Adhesive Dispensing Equipment Market Research, 2033

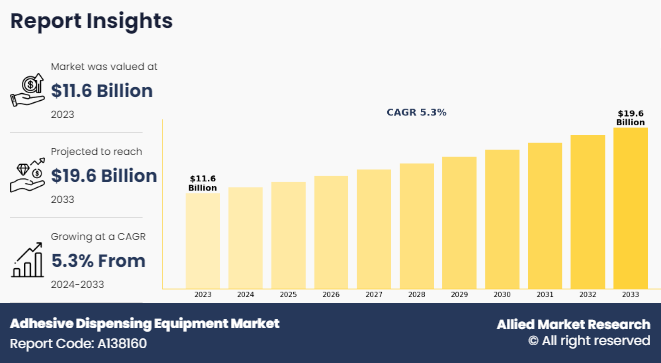

The Global Adhesive Dispensing Equipment Market was valued at $11.6 billion in 2023, and is projected to reach $19.6 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

Adhesive dispensing equipment provides controlled application of adhesives and silicones, using various devices such as manual caulk guns, robotic & automated dispensing systems, and different mixing & dispensing systems. These systems are configured in several ways: as dispense-only units, mix-and-dispense, meter-mix-and-dispense, or hot melt dispensing setups. Dispense only units, which include both manual and power-driven dispensers, are designed strictly for dispensing without any mixing or monitoring features. They enable precise application, however, lack the capability to monitor or adjust the mix ratio. Overall, these tools are essential for ensuring accuracy and control in adhesive application across industrial and commercial settings.

Key Takeaways:

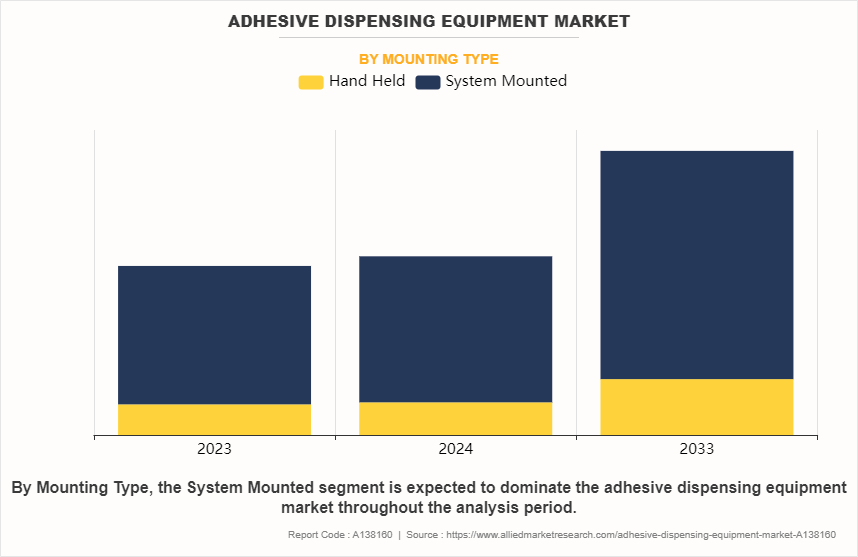

- Based on mounting type, the system mounted held the largest Adhesive Dispensing Equipment market share in 2023. However hand held segment is anticipated to grow at the fastest CAGR during the forecast period.

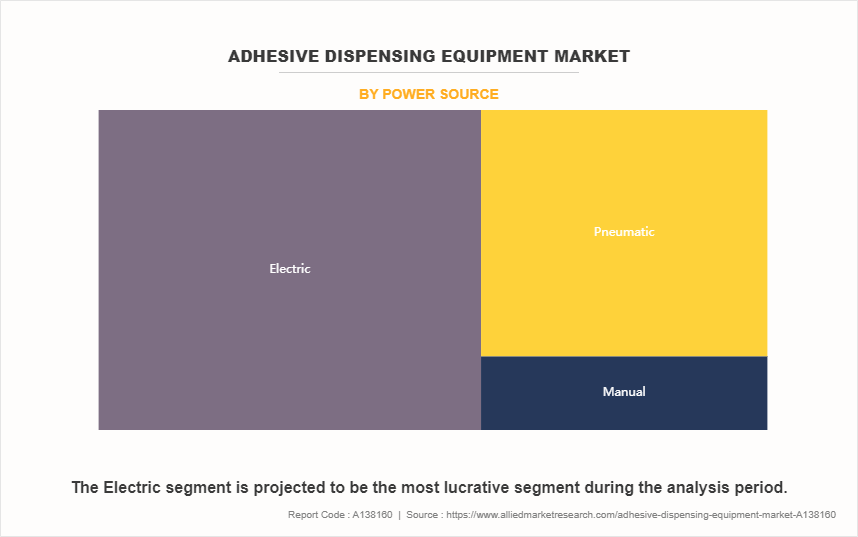

- Based on power source, the electric segment held the largest share of the Adhesive Dispensing Equipment market in 2023 and is also anticipated to grow at the fastest CAGR during the forecast period

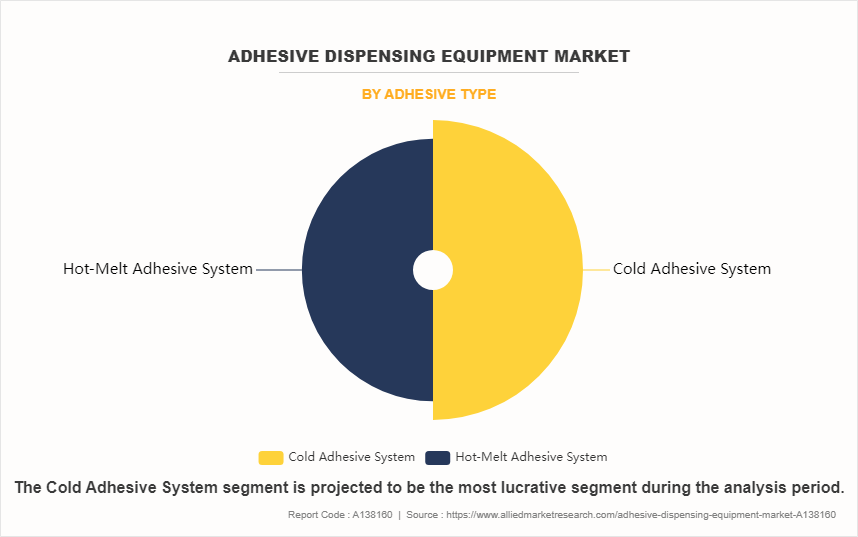

- Based on adhesive type, the cold adhesive system segment dominated the Adhesive Dispensing Equipment market size in terms of revenue in 2023 and is also anticipated to grow at the fastest CAGR during the forecast period.

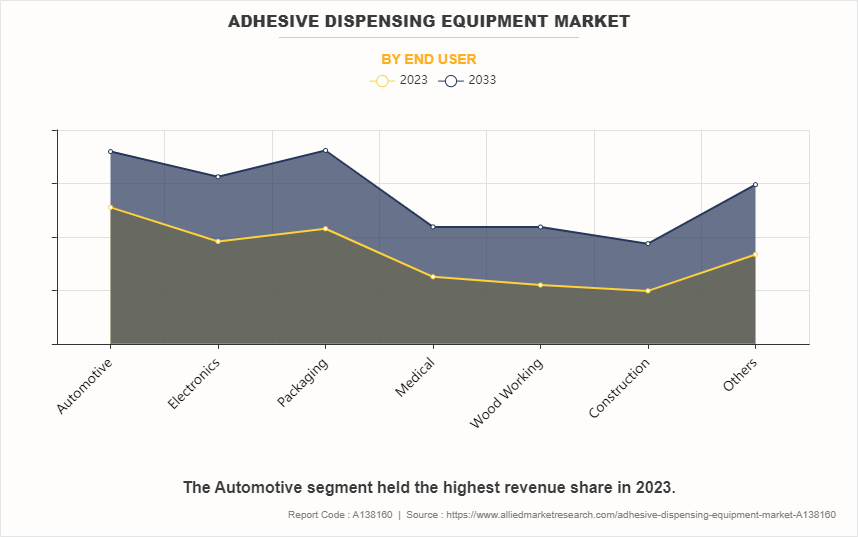

- Based on end user, the automotive segment dominated the Adhesive Dispensing Equipment market size in terms of revenue in 2023. However, wood working segment is anticipated to grow at the fastest CAGR during the forecast period.

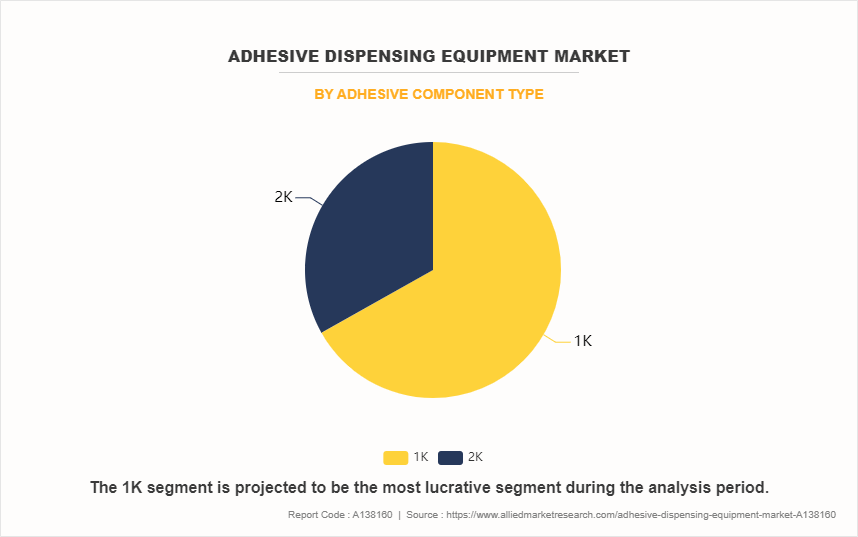

- Based on adhesive component type, the 1k segment dominated the Adhesive Dispensing Equipment market size in terms of revenue in 2023 and is also anticipated to grow at the fastest CAGR during the forecast period.

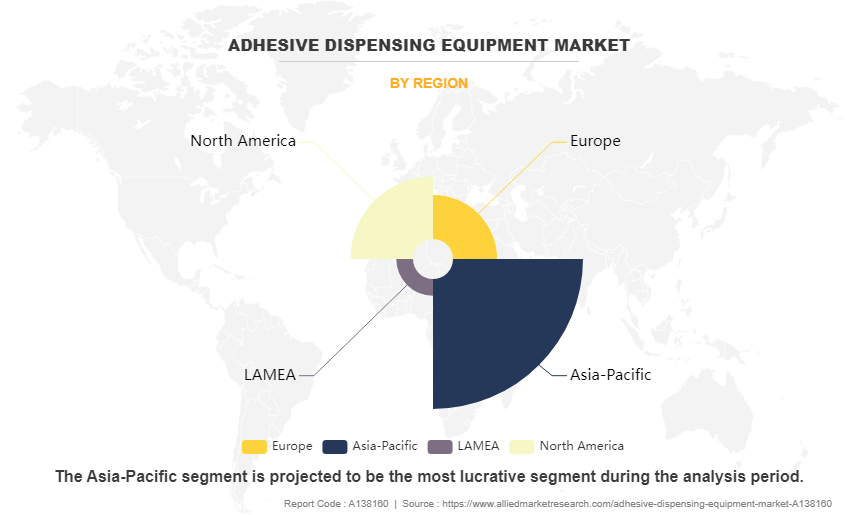

- Region-wise, Asia-Pacific held the largest market share in 2023 and is expected to witness the highest CAGR during the forecast period.

Segment Overview

The global adhesive dispensing equipment market is analyzed by adhesive component type, mounting type, power source, adhesive type, end user, and region.

On the basis of component type, the market is classified into 1k and 2k. In 2023, the 1k segment dominated the Adhesive Dispensing Equipment market size in terms of revenue due to its rising popularity across multiple industries for its efficiency, precision, and user-friendliness. Unlike two-component systems that require mixing, 1K systems use single-component adhesives, simplifying application and reducing the likelihood of errors.

On the basis of mounting type, the Adhesive Dispensing Equipment market is broken down into hand held, and system mounted. In 2023, the system mounted held the largest share of the Adhesive Dispensing Equipment market due to increasing demand for automation in manufacturing processes has been witnessed across various industries, including electronics, electric vehicle (EV) battery, general industry, solar, and telecommunication.

On the basis of power sources, the market is classified into pneumatic, manual and electric. In 2023, the electric segment dominated the Adhesive Dispensing Equipment market size in terms of revenue due to Increase in demand for automation in manufacturing processes.

On the basis of adhesive type, the market is classified into cold adhesive system and hot-melt adhesive system. In 2023, the cold adhesive system dominated the Adhesive Dispensing Equipment market outlook in terms of revenue due to increasing demand for eco-friendly adhesive options as manufacturers look for substitutes for solvent-based adhesives that release harmful VOCs.

On the basis of end user, the market is classified into automotive, electronics, packaging, medical, wood working, construction and others. In 2023, the automotive segment dominated the Adhesive Dispensing Equipment market size in terms of revenue due driven by the increased use of new material combinations and more complex designs. This trend encouraged manufacturers across industries to integrate adhesive bonding as a core production method, prompting many sectors to adopt automated robotic adhesive dispensing systems.

On the basis of region, the market is analyzed North America, Europe, Asia-Pacific and LAMEA. In 2023, Asia-Pacific held the largest market share in the Adhesive Dispensing Equipment industry due to rising demand across various sectors, including automotive, electronics, packaging, and construction. The increasing adoption of automation and advanced manufacturing technologies is driving the shift toward automated adhesive dispensing solutions, which enhance efficiency and precision in production.

Competitive Analysis

The adhesive dispensing equipment market forecast analysis report highlights the highly competitive nature of the adhesive dispensing equipment market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing adhesive dispensing equipment market demands. The competitive environment in this market is expected to increase as product launches and acquisitions kind of strategies adopted by key vendors increase. Competitive analysis and profiles of the major adhesive dispensing equipment market players that have been provided in the report include Advancements in material science.

Market Dynamics

The surge in demand for adhesives in the construction industry significantly boosting the adhesive dispensing equipment market growth. Adhesives are increasingly preferred over traditional fastening methods due to their ability to bond dissimilar materials, enhance structural integrity, and improve energy efficiency. This trend is particularly evident in sectors such as residential and commercial construction, where adhesives are used for flooring, roofing, wall panels, and insulation materials.

For instance, the rise in green building initiatives has led to a surge in the use of low-VOC (volatile organic compound) adhesives, which require precise dispensing to minimize waste and ensure quality. Companies such as Sika AG has expanded their adhesive product lines, including construction-grade adhesives and sealants, to meet this demand. Sika invested in advanced dispensing equipment. It provides products such as Sika PowerCure dispenser to facilitate the efficient application of their products on construction sites, thereby enhancing productivity and reducing labor costs. Moreover, innovations in adhesive technologies, such as hot melt adhesives and polyurethane-based systems, have created a need for specialized dispensing solutions that handle various viscosity levels and application methods. As construction projects grow in complexity and scale, the demand for reliable and efficient adhesive dispensing equipment continues to rise, shaping the market's future landscape.

However, the high initial cost of adhesive dispensing equipment poses a significant barrier to the growth of the market, particularly for small and mid-sized companies. Advanced adhesive dispensing systems designed for precision, speed, and reduced waste often come with hefty price tags. This investment includes equipment cost and costs for installation, setup, training, and potential infrastructure adjustments. For businesses with tight budgets, these costs slow the adoption of automated dispensing solutions, leading them to rely on manual or semi-automated alternatives, which might not deliver the same efficiency or precision.

For example, adhesive dispensers range in price from $1550 to $2250, depending on the type of dispenser. Robotic adhesive dispensing systems cost from $1,950 to $2,800, depending on the amount. The high initial costs of automated adhesive dispensers create a barrier to entry, especially for small and medium-sized businesses (SMEs) with limited financial resources. While larger organizations may have the resources to invest in such systems. Further, A small automotive parts manufacturer might hesitate to invest in an automated adhesive dispensing system, which can cost tens of thousands of dollars. Instead, they may choose a lower-cost, manual option that meets immediate needs but lacks long-term cost-saving benefits. This hesitation can lead to inefficiencies, lower production speeds, and higher wastage. As a result, the market growth for high-end adhesive dispensing equipment slowed, especially among smaller players.

Furthermore, the adoption of Industry 4.0 technologies presents a valuable adhesive dispensing equipment market opportunity by enhancing manufacturing efficiency, precision, and connectivity. With a focus on automation, data exchange, and real-time analytics, this approach transforms traditional adhesive dispensing methods. Automated systems, often utilizing robotics, enable faster, more precise adhesive application than manual processes, improving product quality and minimizing waste from defects. These systems help reduce consumable costs by dispensing exact amounts, providing notable financial savings. Furthermore, Industry 4.0 connectivity allows manufacturers to link various processes, creating streamlined workflows and centralized network systems that support seamless, efficient operations throughout the production line.

For example, companies such as Nordson Corporation have adopted Industry 4.0 by integrating IoT-enabled adhesive dispensing systems. Their products, such as the BBconn Cloud and Control System, facilitate seamless communication between Nordson's equipment and parent machines, along with other devices. This innovative platform offers comprehensive connectivity options that align with IoT and Industry 4.0 requirements. It enables full remote operation, advanced diagnostics, and real-time monitoring, providing the data and analytics necessary for ongoing improvement. This capability empowers manufacturers to optimize their adhesive application processes, minimize waste, and improve product quality. Furthermore, predictive maintenance powered by AI algorithms helps identify potential equipment failures before they occur, minimizing downtime and improving operational efficiency. As industries increasingly prioritize smart manufacturing, adhesive dispensing equipment that embraces Industry 4.0 principles will be better positioned to meet market demands and driving growth and innovation in adhesive dispensing equipment industry.

Recent Developments in Adhesive Dispensing Equipment Industry

- October 2024, APPLIED Adhesives announced its acquisition of AutomationSupply365. Based in Auburn Hills, MI, AutomationSupply365 specializesin custom dispensing solutionsforsingle- and multi component materials used in in-mold coating, transportation, and product assembly markets. This strategic acquisition will enable APPLIED Adhesivesto strengthen and broaden its advanced dispensing capabilities across North America.

- April 2024 - Dymax hasintroduced the RotoSpense 360 Workstation, an advanced adhesive application system within its dispensing equipment line. Designed for precise, one-handed application of adhesive rings onto cylindricalsubstrates, this workstation enhances bonding for plastic tubing and connectors.

- June 2024 - Dymax partnered with Ingenieria en Sistemas de Adhesivos(ISASA) in Mexico City. ISASA will promote Dymax’s advanced light-curable solutions within the General Industrial markets. With a skilled team specializing in marketing and business development, ISASA will introduce Dymax productsto key customers, provide expert technicalsupport, and help design cost efficient manufacturing processes,strengthening Dymax’s market reach in Mexico.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the adhesive dispensing equipment market analysis from 2023 to 2033 to identify the prevailing adhesive dispensing equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the adhesive dispensing equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global adhesive dispensing equipment market trends, key players, market segments, application areas, and market growth strategies.

Adhesive Dispensing Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 19.6 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 370 |

| By Adhesive Component Type |

|

| By Mounting Type |

|

| By Power Source |

|

| By Adhesive Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | 3M, Henkel AG & Co.KGaA, APPLIED Adhesives, Graco Inc., EXACT Dispensing Systems, Nordson Corporation, Valco Melton, Kirkco Corp, Dymax Corporation, Hernon Manufacturing |

Integration of Industry 4.0 technologiesin Adhesive Dispensing Equipment and increased demand for dispensing equipment that can handle biodegradable and low-VOC adhesives are the upcoming trends of adhesive dispensing equipment market.

The automotive industry is currently the leading application for the adhesive dispensing equipment market.

Asia-Pacific is the largest regional market for adhesive dispensing equipment.

The adhesive dispensing equipment market was valued at $11.6 billion in 2023.

Nordson Corporation, Graco Inc, Valco Melton, Hernon Manufacturing, Dymax Corporation, Henkel AG & Co.KGaA, Kirkco Corp, EXACT Dispensing Systems, 3M, and APPLIED Adhesives are the top companies to hold the market share in adhesive dispensing equipment.

Loading Table Of Content...

Loading Research Methodology...