Acoustic Vehicle Alert System Market Insights, 2032

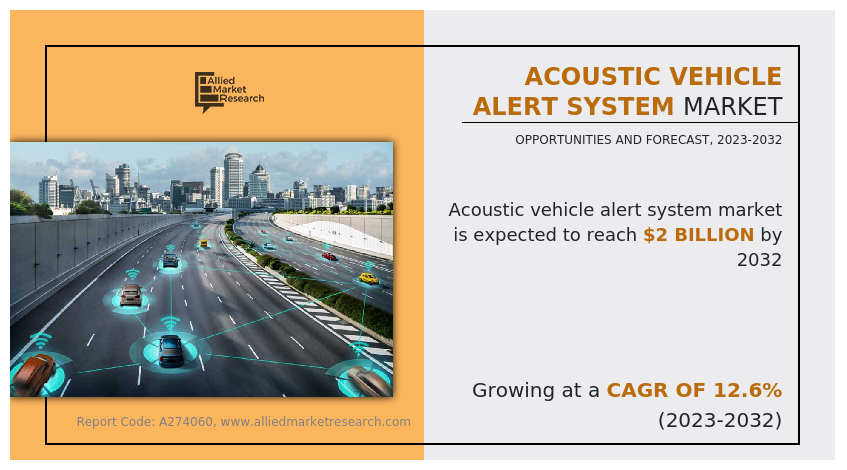

The global acoustic vehicle alert system market size was valued at $653 million in 2022, and is projected to reach $2 billion by 2032, growing at a CAGR of 12.6% from 2023 to 2032.

Report Key Highlighters:

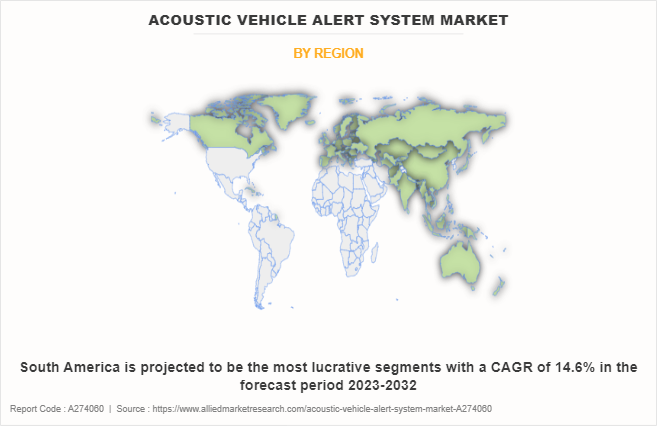

- The acoustic vehicle alert system market report study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The acoustic vehicle alert system market share is highly fragmented, into several players including Continental AG, STMicroelectronics, HELLA GmbH & Co. KGaA, Mercedes-Benz AG, Brigade Electronics Group PLC, HARMAN International, Honda Motor Company, Kendrion N.V., Soundracer AB, Maruti Suzuki India Ltd. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

AVAS creates alerts to the pedestrians of the presence of electric-drive vehicles when they are traveling at low speeds. Government regulations mandated warning sound devices necessary for the vehicle operating in electric mode as it generates less noise compared to traditional combustion engine vehicles. These warning sounds, such as artificial beeps, chimes, tire movements over gravel, and engine-like sounds, are automatically activated at low speeds. AVAS reduces the risk of accidents at crosswalks and on roadways by emitting an audible warning sound in both forward and reverse motion, alerting pedestrians to the presence of an approaching electric vehicle.

The regulations mandate that the vehicle produces a continuous sound up to speeds of 20 km/h, with the volume and pitch adjusting proportionally to the vehicle's speed. This ensures that pedestrians can perceive the car's speed solely through auditory cues. For instance, according to UN Regulation No. 138, a vehicle equipped with AVAS should not exceed an overall sound level of 75 dB(A). The regulation further specifies that the AVAS sound frequency range should vary by at least 0.8% per 1 km/h within the speed range of 5-20 km/h when moving in the forward direction. All these factors are driving the growth of AVAS market.

The growth of the global acoustic vehicle alerting system market is driven by surge in government regulation, technological advancement. However, the increasing complexity of AVAS system restrain the market growth. On the contrary, rise in demand for electric vehicles provide lucrative growth opportunities for the market growth.

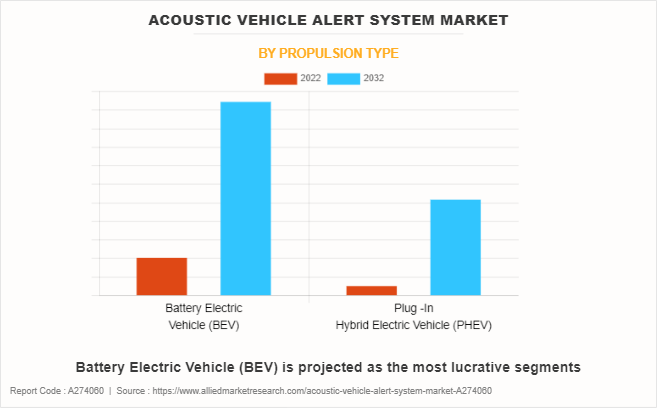

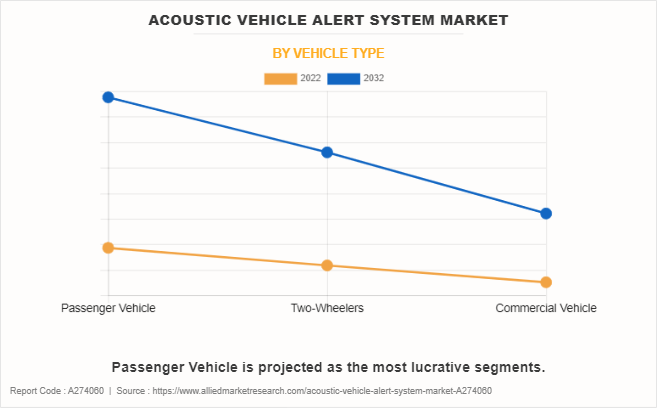

The global acoustic vehicle alert system industry is segmented on the basis of propulsion type, vehicle type, and region. Depending on the propulsion type, the market is segregated into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV). By vehicle type, two-wheelers, passenger vehicles, commercial vehicle. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The lack of external noise in hybrid and electric vehicles, particularly at low speeds, is a matter of concern for both automotive manufacturers and regulators. Pedestrian safety, especially for individuals with visual impairments, is a significant consideration. Consequently, legislation globally has shifted towards mandating the implementation of an Acoustic Vehicle Alerting System (AVAS) for electric vehicles.

Surge in Government Regulations:

Surge in government regulations related to road safety is driving the growth of acoustic vehicle alert system. For instance, according to the European Regulation, all vehicles entering or being sold in the European Union after July 1, 2021, should be equipped with an AVAS, irrespective of their type. Similarly, the U.S government has mandated the incorporation of acoustic vehicle alerting systems in electric and hybrid vehicle production from September 2020.

Moreover, surge in the adoption of electric cars and light-duty trucks is primarily driven by continuous innovations, a wide array of models offered by automakers, and decreasing prices driving the growth of acoustic vehicle alert system market. According to IEA, the sales of electric vehicles increased from 4% in 2020 to 14% in 2022.

Technological Advancements:

As digitization becomes more prevalent globally, there is a growing demand for vehicles equipped with advanced systems. Owing to this acoustic vehicle alert systems are deployed in the electric vehicles for safety purposes. Acoustic Vehicle Alerting Systems (AVAS) serve as sound generators implemented in electric vehicles to notify pedestrians, cyclists, children, and other road users of the car's presence. Emitting sounds through speakers positioned below the vehicle's body, these auditory signals are synchronized with the real-time data of the vehicle, offering external information about its speed, direction, and distance.

Integration Complexity of AVAS System:

Integration of AVAS technology into current vehicles and the older models, is a complicated process. Retrofitting AVAS in vehicles not initially designed for such systems introduce technical difficulties and additional expenses. This complexity hampers the deployment of AVAS technology.

Rise in Demand for Electric Vehicle

The growing demand for alternative fuel vehicles has stimulated the market demand for battery-operated and hybrid vehicles. Furthermore, global government authorities have implemented favorable policies to encourage the use of electric vehicles, aiming to reduce crude oil consumption, automotive emissions, and air pollution. For instance, British transport secretary announced in February 2020, launching the first fully electric bus town with a government grant of $69 million for electric bus. Thus, these factors are propelling the opportunities for growth of acoustic vehicle alert system market as the government has mandated the deployment of AVAS in electric vehicles.

Electric vehicles are now subject to a legal mandate that requires them to emit sounds exceeding 56 decibels. The upper limit for these sounds is set at 75 decibels, comparable to the typical noise produced by combustion vehicles. Additionally, the specified frequency for these sounds is 1,600 Hz, a design consideration tailored to accommodate the heightened sensitivity of older individuals' ears. This shift in regulations aims to address concerns about pedestrian safety by reintroducing audible cues in urban environments. Jaguar took an early initiative by developing a unique acoustic warning system specifically tailored for individuals with visual impairments. Similarly, Audi, with its e-tron model, has ventured into creating a distinctive sound.

Growth of electric and hybrid buses has raised fresh safety concerns for road users, particularly those who are blind or partially sighted. The diminished audible cues from these quieter vehicles pose a potential risk, as individuals may not be alerted to the approaching bus, potentially leading to a rise in road accidents.

AVAS functions by generating synthetic sounds that mimic the noise of a traditional internal combustion engine. This system becomes active when the vehicle's speed drops below a designated threshold. European regulations mandate that AVAS emits sound when the vehicle is moving at speeds below 20 km/h, whereas in the U.S, the threshold is set at speeds below 30 km/h. The intentionally crafted sound is distinct from surrounding environmental noises, aiming to provide an effective alert without contributing to unnecessary noise pollution.

The application of AVAS extends beyond private cars, it encompasses a diverse range of vehicle categories. Mandatory for not only electric cars but also hybrids, plug-in hybrids, and fuel cell vehicles, AVAS is a requirement that spans both personal and commercial transportation. This mandate applies to vehicles used for both passenger and cargo transport, reflecting a comprehensive approach to road safety. The widespread inclusion of AVAS in various vehicles is a regulatory measure aimed at bolstering safety for all road users.

Key Developments in AVAS Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In April 2022, Honda Motors launched a new e-HEV hybrid vehicle in India, featuring an Acoustic Vehicle Alerting System (AVAS) activated during low-speed EV Mode.

In August 2022, Maruti Suzuki, India's largest automaker, has an objective to launch the first electric vehicle by the end of 2025. The company has stated its intent not only to manufacture electric vehicles domestically but also to initiate the production of lithium-ion batteries, currently imported by various OEMs from other countries. These trends covers the acoustic vehicle alert system market analysis.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, dynamics and acoustic vehicle alert system market trends and analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Acoustic Vehicle Alert System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 267 |

| By Propulsion Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | ST Microelectronics , HARMAN International, Continental AG, Brigade Electronics Group PLC, Mercedes-Benz AG, Kendrion N.V., HELLA GmbH & Co. KGaA, Soundracer AB, Honda Motor Company, Maruti Suzuki India Ltd. |

Battery Electric Vehicle (BEV) are the upcoming trends of Acoustic Vehicle Alert System Market

Passenger Vehicle is the leading application of Acoustic Vehicle Alert System Market

North America is the largest regional market for Acoustic Vehicle Alert System

2 billion is the estimated industry size of Acoustic Vehicle Alert System

HELLA GmbH & Co. KGaA is the the top companies to hold the market share in Acoustic Vehicle Alert System.

Loading Table Of Content...

Loading Research Methodology...