The global aerospace adhesives market size was valued at $0.9 billion in 2022, and is projected to reach $1.5 billion by 2032, growing at a CAGR of 5% from 2023 to 2032.

Report Key Highlighters:

- The aerospace adhesives market studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth goals.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The aerospace adhesives market share is marginally fragmented, with 3M, Huntsman Corporation, H.B. Fuller, Henkel, Illinois Tool Works Inc., PPG, Cytec Solvay Group, Hexcel Corporation, Bostik (Arkema), Dupont, Permabond, Lord Corporation, Master Bond, Scigrip Adhesives, General Sealants, and Beacon Adhesives. Major strategies such as contract, agreements, partnerships, product launches, acquisitions, expansion, and other strategies of players operating in the market are tracked and monitored.

Aerospace adhesives are specialized adhesive formulations meticulously crafted to meet the demanding standards of the aerospace industry. These adhesives are crucial in the fabrication, assembly, and maintenance of diverse aerospace components and structures, spanning from aircraft to spacecraft. Aircraft extensively employ aerospace adhesives, encompassing both internal and external components, as well as the engine compartment. Their applications vary widely, ranging from securing threads and retaining components to creating gaskets and sealing threads. These adhesives effectively distribute stress across bonded joints, thereby augmenting the structural integrity of the aircraft. In addition, they serve as a protective shield against corrosion, a pivotal factor for ensuring the durability and dependability of aircraft elements. The strategic use of adhesives contributes to enhanced aerodynamics, facilitating a smoother and more streamlined aircraft design

In terms of performance enhancement, adhesives play a pivotal role in reducing the overall weight of the aircraft, a critical factor for enhancing fuel efficiency and overall operational performance. Moreover, their application in manufacturing and assembly processes presents a cost-effective and time-saving alternative compared to conventional mechanical fastening methods.

Factors such as increase in number of aircraft and air passengers, surge in penetration of composites in aircraft manufacturing, and rise in demand for lightweight and fuel-efficient aircraft drive the growth of the aerospace adhesives market. However, the increase in need for high-quality adhesives to bond lightweight material and delay in aircraft deliveries hinder the growth of the market. On the contrary, the surge in demand for commercial aircraft and advancements in aircraft are expected to offer lucrative opportunities for the players operating in the aerospace adhesives industry.

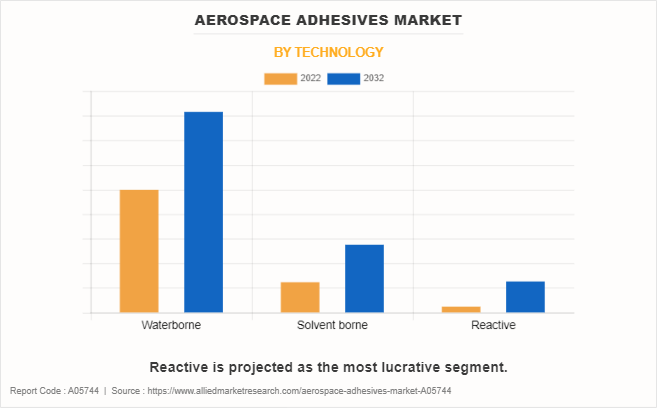

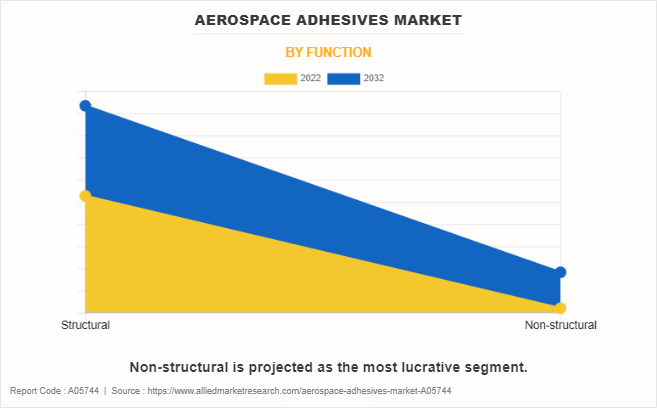

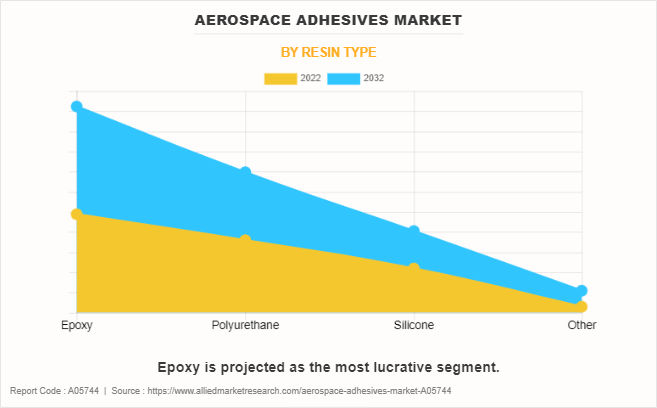

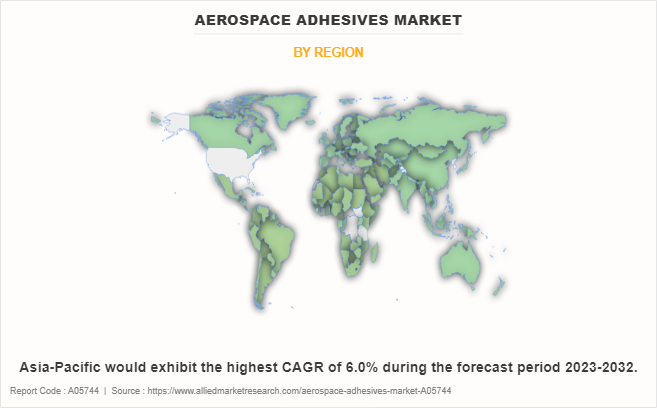

The global aerospace adhesives market is segmented into resin type, technology, function, end user, and region. By resin type, the market is segregated into epoxy, silicone, polyurethane, and others. On the basis of technology, it is classified into waterborne, solvent borne, and reactive. Depending on function, it is fragmented into structural and non-structural. By end user, it is categorized into original equipment manufacturer and maintenance, repair, and operations. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the aerospace adhesives market report include 3M, Huntsman Corporation, H.B. Fuller, Henkel, Illinois Tool Works Inc., PPG, Cytec Solvay Group, Hexcel Corporation, Bostik (Arkema), Dupont, Permabond, Lord Corporation, Master Bond, Scigrip Adhesives, General Sealants, and Beacon Adhesives.

The Asia-Pacific aerospace adhesives market is analyzed with a focus on China, India, Japan, Australia, South Korea, and the rest of the region. Anticipated to command a substantial share of the worldwide demand for airplanes, China is poised to escalate aircraft production to meet this demand, consequently fueling the expansion of the market.

According to the Boeing's Commercial Market Outlook (CMO) report 2023, China is projected to become the largest domestic aviation market globally within the next two decades. The report anticipates that China will contribute to 20% of the global demand for airplanes by 2042. Aviation providers in the country are expected to place orders for over 8,500 new jets by 2042, which is expected to drive the demand for aerospace adhesives. Furthermore, commercial fleet of China is expected to generate demand for $675 billion in aviation services, including maintenance, repair, training, and spare parts.

The report also mentioned that the continued growth in e-commerce and express shipping will drive demand for 190 new freighter deliveries. The need for more deliveries means more frequent flights, which should help expand the aerospace glue market. China’s growing commercial fleet is expected to create greater demand from airlines for resources including training, maintenance and replacement parts. Aerospace adhesives is important for maintenance and repair as it makes aircraft parts stronger and safer. The increasing importance of composite materials used in these service activities may be due to the high demand from airlines.

Increase in number of aircraft and air passengers

The International Civil Aviation Organization (ICAO) projects that air travel will increase by 2035, and these projections are fueled by many variables. This includes rising disposable income of middle class, rise of low-cost airlines, with higher number of aircraft. Aerospace adhesives market benefits from increased demand for aircraft, which is mainly due to increase in air passengers. According to data from IATA, the U.S. airline passengers grew by an impressive 119% in October 2021 compared to October 2020.

The aerospace industry grew significantly due to the easing of COVID-19 restrictions worldwide due to the demand for air travel. Increased demand for air travel led to an increase in aircraft production to meet the expanding number of passengers. Thus the development of aircraft manufacture coincides with the increasing importance of aerospace adhesives for bonding and manufacturing various aircraft components.

Surge in penetration of composites in aircraft manufacturing

Modern aircraft is incorporating composite materials such as reinforced carbon fiber composites and advanced polymer composites, offering outstanding advantages such as high strength-to-weight ratios, high strength, durability and corrosion resistance. Composites exhibit impact resistance, thermal stability and damage resistance, enabling composite aircraft to provide improved crash performance Moreover, composites outperforms conventional steel in terms of fatigue resistance and corrosion resistance. The increasing use of composite materials as in-flight materials, driven by their positive properties such as improved performance in extremely hot and humid environments, is a key factor supporting demand increasingly for space adhesives.

Epoxy materials find extensive use in interior applications such as insert potting, reinforcement, panel joining, and panel structures. For instance, in February 2022, Permabond, manufacturer of adhesives and sealants, announced the introduction of the ET5422 structural epoxy in February 2022. This ultra-high strength two-part epoxy adhesive, initially developed for a spacecraft project, was later adopted by an aircraft parts manufacturer. These factors collectively contribute to the aerospace adhesives market demand during the forecast period.

Increase in need for high-quality adhesives to bond lightweight material

Addressing the growing demand for high-quality adhesives requires substantial investments in research and development. The formulation of adhesives that not only effectively bond lightweight materials but also align with industry standards and regulations demands continuous innovation. Aerospace adhesives companies encounter the ongoing challenge of remaining at the forefront of technology and formulations to meet the dynamic requirements of the aerospace sector.

The escalating need for superior adhesives adds intricacies to the supply chain. Ensuring a dependable and consistent supply of specialized adhesives becomes a complex task, especially when dealing with unique formulations designed for bonding specific lightweight materials. Any disruptions in the supply chain have the potential to negatively impact the timelines of aerospace manufacturing processes.

Delay in aircraft deliveries

IATA estimated that airlines will make $9.8 billion in profits globally this year, after three years of losses due to pandemics, as the airline deals with the consequences of delays in deliveries and therefore delays in of aircraft delivery which hampers the growth of the airline industry. The impact of supply constraints extends beyond delivery delays, affecting the ability of airlines to quickly replace parts, ground aircraft, and war has The Ukraine disrupted supply of titanium, a key material for aircraft, which is known for its durability and lightness. Aircraft companies such as Boeing and Airbus are facing challenges in obtaining titanium, as the conflict has affected Russia, one of the world’s largest titanium producers.

Surge in demand for commercial aircraft

The increasing demand for commercial aircraft is expected to create opportunities which have rewarded for the expansion of the aerospace adhesives market. Faced with increasing mandates for airlines and aircraft manufacturers to meet the increasing demands of air travel, the need for high-performance adhesives to connect aircraft components is increasing at the same time.

Aerospace adhesives plays an important role in ensuring the structural integrity, safety and overall performance of commercial aircraft. To take advantage of this opportunity, adhesive manufacturers can focus on innovation and customization, tailoring their products to meet the specific needs of commercial aircraft. They produce adhesives that are stronger and lightweight to meet the industry’s goal of a fuel-efficient, environmentally friendly aircraft. The expansion of the commercial airline industry provides airlines with the opportunity to offer innovative solutions that contribute to overall aircraft performance, safety and longevity.

Recent Developments in the Aerospace Adhesives Industry

In August 2023, PPG Industries announced to invest $9.8 million to expand its existing product line at the Temple, Texas facility. The expansion project specifically targets the adhesives and sealants line.

In October 2023, Solvay introduced FusePly 250, a new addition to its chemical bonding technology designed for aerospace manufacturing. This product complements the existing FusePly 100 (now renamed FusePly 350) and is tailored for bonding composite structures at 250°F and higher.

In March 2022, Solvay announced a partnership with Wichita State University (WSU) National Institute for Aviation Research (NIAR) to develop future solutions to advance the aviation industry. The strategic involvement with NIAR furthers its commitment to expanding its broad portfolio in the aerospace industry, from composite materials, adhesives, and surfacing films.

In March 2022, Bostik announced a partnership with DGE, a company providing marketing and distribution services for premium specialty chemicals finished products. The aim of the partnership is for the distribution of adhesive and sealant products in the Europe, Middle East, and Africa (EMEA).

In February 2022, Arkema (parent company of Bostik) acquired Ashlandâ Performance Adhesives business in the U.S. Through this acquisition, Arkema strengthened its adhesive solutions segment, and fully aligns with the group strategy.

In January 2022, H.B. Fuller Company acquired Apollo UK based manufacturer of liquid adhesives, coatings, and primers for the roofing, industrial, and construction markets. Through this acquisition, it aims to enhance H.B. Fullerâ position in key high-value, high-margin markets in the UK and Europe.

In June 2021, PPG Industries announced that it supplied aerospace sealants, coatings, and adhesives to United Launch Alliance (ULA) for the ATLAS V 541 rocket that launched NASA Perseverance rover to Mars in July 2020.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace adhesives market analysis from 2022 to 2032 to identify the prevailing aerospace adhesives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace adhesives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace adhesives market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Adhesives Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 355 |

| By Technology |

|

| By Function |

|

| By Resin Type |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Permabond, General Sealants, Henkel, Scigrip Adhesives, H.B. Fuller Company, Huntsman Corporation, 3M, Illinois Tool Works Inc., PPG Industries, Inc., Solvay, Hexcel Corporation, Bostik (Arkema), LORD Corporation, Beacon Adhesives, DuPont, Master Bond Inc. |

The global aerospace adhesives market was valued at $946.9 million in 2022, and is projected to reach $1,516.9 million by 2032, registering a CAGR of 5.0% from 2023 to 2032

The leading companies profiled in the report include 3M, Huntsman Corporation, H.B. Fuller, Henkel, Illinois Tool Works Inc., PPG, Cytec Solvay Group, Hexcel Corporation, Bostik (Arkema), Dupont, Permabond, Lord Corporation, Master Bond, Scigrip Adhesives, General Sealants, and Beacon Adhesives.

The largest regional market for aerospace adhesives is Asia-Pacific.

The leading resin type of aerospace adhesives market is epoxy.

The upcoming trends of aerospace adhesives market in the world are surge in demand for commercial aircraft and advancements in aircraft.

Loading Table Of Content...

Loading Research Methodology...