AC MCB Market Summary, 2032

The AC MCB Market was valued at $2.2 billion in 2022, and is projected to reach $3.8 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032. An alternating current miniature circuit breaker (AC MCB) is a type of electrical protection device that automatically switches off the power supply in the event of an overload or short circuit. AC MCBs are commonly used in residential, commercial, and industrial applications to protect electrical circuits and devices from damage due to overcurrent’s.

AC MCBs work by monitoring the current flowing through a circuit and tripping the breaker when the current exceeds a pre-set limit. When a fault occurs, the AC MCB quickly opens the circuit and interrupts the current flow to prevent further damage.

AC MCBs are typically installed in distribution boards or consumer units and are used to protect a range of electrical devices, including lighting circuits, power sockets, mcb for air conditioner unit, and other electrical equipment. The ac dc mcb are commonly used in residential buildings, commercial offices, retail spaces, and industrial facilities.

AC MCBs are typically designed to protect single-phase or three-phase AC electrical systems. They consist of a switch mechanism that is connected in series with the electrical circuit, along with a tripping mechanism that detects overcurrent conditions and trips the switch to interrupt the current flow. The switch mechanism typically consists of a bimetallic strip that heats up and bends when current flows through it, which triggers the tripping mechanism to open the circuit.

AC MCBs are available in a range of current ratings and trip curves, which determine the maximum current they can handle and the time it takes for them to trip in response to an overload or short circuit. The trip curve describes the relationship between the trip time and the magnitude of the overcurrent and is used to select the appropriate AC MCB for a particular application.

AC MCBs also typically have other features such as a test button for manual testing, an indicator for indicating the status of the breaker (i.e., on or off), and a mechanism for locking the breaker in the off position for maintenance or repair.

In addition, some AC MCBs are designed to provide additional protection against electrical hazards such as arc faults and ground faults. These are known as arc fault circuit interrupters (AFCIs) and ground fault circuit interrupters (GFCIs), respectively, and are commonly used in residential and commercial applications to enhance electrical safety.

Segment Overview

The AC MCB market is segmented into type, voltage and end use industry.

The AC MCB market overview is expected to witness notable growth during the forecast period, owing to surge in demand for electricity and increase in need for reliable power delivery, and growth in infrastructure activities across the globe. In the energy sector, AC MCBs and fuses provide power protection in case of excess power or overload.

However, AC MCBs have multiple advantages over fuses, which make them a preferred choice over fuses. For instance, they respond more rapidly than fuses, and are more reliable in terms of providing short circuit protection, over current protection.

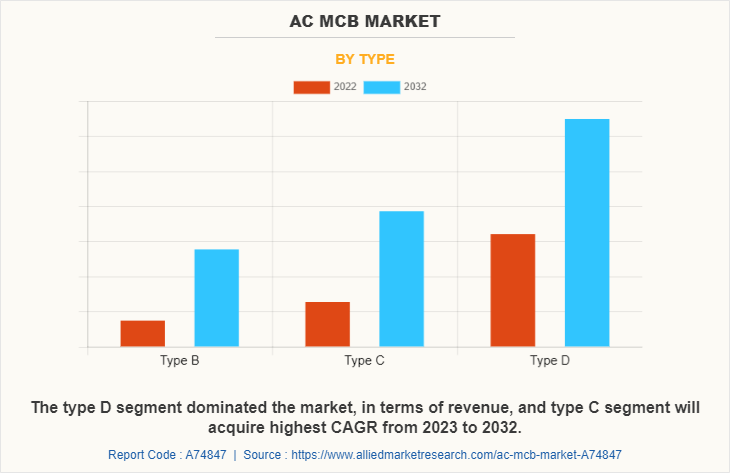

On the basis of type, the AC MCB market size is divided into type B, type C, and type D. In 2022, the type D segment dominated the market, in terms of revenue, and type C segment will acquire highest CAGR from 2023 to 2032.

Fuses are used once & replaced, however, AC MCBs can be reused and it comes with the option of repairing, which acts as one of the key advantages. These factors make them reliable in terms of power delivery, which reduces the risk of short circuits. Therefore, increase in electricity demand across the globe fuels the need for low voltage circuit breakers, in terms of reliable power delivery.

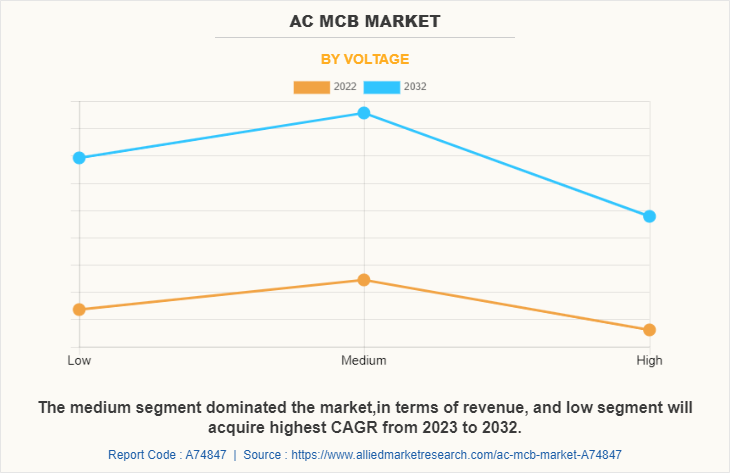

On the basis of voltage, the AC MCB market is segregated into low , medium, and high. According to the analysis, the medium segment acquired the largest share in 2022 and low voltage is expected to grow at a significant CAGR from 2023 to 2032.

Similarly, investments in the power sector of the developing economies such as China, Brazil, India, and others are increasing the focus toward the safety of these smart technologies, which in turn resulted in improving the efficiency and performance with the help of AC MCBs in the smart grid system.

In addition, increase in investment on AC MCBs production in the manufacturing hubs such as China and India has aided the key opportunities in the AC MCBs market to maintain the strong demand for energy efficiency in the upcoming years. On the contrary, frequent operational failures is the restraint for AC MCB market growth during the forecast period.

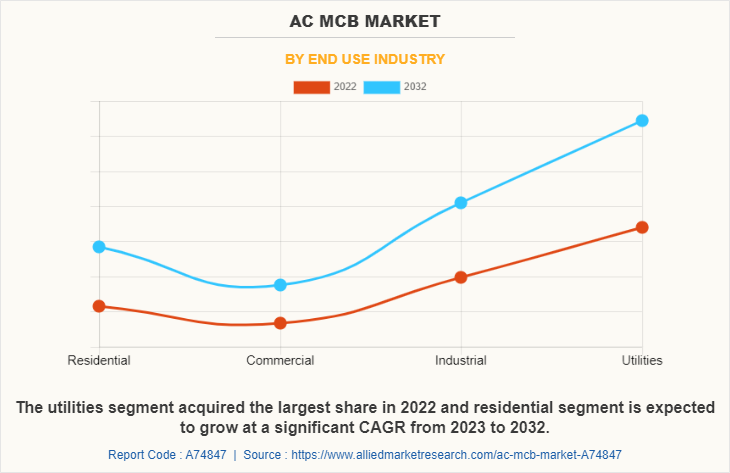

On the basis of end use industry, the market is bifurcated into residential, commercial, industrial, and utilities. The utilities segment acquired the largest share in 2022 and residential segment is expected to grow at a significant CAGR from 2023 to 2032.

Moreover, increase in investment on research & developments to meet future requirements of safety is expected to provide lucrative opportunities for the growth of the AC MCB market during the forecast period. The recent development in the smart grid infrastructure owing to the economic growth in the various countries across the globe has created opportunities for AC MCBs market.

Region-wise, the AC MCB market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Spain, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific remain significant participants in the AC MCB market.

Country Analysis

Country-wise, the U.S. acquired a prime share in the AC MCB market share in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, Germany, dominated the AC MCB market, in terms of revenue, in 2022 and is expected to follow the same trend for AC MCB market forecast period. However, the France is expected to emerge as the fastest-growing country in Europe's AC MCB with a CAGR of 6.71%.

In Asia-Pacific, China is expected to emerge as a significant market for the AC MCB market industry, owing to a significant rise in investment by prime players due to rise in investment in renewable energy resources for rural and urban electrification in the region.

By LAMEA region, the Latin America garner significant market share in 2022. The LAMEA AC MCB market has been witnessing improvement, owing to the growing inclination of companies towards research and development and expanding manufacturing units of circuit breakers across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 5.25% from 2023 to 2032.

Competitive Analysis

Competitive analysis and profiles of the major global AC MCB market players that have been provided in the report include ABB, Altech Corporation, Eaton Corporation, Fuji Electric, General Eletric, Legrand, Mitsubishi Electric, Schneider Electric, Sentai, and Siemens.

Top Impacting Factors

The AC MCB market analysis is anticipated to expand significantly during the forecast period owing to surge in demand for electricity and increase in need for reliable power delivery, and growth in infrastructure activities across the globe. Additionally, during the forecast period, the AC MCB market is anticipated to benefit from increase in investment on research & developments to meet future requirements of safety. On the other hand, growth in the AC MCB market is expected to be restrained by the frequent operational failures.

Historical Data & Information

The global AC MCB market is highly competitive, owing to the strong presence of existing vendors. Vendors of the AC MCB market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

ABB, Altech Corporation, Eaton Corporation, Fuji Electric, General Eletric, Legrand, Mitsubishi Electric, Schneider Electric, Sentai, and Siemens are the top companies holding a prime share and provides AC MCB market opportunity for the growth. Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others to expand their foothold in the AC MCB market.

In April 2023, ABB Unveiled ABB S300 a high-performance industrial Miniature Circuit Breaker (MCB). The ABB S300 P Industrial MCB updates the fundamental component in a modern electrical system, improving safety, performance, efficiency installation and information accessibility.

In July 2022, Eaton announced the acquisition of circuit breaker business of Jiangsu Huineng Electric Co., Ltd. (Huineng), which manufactures and markets low-voltage circuit breakers in China.

In July 2021, GE’s developed of a 245 kV g3 circuit-breaker to accelerate decarbonization of Europe’s electrical grid. GE circuit-breaker, is based on International Electrotechnical Commission (IEC) standards, which was the second G3 gas project co-funded by the EU.

In May 2022, Schneider Electric announced the launch of its SureSeT MV switchgear. This solution, backed by the innovative and award-winning EvoPacT circuit breaker, replaced the Schneider Electric Masterclad solution for primary switchgear applications with a smaller, stronger and smarter solution for managing digital day-to-day operations.

In January 2021, ABB launched Formula DIN-Rail, a complete range of Miniature Circuit Breakers (MCBs).The ABB Formula DIN-Rail portfolio with its contemporary design, provides optimum protection to electrical circuits from possible damages caused by overload, short circuits, and earth leakages in buildings.

Key Benefits For Stakeholders

This AC MCB Industry report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ac mcb market analysis from 2022 to 2032 to identify the prevailing ac mcb market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the ac mcb market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the AC MCB industry players.

The report includes the analysis of the regional as well as global ac mcb market trends, key players, market segments, application areas, and AC MCB market growth strategies.

AC MCB Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.8 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 284 |

| By Type |

|

| By Voltage |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Legrand, General Electric, ABB Ltd., Altech Corporation, Schneider Electric, Zhejiang Sentai Electrical Apparatus Factory, Mitsubishi Electric, Eaton Corporation, Siemens, Fuji Electric Co Ltd. |

Analyst Review

According to the perspectives of CXOs of a leading AC MCB market company, the market for AC MCB is expected to grow significantly in the coming years. There are several factors driving the growth of the AC MCB market, including surge in demand for electricity and increase in need for reliable power delivery, growth in infrastructure activities across the globe, and increase in investment on research & developments to meet future requirements of safety.

Additionally, the increasing adoption of AC MCB in various applications, such as Residential buildings, and others, is expected to further boost the growth of the AC MCB market in the coming years. AC MCBs are commonly used in commercial office buildings to protect electrical circuits and devices. They are typically installed in distribution boards or panel boards and are used to protect lighting circuits, power sockets, air conditioning units, and other electrical equipment. AC MCBs are increasingly being used in renewable energy systems such as solar photovoltaic (PV) and wind power systems. They are used to protect the inverters, which convert the DC power generated by the PV panels or wind turbines into AC power for use in the electrical system.

With the growing population and urbanization, there is a rising demand for electricity, particularly in emerging economies. This is driving the need for reliable and efficient electrical infrastructure, including protection devices such as AC MCBs. The construction industry is experiencing significant growth globally, with increasing construction of residential, commercial, and industrial buildings. This is driving the demand for AC MCBs as they are an essential component of electrical safety systems in these buildings. In addition, there is a growing awareness about the importance of electrical safety, particularly in residential and commercial buildings. This is driving the adoption of AC MCBs as they are an effective way to prevent electrical hazards and protect against electrical fires. Governments around the world are implementing regulations and standards to ensure electrical safety in residential, commercial, and industrial buildings. This is driving the demand for AC MCBs as they are a key component of compliance with these regulations.

Surge in renewable energy installations is the upcoming trends of AC MCB Market in the world

The Global AC MCB Market to grow at a CAGR of 5.5% from 2023 to 2032.

Asia-Pacific is the largest regional market for AC MCB.

The Global AC MCB Market was valued at $2.2 billion in 2022 and is projected to reach $3.8 billion by 2032.

ABB, Altech Corporation, Eaton Corporation, Fuji Electric, General Eletric, Legrand, Mitsubishi Electric, Schneider Electric, Sentai, and Siemens.

Loading Table Of Content...

Loading Research Methodology...