Adblue Market Research, 2032

The global Adblue market was valued at $33.1 billion in 2022, and is projected to reach $66.7 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

Report Key Highlighters:

- Quantitative information mentioned in the global Adblue market includes the market numbers in terms of value ($Million) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of method and application. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including BASF SE, CrossChem, Yara, Shell plc, Nissan Chemical Corporation, TotalEnergies, Cummins Inc., and Mitsui Chemicals India Pvt. Ltd., hold a large proportion of the Adblue market.

- This report makes it easier for existing market players and new entrants to the Adblue business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Adblue, also known as Diesel Exhaust Fluid (DEF), is a clear, non-toxic, and high-purity urea solution used in selective catalytic reduction (SCR) systems to reduce harmful nitrogen oxide (NOx) emissions from diesel engines. Adblue is composed of approximately 32.5% urea and 67.5% deionized water, and its primary function is to chemically react with NOx emissions in the exhaust gases, converting them into harmless nitrogen and water vapor. This eco-friendly solution helps diesel vehicles comply with stringent emission regulations by effectively reducing air pollution.

Adblue has several key properties, including being colorless, odorless, and non-flammable, making it safe for handling and storage. It must be stored between 12°F (-11°C) and 86°F (30°C) to maintain its stability. In addition, it has a shelf life of approximately one year. Adblue is crucial in modern diesel vehicles and heavy machinery, playing a vital role in reducing environmental impacts and promoting cleaner air quality.

The Adblue market is experiencing notable growth, primarily due to the expanding construction industry.

The construction industry is experiencing a progressive increase in Adblue usage as the demand for engine coolants utilized in construction equipment rises. Construction equipment consists of, among other things, loaders, bulldozers, graders, and dragline excavators. There has been a substantial expansion in the construction industry in recent years. Infrastructure project investments, economic expansion, and technological progress are all contributing to the industry's expansion. The construction industry is a significant contributor to the economy of the GCC nation. In 2019, the UAE construction industry experienced a growth rate of 3.3 %; by 2021, that figure is anticipated to increase to 4.3%.

The Khaleej Times reports that projects with an estimated cost of $198.8 billion were finalized in the GCC during the year 2019. Qatar is making substantial investments in construction and infrastructure development. In Qatar, ongoing construction projects include stadiums for the 2022 FIFA World Cup, the expansion of the New Doha Port Pro, the expansion of Hamad International Airport, and the development of expressways. These initiatives are anticipated to contribute to the growth of the market over the forecast period.

The expansion of commercial vehicle fleets, including trucks and buses, is poised to be a significant driver for the Adblue market.

This growth is attributed to several factors. The demand for the transportation of goods and people has surged as the global economy continues to expand, necessitating a larger fleet of commercial vehicles. Governments globally are implementing stringent emissions regulations, such as Euro VI in Europe and EPA standards in the U.S., mandating the use of Adblue to reduce nitrogen oxide (NOx) emissions from these vehicles. Consequently, fleet operators are increasingly adopting Selective Catalytic Reduction (SCR) technology, which relies on Adblue for NOx reduction, to comply with these regulations. As a result, the Adblue market is set to experience sustained growth as the commercial vehicle sector continues to expand and adhere to environmental mandates, contributing to a cleaner and more sustainable transportation ecosystem.

The Adblue market is poised for growth due to increasing government incentives aimed at reducing emissions from diesel-powered vehicles and machinery.

Governments globally are recognizing the need to curb air pollution and combat climate change, leading them to offer financial incentives, tax benefits, and regulatory support to encourage the use of Adblue. These incentives often target vehicle owners, operators, and manufacturers, providing cost-saving measures for adopting Selective Catalytic Reduction (SCR) technology, which requires Adblue for effective emission control. As countries tighten their environmental regulations and enforce stricter emission standards, these government incentives serve as a catalyst for the expansion of the Adblue market.

Fluctuations in the prices of urea can significantly impact the Adblue market. Adblue, a diesel exhaust fluid (DEF), contains urea as a key component, and its cost is directly influenced by urea prices. Urea is a critical ingredient in the Adblue manufacturing process, and its price volatility can create challenges for both producers and consumers. When urea prices rise, the production cost of Adblue increases, which can lead to higher prices for end-users, including vehicle operators and manufacturers.

This can make Adblue less cost-competitive and deter its use, potentially pushing some consumers to seek alternatives or cut back on consumption. Conversely, a drop in urea prices may not significantly benefit Adblue users, as manufacturers often do not lower Adblue prices in tandem with reduced production costs. In this way, urea price fluctuations can serve as a restraint for the Adblue market, affecting its affordability and adoption by diesel vehicle operators and manufacturers.

There is a growing demand for eco-friendly alternatives in the transportation sector as global environmental concerns and stringent emissions regulations continue to gain momentum. Green Adblue solutions, which emphasize sustainable sourcing, production processes, and reduced environmental impact, address these needs effectively. Manufacturers are increasingly exploring renewable and low-carbon feedstocks, like biomethanol and waste-based urea, to produce Adblue.

These greener production methods not only reduce the carbon footprint of Adblue but also align with corporate sustainability goals. In addition, advances in Adblue dispensing technologies and real-time emissions monitoring systems offer improved efficiency and accountability, further enhancing the attractiveness of the market. Businesses in the Adblue sector have the opportunity to meet this demand for environmentally conscious solutions as governments and industries push for cleaner transportation options, driving revenue growth and strengthening their market position while contributing to a more sustainable future. Thus, the development of green Adblue solutions is projected to offer lucrative opportunities for the Adblue market growth.

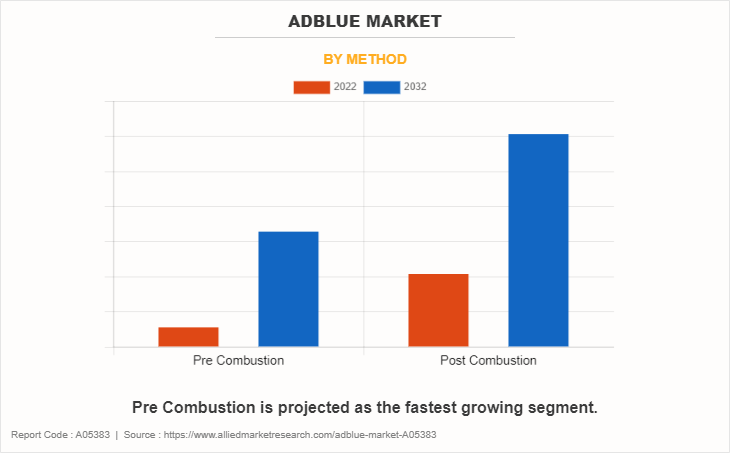

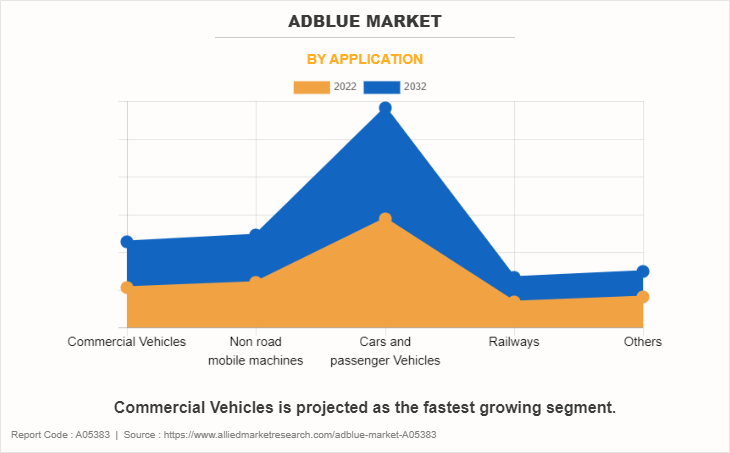

The Adblue market is segmented on the basis of method, application, and region. By method, the market is divided into pre-combustion and post-combustion. On the basis of the application, the market is categorized into commercial vehicles, non-road mobile machines, cars and passenger vehicles, railways, and others. region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global Adblue market are BASF SE, CrossChem, Yara, Shell plc, Nissan Chemical Corporation, TotalEnergies, Cummins Inc., Mitsui Chemicals India Pvt. Ltd., CF Industries Holdings, Inc. and Bharat Petroleum Corporation Ltd.

Other players include Chevron, Exxon Mobil Corporation, Sinopec, Mitsubishi Chemical, EcoBlue, Hyundai Xteer, TerraCair and BlueDEF.

The post-combustion segment accounted for the largest share in 2022. The increasing demand for the post-combustion method in Adblue production is driven by several factors. Stricter emissions regulations worldwide necessitate more effective NOx reduction, making post-combustion a crucial technology. Additionally, the versatility of post-combustion systems allows retrofitting in existing vehicles, reducing emissions without major engine modifications, further fueling its adoption in the automotive and industrial sectors.

Pre-combustion is expected to register the highest CAGR of 7.6%. The increasing demand for the pre-combustion method in Adblue production can be attributed to its ability to reduce NOx emissions in diesel engines, comply with stringent environmental regulations, and enhance fuel efficiency, making it a preferred choice for vehicle manufacturers and operators.

The cars and passenger vehicles segment accounted for the largest share in 2022. Several factors contribute to the increasing demand for cars and passenger vehicles. Economic growth and rising incomes enable more people to afford vehicles. Urbanization leads to greater transportation needs while changing lifestyles and preferences favor car ownership. Technological advancements and the appeal of new features also drive demand, along with the necessity of personal transportation for daily life, work, and leisure. These factors collectively stimulate the growing demand for cars and passenger vehicles in today's society.

Commercial vehicles is expected to register the highest CAGR of 7.8%. Increased economic activity, expanding e-commerce, and a growing need for logistics bolster commercial vehicle demand. Infrastructure development, regulations favoring commercial transport, and a rise in construction projects further drive the market. These factors, coupled with fleet renewals and technological advancements, contribute to the surge in demand for commercial vehicles.

North America garnered the largest share in 2022. The increasing demand for Adblue in North America can be attributed to several factors. Stricter emissions regulations, such as EPA's Phase 2 Greenhouse Gas Emission Standards, have mandated the use of Adblue in commercial vehicles to reduce nitrogen oxide emissions. Furthermore, the growing adoption of diesel engines in trucks and buses, combined with the expansion of the region's transportation industry, has led to a rising need for Adblue to meet these environmental standards, driving its demand in the North American market.

Public Policies:

Environmental Protection Agency (EPA) in the U.S.: The EPA sets emissions standards and regulations for vehicles in the U.S. These standards include limits on NOx emissions from diesel engines, which has led to the increased use of diesel exhaust fluid (DEF) like Adblue. Adblue, which is a urea-based solution, is commonly used in Selective Catalytic Reduction (SCR) systems to reduce NOx emissions in diesel engines. The EPA regulates the quality and standards of DEF to ensure it meets specifications for reducing emissions.

California Air Resources Board (CARB): California often has stricter emissions regulations than federal standards. CARB has its own regulations related to Adblue usage and emissions reduction technologies. CARB's regulations influence not only California but also vehicle manufacturers who often produce vehicles to meet CARB standards.

Canadian Environmental Protection Act: In Canada, the use of Adblue and emissions reduction technologies in diesel engines is governed by the Canadian Environmental Protection Act. Canadian regulations are typically aligned with U.S. EPA standards to ensure that vehicles sold in Canada meet environmental standards.

Tax and Incentive Programs: Various federal and state/provincial incentives and tax programs in North America promote the adoption of clean and fuel-efficient vehicles. These policies can indirectly influence the use of emissions-reduction technologies like Adblue.

Industry Standards: Industry organizations and standards bodies may also have guidelines and standards related to Adblue and emissions reduction technologies. For example, the American Petroleum Institute (API) provides standards for DEF quality and handling.

Emission Reduction Targets: Both the U.S. and Canada have committed to reducing greenhouse gas emissions, and transportation is a significant part of this effort. Policies and regulations related to emissions reductions will continue to shape the Adblue market.

Emission Standards: The European Union (EU) has established strict emission standards for vehicles, including limits on NOx emissions. Adblue is an essential component of achieving compliance with these standards, as SCR systems reduce NOx emissions. The Euro 6 emissions standard, implemented in various stages, mandates the use of Adblue in many diesel vehicles to meet NOx reduction targets.

Adblue Quality Standards: The EU has defined specific quality standards for Adblue to ensure its effectiveness in reducing emissions. Adblue must meet ISO 22241 standards, which specify the purity and composition of the solution. These standards ensure that Adblue maintains its effectiveness and does not harm SCR systems.

Tax Incentives and Subsidies: In some European countries, there may be tax incentives or subsidies to promote the use of Adblue and SCR technology. These incentives are often aimed at encouraging the adoption of cleaner vehicles and reducing air pollution.

Environmental Impact: Environmental policies also play a role in the regulation of Adblue. The production, distribution, and disposal of Adblue can have environmental consequences, and regulations may address these aspects, including proper disposal and recycling methods.

Emission Standards: Many countries in the Asia-Pacific region have adopted strict emission standards for vehicles and industrial equipment. Adblue is commonly used to meet these standards, as it helps reduce nitrogen oxide (NOx) emissions. These standards are often aligned with European or international emission standards.

Import and Quality Standards: Some countries may have specific import and quality standards for Adblue to ensure that the product meets the required specifications. These standards may cover factors such as purity, concentration, and packaging.

Impact Of Russia Ukraine War On the Adblue Market:

The Russia-Ukraine war can have several potential impacts on the Adblue market. Adblue, also known as diesel exhaust fluid (DEF), is a urea-based solution used in selective catalytic reduction (SCR) systems to reduce nitrogen oxide (NOx) emissions from diesel engines.

Russia and Ukraine are significant producers of urea, one of the key components of Adblue. Any disruptions in the supply chain, such as trade restrictions, transportation disruptions, or damage to production facilities, can lead to a shortage of urea and, consequently, Adblue.

Supply disruptions can lead to price fluctuations in the Adblue market. Prices may rise due to scarcity of raw materials or increased production costs. This can impact vehicle operators and industries that rely on Adblue for emissions control, as they may face higher operating expenses.

The impact on the Adblue market may vary by region. Regions that are more reliant on imports from Russia and Ukraine for urea or Adblue may be more affected by supply disruptions. Areas with diverse supply sources may experience less severe impacts.

Increased demand for Adblue can occur as governments tighten emissions regulations to reduce air pollution. The need for Adblue could rise as more diesel engines require SCR systems for compliance with emission standards.

Geopolitical tensions can create uncertainty in the market, affecting investment decisions and long-term planning by Adblue manufacturers and distributors. Companies may seek to diversify their supply sources to mitigate geopolitical risks.

In response to supply disruptions or price volatility, industries may explore alternative emissions control technologies, such as hydrogen fuel cells or electric vehicles. This could impact the demand for Adblue in the long run.

Government policies and incentives related to emissions control can influence the Adblue market. Support for cleaner technologies and stricter emissions standards can drive demand for Adblue.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the adblue market analysis from 2022 to 2032 to identify the prevailing adblue market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the adblue market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global adblue market trends, key players, market segments, application areas, and market growth strategies.

Adblue Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 66.7 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bharat Petroleum Corporation Limited, Mitsui Chemicals India Pvt. Ltd., CF Industries Holdings, Inc., TotalEnergies, CrossChem Limited, Shell plc, Nissan Chemical Corporation, Cummins Inc., BASF SE, Yara |

Analyst Review

According to the insights of the CXOs of leading companies, the key drivers of the Adblue market is the increasing stringency of emissions regulations globally. Governments and regulatory bodies are imposing stricter limits on harmful emissions from vehicles, particularly nitrogen oxides (NOx), which has led to a growing demand for Adblue, a urea-based solution that helps reduce NOx emissions in diesel engines. In addition, the rise in awareness of environmental issues and the need for cleaner air quality are driving the adoption of Adblue in the automotive industry.

However, the market also faces restraints. One major challenge is the availability and distribution of Adblue. Ensuring a steady supply chain and accessibility of Adblue at fuel stations and other locations is essential for its adoption. Moreover, the cost of producing and storing Adblue can be high, impacting its affordability and widespread use, particularly in regions with limited infrastructure.

The CXOs further added that the increasing adoption of SCR (Selective Catalytic Reduction) technology in commercial vehicles presents a significant growth avenue for the Adblue market. Furthermore, innovative Adblue production methods and technologies are emerging, offering the potential for cost reduction and improved environmental sustainability.

The global Adblue market was valued at $33.1 billion in 2022, and is projected to reach $66.7 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

The Adblue Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

BASF SE, CrossChem, Yara, Shell plc, Nissan Chemical Corporation, TotalEnergies, Cummins Inc., Mitsui Chemicals India Pvt. Ltd., CF Industries Holdings, Inc. and Bharat Petroleum Corporation Ltd. are the top companies to hold the market share in Adblue.

Expanding commercial vehicle fleets, including trucks and buses and increasing government incentives are the driving factors of the the Adblue Market.

The increasing environmental awareness and consumer demand for eco-friendly technologies is the upcoming trend of Adblue Market in the world.

North America is the largest regional market for Adblue.

Commercial vehicles is the leading application of Adblue Market.

Loading Table Of Content...

Loading Research Methodology...