Advanced Ceramics Market Research, 2033

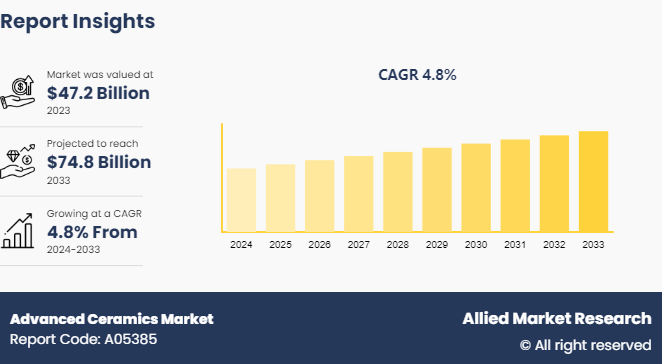

The global advanced ceramics market was valued at $47.2 billion in 2023, and is projected to reach $74.8 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Advanced ceramics, also known as engineering ceramics or fine ceramics, are a class of materials distinguished by their exceptional mechanical, thermal, electrical, and chemical properties. Unlike traditional ceramics, advanced ceramics are engineered with precise compositions and microstructures to achieve specific performance characteristics. These ceramics exhibit high strength, hardness, and wear resistance, along with excellent thermal and chemical stability, making them suitable for demanding applications in industries such as aerospace, automotive, electronics, and healthcare.

Advanced ceramics can withstand extreme temperatures, corrosive environments, and high-pressure conditions, making them ideal for use in cutting tools, engine components, electronic substrates, biomedical implants, and others. In addition, they possess low thermal conductivity and dielectric properties, making them valuable in insulation and electrical applications. The development of advanced ceramics continues to drive innovation in materials science, enabling the creation of lighter, stronger, and durable products across various industrial sectors.

Key Takeaways

- The advanced ceramics market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major advanced ceramics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising automotive industry is set to drive significant growth in the advanced ceramics market. The demand for materials that can withstand high temperatures, offer superior mechanical properties, and ensure long-term durability is escalating as the automotive sector transitions towards more efficient, sustainable, and technologically advanced vehicles. Advanced ceramics meet these requirements exceptionally well, making them indispensable in modern automotive applications. Electric vehicles (EVs) and hybrid vehicles, in particular, benefit from advanced ceramics due to their ability to perform under extreme conditions. Components such as power electronics, batteries, and motor parts use advanced ceramics to improve thermal management, enhance performance, and increase longevity. Moreover, the stringent emission regulations and fuel efficiency standards are pushing automakers to develop lighter and more fuel-efficient vehicles.

Advanced ceramics, being lightweight and resistant to corrosion and wear, are ideal for manufacturing engine components, exhaust systems, and braking systems. Their use of sensors and electronics within vehicles also contributes to better performance and safety features. As automotive manufacturers continue to innovate, the integration of advanced ceramics in high-performance applications such as turbochargers, fuel cells, and catalytic converters is becoming more prevalent. In addition, the push for autonomous and connected vehicles further amplifies the need for reliable and high-performing materials, where advanced ceramics play a critical role in sensors and communication systems. According to the International Organization of Motor Vehicles Manufacturers, in 2021, global motor vehicle production was 80.1 million compared to 77.7 million produced in 2020 showing a 3% increase. Thus, an increase in demand for effective fertilizers boosts the growth of the advanced ceramics market size. The growth of the automotive industry, coupled with advancements in vehicle technology and the increasing focus on sustainability, positions advanced ceramics as a crucial material, driving significant expansion in their market. With ongoing research and development, the applications and benefits of advanced ceramics in the automotive industry are expected to continue broadening, ensuring robust market growth.

High production costs pose a significant challenge to the growth of the advanced ceramics market. The manufacturing process of advanced ceramics involves complex steps such as high-temperature sintering, precision machining, and specialized treatments to achieve the desired properties. These processes require sophisticated equipment and skilled labor, leading to substantial capital investment and operational expenses. In addition, the raw materials used in advanced ceramics, such as high-purity alumina, silicon carbide, and zirconia, are expensive and subject to price volatility, further driving up production costs. These elevated costs make advanced ceramics less competitive compared to alternative materials like metals and polymers, which are cheaper and more readily available.

Consequently, industries that could benefit from advanced ceramics might opt for more cost-effective solutions, despite the superior performance of ceramics. This cost barrier is particularly challenging for price-sensitive markets and emerging economies where the initial investment in advanced ceramics may not be justified by the perceived benefits. Furthermore, the high production costs limit the scalability of advanced ceramics, making it difficult for manufacturers to achieve economies of scale. This cost-related hurdle hampers the widespread adoption and market penetration of advanced ceramics, restraining their potential growth in various applications across industries.

The increase in use of nanotechnology presents a lucrative opportunity for the growth of the advanced ceramics market. Nanotechnology enables the manipulation of materials at the molecular and atomic levels, resulting in advanced ceramics with enhanced properties such as increased strength, improved thermal stability, and superior electrical conductivity. These nanostructured ceramics offer remarkable performance advantages over their conventional counterparts, making them highly desirable in various high-tech applications. For instance, in the electronics industry, nanotechnology-infused ceramics are used to develop smaller, faster, and more efficient components, including capacitors, insulators, and semiconductors, which are critical for the advancement of consumer electronics and telecommunications.

In addition, in the medical field, nanoceramics are used in the fabrication of implants, prosthetics, and diagnostic tools due to their biocompatibility and antibacterial properties, driving their demand in healthcare applications. The aerospace and defense sectors also benefit from nanotechnology-enhanced ceramics, which provide exceptional thermal resistance and lightweight properties essential for components exposed to extreme conditions. Furthermore, ongoing research and development in nanotechnology are continually expanding the potential applications of advanced ceramics, fostering innovation and opening new market opportunities. As industries increasingly adopt nanotechnology to improve product performance and meet stringent regulatory standards, the advanced ceramics market is poised for significant growth, leveraging the unique capabilities of nanostructured materials.

Patent Analysis of the Global Advanced Ceramics Market

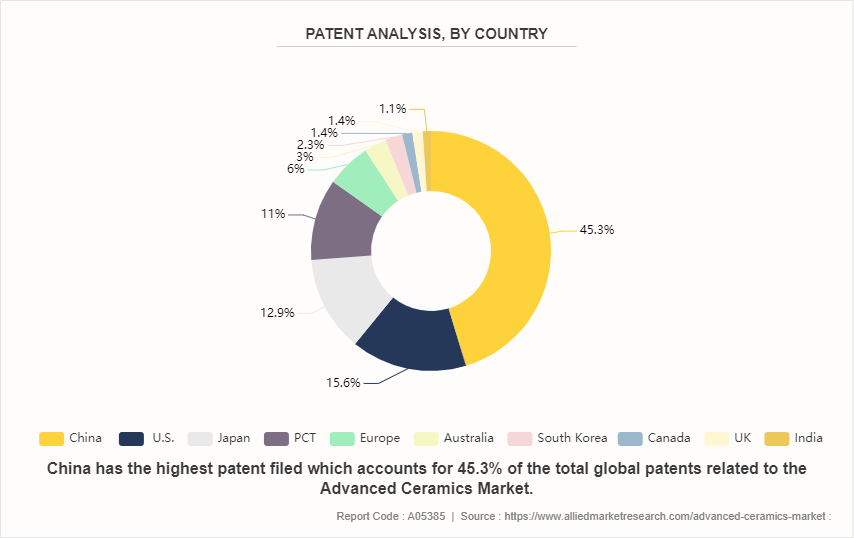

In the advanced ceramics market, China leads with a dominant 45.3% share in global patent filings, underscoring its significant role in technological advancements and innovations. The U.S. follows with a 15.6% share, reflecting its strong research and development capabilities. Japan holds a notable 12.9% share, driven by its established ceramics industry and technological expertise. The Patent Cooperation Treaty (PCT) accounts for 11.0%, indicating international collaboration and cross-border innovations. Europe, Australia, South Korea, Canada, the UK, and India, with shares ranging from 1.1% to 6.0%, collectively contribute to the global patent landscape, demonstrating a diverse yet fragmented market.

Market Segmentation

The advanced ceramics market is segmented into material, type, end-use industry and region. Based on material, the market is classified into alumina, titanate, zirconate, ferrite, aluminum nitride, boron carbide, silicon nitride, silicon carbide, and others. Based on type, the market is categorized into monolithic ceramics, ceramic matrix composites, ceramic coatings and others. By end-use industry, the market is divided into electrical and electronics, transportation, medical, defense and security, chemical, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the advanced ceramics market include 3M, AGC Inc., Applied Ceramics, Blasch Precision Ceramics, CeramTec GmbH, COIC International, Inc, CoorsTek Inc., Corning Incorporated, International Ceramic Engineering, Inc., and KYOCERA Corporation. Other players include MARUWA Co., Ltd., MATERION CORPORATION, McDanel Advanced Ceramic Technologies, Morgan Advanced Materials, and Murata Manufacturing Co. Ltd.

Recent Key Strategies and Developments

- In April 2023, Kyocera Corporation finalized the acquisition of 37 acres of land in Isahaya City, Japan, for the construction of a new smart factory. This strategic move aligns with the company's goal of expanding production capacity for fine ceramic components, driven by the increasing demand for semiconductor-related products.

- In February 2023, MO SCI Corp. successfully concluded the acquisition of 3M's advanced materials business, which involves the transfer of over 350 specialized pieces of equipment and associated intellectual property. By the fourth quarter of 2023, all acquired assets, including equipment and technology, will be fully integrated and operational at MO SCI Corp.'s headquarters in Rolla, Missouri.

- In June 2022, CoorsTek invested over $50 million in establishing a state-of-the-art advanced materials manufacturing campus spanning 230, 000 square feet. This significant investment aims to foster innovation across various markets, enhancing CoorsTek's Benton facility and underlining its long-term commitment to Arkansas.

- In May 2022, Ceram Tec introduced a new product named AlN HP, a high-performance substrate crafted from aluminum nitride. This innovative substrate offers 40% higher flexural strength compared to its predecessors. In addition, Ceram Tec expanded its non-oxide ceramic portfolio with the launch of LKT 100 ceramic, boasting high efficiency, exceptional wear resistance, and heightened notch sensitivity.

- In March 2022, Ceram Tec expanded its non-oxide ceramic portfolio with the launch of LKT 100 ceramic, boasting high efficiency, exceptional wear resistance, and increased notch sensitivity.

- In October 2021, Kyocera Corporation announced a $97 million investment to construct two new production facilities at its Kokubu Plant Campus in Kagoshima, Japan. These factories, covering areas of 5, 174 m2 and 6, 996 m 2, respectively, will further strengthen Kyocera's manufacturing capabilities.

- In July 2021, Morgan Advanced Materials joined The Midlands Industrial, securing $18.27 million in funding through the UK Research and Innovation's Strength in Places Fund. This initiative aims to establish Midlands, England, as a hub for the industry.

- In May 2021, Fralock Holdings, LLC acquired Ceramic Tech Incorporated, a company specializing in pre-fired machining, pressing, sintering, and developing specialized formulations for leading OEMs. This acquisition also includes Stratamet Advanced Materials, which focuses on producing high-purity semiconductor-grade ceramic materials.

Regional Industry Outlook

Asia-Pacific is experiencing robust economic growth. The expansion of the electrical and electronics, wind and power energy, and automotive industries in the Asia-Pacific region is set to drive the growth of the advanced ceramics market. Countries like China, India, South Korea, and Japan are leading in electronics production, increasing the demand for advanced ceramics in high-performance components. The shift towards renewable energy sources, particularly wind and solar power, requires advanced ceramics for efficient energy storage and conversion systems. Additionally, the automotive industry's move towards electric and hybrid vehicles relies on advanced ceramics for their high-temperature resistance and durability, further fueling market growth in this region.

Increase in Automobile production in India is projected to drive the demand for advanced ceramics, especially in the Asia-Pacific region

An increase in automobile production in India is set to drive the market for advanced ceramics in the Asia-Pacific region. Advanced ceramics, with their high-temperature resistance and durability, are essential for automotive components such as engine parts, sensors, and exhaust systems. The demand for these high-performance materials is projected to increase, boosting the growth of the advanced ceramics market across the region, as India expands its automotive manufacturing capabilities. In addition, China and Japan also contribute to this growth.

For instance, according to the China Passenger Car Association, total sales of passenger electric vehicles in China surged by 2.99 million units in 2021, reflecting a 169.1% increase compared to 2020. In addition, the Ministry of New and Renewable Energy reported that India added 1.45 GW of wind capacity in 2021, marking a 30% rise from the 1.11 GW installed in 2020.

Japan's electrical and electronics industry is among the world's foremost, leading in the production of computers, gaming consoles, cell phones, and key electronic components.

Consumer electronics contribute to one-third of Japan's economic output, with the country specializing in electronic components and devices such as passive components, connecting components, electronic boards, and liquid crystal devices.

- The advancing digitalization is boosting demand and exports, with global production by Japanese electronics and IT companies projected to grow by 8% year-on-year in 2021, reaching $ 272.02 billion (JPY 37, 300 billion) .

- In aerospace, Japan manufactures components for commercial and defense aircraft, with commercial production rising due to increasing cargo demands. Japan plays a crucial role in developing aircraft such as the Boeing 767, 777, 777X, and 787, and engines like the V2500, Trent1000, GEnx, GE9X, and PW1100G-JM.

- According to Japan's Ministry of Health, Labour, and Welfare, the country produces over 25% of medical devices for surgical procedures, including sterile tubes, catheters, and blood transfusion sets.

Industry Trends

- The growth of the electronics and electrical industry is poised to propel the demand for advanced ceramics in the market, primarily driven by applications in semiconductors and heat removal systems.

- Silicon carbide is anticipated to witness significant growth in its applications within the electrical and electronics sector in the foreseeable future. Its usage spans across electric vehicles, high-power and high-voltage devices, semiconductors, solar inverters, and LED lighting.

- Aluminum nitride finds utility in heat dissipation applications due to its high thermal conductivity and exceptional electrical insulation properties, particularly valuable in semiconductors, as well as consumer and household products. Similarly, silicon nitride and boron nitride serve various roles in electrical and electronic applications.

- The Asia-Pacific region stands as a frontrunner in global electronics manufacturing, contributing over 70% to the world's electronics output. Key players like South Korea, Vietnam, India, and China lead the charge.

- According to the India Brand Equity Foundation, India, renowned as an upcoming manufacturing hub, has witnessed a surge in domestic electronics production from $29 billion in 2014-15 to $101 billion in 2022-23, with the sector contributing approximately 3.4% to the nation's GDP.

- India's government has pledged nearly $17 billion over six years across four PLI Schemes: Semiconductor and Design, Smartphones, IT Hardware and Components. In addition, the Ministry of Electronics & Information Technology recently unveiled the second volume of the Vision document on Electronics Manufacturing in India, projecting industry growth from $75 billion in 2020-21 to $300 billion by 2025-26.

- In Europe, Germany boasts the largest electronics industry, constituting 11% of the region's total industrial production. According to the German Electrical and Electronic Manufacturers' Association (ZVEI) , the global electronics market has soared to $4.82 trillion in 2021 (EUR 4.6 trillion) .

Key Sources Referred

- Invest India

- India Brand Equity Foundation

- Ministry of Electronics & Information Technology

- Vision document on Electronics Manufacturing in India

- German Electrical and Electronic Manufacturers' Association (ZVEI)

- International Organization of Motor Vehicles

- China Passenger Car Association

- Ministry of Health, Labour, and Welfare of Japan

- Ministry of New and Renewable Energy

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced ceramics market analysis from 2024 to 2033 to identify the prevailing advanced ceramics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced ceramics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global advanced ceramics market trends, key players, market segments, application areas, and market growth strategies.

Advanced Ceramics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 74.8 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Material |

|

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | AGC Inc., Applied Ceramics, Corning Incorporated, KYOCERA Corporation, COIC International, Inc., CeramTec GmbH, 3M, Blasch Precision Ceramics, CoorsTek Inc., International Ceramic Engineering, Inc. |

Advanced ceramics market was valued at $47.2 billion in 2023, and is estimated to reach $74.8 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

3M, AGC Inc., Applied Ceramics, Blasch Precision Ceramics, CeramTec GmbH, COIC International, Inc, CoorsTek Inc., Corning Incorporated, International Ceramic Engineering, Inc., and KYOCERA Corporation are the top companies to hold the market share in Advanced Ceramics.

Growing demand in electronics and electricals and rising environmental and energy efficiency standards are the drivers of Advanced Ceramics Market in the globe.

Asia-Pacific is the largest regional market for Advanced Ceramics.

Electrical and electronics is the leading end-use industry of Advanced Ceramics Market.

Loading Table Of Content...