Aerospace Foam Market Research, 2030

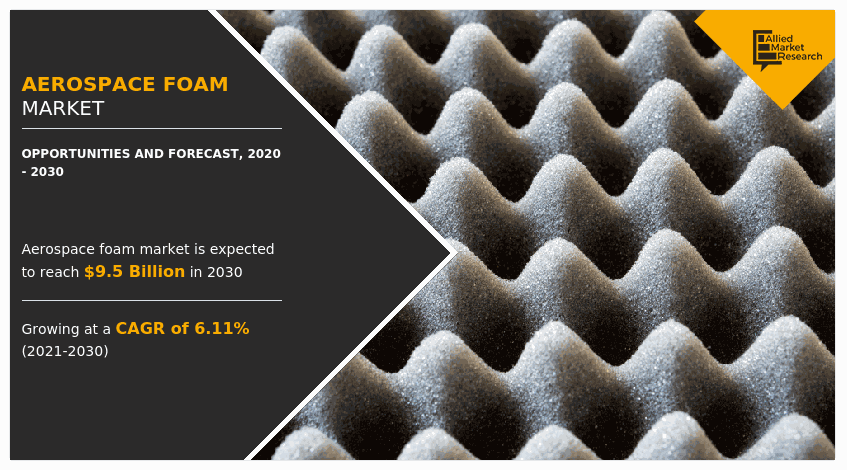

The global aerospace foam market was valued at $5.3 billion in 2020, and is projected to reach $9.5 billion by 2030, growing at a CAGR of 6.11% from 2021 to 2030.

Aerospace foam is a cellular structured material used in aviation industries, owing to its low density property. It is mostly utilized for cushioning, insulation, and vibration dampeners. Furthermore, properties, including lightweight, tensile strength, excellent rigidness, durability, and heat resistance develop various opportunities for the application of aerospace foam in different aircraft applications, including gaskets to seal, rooftops, headsets, and rotor blades.

Surge in the demand for lightweight and fuel efficient aircraft and growth in aviation industry across the globe augment the growth of the market. Manufacturing of advanced materials and new product launches by several key players in aerospace industry drive the growth of the market. Favorable government policies in the developing countries, including Brazil, India, and China and increase in the use of the bio-based polyurethane foams in other regions of the world upsurge and diversify the aerospace foam market. Rise in demand for polyurethane aerospace foam in seating and carpeting applications in the aviation industry and its low cost is considered another key factor driving the growth of the market. Increase in number of air passengers across the globe boosts the growth of the market. The presence of low cost operators in the Asia-Pacific and LAMEA resulted in the increase in demand for commercial aviation products, which, in turn, results in the positive impact on the demand for aerospace foam market. Conversely, stringent government regulations pertaining to the use of aerospace foams, due to the fact that polyurethane foams are still highly petroleum dependent hamper the market.

The global aerospace foam market is segmented on the basis of product type, application, and region.

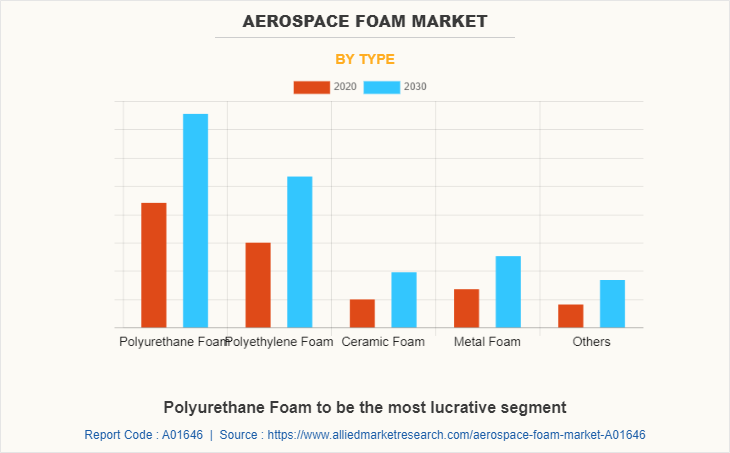

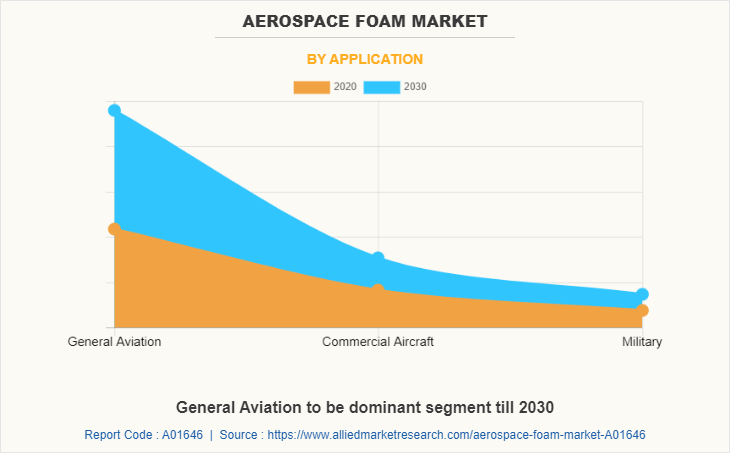

On the basis of product type, it is segmented into polyurethane, polyethylene, ceramic, metal foam, and others. Depending on application, it is classified into general aviation, commercial, and military. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for largest market share of the total revenue in 2020, followed by Europe and Asia-Pacific. Increase in adoption of phase change material products in the region boosts the growth of aerospace foam market, due to the presence of huge population base and presence of many developing countries in this region.

The key players operating in the global aerospace foam market are BASF SE, Huntsman Corporation, Armacell, Boyd Corporation, Evonik Industries, SABIC, Rogers Corporation, Zetofoams Plc., General Plastics Manufacturing Company, and ERG Materials.

The other players in the value chain (not profiled in the report) include Aerospace Corporation, ERG Aerospace Corporation, Aerofoam Industries, Technifab Inc., Mueller, Everchem Specialty Chemicals, UFP Technologies, and Solvay are competing for the share of the market through product launch, joint venture, partnership, and expanding the production capabilities to meet the future demand for the aerospace foam market in the forecast period.

North America occupies the largest part of the aerospace foams market and include countries, such as the U.S., Canada, and Mexico. Presence of large manufacturing giants, such as The Boeing Company, Airbus SE, Lockheed Martin Corporation, General Dynamics Corporation, and Textron Inc., in this region creates a positive impact on the demand for the aerospace foam market. The U.S.-based American airlines announced that it is ordering 30 new 737 Max 8 jets from Boeing. America will order for 57 of the 737 Max 8 jets through 2025. The airline is scheduled to get 15 of the 30 jets in 2023 and the other 15 in 2024. Lynx Air, a new Canadian ultra-low-cost carrier, announced its plan to launch flight operations with three “Boeing 737 Max 8” in the first quarter of 2022. The airline was formerly called Enerjet, a charter provider to Canada’s oil & gas industry. The airline also announced its plan to increase its fleet to 46 aircraft over a period of seven years. The presence of above mentioned expansion of various aircraft by the U.S.-based companies for various purposes are major driving factors for the development of the market in the future.

The polyurethane foam segment dominates the global aerospace foam market. Polyurethane foams are used in insulation, adhesives, sealants, and binders in various aircraft construction products. Polyurethane foams are highly flexible materials, which help reduce total infrastructural costs by minimizing fuel consumption in the aircraft. They enable manufacturers to insulate aircraft in an improved manner, which reduces the consumption of gas, oil, and electricity. This increases the use of polyurethane foams for insulation applications in aviation industry.

The general aviation segment dominates the global aerospace foam market. General aviation is not a commonly used term outside of the pilot community, yet it encompasses the most diverse flying activities in the United States. In fact, more than 90% of civil aircraft registered in the United States are general aviation aircraft. And, more than 80% of pilots certificated in the U.S. fly general aviation aircraft. General aviation generates more than $247 billion in economic activity annually.

COVID-19 Impact Analysis:

COVID-19 severely impacted the global economy with devastating effects on global trade, which simultaneously affected households, business, financial institution, industrial establishments and infrastructure companies. The restrictions on international trade and lockdown regulations on the operations of the chemicals industry limit short term demand in the market. Reducing flight activity negatively impacted airline cash flow. As a result, most airlines decided to cancel or defer their aircraft orders. The commercial aircraft OEMs trimmed their production rates due to the fact that the pandemic decreased the demand for new jets. However, in commercial sector passenger traffic plummeted drastically in 2020 and 2021. The return of the Boeing 737MAX into service and the recovery in domestic demand helped the OEMs in obtaining more orders and increasing aircraft deliveries in 2021.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace foam market analysis from 2020 to 2030 to identify the prevailing aerospace foam market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace foam market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace foam market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Foam Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | BASF SE, HUNTSMAN CORPORATION, SABIC, ERG MATERIALS, ROGERS CORPORATION, GENERAL PLASTICS MANUFACTURING COMPANY, ARMACELL, BOYD CORPORATION, ZETOFOAMS PLC, EVONIK INDUSTRIES |

Analyst Review

Increase in the growth of aircraft market fuels the demand for aerospace foam, owing to its applications in-cabin walls, ceilings, overhead stow bins, composite cores, and aircraft prototypes. Moreover, government investments in military applications are expected to provide lucrative growth opportunities for market expansion. In addition, manufacturers increase their operational facilities to cater the demand for aircraft in LAMEA and Asia-Pacific. Furthermore, developmental activities in aerospace technologies helped the market to witness growth. Decrease in oil prices is expected to provide lucrative growth opportunities for market expansion.

Aircraft fleet modernization and destination expansion plans of the airlines results in gradual revival of aircraft demand, thereby strengthening the demand for aerospace foams. Increase in the demand for the commercial and personal aircraft across the globe and rise in presence of less efficient manufacturing process led to order backlog. Airbus reported a backlog of 7,082 jets. Boeing’s reported backlog of 5,136 aircraft. These numbers reveal that despite the reduction in demand for commercial aircraft from the airlines, deliveries of economic aircraft will continue at a significant rate during the forecast period. The aforementioned factors provide lucrative opportunities for the development of the aerospace foam market during the forecast period.

North America dominates the aerospace foam market, due to rise in production capacities and increase in presence of key market players. Furthermore, joint ventures between companies in Asia-Pacific, especially, China and Japan, fuel the expansion of the market. Asia-Pacific is predicted to have a huge demand for commercial aircraft during the forecast period. Expansion in air passenger traffic is predominant within the region however, China and India are expected to be among the most important aviation markets of the globe during the forecast period.

Increase in demand for low-cost carriers (LCC) and Rise in governmental investments are the key factors boosting the Aerospace Foam Market growth

The market value of Aerospace Foam in 2030 is expected to be US$ 9.5 Billion

BASF SE, Huntsman Corporation, Armacell, Boyd Corporation, Evonik Industries, SABIC, Rogers Corporation, Zetofoams Plc., General Plastics Manufacturing Company, and ERG Materials.

Aviation industry is projected to increase the demand for Aerospace Foam Market

The global aerospace foam market is segmented on the basis of product type, application, and region. On the basis of product type, it is segmented into polyurethane, polyethylene, ceramic, metal foam, and others. Depending on application, it is classified into general aviation, commercial, and military. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Increase in R&D activities to develop green polyurethane foams is the Main Driver of Aerospace Foam Market

General Aviation and Commercial Aircraft applications are expected to drive the adoption of Aerospace Foam

Reducing flight activity negatively impacted airline cash flow. As a result, most airlines decided to cancel or defer their aircraft orders. The commercial aircraft OEMs trimmed their production rates due to the fact that the pandemic decreased the demand for new jets. However, in commercial sector passenger traffic plummeted drastically in 2020 and 2021. The return of the Boeing 737MAX into service and the recovery in domestic demand helped the OEMs in obtaining more orders and increasing aircraft deliveries in 2021.

Loading Table Of Content...