Additive Masterbatch Market Research, 2033

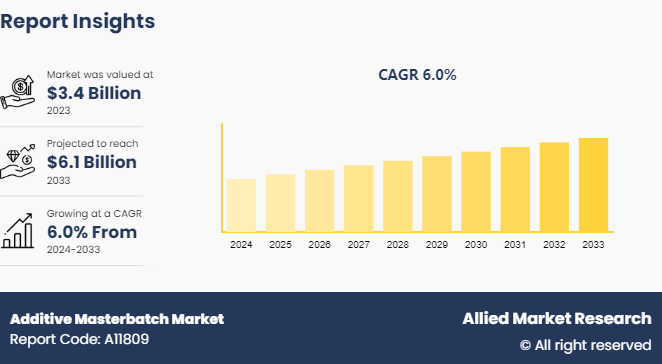

The global additive masterbatch market was valued at $3.4 billion in 2023, and is projected to reach $6.1 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Market Introduction and Definition

Additive masterbatch is a concentrated mixture of additives and carrier resin, primarily used to impart specific properties or functionalities to plastic products during the manufacturing process. These additives include colorants, UV stabilizers, antioxidants, flame retardants, anti-static agents, and others. The carrier resin ensures proper dispersion of additives throughout the polymer matrix, facilitating uniform distribution and consistent performance.

The properties of additive masterbatch vary depending on type and concentration of additives incorporated. Common properties enhanced by additive masterbatch include improved durability, UV resistance, color consistency, flame retardancy, anti-static properties, and antimicrobial characteristics. These masterbatches are tailored to meet the diverse requirements of industries such as packaging, automotive, agriculture, construction, and healthcare. Their versatility, ease of handling, and compatibility with various polymer matrices make additive masterbatches essential in enhancing the performance, aesthetics, and functionality of plastic products while addressing regulatory compliance and environmental sustainability concerns.

Key Takeaways

- The additive masterbatch market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,300 product literatures, industry releases, annual reports, and other such documents of major additive masterbatch industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The escalating number of infrastructure projects globally is poised to significantly boost the demand for additive masterbatch. These projects, spanning the construction of roads, bridges, buildings, and utilities, necessitate materials with enhanced properties like durability, weather resistance, and color stability. Additive masterbatches play a crucial role in meeting these requirements by imparting desirable characteristics to construction materials such as plastics, composites, and coatings. Additionally, the trend towards sustainable construction practices further drives the adoption of masterbatches that enable recyclability and environmental friendliness. The swift pace of development and ongoing urbanization significantly influences expenditure on transport infrastructure. In 2021, the Federal Aviation Administration (FAA) within the U.S. Department of Transportation allocated over $ 479 million for airport infrastructure across all 50 states, Puerto Rico, and American Samoa, supporting 123 projects. Despite a halt in aviation travel due to the global pandemic over the past two to three years, the Civil Aviation Administration of China (CAAC) reported that China had 241 accredited transport airports by the end of 2020. Despite the pandemic, 114 airport construction projects were initiated or continued, resulting in 58 additional airports compared to eight years prior.

To expedite infrastructure projects, the current administration has pledged to reduce delays, streamline processes, and enhance transparency. The government announced infrastructure projects worth $1.5 trillion (INR 111 lakh crore) as part of the National Infrastructure Pipeline (NIP) for FY 2019-25, initially allocating funds for 6, 835 projects, which increased to 7, 400 by the end of 2021. These projects predominantly focus on roads, housing, urban development, railways, renewable energy, conventional power, and irrigation. In the Philippines, the government prioritized infrastructure development in 2021 to drive substantial economic recovery. The Department of Public Works and Highways received $ 6.5 billion from the 2021 national budget for bridge construction, flood management, asset preservation, and transportation network development, emphasizing infrastructure projects. As infrastructure development continues to expand, particularly in urban areas and emerging economies, the demand for additive masterbatch is expected to witness a notable upsurge, driven by the imperative for high-performance and sustainable building materials.

Volatility in raw material prices can indeed pose challenges for the additive masterbatch market. Fluctuations in the prices of key raw materials, such as resins, pigments, and additives, can significantly impact production costs for masterbatch manufacturers. This, in turn, may lead to higher prices for additive masterbatch products, making them less attractive to end-users. Additionally, unpredictable raw material costs can disrupt supply chains and inventory management, causing uncertainties for both suppliers and customers. Moreover, price volatility may deter potential investments in research and development aimed at innovation and product development within the additive masterbatch sector. Companies may become more cautious about introducing new products or expanding their market reach amidst such uncertainty. To mitigate these challenges, companies often engage in strategic sourcing practices, including long-term contracts with suppliers, hedging strategies, and investment in alternative raw materials or technologies. Additionally, focusing on product differentiation, efficiency improvements, and value-added services can help mitigate the impact of raw material price volatility on demand within the additive masterbatch market.

The rising awareness about environmental sustainability presents a lucrative opportunity for the additive masterbatch market. As concerns over plastic pollution and its environmental impact escalate globally, industries are increasingly seeking sustainable solutions to mitigate these issues. Additive masterbatches play a crucial role in this endeavor by enabling the development of eco-friendly plastic products through features such as biodegradability, recyclability, and reduced material usage. Additionally, additives that enhance the durability and lifespan of plastic products contribute to a more sustainable approach by reducing the need for frequent replacements and minimizing waste generation. As regulatory pressures and consumer preferences align towards eco-conscious practices, the demand for additive masterbatch solutions that support environmental sustainability is expected to soar. This trend not only fosters market growth but also encourages innovation in developing more sustainable and eco-friendly additives for diverse applications across industries.

Increasing Plastic production will drive the Additive Masterbatch Market

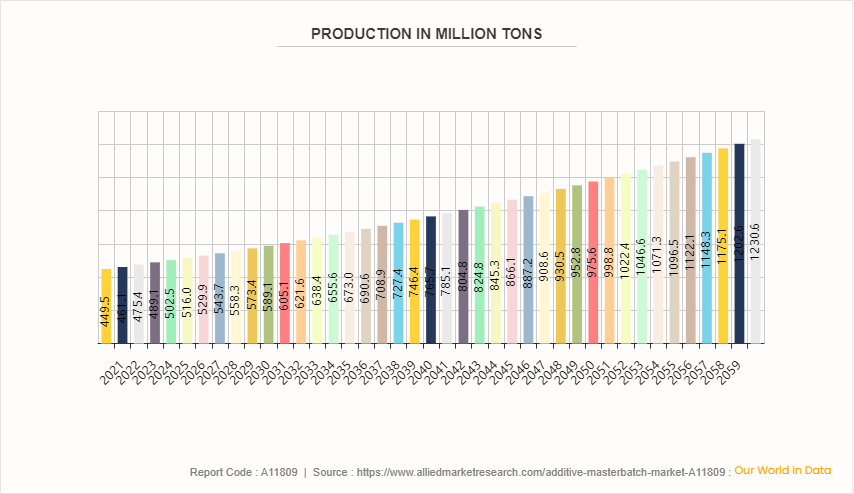

The global surge in plastic production is a significant driver propelling the additives masterbatch market forward. With increasing demand across industries like packaging, automotive, and consumer goods, manufacturers seek ways to enhance the properties of plastic products. Additives masterbatches play a pivotal role by imparting qualities such as color, UV resistance, and durability to plastics. As plastic consumption rises globally, so does the demand for specialized masterbatches. This trend is further fueled by technological advancements, enabling the development of innovative masterbatch solutions to meet evolving industry needs and regulatory standards.

Market Segmentation

The additive masterbatch market is segmented into carrier resin, type, application and region. Based on carrier resin, the market is classified into polystyrene, polyethylene, polyvinyl chloride, polypropylene, polyethylene terephthalate, and others. Based on type, the market is classified into antioxidant, antimicrobial, flame retardants, and others. By application, the market is divided into building and construction, agriculture, automotive, packaging, consumer goods and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the additive masterbatch market include CLARIANT, DOW, Schulman, Inc., LyondellBasell Industries Holdings B.V., Avient Corporation, Plastika Kritis S.A., Plastiblends, PPM, RTP, and Ampacet Corporation. Other players include Tosaf Group, Astra Polymers, Prayag Polytech, and Rajiv Plastic Industries.

Recent Key Strategies and Developments

- In December 2023, Ampacet introduced ColorMark, a technology within its masterbatch additives line, enabling processors to intricately imprint permanent lettering and designs onto dark plastic surfaces.

- In December 2023, MechNano, a prominent supplier of materials for 3D printing, collaborated with Bomar to develop a novel low viscosity masterbatch tailored for 3D printing resins.

- In November 2023, Cabot Corporation unveiled its REPLASBLAK circular black masterbatch product line, featuring certified materials. This release marked the debut of three products as the world's premier International Sustainability & Carbon Certification (ISCC PLUS) certified black masterbatch solutions powered by EVOLVE Sustainable Solutions.

- In November 2023, LyondellBasell inaugurated a new distribution hub in the UK to streamline the availability of its polyolefin grades. This strategic initiative aligns with the company's ongoing commitment to enhancing customer satisfaction by reducing order lead times through closer proximity to customer facilities.

Regional Industry Outlook

Asia-Pacific is experiencing robust economic growth. The developing plastic packaging industry in the Asia-Pacific region is poised to significantly drive the demand for additive masterbatch. With rapid urbanization, expanding middle-class population, and increasing consumer goods consumption, the demand for innovative and sustainable packaging solutions is on the rise. Additive masterbatch plays a crucial role in enhancing the properties of plastic packaging materials, including color consistency, UV resistance, barrier protection, and recyclability. As manufacturers in the region strive to meet regulatory standards and consumer preferences for high-quality packaging, the demand for additive masterbatch is expected to experience substantial growth in the coming years.

- China leads in plastic packaging usage, driven by the growing popularity of packaged meals, the expansion of restaurants and supermarkets, and the increased consumption of bottled water and beverages. According to the National Bureau of Statistics of China, the country produced approximately 74.89 million metric tons of plastic products in 2023, indicating a substantial demand for various rigid plastic packaging items.

- Industry growth is further fueled by the emphasis on sustainability among vendors. Essel Propack, an Indian-based laminated plastic tube manufacturer, exemplifies this commitment by producing recyclable HDPE barrier tubes like Platina 250 and Green Maple Leaf (GML) 300 Lamitubes, catering to brands seeking environmentally friendly packaging formats.

- In July 2023, PepsiCo India, unveiled plans to introduce new 100% recycled polyethylene terephthalate (rPET) bottles for its Carbonated Beverage category, aligning with its 'PepsiCo positive' (pep+) value chain initiative focused on promoting a circular economy.

- Moreover, In December 2023, Mars China launch of a Snickers bar with dark chocolate cereal in mono-material flexible packaging underscores the trend towards sustainable packaging. This product, packaged in mono PP material, offers low-sugar and low-glycemic index options, designed for easy recycling, emphasizing the concept of 'Designed for Recycling' and contributing to a circular economy system.

Industry Trends

- The increase in global demand for electric vehicles, coupled with government support for sustainable transportation, is expected to drive significant growth in the additive masterbatch market. These materials play a crucial role in enhancing the performance, aesthetics, and functionality of various components used in electric vehicle manufacturing.

- The automotive sector is witnessing a significant shift toward electric vehicles (EVs) , spurred by their potential to boost energy efficiency and mitigate greenhouse gas emissions. This transition is primarily fueled by the surge in environmental concerns and supportive government policies globally. Notably, global EV sales experienced a robust growth of 10.82% in 2022 compared to the previous year. Projections suggest that annual sales of electric passenger cars are set to exceed 5 million by the close of 2025, constituting approximately 15% of total vehicle sales.

- Prominent players and institutions, such as the London Metropolitan Police & Fire Service, are actively pursuing their electric mobility agendas. They have set ambitious targets, aiming for a zero-emission fleet by 2025, with plans to electrify 40% of their vans by 2030 and achieve full electrification by 2040.

- Asia-Pacific and Europe are positioned to lead electric vehicle production, leveraging their advancements in battery technology and vehicle electrification. Notably, Kia Motors Europe unveiled its "Plan S" in May 2020, signaling a strategic pivot towards electrification following the remarkable sales performance of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning diverse segments like passenger vehicles, SUVs, and MPVs, with the aim of achieving annual global EV sales of 500, 000 units by 2026.

- Thus, the rise in global demand and government support propel the electric vehicle market growth, which is projected to drive the demand for additive masterbatch market.

Key Sources Referred

- OurWorldInData.org

- National Bureau of Statistics of China

- The Ministry of Civil Aviation

- Organisation for Economic Co-operation and Development (OECD)

- The Federal Aviation Administration (FAA)

- The CAAC (Civil Aviation Administration of China)

- Airports Authority of India (AAI)

- Invest India

- International Organization of Motor Vehicle Manufacturers (OICA)

- Federation of Automobile Dealers' Association (FADA) .

- Chinese Association of Automotive Manufacturers

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the additive masterbatch market analysis from 2024 to 2033 to identify the prevailing additive masterbatch market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the additive masterbatch market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global additive masterbatch market trends, key players, market segments, application areas, and market growth strategies.

Additive Masterbatch Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.1 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Carrier Resin |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | RTP, Plastiblends, Avient Corporation, Ampacet Corporation, Schulman, Inc., Dow, PPM, Plastika Kritis S.A., CLARIANT, LyondellBasell Industries Holdings B.V. |

Asia-Pacific is the largest regional market for Additive Masterbatch.

The additive masterbatch market was valued at $3.4 billion in 2023 and is estimated to reach $6.1 billion by 2033, exhibiting a CAGR of 6.0% from 2024 to 2033.

Eco-friendly and sustainable masterbatch solutions is the upcoming trend of Additive Masterbatch Market in the globe.

CLARIANT, DOW, Schulman, Inc., LyondellBasell Industries Holdings B.V., Avient Corporation, Plastika Kritis S.A., Plastiblends, PPM, RTP, and Ampacet Corporation are the top companies to hold the market share in Additive Masterbatch.

Packaging is the leading application of Additive Masterbatch Market.

Loading Table Of Content...