Aerospace Composite Market Outlook - 2032

The global aerospace composite market size was valued at $29.6 billion in 2022, and is projected to reach $87.0 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032. The aerospace industry is increasingly concentrating on the comprehensive lifecycle management of aircraft, encompassing aspects such as maintenance, repair, and overall service life. This shift is driven by the need to optimize the performance and cost-effectiveness of aircraft throughout their operational lives.

Introduction

Aerospace composites are advanced materials utilized in the aerospace industry to enhance the performance, efficiency, and durability of aircraft and spacecraft components. These composites are typically made from a combination of high-strength fibers embedded in a matrix material. The fibers, often carbon, aramid, or glass, provide strength and stiffness, while the matrix, which can be polymer-based, metal-based, or ceramic-based, binds the fibers together and transfers loads. The result is a material that combines lightweight properties with high strength, rigidity, and resistance to environmental factors.

In commercial aviation, composites are extensively used in the construction of aircraft structures. The Boeing 787 Dreamliner, for example, utilizes composites for more than 50% of its airframe, including the fuselage, wings, and tail. This use of composites contributes to a lighter aircraft, leading to better fuel efficiency and reduced operating costs. The Airbus A350 is another example where composites are employed in its fuselage and wings to achieve similar benefits.

Military aircraft benefit from composites due to their high strength-to-weight ratio and resistance to radar detection. The F-22 Raptor and the F-35 Lightning II, two advanced stealth fighters, use composites extensively in their structures. These materials help in reducing the radar cross-section of the aircraft, making them less detectable by enemy radar systems, and enhancing their overall maneuverability and performance.

In space exploration, composites play a crucial role in spacecraft design due to their ability to withstand the harsh conditions of space while being lightweight. The thermal protection systems of spacecraft, such as the Space Shuttle's tiles and the Mars rovers' structures, are made from composite materials. These composites protect spacecraft from the extreme temperatures encountered during re-entry and provide structural support in the vacuum of space.

Key Takeaways:

- The aerospace composite market share covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kiloton) for the projected period 2021-2031.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The aerospace composite market growth is highly fragmented, with several players including Bally Ribbon Mills, DuPont, Hexcel Corporation, Mitsubishi Electric Corporation, SGL Carbon, Solvay, Spirit AeroSystems, Inc., TEIJIN LIMITED., Toray Industries Inc, VX Aerospace Corporation. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the aerospace composite market.

Market Dynamics

The emergence of 3D printing, known as additive manufacturing, drives the growth of aerospace composite market. This innovative manufacturing technique enables the creation of intricate geometric shapes and structures, overcoming challenges that were once deemed difficult or even impossible using conventional manufacturing methods. The ability to precisely control the placement of fibers and matrix materials during the printing process enables the creation of customized composites tailored for specific applications.

Aerospace composites have found a significant role in space exploration. Satellites and spacecrafts benefit from the lightweight nature of composites, enabling them to achieve the high speeds and maneuverability required for space missions. The Mars rovers employed composite materials in their construction, a strategic choice aimed at ensuring durability in the challenging Martian environment. These materials offered a balance between resilience against the harsh conditions on the Martian surface and the necessity for lightweight structures suitable for space travel. In November 2023, Markforged, based in Waltham, Mass., introduced two significant advancements in 3D printing technology, the FX10 and Vega. The FX10 is a new composite 3D printer equipped with automation and aerospace features, specifically engineered for industrial environments and on-the-floor manufacturing. Complementing this innovation is Vega, a high-performance material composed of carbon fiber-filled polyetherketoneketone (PEKK). This new material is designed to enhance 3D printing by offering improvements in weight, cost efficiency, and lead times, thereby reinforcing manufacturing resilience and enabling production precisely where it's needed.

The high cost of raw materials and advanced manufacturing techniques of aerospace composite is expected to drive the growth of the aerospace composite market during the forecast period. One of the significant barriers to the widespread adoption of aerospace composites is the high initial cost associated with their production. The expense of raw materials used in composite manufacturing, such as high-grade carbon fibers and specialty resins, is substantial. These materials are not only costly but also require sophisticated and precise manufacturing processes to achieve the desired performance characteristics. The advanced manufacturing techniques needed to produce aerospace composites, including processes such filament winding, resin transfer molding, and autoclave curing, contribute further to the high costs. These methods demand specialized equipment and skilled labor, adding to the overall expense. The complexity of these processes also results in longer production times and higher capital investment in technology and infrastructure.

Segments Overview:

The aerospace composite market is segmented into fiber type, manufacturing process, aircraft, and region. On the basis of fiber type, the market is classified into carbon fiber, glass fiber, aramid fiber, and others. On the basis of the manufacturing process, the market is divided into ATL or AFP, filament winding, resin transfer molding, hand layup, and others. On the basis of aircraft, the market is categorized into commercial aircraft, business & general aviation, civil helicopter, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

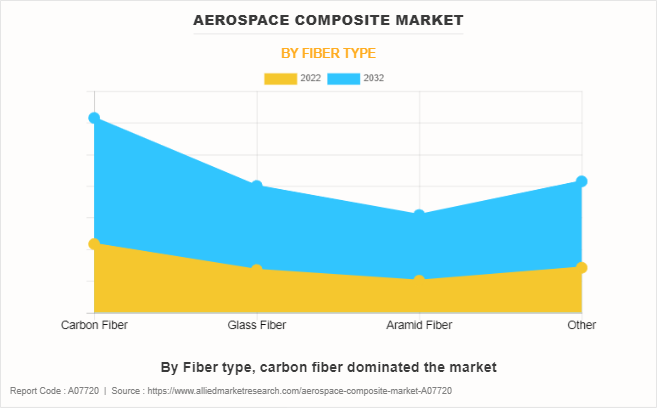

Aerospace Composite Market By Fiber Type

By fiber type, the carbon fiber segment dominated the global aerospace composite market in terms of revenue in 2022 and is expected to witness a CAGR of 11.1% during the forecast period. The fiber composites act as the primary load-bearing component, providing tensile strength and stiffness. Carbon fibers, for instance, are known for their high strength and rigidity, while aramid fibers offer excellent impact resistance and toughness. The matrix, usually an epoxy resin, binds the fibers together and helps distribute loads evenly across the composite material. This matrix also protects the fibers from environmental factors and damage during use. The usage of aerospace composites in fiber composites has transformed aircraft design and manufacturing. These materials are used extensively in various parts of aircraft, including fuselages, wings, and tail assemblies. By replacing traditional metal components with composite materials, aerospace engineers can significantly reduce the overall weight of the aircraft. This reduction in weight leads to enhanced fuel efficiency, improved performance, and increased payload capacity.

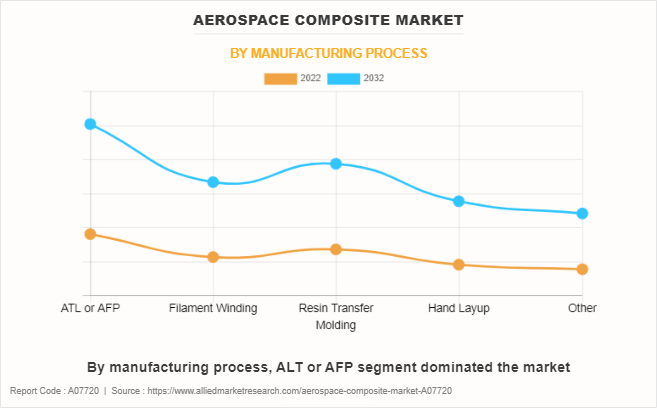

Aerospace Composite Market By Manufacturing Process

Automated Tape Laying (ATL) and Automated Fiber Placement (AFP) manufacturing processes dominated the aerospace composite market in 2022 and are expected to witness a CAGR of 11.0% during the forecast period. Aerospace designs often involve complex shapes and geometries. ATL and AFP systems excel at laying tapes and fibers in intricate patterns, enabling the creation of components with sophisticated designs that would be challenging or impossible to achieve manually. Automated manufacturing processes such as ATL and AFP, have become integral to the aviation and space industries. Their applications in structural and interior components, engine parts, space exploration, military aircraft, and UAVs highlight the versatility and importance of these materials. The National Composites Centre in Bristol, UK, introduced a new state-of-the-art Automated Tape Layup (ATL) cell. This advanced system features an ATL head capable of laying down tapes in widths of 75, 200, or 300mm. It utilizes the same heating systems and material processing technologies as those found in Automated Fiber Placement (AFP), enhancing its versatility and efficiency in composites manufacturing.

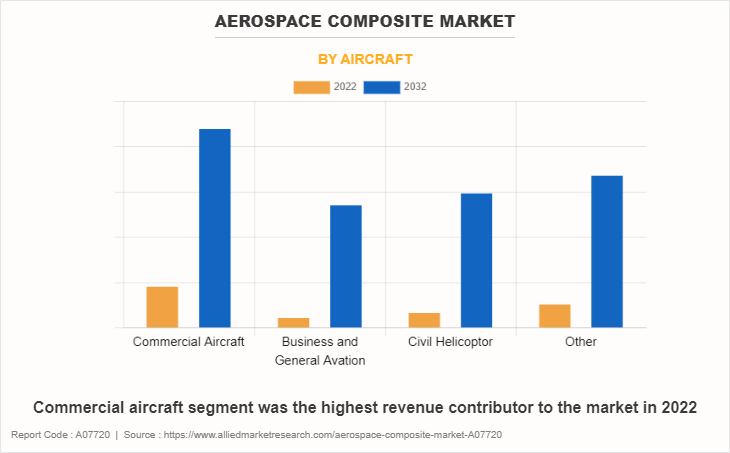

Aerospace Composite Market By Aircraft

By aircraft, aerospace composite dominated the market accounting for one-third of the market share in 2022. Aerospace composites are extensively utilized in the construction of wing structures. The wings of modern commercial aircraft often feature composite materials, including carbon-fiber-reinforced composites, which offer high strength and stiffness. This application is crucial for achieving optimal aerodynamics and fuel efficiency. Aerospace composites are employed for various interior components of commercial aircraft. These include panels, overhead bins, and partitions. The use of composites in cabin interiors not only reduces weight but also allows for creative and ergonomic design, contributing to a more comfortable and aesthetically pleasing passenger experience.

Aerospace Composite Market By Region

Aerospace composite in North America was the highest revenue contributor accounting for one-third of the market share representing the CAGR of 11.2%. Aerospace composites are substantially used in North America for a variety of applications in the aerospace industry. Composites such as wings, fuselage sections, and tail aspects are extensively used in setting up plane structures. They provide a excessive strength-to-weight ratio, which is essential for improving gasoline efficiency and lowering ordinary plane weight. The U.S. is a world leader in aerospace technology and innovation, and it closely relies on aerospace composites. The Boeing Company, one of the world greatest aerospace manufacturers, considerably makes use of composites in its business aircraft, which include the Boeing 785, which aspects a full-size proportion of composite materials in its construction. In April 2024, the Society for the Advancement of Material and Process Engineering (SAMPE) announced that its North America 2025 conference and expo will be held in Indianapolis, Indiana. SAMPE chose Indianapolis due to its favorable business environment and strategic location. Indianapolis, Indiana has been selected as the 2025 conference’s location owing to the area’s strong ties to automotive and aerospace manufacturing activities and modern conveniences.

Competitive Analysis

The major players operating in the aerospace composite market include Bally Ribbon Mills, DuPont, Hexcel Corporation, Mitsubishi Electric Corporation, SGL Carbon, Solvay, Spirit AeroSystems, Inc., TEIJIN LIMITED., Toray Industries Inc, VX Aerospace Corporation.

Apart from the above-listed companies, there are many manufacturers of aerospace composite including (Boeing, Airbus, Lockheed Martin, Northrop Grumman, General Dynamics, Raytheon Technologies, BAE Systems, Safran, Thales Group, Bombardier Aerospace, Embraer, Cytec Solvay Group, Triumph Group, Albany International, Kawasaki Heavy Industries, and others).

Historic Trends of Aerospace Composite Market:

- In the 1950s advancements in materials science led to the development of new composite materials. Epoxy resins and carbon fibers started to be used in experimental aircraft structures. The aerospace industry began to see more widespread use of composites. The A-6 Intruder was a groundbreaking aircraft known for its composite wings, while the Boeing 727 stood out with its innovative use of composite materials in the empennage components.

- In the 1970s the introduction of high-strength carbon fibers significantly improved the strength-to-weight ratio of composite materials. Aircraft such as the Boeing 757 and 767 incorporated composites in their structures. The development of advanced manufacturing techniques, such as autoclave curing and filament winding, contributed to the increased use of composites in aerospace. The Airbus A320 and A330 featured composite components.

- In 2000 the Boeing 787 Dreamliner and the Airbus A350 XWB were introduced, both featuring a high percentage of composite materials in their airframes. This era marked a shift toward more extensive use of composites to reduce weight and improve fuel efficiency.

- In 2010 advancements in composite materials, including the use of carbon-fiber-reinforced composites, continued to shape aerospace design. The Boeing 777X and the Airbus A220 incorporated advanced composite structures.

- In 2020 the use of composites in the construction of spacecraft has become increasingly prevalent. Composites offer a favorable strength-to-weight ratio, making them suitable for components that need to withstand the harsh conditions of space while keeping weight to a minimum. This includes applications in satellite structures, payload fairings, and other critical components.

Key Regulation Analysis

Regulatory Bodies

Federal Aviation Administration (FAA): This U.S. agency establishes rigorous standards for aircraft design, manufacturing, and operation. Manufacturers must comply with FAA regulations to supply components for the U.S.-made aircraft.

European Union Aviation Safety Agency (EASA): EASA oversees the safety of civil aviation within the EU, ensuring that materials and manufacturing processes meet strict safety criteria.

Industry Standards: This internationally recognized standard outlines the requirements for a Quality Management System (QMS) specifically designed for the aerospace industry. AS9100 certification is frequently required for suppliers working with major aerospace companies, thus showcasing their dedication to maintaining high standards of quality and safety throughout the production process.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace composite market analysis from 2022 to 2032 to identify the prevailing aerospace composite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace composite market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace composite market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Composite Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 87 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Fiber Type |

|

| By Manufacturing Process |

|

| By Aircraft |

|

| By Region |

|

| Key Market Players | Solvay, SGL Carbon, TEIJIN LIMITED., Bally Ribbon Mills, Spirit AeroSystems, Inc., Hexcel Corporation, VX Aerospace Corporation, TORAY INDUSTRIES, INC., Mitsubishi Electric Corporation, DuPont |

Analyst Review

According to the opinions of various CXOs of leading companies, the global aerospace composite market was dominated by the carbon fiber segment. The aerospace sector has seen increased adoption of carbon fiber composites due to advancements in manufacturing technologies such as automated layup processes and 3D printing. These innovations have improved production efficiency and made carbon fiber composites more cost-effective in the manufacturing processes.

Lightweight material demand for fuel efficiency in aerospace drives the growth of the aerospace composite market. Aerospace composites, particularly carbon fiber composites, are highly valued in the aviation industry due to their excellent tensile strength and stiffness. These structural properties make them ideal for applications where maintaining structural integrity is crucial. The ability of composites to withstand high stress and fatigue contributes to the longevity and durability of aircraft components, reducing maintenance needs and operational costs in the aviation sector.

However, the high initial costs of composite materials in aerospace are expected to restrain industry expansion. Composite materials in aerospace involve high-cost components such as advanced carbon or glass, and epoxy resin. The manufacturing process includes precision molding, curing, and strict quality control, leading to elevated initial costs. Specialized equipment and skilled labor are necessary, further increasing production expenses. In addition, the time-intensive nature of ensuring uniformity and quality in large-scale production contributes to higher operational expenditures in the aerospace sector.

The North America region is projected to register robust growth during the forecast period. In the commercial aviation sector, U.S. manufacturers such as Boeing have been pioneers in incorporating composites. Aircraft such as the Boeing 787 Dreamliner feature a significant percentage of composite materials in their construction, leading to improved fuel efficiency and operational flexibility. NASA, the U.S. space agency, utilizes aerospace composites in various space exploration missions. Composite materials play a vital role in the construction of spacecraft, satellites, and space probes, contributing to the success and durability of these missions.

The global aerospace composite market size was valued at $29.6 billion in 2022, and is projected to reach $87.0 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

The major players operating in the aerospace composite market include Bally Ribbon Mills, DuPont, Hexcel Corporation, Mitsubishi Electric Corporation, SGL Carbon, Solvay, Spirit AeroSystems, Inc., TEIJIN LIMITED., Toray Industries Inc, VX Aerospace Corporation.

North America is the largest region for aerospace composite market.

The leading fiber type of aerospace composite includes carbon fiber, glass fiber, aramid fiber, and others.

Lightweight material demand for fuel efficiency in aerospace and integration of nanotechnology in composite development in aerospace drives the growth of aerospace composite market.

High initial costs of composite materials in aerospace are the restraint factor of aerospace composite market.

Rise in demand for next-generation aircraft are the upcoming trends of Aerospace Composite Market in the world.

Loading Table Of Content...

Loading Research Methodology...