Aerographite Market Research, 2031

The global aerographite market size was valued at $4.0 million in 2021, and is projected to reach $7.1 million by 2031, growing at a CAGR of 6.2% from 2022 to 2031.

Report Key Highlighters:

- The study covers the aerographite market analysis across 20 countries. The segment analysis of the country in terms of value and volume during the forecast period 2021-2031 is covered in the aerographite market report.

- More than 6,000 product literatures, annual reports, and other such documents of major industry participants along with authentic industry journals have been analyzed for generating high-value industry insights.

- The aerographite market is consolidated, with few players operating globally including Aero Industries, Miami Advanced Material Technology Co., LTD, Pingdingshan Kaiyuan Special Graphite Co., Ltd., Xinghe County Muzi Carbon Co., Ltd. and Zhejiang Huarong Technology Co., Ltd.

Aerographite is a novel carbon-based cellular material comprising a three-dimensional interconnected graphite structure. It is produced in a two-step process. At first, ZnO is fabricated in a flame spray process forming a solid 3-D scaffold as a template, followed by a chemical vapor deposition (CVD) method in which the ZnO is covered by thin layers of graphite, while the ZnO template disappears. Aerographite is six times lighter as compared to air and has a density of five thousand times less than that of water.

Furthermore, it has excellent properties that have made it attractive for numerous fields of research as well as commercial applications. Moreover, its other properties include ductility and improved performance against increased tensile loads and compression. It can undergo extreme compression and aerographite intriguingly exhibits improved conductivity and strength under these stresses. Once the compressive load is removed, it can return to its original size without damage. Moreover, it has the ability to bear loads thousands of times heavier than itself.

Rising demand for aerographite from the electric vehicles sector is anticipated to propel the aerographite market growth during the forecast period.

In recent years, the most appropriate energy storage device for powering electric vehicles (EVs) is lithium-ion batteries (LIBs) due to their superior attributes such as high energy density, high power density, long life cycle, lack of memory effect, and high energy efficiency. Owing to these characteristics, they are lighter and smaller compared to any other traditional rechargeable batteries such as nickel-cadmium batteries (Ni-Cd), nickel-metal hydride batteries (Ni–MH), and lead-acid batteries.

Modern electric vehicles, still, face technological barriers, such as reliability, high cost, & safety, and performance barriers such as charging rate, a lifetime, & range, consequently limiting their widespread adoption. Moreover, there has been surge in the use of the Li-ion batteries in a wide range of automotive passenger car applications.

Owing to the unique material characteristics of aerographite, it fits onto the electrodes of Li-ion batteries. In that case, only a minimal amount of battery electrolyte is required, thereby leading to a crucial decline in the battery’s weight.

Furthermore, as per the International Trade Administration, the U.S. has one of the biggest automotive markets globally. In 2020, U.S. light vehicle sales were 14.5 million units. The U.S. is the world’s second-largest market for vehicle sales and production. Moreover, in 2020, the U.S. exported 1.4 million new light vehicles and 108,754 medium & heavy trucks (worth a combined value of more than $52 billion) to over 200 markets worldwide, with additional exports of automotive parts valued at $66.7 billion.

In addition, according to an International Energy Agency, electric vehicles (EVs) sales in 2021 were the highest in China at 3.3 million (tripling 2020 EV sales), followed by Europe with 2.3 million EVs sold in 2021 (up from 1.4 million in 2020). In the U.S., EV sales doubled their market share to 4.5% in 2021.

However, the availability of substitutes such as graphene is likely to restrain market growth. Aerographite is an organically engineered material with strong covalent bonds between carbon atoms. It comes under an identical group as a couple of other upcoming organic construction materials such as graphene and aero graphene.

Graphene is ideal for countless applications such as transport, medicine, electronics, energy, and defense. It is stronger than steel, yet incredibly lightweight & flexible; and electrically & thermally conductive. Besides, it is the world's first 2D material and is one million times thinner than the diameter of a single human hair.

Furthermore, graphene-based materials find applications in different construction materials, including cement, thermal, & acoustic insulators, anti-corrosion coatings, asphalt, and firefighting materials. Moreover, adding it to construction materials improves mechanical strength, durability, hardness, and flexibility. It could be used to enhance energy efficiency and lower the environmental impact of buildings.

Graphene has some superior strength properties, particularly due to Young's Modulus and tensile strength. This high strength has led to graphene being utilized in multiple composite materials. In addition to its high strength, graphene’s other properties enable it to be used in a variety of applications in the construction sector. On the contrary, the surge in demand for water treatment is anticipated to provide lucrative growth opportunities for the aerographite industry.

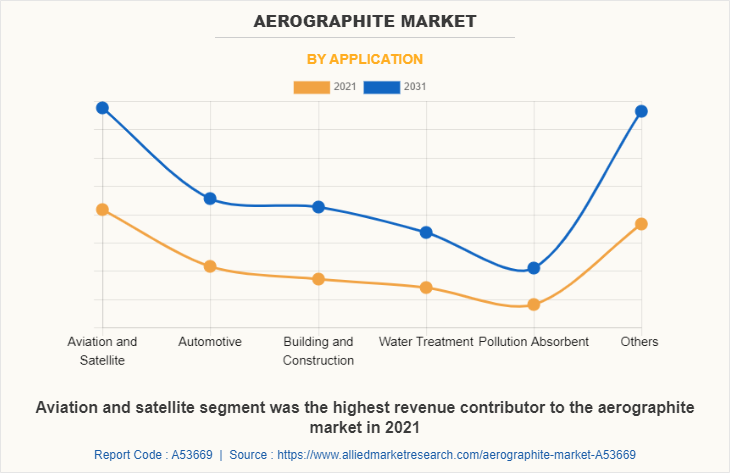

The aerographite market is segmented into application and region. On the basis of application, the market is divided into aviation & satellite, automotive, building & construction, water treatment, pollution absorbent, and others. Region-wise, the aerographite market share is studied across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the global aerographite market include Aero Industries, Miami Advanced Material Technology Co., LTD, Pingdingshan Kaiyuan Special Graphite Co., Ltd., Xinghe County Muzi Carbon Co., Ltd. and Zhejiang Huarong Technology Co., Ltd. These players adopted several growth strategies such as product launch, business expansion, merger & acquisition, and others to strengthen their position in the market.

Asia-Pacific was the highest revenue contributor to the market in 2021. Aerographite is gaining popularity for use in batteries of cars & bikes due to its light application. The Indian automotive industry is considered to be the third largest by 2030 in terms of volume. Catering to an expansive domestic market, dependence on the traditional modes of fuel-intensive mobility will not be sustainable. To address this, federal policymakers are designing a mobility option that is “Shared, Connected, and Electric” and have projected an ambitious target of attaining 100% electrification by 2030.

Furthermore, according to India Energy Storage Alliance (IESA), the EV market in the country will rise at a CAGR of 36% till 2026. The EV battery market is also anticipated to develop at a CAGR of 30% during the same period. The Indian EV market is anticipated at 49% CAGR in the 2022-2030 period as per the IESA report.

Moreover, as per China’s National Bureau of Statistics, in 2020, the construction sector in China generated an additional value of about $1.08 (CNY 7.3) trillion. Thus, the growth of automotive and construction industries is expected to boost the growth of the aerographite market during the forecast period.

Aviation & satellite segment was the highest revenue contributor to the market in 2021. Aerographite has a high tolerance for vibration, thus it can be used for aviation and satellites. It is an innovative material and is used in solar sails. Aerographite has been extensively proposed for usage in deep space probes which will be able to travel further into the cosmos than current technologies.

According to India Brand Equity Foundation, India has become the third-largest domestic aviation market globally and is expected to surpass the UK to become the third-largest air passenger market by 2024. The Indian aviation sector also contributed 5% of the GDP, creating 4 million jobs. Moreover, there is a $72 billion gross value-added contribution to GDP by the aviation sector.

Furthermore, the satellite industry generated just about $279 billion in revenue in 2021. As of April 30, 2022, there were approximately 3,433 U.S.-operated satellites. As per Satellite Industry Association (SIA), the satellite industry dominated the international space economy, which generated $386 billion in revenue, a 4% boost compared to 2020. Moreover, the commercial satellite sector led with 72% of the global space business, a total of $279 billion in revenue.

In addition, satellite manufacturing revenue increased by over 12% in 2021 to $13.7 billion. The U.S. dominated the industry, producing 87% of all commercial satellites procured during 2021.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerographite market analysis from 2021 to 2031 to identify the prevailing aerographite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerographite market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerographite market trends, key players, market segments, application areas, and market growth strategies.

Aerographite Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7.1 million |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 171 |

| By Application |

|

| By Region |

|

| Key Market Players | Miami Advanced Material Technology Co., LTD, Aero Industries, Xinghe County Muzi Carbon Co., Ltd., Zhejiang Huarong Technology Co., Ltd., Pingdingshan Kaiyuan Special Graphite Co., Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the aerographite market is driven by the surge in demand for aerographite from electric vehicles coupled with the growth of aviation industry. Electric vehicles (EVs)are useful in decarbonizing road transport, a sector that accounts for 16% of the global emissions. Moreover, there has been an exponential boost in the sale of EVs along with wider model availability, improved range, and enhanced performance.?

As per International Energy Agency, EVs sales achieved a record high in 2021, despite COVID-19 pandemic and supply chain bottlenecks. Compared with 2020, sales of EVs almost doubled to 6.6 million bringing 16.5 million EVs on the road. Moreover, the sales share of electric cars was boosted by 4% points in 2021.?

The global aerographite market size was valued at $4.0 million in 2021, and is projected to reach $7.1 million by 2031, growing at a CAGR of 6.2% from 2022 to 2031.

Growing demand for aerographite from the electric vehicles industry is predicted to propel the aerographite market growth during the forecast period.

Aviation And Satellite is the leading application of Aerographite Market.

Asia-Pacific is the largest regional market for Aerographite.

Aero Industries, Miami Advanced Material Technology Co., LTD, Pingdingshan Kaiyuan Special Graphite Co., Ltd., Xinghe County Muzi Carbon Co., Ltd. and Zhejiang Huarong Technology Co., Ltd. are the top companies to hold the market share in Aerographite.

Loading Table Of Content...

Loading Research Methodology...