Absorption Chillers Market Research - 2031

The Global Absorption Chillers Market Size was valued at $1,485.9 million in 2021, which stood at 1,385.3 million in 2018, and is projected to reach $2,263.7 million by 2031, registering a CAGR of 4.2% from 2022 to 2031.

An absorption chiller is a machinery used in industrial, commercial, and residential buildings for air conditioning, refrigeration, and also for process cooling in industrial facilities. Absorption chillers work on the concept of vapor absorption technology, it uses waste heat from hot water, steam, and others from various industrial and non-industrial sources to move the refrigerant around the circuit of chillers. In addition, direct fired absorption chillers are also available in the market, that use direct flames generated from oil or gas to introduce energy to the system.

Market Dynamics

The Absorption Chillers Market has been witnessing rapid growth for the past few decades, largely due to increasing number of industries especially in the developing nations. In addition, the rise in urbanization which is fueling the growth of commercial and residential buildings is creating implementation opportunities for absorption chillers equipment.

Typically, an absorption chiller does not use electricity as energy source, instead it uses wasted heat energy from hot water, steam, flue gas, and others from various industrial and non-industrial sources; thereby reducing expenses that go on air conditioning of an organization as well as on process cooling in an industry. Moreover, in many parts of the world, electricity is more expensive than oil and gas, and using electrical machinery is often expensive.

Therefore, absorption chillers are popular in such places. Contrarily, the coefficient of performance (COP), of an absorption chiller is less as compared to electric compression-based chillers; however, inexpensive or free of cost nature of energy source for absorption chiller make it competitive to electric compression-based chillers. Moreover, absorption chillers do not use refrigerants that release greenhouse gases, making it comparatively environment friendly than the electric compression-based chillers.

Few of the major industries that make extensive use of absorption chillers are food and beverages, pharmaceuticals, power plants, petrochemical industries, and metal fabrication industries. Industries such as power plants, and petrochemical industries use high temperature processes which include use of steam, hot water, and others, which are the perfect energy source for an absorption chiller. In addition, owing to high temperature process, industrial machineries become excessive hot, which need to be cool down to ensure their long life; thereby, increasing demand for industrial chillers including absorption chillers.

Governments around the world, especially in the developing countries, offer financial aid or other policy support to help establish and grow the domestic industrial sector. For instance, in October 2022, Argentina launched a $3.2 billion scheme called ‘Argentine Credit Program’. This is done to help grow SMEs and large industrial and agro-industrial companies for investments and import substitution projects. Such support increases the number of industrial facilities; therefore, such supportive policies opens absorption chillers market opportunity in a country and creates opportunities for absorption chillers market.

Furthermore, food & beverages and pharmaceutical industries are witnessing rapid growth. For instance, in 2021, UberEats, a major food aggregator and delivery platform registered $8.3 billion in revenue a major increase from $4.8 billion in 2020. In addition, pharmaceutical production has increased in China, and India with help from favorable government policies, also due to increasing population. These industries produce products that have to be stored in cold storage, as the products from these industries are susceptible to bacterial and pathogen infestation. Thus, these industries use absorption chillers for machinery cooling, and most importantly for maintaining cold storage.

However, the initial setup cost of an absorption chiller is high as compared to compression-based chiller of the same size and capacity. In addition, owing to the use of corrosive refrigerant and absorber mixture solution, the maintenance cost of absorption chillers is high. Such factors restrain the adoption of absorption chiller; thereby negatively impacting the market growth.

The market growth for absorption chillers witnessed a stand-still in 2020, owing to low demand for absorption chillers from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic had reduced the production of petrochemicals, textiles, metals, semiconductors, plastic, and others; thus, hampered the growth of the absorption chillers market significantly during the pandemic.

However, the demand for food and beverages and pharmaceuticals had increased during the COVID-19 pandemic, which prevented the market demand for absorption chillers from taking a steep dive. The major demand for absorption chillers was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, India, and China, which were badly affected by the spread of coronavirus, thereby halting demand for absorption chillers.

However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. This has led to the full-fledged reopening of absorption chillers manufacturing companies, and their end user sectors as well at their full-scale capacities.

Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, as of end-2022, the number of Covid-19 infection cases are surging again, especially in China, this has brought negative sentiments in the market, which may have negative impact on the absorption chillers market.

Segmental Overview

The Absorption Chillers Market is segmented on the basis of refrigerant type, energy source, application, end-user industry, and region.

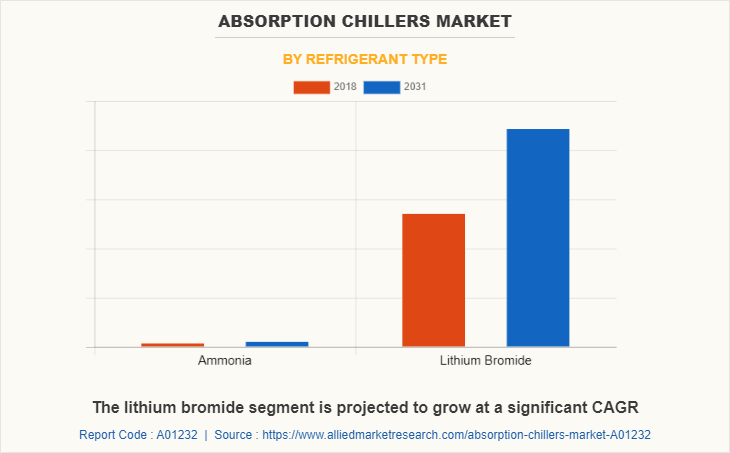

By Refrigerant Type,

The Absorption Chillers Market is bifurcated into ammonia, and lithium bromide. In 2021, the lithium bromide segment dominated the absorption chillers market, in terms of revenue, and the same is expected to grow with a higher CAGR during the forecast period. Companies such as LG Electronics and Thermax Limited, along with others offer a wide range of lithium bromide (LiBr) absorption chillers. Lithium bromide is odorless, non-toxic, non-explosive, safe, reliable, pollution-free, and is suitable to meeting the requirements of environmental protection. Moreover, ammonia-based absorption chillers are also growing at a significant pace.

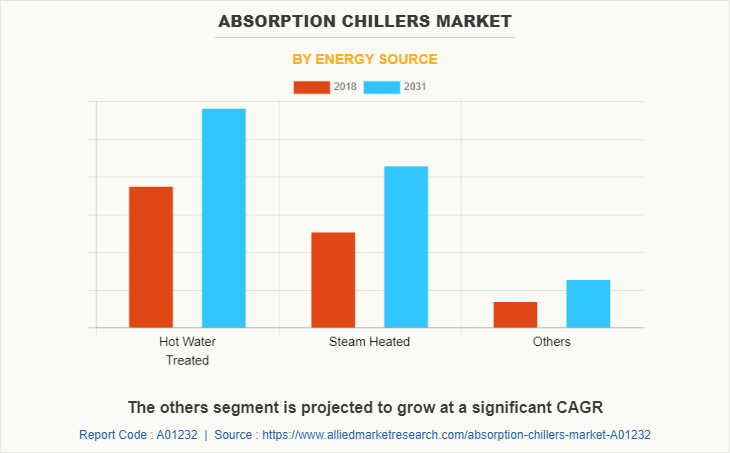

By Source of Energy,

The hot water treated segment accounted for a higher revenue in 2021. The others segment is expected to grow with the highest CAGR during the forecast period. The energy utilized by the absorption chillers is mostly extracted from the used steam, flue gas, hot water, and others. The hot water treated absorption chillers use hot water from process machinery of an industrial facility as a power source. Moreover, other absorption chillers that use steam, are also essentially using free energy from the process machinery.

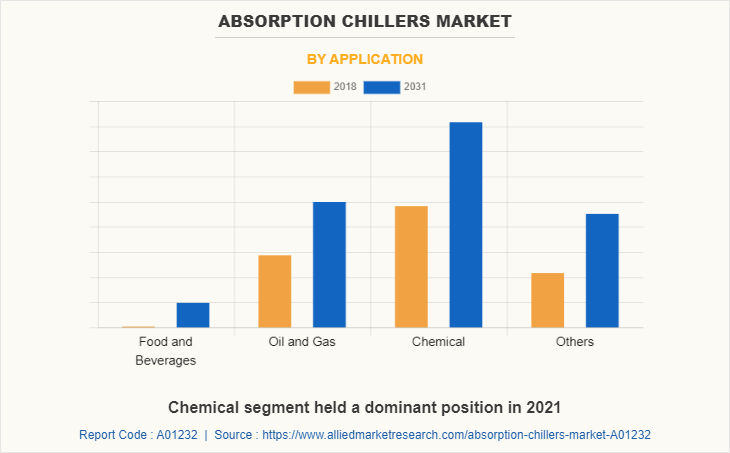

By Application,

The market is classified into food and beverages, oil and gas, chemicals, and others. The chemical segment accounted for the largest revenue share in 2021, and the food and beverages segment is expected to grow with the highest CAGR during the forecast period. Chemical industries use absorption chillers for air conditioning as well as for process cooling. Mostly, the absorption chillers harness energy from wasted heat such as hot water or steam.

Moreover, it has a perfect temperature range to be used as air conditioning equipment in the chemical industry. Chemicals are widely used across industries such as pharmaceuticals, food and beverages, textile, agriculture, and others, and the rise in these industries is anticipated to provide growth opportunities to the chemical industry.

Furthermore, the food and beverages segment is expected to witness high growth owing to increased demand for food and beverages products; thereby, driving need for absorption chillers.

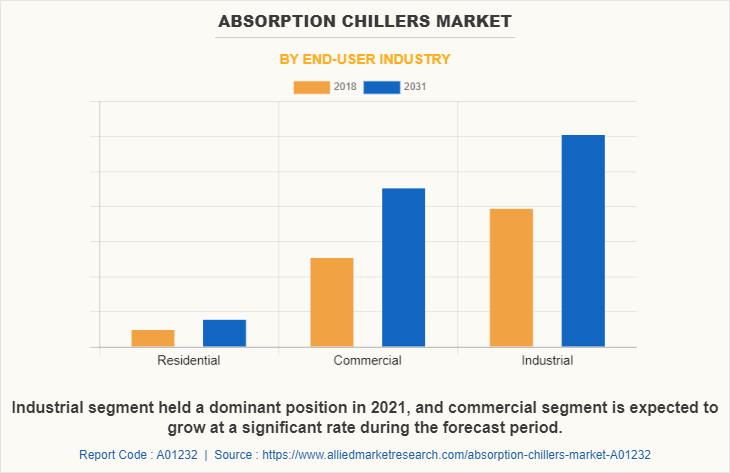

On Basis of End-User Industry,

The absorption chillers market is classified into residential, commercial, and industrial. The Industrial segment was the highest revenue contributor to the market in 2021. And the commercial segment is expected to register a higher CAGR during the forecast period. The industrial segment includes the usage of absorption chillers in industrial spaces for process cooling, cold storages, and general comfort cooling. Rise in industries across the world and need for utilization of waste heat from industrial spaces together are driving demand for absorption chillers.

Furthermore, commercial buildings such as hospitals, school/universities, airports, and other similar buildings are growing with the increasing population and urbanization. Thus, the growing number of commercial buildings is expected to positively influence the absorption chillers market growth during the forecast period.

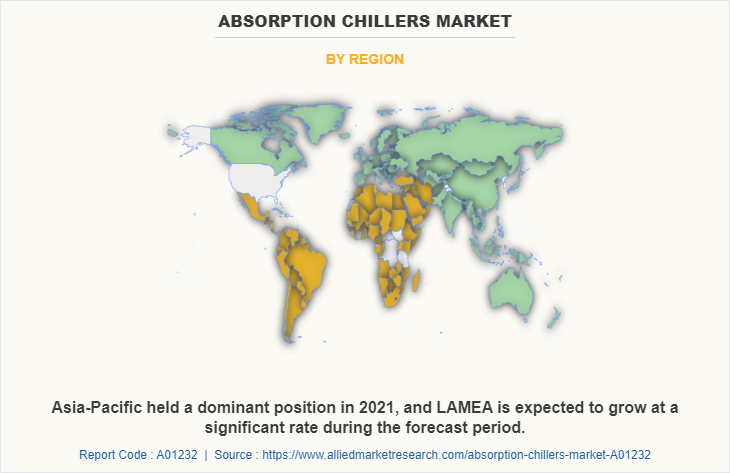

By Region,

The absorption chillers market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for the highest absorption chillers market share in 2021, and LAMEA is anticipated to secure the leading position during the forecast period, due to the high growth potential of the manufacturing sector including food & beverages, petrochemical industries, pharmaceuticals, and others in LAMEA. Fast-developing countries such as India, China, and Vietnam are a few of the major manufacturing hubs in Asia-Pacific, owing to the availability of cheap and skilled labor, and support from governments.

Therefore, major players are striving to develop manufacturing units in these markets to improve production quantities as well as serve the industries in Asia-Pacific. Demand for comfort cooling equipment is expected to rise at a significant rate in hot climate countries such as China, India, and Indonesia. According to the International Energy Agency (IEA), by 2050, about 60% of the world’s households are estimated to have an air conditioner. China, India and Indonesia are expected to account for half of the total number. Moreover, India, and China are the major producers and exporters of pharmaceuticals and medical devices; thus, demand for absorption chillers for pharmaceuticals storages is expected to increase.

The Major Players In The Absorption Chillers Market

Carrier Global Corporation, Century Corporation, EAW Energieanlagenbau GmbH, Yazaki Corporation (Yazaki Energy Systems, Inc.), World Energy Co., Ltd., Kirloskar Group, Styne Group, Hitachi Ltd., Thermax Limited, LG Electronics Inc., Johnson Controls International plc, Shuangliang Eco-Energy Systems Company Ltd., BROAD U.S.A. INC., Bry-Air (Asia) Pvt. Ltd., Shinsung Engineering, EBARA THERMAL, SYSTEMS (THAILAND) CO., LTD., Heinen and Hopman, Trane, Kawasaki Thermal Engineering Co., Ltd., and AGO AG Energie + Anlagen, are analyzed and incorporated in the report.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging absorption chillers market trends and dynamics.

In-depth absorption chillers market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the absorption chillers market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing absorption chillers market opportunity.

The absorption chillers market forecast analysis from 2022 to 2031 is included in the report.

The key players within the absorption chillers market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the absorption chillers industry.

Absorption Chillers Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.3 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2018 - 2031 |

| Report Pages | 352 |

| By Refrigerant Type |

|

| By Energy Source |

|

| By Application |

|

| By End-user Industry |

|

| By Region |

|

| Key Market Players | EBARA THERMAL SYSTEMS (THAILAND) CO., LTD., BROAD U.S.A. INC., Shuangliang Eco-Energy Systems Company Ltd., Bry-Air (Asia) Pvt. Ltd., Hitachi Ltd., EAW Energieanlagenbau GmbH, Shinsung Engineering, Heinen and Hopman, Styne Group, Kawasaki Thermal Engineering Co., Ltd., Carrier Global Corporation, Trane, AGO AG Energie + Anlagen, World Energy Co., Ltd., Johnson Controls International plc, Yazaki Corporation (Yazaki Energy Systems, Inc.), Century Corporation, LG Electronics Inc., Kirloskar Group, Thermax Limited |

Analyst Review

An increase in the number of industrial facilities and increasing commercial and residential buildings are playing key roles in driving demand for absorption chillers. During 80s and 90s, when the prices of oil and gas were cheap, the absorption chillers were highly popular; however, when gas prices increased a reduced adoption in absorption chillers among industrial and commercial users was witnessed. Contrarily, increasing demand for environmentally friendly and cheaper to operate chillers is again propelling the absorption chillers market growth.

Moreover, increasing demand for air conditioning, especially in the hotter regions such as India, Indonesia, Middle east is driving demand for absorption chillers. In addition to this, rising industrialization and which require chillers for process cooling and cold storage, along with comfort cooling is expected drive demand for absorption chillers during the forecast period. However, high setup and maintenance cost is expected to restrain the market growth.

Moreover, various technological advancements in absorption chillers that make it more efficient and easy to control are expected to drive lucrative growth opportunities for the market growth.

Increasing demand from Industrial and IT Sectors, and increasing number of Institutional and commercial buildings along with others are few of the upcoming trends of Absorption Chillers Market in the world.

Absorption Chillers are widely used in air conditioning, cold storage, and others.

Asia-Pacific held the largest market share for Absorption Chillers in 2021.

The global absorption chillers market size was valued at $1,485.9 million in 2021, which stood at 1,385.3 million in 2018.

Carrier Global Corporation, Century Corporation, EAW Energieanlagenbau GmbH, Yazaki Corporation (Yazaki Energy Systems, Inc.), World Energy Co., Ltd., Kirloskar Group, and others are profiled in the report.

By refrigerant type, the lithium bromide segment was the highest revenue contributor to the market in 2021.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The global absorption chillers market size is projected to reach $2,263.7 million by 2031.

Loading Table Of Content...