AC Electric Motor Market Research: 2032

The Global AC Electric Motor Market Size was valued at $17.5 billion in 2022, and is projected to reach $27.9 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Electrical energy is converted to mechanical energy by the electric motor. Among the many applications for electric motors are blowers, industrial machinery, pumps, compressors, and other devices. Because of their efficiency and adaptability, AC motors in particular, synchronous and induction motors are ideal for a wide range of industrial and commercial applications. Because of their excellent controllability, durability, high torque, high efficiency, and great reliability, electric motors are being used in industrial sector rapidly. Key drivers of market growth include rise in demand for electric motors from electric car applications, robotics technologies, and HVAC applications.

Market Dynamics

Compressors, pumps, automobiles, machine tools, lathes, power tools, home appliances, and electric autos all contain electric motors. These highly effective motors are more expensive than normal motors, but they offer a variety of advantages over standard motors, including longer operational lives, lower energy usage, less maintenance, and higher tolerance to voltage fluctuations. The need for high-efficiency motors is anticipated to rise due to the applications of electric motors' need for increased productivity and low power consumption. Moreover, key market players are using product launch strategy for strengthening product portfolio.

For instance, in June 2023, ABB introduced the AMI 5800 NEMA modular induction motor, representing a new generation of technology aimed at delivering outstanding energy efficiency and reliability in challenging applications. Designed for use in demanding scenarios such as pumps, compressors, fans, extruders, conveyors, and crushers, the AMI 5800 boasts a power output rating of up to 1750 HP. Its notable feature lies in its high degree of modularity and customization, making it suitable for both new construction projects and upgrades. This motor is particularly targeted at industries including chemical, oil, and gas, showcasing BB's commitment to providing adaptable and efficient solutions across various sectors. Such instances support the ac electric motor market growth.

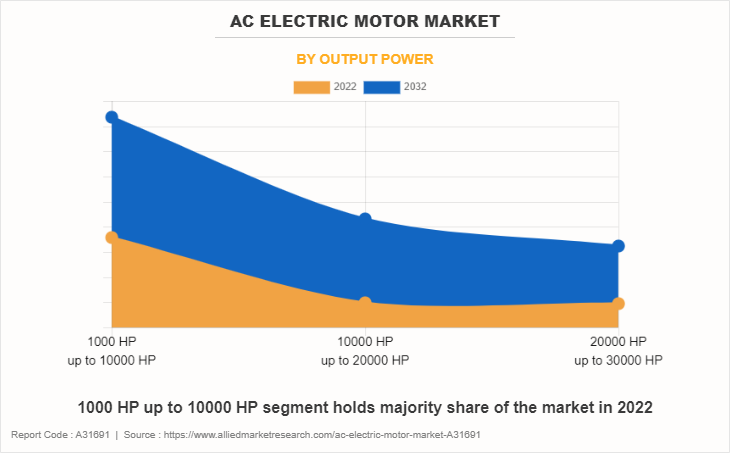

The 1000 HP up to 10000 HP segment held the highest market share in 2022, and 10000 HP up to 20000 HP segment is projected to manifest the highest CAGR from 2022 to 2032, owing to increase in demand for high output and efficiency ac electric motor for industrial sector.

The high initial capital expenditure is anticipated to impede the expansion of the market for electric motors. Extra equipment is required such as an electronic switching controller, speed controller (ESC), and other devices to setup ac electric motor which increases the overall cost. Such factor acts as a restraint on ac electric motor industry growth.

Furthermore, the growing demand for electric motors from robotics and automated robot technologies is expected to create profitable prospects for the market's expansion. In addition, the France Government offers incentives for electric car owners of up to $6,300 depending on the emission levels of the car. Therefore, government funding initiatives for electric cars drive the global ac electric motor market.

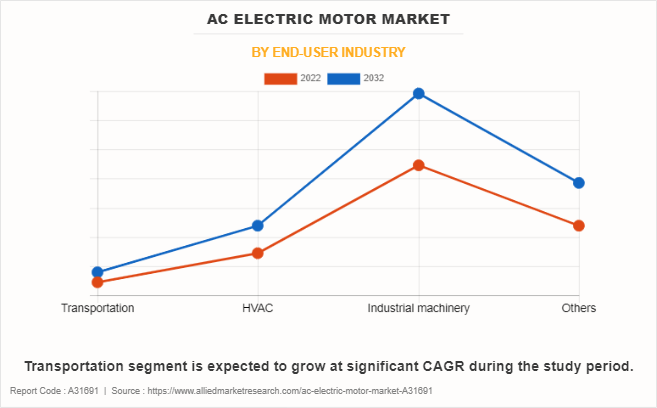

The industrial machinery segment held the highest market share in 2022, and transportation segment is projected to manifest the highest CAGR. This is attributed to increasing demand for efficient and specialized equipment for industrial sector and rising demand of ac electric motor for transportation sector to reduce carbon emission.

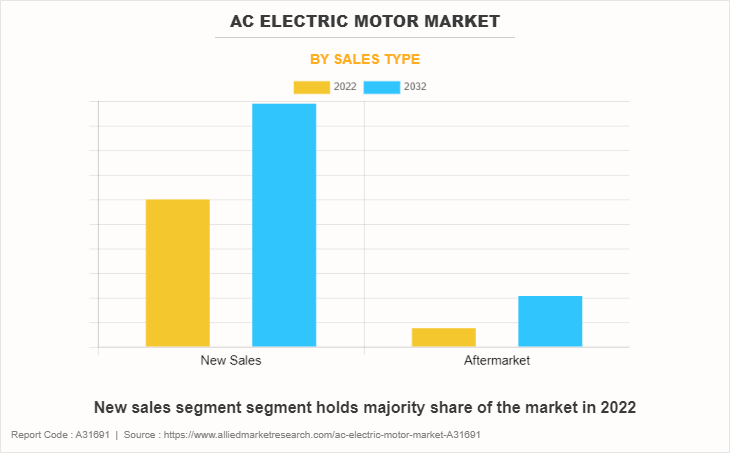

The global ac electric motor market forecast is segmented on the basis of output power, sales type, and end-user industry, and region. By output power, the market is divided into 1000 hp Up To 10000 hp, 10000 hp Up To 20000 hp, and 20000 hp Up To 30000 hp. By sales type, the market is divided into new and after-sales. By end-user industry, the market is divided into automobile, HVAC, industrial machinery, and others.

The new sales segment led the market in 2022, in terms of revenue; however, the aftermarket segment is anticipated to register the highest CAGR during the forecast period.

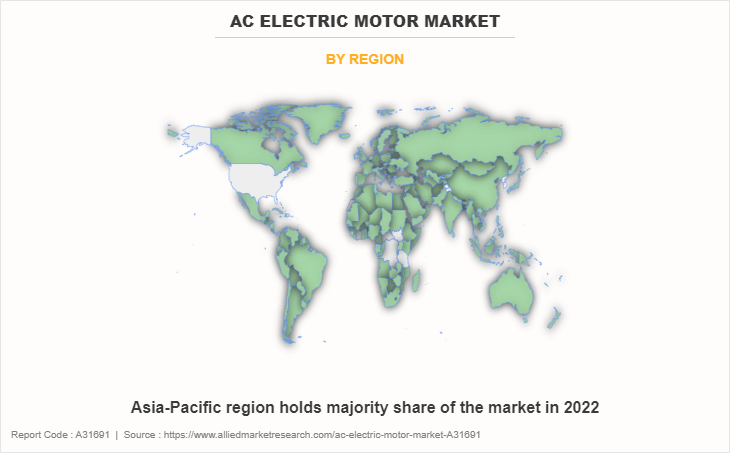

Region-wise, the global ac electric motor market is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

In 2022, Asia-Pacific was the highest contributor to the global ac electric motor market share, and LAMEA is anticipated to secure a leading position during the forecast period.

Competition Analysis

The major players profiled in the ac electric motor market include ABB Ltd, Cantoni Group, General Electric, Hitachi, Nidec, SEC Electric Machinery Co., Ltd, Siemens, Teco, Toshiba, and Weg. Major companies in the market have adopted product launch, acquisition, and partnership as their key developmental strategies to offer better products and services to customers in the ac electric motor market.

Recent Developments in AC Electric Motor Market.

In March 2023, Innomotics, a new distinguished player in motors and massive drives, launched a complete product range spanning low- to high-voltage vehicles, geared vehicles, medium-voltage converters, and motor spindles. As of July 1, 2023, Innomotics will feature as a distinct, fully owned subsidiary of Siemens AG in Germany, with the global separation process line up for completion by October 1, 2023.

In July 2023, Nidec Corporation finished the acquisition of Houma Armature Works, a privately held U.S. Organization, through its subsidiary Nidec Motor Corporation (NMC). Houma Armature Works organization makes a specialty of motor and generator remanufacturing and gives field offerings to oil and gas producers. The agency is based totally in Louisiana and Texas, strategically positioning itself inside key areas of the oil and fuel industry. Such factor are expected to drive the growth of ac electric motor market.

In June 2022, the world's first synchronous reluctance (SR) motor with an aluminum cage rotor was introduced by Nidec Corporation with the SynRA (Synchronous Reluctance Motor with Aluminum Cage Rotor) model for the US market. SynRA combines the basic ideas of a cage-type induction motor with the great efficiency of an SR motor. By fusing the benefits of both technologies, this creative motor design provides improved efficiency and performance. By introducing SynRA, Nidec is demonstrating its dedication to driving forward motor technology and satisfying the changing demands of the American market, thereby expanding the market for high-performance, energy-efficient motors.

In June 2023, ABB introduced the AMI 5800 NEMA modular induction motor, representing a new generation of technology aimed at delivering outstanding energy efficiency and reliability in challenging applications. Designed for use in demanding scenarios such as pumps, compressors, fans, extruders, conveyors, and crushers, the AMI 5800 boasts a power output rating of up to 1750 HP. Its notable feature lies in its high degree of modularity and customization, making it suitable for both new construction projects and upgrades. This motor is particularly targeted at industries including chemical, oil, and gas, showcasing BB's commitment to providing adaptable and efficient solutions across various sectors. Such factor are expected to drive the growth of ac electric motor market.

In May 2023, ABB India, a significant player in electrification and automation, revealed plans to expand its facility at the Peenya factory in Bengaluru. The expansion will involve the establishment of a new production line specifically for variable speed drive modules. These modules play a crucial role in controlling the speed of electric motors, aligning them with the specific requirements of a process. This results in enhanced energy efficiency and performance across various industrial applications and buildings worldwide.

In September 2023, WEG S.A. has disclosed the acquisition of the industrial electric motors and generators business from Regal Rexnord Corporation, a global electromechanical equipment manufacturer. The deal, conducted through its indirect subsidiaries abroad, is valued at $400.0 million, with adjustments expected based on common price considerations for such transactions. Such factor are expected to drive the growth of ac electric motor market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ac electric motor market analysis from 2022 to 2032 to identify the prevailing ac electric motor market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ac electric motor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ac electric motor market trends, key players, market segments, application areas, and market growth strategies.

AC electric motor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 27.9 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 253 |

| By Output Power |

|

| By End-User Industry |

|

| By Sales Type |

|

| By Region |

|

| Key Market Players | SEC Electric Machinery Co., Ltd., ABB Ltd., NIDEC CORPORATION, Cantoni Group, LLC., Siemens AG, Toshiba Corporation, Hitachi Ltd., WEG., Teco Electric & Machinery Co., Ltd., General Electric |

Analyst Review

The AC electric motor witnessed huge demand in Asia-Pacific followed by Europe and North America. The Asia-Pacific market registered the highest share is attributed to the increase in demand for AC electric motors in industrial sectors.

AC electric motors are widely adopted in electric vehicles, construction equipment, and other equipment. The benefits associated with AC electric motors include high efficiency and high torque speed. Rise in demand for AC electric motor in industrial and manufacturing sector globally fuels the growth of the AC electric motor market. In addition, huge demand for heating, ventilation, and air conditioning (HVAC) and in industrial equipment’s is expected to provide lucrative opportunities for the growth of the AC electric motor market.

Moreover, major players such as Mabuchi Motor Co. Ltd. and Siemens AG are adopting acquisition as a key developmental strategy to improve the product portfolio of AC electric motor products. For instance, in July 2023, Nidec Corporation completed the acquisition of full ownership of Houma Armature Works, a privately held U.S. company, through its subsidiary Nidec Motor Corporation (NMC). The acquisition involved purchasing the remaining stake from Houma's founding family. Houma Armature Works specializes in motor and generator remanufacturing and offers field services to oil and gas producers. The company is based in Louisiana and Texas, strategically positioning itself within key regions of the oil and gas industry. This acquisition aligns with Nidec's strategic expansion and strengthens its presence in the service sector for motors and generators, particularly in the vital oil and gas market. Such trends are expected to drive the market growth.

The global ac electric motor market was valued at $17,472.4 million in 2022, and is projected to reach $27,892.2 million by 2032, registering a CAGR of 4.7% from 2023 to 2032.

The forecast period considered for the global AC electric motor market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global AC electric motor market report can be obtained on demand from the website.

The base year considered in the global AC electric motor market report is 2022.

The major players profiled in the AC electric motor market include ABB Ltd, Cantoni Group, General Electric, Hitachi, Nidec, SEC Electric Machinery Co., Ltd, Siemens, Teco, Toshiba, and Weg.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on end-user industry, the industrial machinery segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...