Affordable Housing Market Research, 2031

The global affordable housing market size was valued at $52.2 billion in 2021, and is projected to reach $84.7 billion by 2031, growing at a CAGR of 4.9% from 2022 to 2031.

The market for affordable housing is anticipated to expand at a remarkable rate during the forecast period. The growing middle-class population and expanding working population are driving the market for affordable homes. This has caused a significant influx of migrants, particularly in Tier 1 cities, who are moving there for employment and educational reasons. During the projected period, this is expected to support market growth.

Affordable Housing Market Dynamics

Additionally, it is anticipated that ease of access to home financing will fuel market expansion during the forecast period. Furthermore, it is anticipated that the Indian government's goal of "Housing for everyone by FY2023" will open up profitable chances for market expansion. This gained momentum when the union government announced an extension of the ability to deduct additional interest expenses up to a certain amount on loans for affordable houses by an additional one year till 31 March FY2023 in the Budget FY2022. Such initiatives by the government are driving the affordable housing market growth.

Rapid urbanization in emerging economies and majority of the population is concentrated in emerging economies such as Brazil, China, India, and Eastern European nations is driving the demand for affordable housing market.

All major cities in developed nations have reached a saturation point where expansion of city boundaries and economy has stalled or has a very low growth rate restraining the affordable housing market share. For instance, in the U.S., the residential real estate market witnessed a drop-in rate of sales of affordable housing and residential properties in major cities such as Washington D.C., owing to rise in prices of properties and drop in investments by foreign investors.

Furthermore, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. Construction and transportation activities, along with their supply chains, were hampered on a global level. This led to decline in construction of affordable housing as well as their demand in the market, thereby restraining the growth of the affordable housing market. Conversely, industries are gradually resuming their construction and services. This is expected to lead to re-initiation of construction industry at their full-scale capacities, which helped the affordable housing industry to recover by end of 2021.

Rise in government policies for affordable housing and collaboration in between key market players is anticipated to provide lucrative opportunities for the growth of affordable housing. Growing partnerships across Europe also point to the region's affordable housing market having a bright future in the coming years. For instance, in March 2022, the SHAPE-EU project was started by the European Affordable Housing Consortium for Sustainable Housing and Social Impact.

Affordable Housing Market Segmentation

The affordable housing market is segmented into Providers, Size of Unit and Location. By provider, the market is divided into government, and public-private partnership. By size of unit, the market is divided into up to 400 square feet, 400-800 square feet, and above 800 square feet. By location, the market is divided into urban and rural. Region wise, the global market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

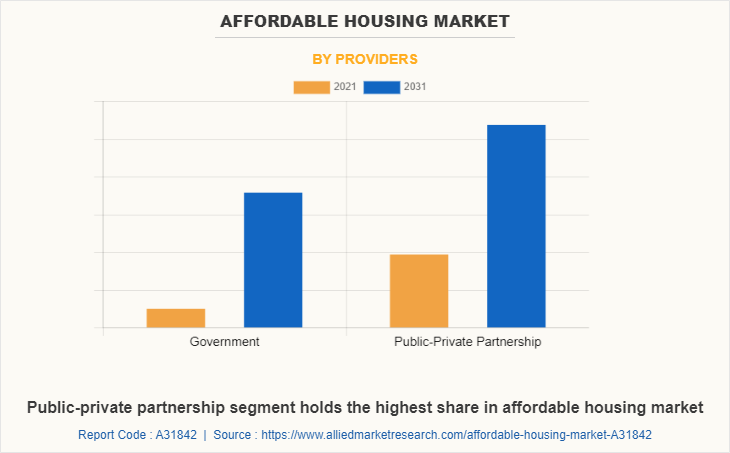

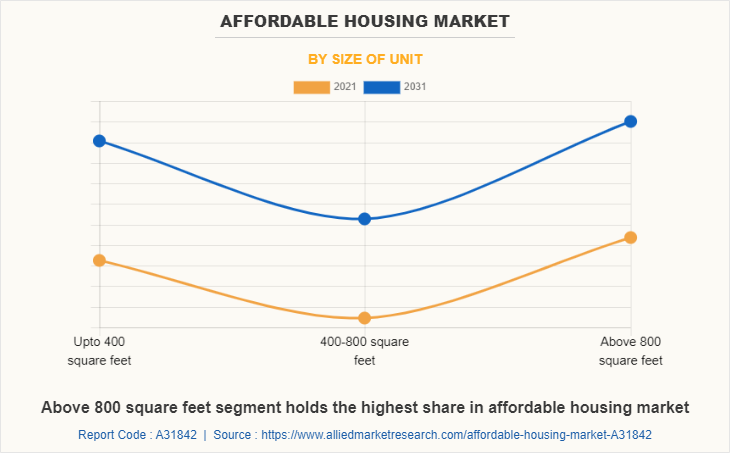

On the basis of provider, in 2021, the public-private partnership segment dominated the affordable housing market, in terms of revenue, whereas the government segment is expected to witness growth at the highest CAGR during the forecast period. As per size of unit, in 2021, the above 800 square feet segment led the affordable housing, in terms of revenue, however, the 400-800 square feet segment is expected to exhibit highest CAGR in the near future.

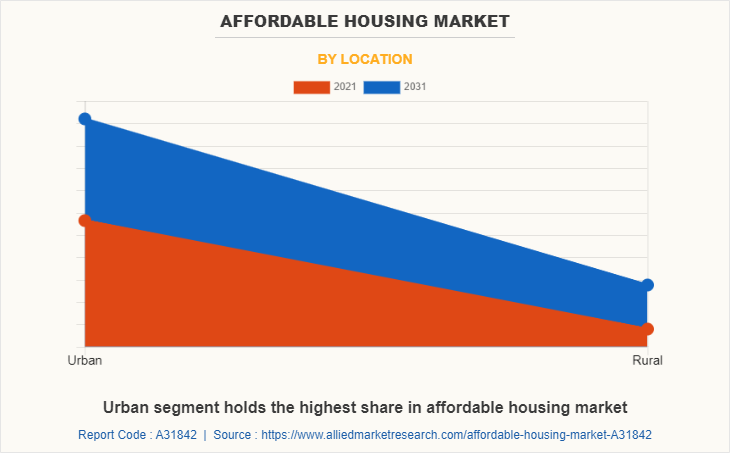

By location, the urban segment led the market in 2021, in terms of revenue; however, the rural segment is anticipated to register highest CAGR during the forecast period.

Region wise, Asia-Pacific garnered the highest revenue in 2021; however, LAMEA is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the affordable housing market include Dominium, Jonathan rose cos, Larsen & Toubro Ltd., LDG Development, TATA Projects, The NRP Group, Pennrose, Prestige Group, Related Group, and Skanska. Major companies in the market have adopted acquisition, partnership and business expansion as their key developmental strategies to offer better products and services to customers in the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the affordable housing market analysis from 2021 to 2031 to identify the prevailing affordable housing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the affordable housing market forecast.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global affordable housing market trends, key players, market segments, application areas, and market growth strategies.

Affordable Housing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 84.7 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Providers |

|

| By Size of Unit |

|

| By Location |

|

| By Region |

|

| Key Market Players | Skanska AB, Jonathan Rose Companies LLC, Larsen & Toubro Ltd., The NRP Group, Tata projects, Pennrose, Related Group, LDG Development, Prestige group, Dominium |

Analyst Review

The global affordable housing market witnessed a huge demand in Asia-Pacific followed by North America & Europe. LAMEA is expected to exhibit the highest CAGR during the forecast period. Affordable housing is defined as housing that is fundamentally affordable for individuals whose income is lower than or equal to the national average for all households. The population of Tier 1 cities expanded due to a significant influx of migrants for societal and economic reasons. Both in rural and urban regions, old apartments are being renovated and are seen as being affordable. Purchasing land and constructing a home can be challenging for an individual or real estate developers due to escalating legal concerns and a growing number of lenders' involvement. This increases the need for affordable housing .

The development of infrastructure is strongly impacted by increased urbanization, and this is anticipated to increase the demand for affordable housing. Moreover, decrease in new construction activities in developed nations restrain the market growth. Government also launch policy to drive demand for the affordable housing market. For instance, Europe launched “First Home” scheme which offers 30% to 50% discount on buying new house in specified areas. Such instances are expected to offer lots of opportunities during the forecast period.

The global affordable housing market was valued at $52,160.2 million in 2021, and is projected to reach $84,700.0 million by 2031, registering a CAGR of 4.9% from 2022 to 2031.

The forecast period considered for the global affordable housing market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

To latest version of global affordable housing market report can be obtained on demand from the website.

The base year considered in the global affordable housing market report is 2021.

The top companies holding the market share in the global affordable housing market report include Dominium, Jonathan rose cos, Larsen & Toubro Ltd., LDG Development, TATA Projects, The NRP Group, Pennrose, Prestige Group, Related Group, and Skanska.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By providers, the public-private partnership segment is the highest share holder of affordable housing market.

Loading Table Of Content...