Acetal Copolymer Market Research, 2030

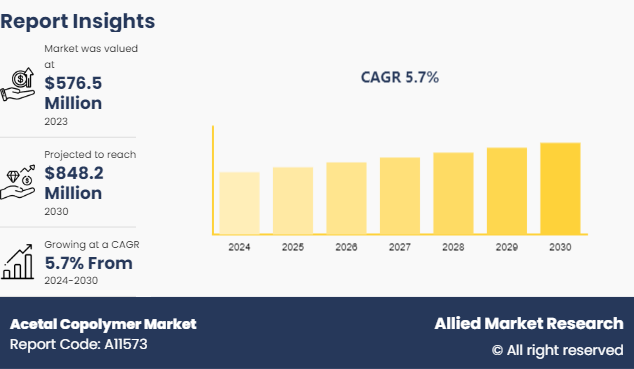

The global acetal copolymer market was valued at $576.5 million in 2023, and is projected to reach $848.2 million by 2030, growing at a CAGR of 5.7% from 2024 to 2030.

Market Introduction and Definition

Acetal copolymer is a thermoplastic material derived from formaldehyde and other chemicals. It exhibits excellent mechanical properties, including high strength, stiffness, and toughness, making it suitable for various engineering applications. Its low coefficient of friction, chemical resistance, and dimensional stability further enhance its utility. Acetal copolymer is commonly used in industries such as automotive, aerospace, and consumer goods manufacturing. Its versatility extends to applications like gears, bearings, fasteners, and electrical components. This copolymer's ability to withstand moisture, abrasion, and fatigue makes it a preferred choice for parts requiring durability and reliability in demanding environments.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The acetal copolymer market is fragmented in nature among prominent companies such as Delrin USA, LLC, Boedeker Plastics, Inc, Asahi Kasei Plastics, Ensinger, Emco Industrial Plastics, Radici Partecipazioni SpA, Celanese Corporation, Mitsubishi Chemical Group of companies, Entec Polymers, and thyssenkrupp Materials NA, Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global acetal copolymer market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,400 acetal copolymer -related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global acetal copolymer market.

Key Market Dynamics

Factors such as increasing disposable income, technological upgrades, and spurring rise in original equipment manufacturers (OEMs) have led the automotive sector to witness a significant growth. For instance, according to a report published by India Brands Equity Foundation, the FDI inflow in automobile sector in India increased by 5.34% in May 2024 as compared to May 2023. Thus, the use of acetal copolymer in automotive sector in various applications such as automotive interior components, fuel systems, and under-the-hood parts due to its mechanical strength, chemical resistance, and low friction properties may fuel the growth of the acetal copolymer market during the forecast period.

Additionally, the growing incidence of lifestyle diseases has led the healthcare sector to witness significant growth. For instance, according to a report published by National Investment Promotion & Facilitation Agency, the Indian healthcare sector is expected to reach $372 billion by 2022 at a compound annual growth rate (CAGR) of 39%. Acetal copolymers are widely used in healthcare sector or its biocompatibility, sterilizability, and suitability for precision components. This factor may act as one of the key drivers responsible for the growth of the acetal copolymer market in the growing healthcare sector. However, the prices of raw materials used in acetal copolymer production, such as formaldehyde and other chemical intermediates, are subject to fluctuations due to factors like supply-demand dynamics, geopolitical tensions, and currency exchange rates. This volatility affects production costs and profit margins for manufacturers; thus, hampering the growth of the acetal copolymer market.

On the contrary, the increasing adoption of engineering plastics over traditional materials such as metals and commodity plastics presents a significant opportunity for the acetal copolymer market. Engineering plastics offer superior mechanical properties, chemical resistance, and design flexibility, making them ideal for a wide range of applications across industries. As industries prioritize lightweighting, durability, and sustainability, acetal copolymer stands to benefit from its excellent balance of properties and processing advantages. Moreover, the substitution of metal parts with plastic components in automotive, aerospace, and industrial applications drives demand for acetal copolymer, offering opportunities for market expansion and penetration into new application areas.

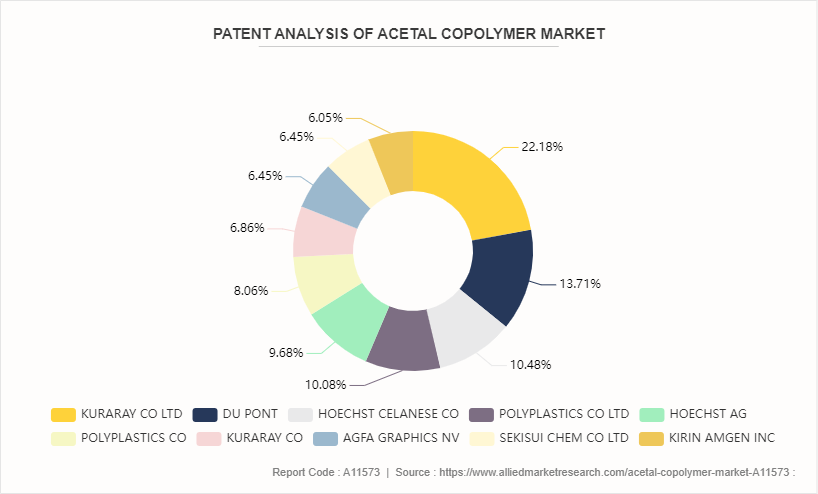

This patent analysis provides a comprehensive overview of patents related to acetal copolymer and its applications across various industries, including automotive, chemical manufacturing, and emerging fields. The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future-outlook within the acetal copolymer market. Patent filings related to acetal copolymer have shown a steady increase over the past decade, indicating growing interest and investment in acetal copolymer R&D.

Market Segmentation

The acetal copolymer market is segmented on the basis by product type, forming methods, end-use industry, and region. By product type, the market is classified into low heat resistant, medium heat resistant, and high heat resistant. Based on forming method, the market is segmented into injection molding, extrusion, rotational molding, blow molding, and others. By end-use industry, the market is classified into automotive, electrical and electronics, building and construction, aerospace, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for acetal copolymer, driven by rising building & construction, transportation, industrial, and other sectors that have enhanced the performance of the acetal copolymer market in the Asia-Pacific region. China's industrial sector is increasing rapidly which in turn has enhanced the performance of the acetal copolymer market in the region. According to a report published by the United Nations Statistics Division, China witnessed around 20.7% of the global manufacturing output for consumer goods in 2022. Also, countries such as India and Australia are witnessing a rapid increase in transportation sectors where acetal copolymers are employed as preferred materials in modern fuel systems of both light weight and heavy automotive vehicles. For instance, according to a report published by the Indian Ministry of Commerce and Industry, the transportation sector in India is expected to grow at a compound annual rate (CAGR) of 5.9% owing to the development of highways, widespread railway networks, aviation ports, and waterways structure. This may enhance the performance of the acetal copolymer market in the Asia-Pacific region.

Competitive Landscape

The major players operating in the acetal copolymer market include Delrin USA, LLC, Boedeker Plastics, Inc, Asahi Kasei Plastics, Ensinger, Emco Industrial Plastics, Radici Partecipazioni SpA, Celanese Corporation, Mitsubishi Chemical Group of companies, Entec Polymers, and thyssenkrupp Materials NA, Inc. Other players in the acetal copolymer market include Modern Plastics, Inc., Merck KGaA, Redwood Plastics and so on.

Public Policies

Several acts and regulations have been imposed in order to avoid safeguard the manufacturing and utilization of acetal copolymer for application in various end-use sectors. For instance:

- In U.S, the Toxic Substances Control Act (TSCA) regulates the manufacture, importation, processing, distribution, and use of chemicals, including polymers, in the U.S. Acetal polymers fall under the purview of TSCA regulations, which require manufacturers to submit pre-manufacture notices (PMNs) for new chemical substances.

- In Europe, Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation (EC) No 1107/2009 governs the registration, evaluation, and authorization of chemicals in the European Union (EU) . Acetal polymers are considered chemical substances under REACH and must comply with registration requirements if manufactured or imported in quantities exceeding specified thresholds.

- In South Korea, Korea Chemicals Control Act (CCA) regulates the management, importation, and use of chemical substances in South Korea. Acetal polymers may be subject to registration, notification, or other requirements under the CCA, depending on their classification and intended use.

- In China, EACH (MEP Order No. 7) also known as the Measures on the Environmental Management of New Chemical Substances (MEP Order No. 7) , governs the registration and management of new chemical substances in China. Acetal polymers manufactured or imported in China may require registration or notification under China REACH regulations.

Industry Trends

- In 2022, researchers from Germany have developed printable hierarchical liquid-crystal-polymer structures with superior mechanical performance. This may surge the demand for novel printable polymer across various chemical industries.

- In 2021, researchers from Punjab Technical University, India have developed conducting polymers by modifying their surface structures. This strategic invention may surge the demand for conducting polymers across various end-use industries including electronics, nanotechnology, and others.

Key Sources Referred

- National Promotion and Facilitation Agency

- India Brands Equity Foundation

- U.S. Development Authority

- Science Direct

- American Automotive Policy Council

- Invest In India

- Press Information Bureau

- International Trade Administration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the acetal copolymer market analysis from 2024 to 2030 to identify the prevailing acetal copolymer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the acetal copolymer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global acetal copolymer market trends, key players, market segments, application areas, and market growth strategies.

Acetal Copolymer Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 848.2 Million |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2030 |

| Report Pages | 350 |

| By Product Type |

|

| By Forming Method |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Celanese Corporation, Radici Partecipazioni SpA, Delrin USA, LLC, thyssenkrupp Materials NA, Inc., Boedeker Plastics, Inc, Emco Industrial Plastics, Entec Polymers, Asahi Kasei Plastics, Ensinger, Mitsubishi Chemical Group of companies |

Escalating demand for automotive sector, increase in demand from healthcare sector, and rise in demand from industrial sector are the upcoming trends of acetal copolymer market in the globe.

Automotive is the leading application of acetal copolymer market.

Asia-Pacific is the largest regional market for acetal copolymer.

The acetal copolymer market was valued at $576.5 million in 2023, and is projected to reach $848.2 million by 2030, growing at a CAGR of 5.7% from 2024 to 2030.

Delrin USA, LLC, Boedeker Plastics, Inc, Asahi Kasei Plastics, Ensinger, Emco Industrial Plastics, Radici Partecipazioni SpA, Celanese Corporation, Mitsubishi Chemical Group of companies, Entec Polymers, and thyssenkrupp Materials NA, Inc are the top companies to hold the market share in acetal copolymer.

Loading Table Of Content...