, and NXP Semiconductors. The key players in the RFID sensor market are focusing on acquisitions and partnerships to increase RFID sensor capabilities and invest in the R&D of RFID sensors.

Market Dynamics

Rising Focus on Asset Tracking

The rising focus on asset tracking is a significant driver of the RFID sensor market, fueled by the need for businesses to improve operational efficiency and reduce losses. Companies across various sectors, including manufacturing, logistics, and healthcare, are increasingly recognizing the importance of real-time asset visibility. RFID technology enables seamless tracking of assets throughout the supply chain, from production to distribution and beyond. This capability not only enhances inventory management but also minimizes the risks of theft, misplacement, and obsolescence.

In industries like healthcare, accurate asset tracking is crucial for managing expensive medical equipment and ensuring patient safety. The integration of RFID systems allows hospitals to monitor the location and availability of critical devices, reducing downtime and improving service delivery. Furthermore, the growing trend toward automation and smart warehouses is pushing organizations to adopt RFID solutions for better data accuracy and efficiency. Tag and reader communication, sensor integration, data encryption, and security protocols enhance automotive sensor functionality, ensuring secure, efficient, and reliable operations.

Additionally, as businesses strive to meet customer demands for faster service and transparency, RFID technology offers a competitive edge by providing detailed insights into asset utilization and movement. With increasing investments in digital transformation, organizations are turning to RFID as a reliable tool to streamline operations and enhance decision-making. As a result, the demand for RFID sensors continues to surge, positioning them as a vital component in modern asset management strategies across diverse industries.

Limited Read Range and Performance Issues

Limited read range and performance issues present significant restraints for the RFID sensor market. The effectiveness of RFID technology largely depends on the distance between the reader and the tags; traditional passive RFID systems typically have a limited read range, often only a few centimeters to several meters. This constraint can hinder their application in larger environments or when tracking assets spread across vast areas. Additionally, performance can be affected by environmental factors such as interference from metals or liquids, which can absorb or reflect radio waves, leading to inconsistent readings.

These limitations can complicate implementation in industries where precise tracking is critical, such as healthcare or logistics. Companies may encounter challenges in achieving the desired level of efficiency and accuracy, leading to hesitation in adopting RFID solutions. Furthermore, the need for more advanced active RFID tags, which offer greater read ranges, may increase costs and complexity, deterring some organizations, especially small and medium enterprises, from fully embracing the technology. As a result, addressing these performance-related concerns is essential for the broader acceptance and growth of the RFID sensor market.

Increased Focus on Sustainability and Environmental Monitoring

The increased focus on sustainability and environmental monitoring presents a compelling opportunity for the RFID sensor market. As organizations worldwide strive to reduce their carbon footprint and adopt more sustainable practices, RFID technology can play a pivotal role in enhancing resource efficiency and waste management. By providing real-time data on asset usage, inventory levels, and supply chain dynamics, RFID systems can help businesses optimize their operations and minimize excess consumption of materials and energy.

In sectors like agriculture, RFID sensor is increasingly used to monitor environmental conditions and track the lifecycle of crops, contributing to more sustainable farming practices. This technology allows farmers to make data-driven decisions, improving yield while reducing pesticide and water use. In manufacturing, RFID can streamline production processes by ensuring that materials are used efficiently, ultimately reducing waste.

Moreover, as consumers become more environmentally conscious, companies that utilize RFID for sustainable practices can enhance their brand reputation and appeal to a broader customer base. Regulatory bodies are also pushing for greater transparency in supply chains, which RFID can facilitate by providing detailed tracking and reporting capabilities.

Additionally, the growth of the circular economy, where products are designed for reuse and recycling,g can be supported by RFID technology, which helps track products throughout their lifecycle. This integration of sustainability with RFID solutions not only meets regulatory requirements but also aligns with corporate social responsibility goals, creating a win-win scenario for businesses and the environment.

Historical Data and Information

The RFID sensor market has experienced substantial growth over the past two decades, fueled by advancements in wireless technology and an increasing demand for efficient asset tracking and inventory management solutions. Initially developed for applications in supply chain management and logistics, RFID technology has expanded into various sectors, including healthcare, retail, and manufacturing.

In the early 2000s, RFID adoption was limited by high costs and technological constraints. However, as technology evolved, costs decreased, and performance improved, leading to broader implementation. The rise of e-commerce and the need for real-time inventory visibility significantly boosted the demand for RFID solutions, allowing businesses to enhance operational efficiency and reduce losses from theft and mismanagement. The growing focus on automation and the Internet of Things (IoT) has further accelerated the adoption of RFID sensors. Industries are increasingly leveraging RFID for smart inventory management, tracking assets in real-time, and improving supply chain transparency. Government initiatives aimed at promoting efficiency and reducing waste have also played a pivotal role in supporting market expansion.

Additionally, advancements in RFID technology, such as the development of passive and active RFID tags with improved read ranges and capabilities, have opened new avenues for application. As organizations recognize the value of real-time data for decision-making and operational efficiency, the RFID sensor market has positioned itself as a critical player in the broader landscape of digital transformation and smart solutions.

Recent Developments in the RFID Sensor Industry

- In September 2023, Amazon enhanced its innovative Just Walk Out technology by integrating an RFID sensor, enabling customers to shop without waiting in line to pay and check out. This advanced system combines artificial intelligence, cameras, and shelf sensors, with the goal of increasing revenue and lowering costs.

Key Benefits For Stakeholders

- This RFID sensor market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the RFID sensor market from 2023 to 2033 to identify the prevailing RFID sensor market opportunities. The RFID sensor market size is in $ million in the report.

- The market research is offered along with information related to key drivers, restraints, and RFID sensor market growth opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the RFID sensor market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- RFID sensor market key players' positioning facilitates benchmarking and provides a clear understanding of the present position of the market players. RFID sensor market share by key players and RFID sensor market overview are provided in the report.

- The report includes the analysis of the regional as well as global RFID sensor market trends, key players, market segments, application areas, RFID sensor market demand, and market growth strategies.

RFID Sensor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 50 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Frequency Range |

|

| By Application |

|

| By Region |

|

| Key Market Players | NXP Semiconductors., Smartrac, STMicroelectronics, GAO RFID Inc., Avery Dennison Corporation., Zebra Technologies, Symbol Technologies, Texas Instruments, Alien Technology Corporation, Impinj, Inc. |

Analyst Review

A radio frequency identification reader (RFID) is a device used to gather information from an RFID tag, which is used to track individual objects. Radio waves are used to transfer data from the tag to a reader. Presently, increase in demand for the RFID sensors has been witnessed from the developed countries such as the U.S., Canada, and others. Companies in this industry adopt various techniques to provide customers with advanced and innovative product offerings.

These tags have a wide area of application in retail, security authentication, aerospace, and transportation industries. Rise in need for tracking inventory & equipment in businesses, robust security offered by RFID sensors, and feature of RFID tags to read the signal from long distance even in harsh environment drive the growth of the RFID sensors market. However, high RFID cost and tag collisions impede the growth of the market. In future, rise in investment in the automotive sector and surge in penetration of RFID sensors in different applications are expected to create lucrative opportunities for the key players operating in the RFID sensor market.

Among the analyzed geographical regions, North America is expected to account for the highest revenue in the global market throughout the forecast period, followed by Asia-Pacific, Europe, and LAMEA. However, Europe is expected to grow at a higher growth rate, predicting a lucrative market growth.

Murata Manufacturing Co., Ltd, Vitaran Electronics, SMARTRAC, ELA Innovation , Balluff Inc., AB&R® (American Barcode and RFID), VisuaScan Inc., Imprint Enterprises, Coridian Technologies, Inc., AbeTech Corporate, and Invengo Technology Pte. Ltd.

The RFID Sensor market was valued at $18 billion in 2023 and is estimated to reach $ 50.billion by 2033, exhibiting a CAGR of 10.9% from 2024 to 2033.

The players operating in the RFID sensor market include Zebra Technologies, STMicroelectronics, Impinj, Texas Instruments, GAO RFID, Smartrac, Symbol Technologies, Avery Dennison, Alien Technology, and NXP Semiconductors. The key players in the RFID sensor market are focusing on acquisition and partnership to increase RFID sensor capabilities and invest in R&D of RFID sensor.

The North America region dominated the RFID sensor market in 2023 and is expected to continue its dominance during the forecast period. The region boasts a well-established technological infrastructure and high levels of investment in research and development, which foster innovation in RFID technology.

In 2023, the Logistics and Supply Chain segment was the leading applicaion in the RFID sensor market due to the growing need for efficient inventory management and tracking solutions. Businesses increasingly adopt RFID technology to enhance visibility and streamline operations, reducing costs and improving accuracy. The North America region dominated the RFID sensor market in 2023 and is expected to continue its dominance during the forecast period. The region boasts a well-established technological infrastructure and high levels of investment in research and development, which foster innovation in RFID technology.

The global RFID sensor market is expected to grow with advancements in IoT integration, smart packaging, supply chain automation, enhanced data analytics, and increasing demand for contactless and real-time tracking solutions.

Loading Table Of Content...

Loading Research Methodology...