Advanced Polymer Composites Market Research, 2033

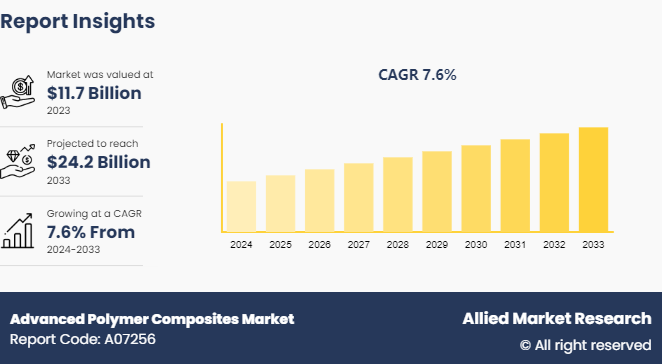

The global advanced polymer composites market was valued at $11.7 billion in 2023, and is projected to reach $24.2 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Market Introduction and Definition

Advanced polymer composites are a class of materials formed by embedding high-performance polymer matrices with reinforcing fibers or particles to create materials with superior mechanical, thermal, and chemical properties. These composites exhibit exceptional strength-to-weight ratios, making them lightweight yet incredibly strong and durable. They possess high resistance to corrosion, fatigue, and impact, making them suitable for applications in aerospace, automotive, marine, and construction industries.

In addition, advanced polymer composites offer excellent thermal and electrical insulation properties, contributing to their versatility in various engineering applications. Their design flexibility allows for the creation of complex shapes and structures, further expanding their range of uses. With ongoing advancements in manufacturing techniques and material formulations, advanced polymer composites continue to gain prominence as an alternative to traditional materials, offering enhanced performance and efficiency across a wide array of industries.

Key Takeaways

- The advanced polymer composites market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 800 product literatures, industry releases, annual reports, and other such documents of major advanced polymer composites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

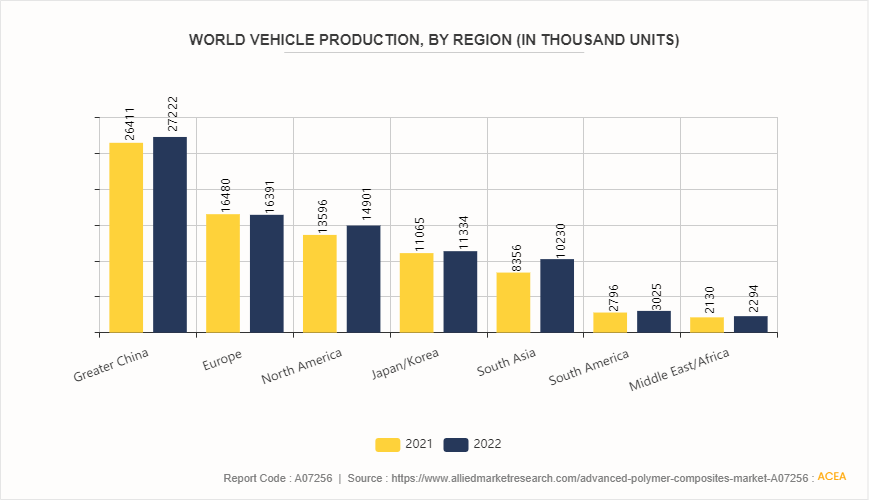

The expanding automotive industry is a significant driver for the growth of the advanced polymer composites market. According to ACEA, in 2022, around 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. The demand for materials that can meet these requirements is increasing as the industry shifts towards lightweight, fuel-efficient, and eco-friendly vehicles. Advanced polymer composites, known for their high strength-to-weight ratio, durability, and resistance to corrosion and fatigue, are becoming essential in manufacturing various automotive components. These materials contribute to weight reduction, improving fuel efficiency and reducing emissions.

In addition, advanced polymer composites offer design flexibility, allowing for the creation of complex and aerodynamic structures that enhance vehicle performance. The rise in electric and hybrid vehicles, which require lightweight materials to maximize battery efficiency and range, further fuels the demand for advanced composites. With continuous advancements in composite technology and growing automotive production, the market for advanced polymer composites is poised for significant growth, driven by the industry's evolving needs and regulatory standards. The high cost of advanced polymer composite production poses a significant challenge to market growth. Manufacturing these composites involves expensive raw materials, such as high-performance polymers and reinforcing fibers, which increase costs. In addition, the production process itself, which includes sophisticated techniques like resin transfer molding, filament winding, and autoclave curing, requires specialized equipment and skilled labor, further escalating expenses.

These factors contribute to the overall high cost of advanced polymer composites, making them less accessible for cost-sensitive applications and industries. While their superior properties offer numerous advantages, the economic barrier can limit widespread adoption, especially in markets where cost-effectiveness is a critical consideration. As a result, efforts are being made to develop more cost-efficient production methods and alternative materials to mitigate these challenges and expand the use of advanced polymer composites across various sectors. However, until significant cost reductions are achieved, the market growth may be constrained by these financial limitations.

The increase in focus on sustainable and eco-friendly solutions presents a lucrative opportunity for the growth of the advanced polymer composites market. There is a growing demand for materials that offer high performance while being environmentally responsible as industries strive to reduce their environmental impact. Advanced polymer composites, particularly those incorporating bio-based or recyclable polymers, align with these sustainability goals. These composites reduce reliance on non-renewable resources and lower carbon footprints. In addition, their lightweight nature contributes to energy efficiency in applications such as automotive and aerospace, where reduced weight leads to lower fuel consumption and emissions. With regulations and consumer preferences increasingly favoring green technologies, the adoption of sustainable advanced polymer composites is poised to expand, driving market growth.

Patent Analysis of the Global Advanced Polymer Composites Market

In the advanced polymer composites market, patent activity is geographically diverse, reflecting the global interest in this technology. The U.S. leads with 24.4% of patents, highlighting its prominent role in innovation. The PCT (Patent Cooperation Treaty) follows closely with 23.6%, indicating a significant number of international filings. Europe holds 18.5% of patents, showing strong regional development. China, Canada, and Australia contribute 8.3%, 7.5%, and 5.5%, respectively, while India and South Korea each hold 5.5% and 2.8%. Mexico and Spain have smaller shares at 2.8% and 1.2%, respectively, illustrating varying levels of involvement and investment in advanced polymer composites across different regions.

Market Segmentation

The advanced polymer composites market is segmented into type, end-use industry, and region. By type, the market is classified into resins, fiber, and others. By end-use industry, the market is divided into automotive, construction, electrical and electronics, aerospace and defense, marine, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the advanced polymer composites market include BASF SE, Arkema, Solvay S.A., Mitsubishi Chemical Carbon Fiber and Composites, Inc., Toray Advanced Composites, Covestro AG, Hexcel Corporation, SGL Carbon, Huntsman International LLC., and TPI Composites Inc.

Top Startups in the Advanced Polymer Composites Market

- Arris Composites: This start-up has emerged as a pioneer in next-generation composites for mass applications across various markets, including automotive, aerospace, and consumer products. They manufacture and design highly integrated products that are more compact, lighter, and tougher.

- Atomic-6 LLC: An advanced composite manufacturing company, Atomic-6 LLC uses a proprietary process that takes composites to new levels of innovation. They create highly customizable products that are faster, lighter, and stronger than before.

- Actuation Lab Ltd: This firm is a modern-day innovator utilizing advanced materials and techniques for manufacturing products. The start-up leverages the latest design methods and rapid manufacturing, maintaining the perspective that mechanical hardware drives industry progress.

Recent Key Strategies and Developments

- In September 2023, Teijin Ltd., has announced its intention to sell its whole investment in GH Craft Co. Ltd, an equity-method subsidiary of Teijin's composites business in Japan, to TIP Composite Co. Ltd (Tokyo) . The agreement will enable Teijin Ltd to expand its operations in other locations.

- In July 2023, The Gumi facility in Gyeongsangbuk-do, Korea, and the Spartanburg plant in South Carolina, both produce normal tow carbon fiber, according to a plan released by Toray Industries Inc. Beginning in 2025, the expenditures will contribute to a more than 20% increase in the company's yearly capacity to produce carbon fiber, reaching 35, 000 metric tons.

- In July 2022, A significant manufacturer of emulsion resin in Mexico, Polimeros Especiales, was purchased by Arkema. Arkema's position in the rapidly expanding regional market will be strengthened by the proposed acquisition.

- In January 2021, Huntsman Advanced Materials successfully acquired Gabriel Performance Products from Audax Private Equity. Gabriel Performance Products is a specialty chemical business in North America that produces epoxy curing agents and specialized additives for use in coatings, adhesives, sealants, and composite end-markets. to gain access to the whole Gabriel product line.

- In June 2020, Solvay and Leonardo announced a five-year supply agreement under which Solvay is expected to deliver a wide range of market-dealing materials to Leonardo's Aircraft, Aeronautics, Electronics, and Helicopters businesses.

- In May 2020, CVC Thermoset Specialties (CTS) , a North American specialty chemical producer catering to the industrial composites, adhesives, and coatings markets, was acquired by Huntsman Advanced Materials. In addition to resin adducts and other high-performance epoxy resins utilized in a variety of applications, CTS provides specialty curing and toughening agents.

Regional Market Outlook

North America is experiencing robust economic growth. The demand for advanced polymer composite materials is rising significantly in the aerospace and defense, automotive, and electronics industries in the U.S., Canada, and Mexico. These materials offer exceptional strength-to-weight ratios, durability, and corrosion resistance, making them ideal for high-performance applications. In aerospace and defense, they enhance fuel efficiency and structural integrity. The automotive industry benefits from their lightweight properties, improving vehicle efficiency and performance. In electronics, advanced composites contribute to the development of robust, miniaturized components. As these industries continue to innovate and prioritize efficiency, the adoption of advanced polymer composites is set to grow further in North America.

- According to the Bureau of Transportation Statistics, U.S. airlines carried 853 million passengers in 2022, a 30% increase from 674 million in 2021. This surge has prompted several airline companies to expand their fleets with advanced aircraft to meet the growing demand. For example, in February 2022, American Airlines ordered 30 new 737 Max 8 jets from Boeing, highlighting the rising demand for commercial airplanes and its positive impact on the market.

- In North America, particularly the U.S., the electronics industry is projected to grow at a moderate rate. The increasing demand for new technological products is expected to drive market expansion. The rapid pace of technological advancements and R&D in the U.S. electronics industry is fueling the demand for newer and faster electronic products. According to the Consumer Technology Association, retail revenue from consumer electronics and technology sales in the U.S. reached an estimated $ 505 billion in 2022, up from $ 461 billion in 2021.

- America's medical technology companies play a critical role in improving patient outcomes, reducing healthcare costs, and driving economic growth. The U.S., holding over 40% of the global medical device market, is the largest market for medical devices, as reported by the Advanced Medical Technology Association (AMTA) .

- According to the OICA, U.S. automotive vehicle production reached 10.06 million units in 2022, up from 9.15 million in 2021, reflecting a 9% growth rate. This rise in vehicle production is expected to boost the demand for advanced polymer composite materials in the region.

Increasing vehicle production will drive the Advanced Polymer Composites Market

The increasing global vehicle production is set to drive the advanced polymer composites market. As the automotive industry seeks lightweight, durable materials to enhance fuel efficiency and performance, advanced polymer composites are becoming essential. These composites, known for their high strength-to-weight ratio and corrosion resistance, are ideal for various vehicle components. With the surge in electric and hybrid vehicle production, the demand for advanced polymer composites is expected to rise significantly, supporting market growth.

Industry Trends

- The expanding aerospace and defense industry is projected to drive the demand for advanced polymer composites due to their lightweight, high-strength, and durable properties. These materials are essential for manufacturing aircraft components, improving fuel efficiency, and enhancing performance in extreme conditions. Increased production of commercial and military aircraft, coupled with rise in defense expenditures, are projected to further boost the growth of the advanced polymer composites market.

- According to the International Air Transport Association (IATA) , the global revenue for commercial airlines reached $472 billion in 2021 and surged to $727 billion in 2022, marking a significant year-on-year growth of 43.6%. Projections indicate that by the close of 2023, this figure will climb to $779 billion, driving increased demand for advanced polymer composite materials in aerospace parts manufacturing.

- Boeing, a prominent global aircraft manufacturer, reported a notable uptick in deliveries, totaling 480 aircraft in 2022, a substantial 41% increase compared to the previous year's total of 340. This surge in new aircraft deliveries is anticipated to bolster the demand for advanced polymer composites.

- The U.S. serves as a key manufacturing hub for airplanes in North America, with Airbus and Boeing leading the way. In 2022, Airbus delivered 661 commercial aircraft, with 1, 078 new orders by year-end. Similarly, Boeing received orders for 57 737 Max 8 jets, slated for delivery through 2025, underscoring the burgeoning demand for airplanes and consequent advanced polymer composite materials.

- Increased aircraft production, in Europe, particularly in countries like France and Germany, is poised to fuel demand for advanced polymer composites. Notably, in May 2023, VoltAero announced plans to establish a manufacturing facility for hybrid-electric aircraft in France, further stimulating demand for advanced polymer composites in the region.

Key Sources Referred

- OurWorldInData.org

- ACEA

- Bureau of Transportation Statistics

- Consumer Technology Association

- Advanced Medical Technology Association

- International Organization of Motor Vehicle Manufacturers (OICA)

- International Air Transport Association (IATA)

- Chinese Association of Automotive Manufacturers

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced polymer composites market analysis from 2024 to 2033 to identify the prevailing advanced polymer composites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the advanced polymer composites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global advanced polymer composites market trends, key players, market segments, application areas, and market growth strategies.

Advanced Polymer Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.2 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | TPI Composites Inc., Toray Advanced Composites, BASF SE, Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites, Inc., Huntsman International LLC., SGL Carbon, Solvay S.A., Arkema, Covestro AG. |

Advanced polymer composites market was valued at $11.7 billion in 2023, and is estimated to reach $24.2 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Technological advancements and innovations and sustainability and environmental regulations are the upcoming trends of Advanced Polymer Composites Market in the globe.

BASF SE, Arkema, Solvay S.A., Mitsubishi Chemical Carbon Fiber and Composites, Inc., Toray Advanced Composites, Covestro AG, Hexcel Corporation, SGL Carbon, Huntsman International LLC., and TPI Composites Inc. are the top companies to hold the market share in Advanced Polymer Composites.

Aerospace and defense is the leading end-use industry of Advanced Polymer Composites Market.

North America is the largest regional market for Advanced Polymer Composites.

Loading Table Of Content...