Acrylic Rubber Market Research, 2033

The global acrylic rubber market was valued at $1.2 billion in 2023, and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

Market Introduction and Definition

Acrylic rubber, also known as acrylate rubber or alkyl acrylate copolymer, is a synthetic elastomer derived from the polymerization of acrylic monomers. This specialized type of rubber is characterized by its unique chemical composition, primarily consisting of repeating units derived from acrylic acid or related alkyl acrylate compounds. The polymerization process results in the creation of a polymer chain that imparts distinctive properties to acrylic rubber, making it particularly well-suited for specific industrial applications.

Acrylic rubber exhibits remarkable resistance to heat, ozone, and weathering, distinguishing it as a high-performance elastomer. The unique characteristics positions acrylic rubber as a reliable material for seals, gaskets, hoses, and other components in the industries such as automotive, construction, and manufacturing.

Key Takeaways

- The acrylic rubber market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) and volume for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major acrylic rubber industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The growth of the acrylic rubber market is propelled by automotive demand, as the sector requires advanced materials, which exhibit excellent resistance to heat, oil, and chemicals. Moreover, its mechanical properties such as high tensile strength and tear resistance cater to the environmental standards and high-performance needs. Acrylic rubber's ability to withstand extreme temperatures and resist degradation from UV radiation ensures durability in automotive components. Thus, acrylic rubber serves as a vital solution for ensuring longevity, reliability, and efficiency in automotive applications.

The global increase in construction and infrastructure projects has driven the growth of the acrylic rubber market. Acrylic rubber exhibits remarkable resistance against a wide range of environmental factors, including temperature fluctuations, moisture exposure, and chemical exposure, making it highly suitable for demanding construction conditions., . With its high durability and reliability, it can withstand extreme temperatures, weather changes, and exposure to common construction chemicals. Its versatility suits various construction applications, especially in seals and gaskets.

However, the market expansion is hindered by challenges in recycling and disposal, impacting environmental sustainability and market dynamics. In addition, lack of efficient recycling methods for acrylic rubber, leads to increased waste accumulation and environmental strain. The inability to effectively manage end-of-life products hampers sustainability efforts, as disposal methods often involve landfilling or incineration, both contributing to pollution and resource depletion. The difficulties in effectively recycling or disposing of these products pose significant constraints for the growth of the market.

Technological advances in rubber compounding offer a notable opportunity for the acrylic rubber market. Advanced techniques enable precise incorporation of additives and modifiers, enhancing durability, flexibility, and resistance to environmental factors. This customization empowers manufacturers to develop formulations tailored to excel in various industrial applications.

Market Segmentation

The global acrylic rubber market is segmented into source, fabrication process, application, and region. By source, the market is divided into ethyl acrylate, butyl acrylate, methoxyethyl acrylate, and ethoxy ethyl acrylate. Depending on fabrication process, it is segregated into compression molding, transfer molding, injection molding and others. As per application, the market is categorized into coating, textiles, seals & gaskets, adhesives, plastics, engine oils & lubricants, piping, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

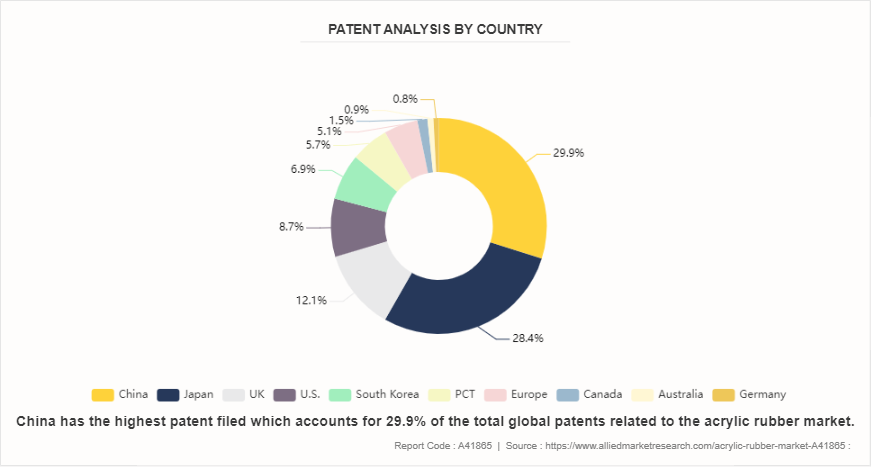

Patent Analysis of Global Acrylic Rubber Market

Acrylic rubber is a versatile material used in various industrial applications. It exhibits high heat resistance, oil resistance, and mechanical properties. The patent WO/2023/0429211, published in March 2023, pertains to an acrylic rubber composition and a crosslinked product thereof. The invention aims to provide an acrylic rubber composition with excellent compression set properties and heat resistance, without a significant difference in hardness or tensile strength before and after exposure to a high temperature environment. The inventors discovered that a crosslinked product fabricated from an acrylic rubber composition comprising a chlorine group-containing acrylic rubber, carbon black, silica, a mercapto group-containing silane coupling agent, and a triazine-based crosslinking agent exhibits excellent compression set properties and heat resistance.

Another patent EP4190861, published in June 2023, pertains to an innovative acrylic rubber composition. This composition is proposed to comprise 10 to 20 wt.% of methyl methacrylate unit, 15 wt.% or less of ethyl acrylate unit, 60 to 80 wt.% of n-butyl acrylate unit, and 10 to 30 wt.% of 2-methoxyethyl. The unique formulation of this acrylic rubber is designed to offer superior moldability and releasability from the metallic surfaces of milling rollers for the compounding works and metal molds.

Competitive Landscape

The key market players operating in the acrylic rubber market include ZEON CORPORATION, DuPont, Hi Tech Polymers, GBSA, Inc., RubberMill, Inc., CSL Silicones Inc., ZORGE, Kivi Markings, Hanna Rubber Company, and Tiger Rubber Company.

Other players in acrylic rubber market include NOK CORPORATION, Anabond Limited, Denka, and Fostek Corporation. The key players have adopted development strategies for instance, in September 2021, Zeon Corporation began commercial production of acrylic rubber in August 2021 at its Group company, Zeon Chemicals Asia Co., Ltd., in Rayong Province, Thailand.

Regional Industry Outlook

In Asia-Pacific and North America, the growth of automotive and construction industries drives the growth of the acrylic rubber market. Acrylic rubber is used in a variety of automotive applications, including transmission seals, O-rings, gaskets, and hoses. It is also used in automotive interior components, such as dashboards and door panels.

- In 2023, there was a notable surge in car production, with a 30% increase reported by the China Automotive Association. In addition, the number of newly registered passenger vehicles saw a significant rise, reaching 23.14 million. China's FDI policy, which has been particularly supportive of the automotive sector, has attracted substantial investment from prominent global brands, contributing to the industry's success. Notably, trucks constituted approximately 90% of all commercial vehicle sales in China during the same year, with 1.1 million heavy-duty trucks and 229, 113 medium-duty trucks sold.

- In 2022, the combined demand for passenger cars and commercial vehicles in Japan reached 5.19 million units, marking a 2.2% increase from the previous year. Passenger cars and commercial vehicles, excluding mini vehicles, totaled 3.34 million units, experiencing a slight decrease of 0.7% compared to fiscal 2022. Mini vehicles saw a notable increase, reaching 1.86 million units, up by 7.9%. South Korea's commercial vehicle market constitutes 10% of its overall automotive sector. In 2022, South Korea produced 4.2 million automobiles, with 360, 000 of them categorized as commercial vehicles. Asia-Pacific witnessed a surge in sales of heavy-duty trucks and commercial vehicles, driven by factors such as economic expansion and substantial ongoing investments in infrastructure.

- According to the Invest India, the India's automotive industry is worth around $222 billion in 2022, while the EV market in India is estimated to be valued at $2 billion by 2023 and $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billion of global R&D spending. Thus, acrylic rubber’s ability to maintain flexibility and elasticity across a broad temperature range makes it an ideal material for seals, gaskets, and hoses in engines and other automotive systems.

- According to the Bureau of Economic Analysis, the total value generated by the construction industry in the first three quarters of 2022 in the U.S. was around $2, 980 billion, or roughly 5% more than the previous year for the same time. In February 2022, the Manchester City Council approved a nine-year development project for four skyscrapers. Under this project, residential buildings with 39–60 floors will be built on the Trinity Islands, which are the banks of the River Irwell. The project is expected to involve building 1,950 apartments. Thus, the expanding landscape of construction and infrastructure projects globally drives the growth of the acrylic rubber market.

Industry Trends

- In May 2022, the Statistics & Planning Department, Rubber Board, Kottaya announced that natural rubber (NR) production in India increased to 775, 000 tons during 2021-22 as compared to 715, 000 tons during 2020-21, recording a growth of 8.4% compared to a 0.4% registered during the previous year.

- According to the International Rubber Study Group (IRSG) , world natural rubber production during 2021 was 13.770 million tons compared to 13.065 million tons produced in 2020, registering a positive growth of 5.4%. During 2021, NR production in major producing countries, Thailand, Indonesia, Vietnam, Cote d’Ivoire, China, and India increased whereas production in Malaysia decreased when compared to 2020.

Key Sources Referred

- Statistics & Planning Department, Rubber Board

- Invest India

- International Rubber Study Group (IRSG)

- Rubber Board, Ministry of Commerce, and Industry

- India Brand Equity Foundation

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the acrylic rubber market analysis from 2024 to 2033 to identify the prevailing acrylic rubber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the acrylic rubber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global acrylic rubber market trends, key players, market segments, application areas, and market growth strategies.

Acrylic Rubber Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 Billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Source |

|

| By Fabrication Process |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hanna Rubber Company, GBSA, Inc., CSL Silicones Inc., ZEON CORPORATION, Kivi Markings, Hi Tech Polymers, DuPont, Tiger Rubber Company, RubberMill, Inc., ZORGE |

Loading Table Of Content...