Agricultural Disinfectants Market Research, 2032

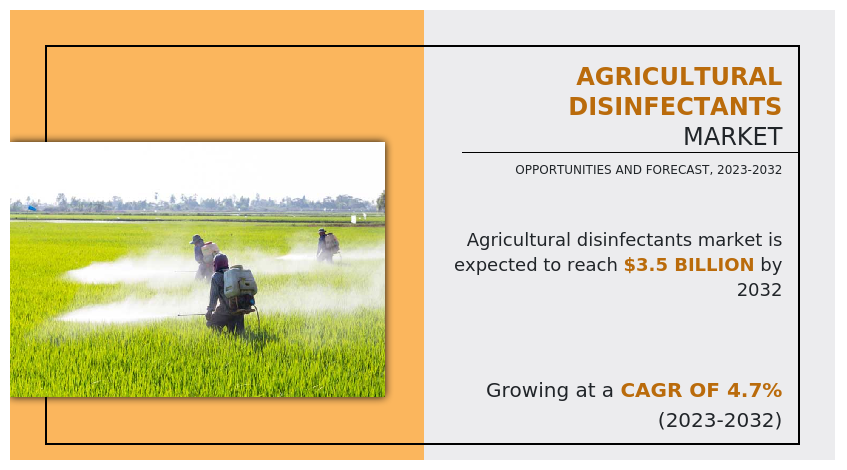

The global agricultural disinfectants market was valued at $2.3 billion in 2022 and is projected to reach $3.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Report Key Highlighters:

- Quantitative information mentioned in the global agricultural disinfectants market includes the market numbers in terms of value ($Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of type form and application. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Acuro Organics Limited, LANXESS, Stepan Company, Neogen Corporation, Ceva, Bayer AG, and Nufarm Limited, hold a large proportion of the agricultural disinfectants market.

- This report makes it easier for existing market players and new entrants to the agricultural disinfectants business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Agricultural Disinfectants are chemical or biological agents used to eliminate or reduce the presence of harmful microorganisms, such as bacteria, viruses, fungi, and parasites, in farming and livestock environments. These disinfectants are vital for maintaining biosecurity, preventing the spread of diseases, and ensuring the overall health and productivity of agricultural operations.

Key properties of agricultural disinfectants include their broad-spectrum antimicrobial activity, compatibility with various surfaces and equipment, and safety for both humans and animals when used as directed. They are commonly employed in farm facilities, animal housing, equipment, and vehicles to create a sanitized and disease-free environment, ultimately promoting healthier livestock and more robust crop yields.

The ban of antibiotics in animal products will propel the market for agricultural disinfectants.

Antibiotics are frequently used to save the lives of humans and animals, but their misuse can contribute to the development of resistance. In their intestines, animals frequently harbor bacteria, which may include antibiotic-resistant bacteria. When animals are slaughtered and processed for human consumption, the resistant microorganisms in their guts may contaminate meat and other animal products.

Consequently, numerous nations have already taken steps to reduce antibiotic use in food-producing animals. For instance, the European Union prohibited the use of antibiotics for growth promotion in 2006. In 2019, the Indian Ministry of Health prohibited the production, sale, and distribution of the drug colistin and its formulations for food-producing animals, poultry, aquaculture, and animal feed supplements because they pose a risk to humans. Alternatives to using antibiotics for disease prevention in animals include improving hygiene, better use of vaccination, changes in animal housing and husbandry practices, and the use of agricultural disinfectants, which will act as a market driver during the forecast period.

The agricultural disinfectants market is poised for significant growth due to the surging consumer demand for safe and contamination-free food.

As consumers become increasingly conscious of the quality and safety of the products they consume, the agricultural industry is under mounting pressure to ensure the integrity of its produce. Agricultural disinfectants play a pivotal role in this pursuit by safeguarding crops, livestock, and equipment against harmful pathogens and contaminants. Farmers and agricultural enterprises are recognizing the importance of employing effective disinfection measures to enhance food safety, reduce disease transmission among livestock, and minimize crop spoilage during storage and transportation. This heightened awareness is driving investments in agricultural disinfectants, fostering innovation in the sector, and prompting regulatory authorities to tighten safety standards. Consequently, the agricultural disinfectants market is experiencing robust growth as it aligns with the growing consumer preference for food products that are free from contaminants, ultimately contributing to a safer and healthier food supply chain.

When used appropriately, agricultural disinfectants are effective and safe tools for eliminating viruses and microbes. If not, they are potentially hazardous. For instance, ethylene oxide is highly combustible and explosive, and disinfectants may have hazardous properties that pose a risk to employees. When interacting with other substances, agricultural disinfectant produces toxic byproducts. Many chemical disinfectants can be hazardous to employees if they are handled improperly.

Some agricultural disinfectants are irritating to the skin, eyes, and lungs. The highly corrosive disinfectants could cause severe damage to the epidermis or eyes if they come into contact with them. In areas with inadequate ventilation, the airborne disinfectants would also create respiratory issues. Alcohol-based disinfectants can irritate injured skin. Inhalation of concentrated alcohol vapor can cause respiratory tract irritation and has effects on the central nervous system. All of these health risks associated with agricultural disinfectants may inhibit their market expansion.

Traditional agricultural disinfectants often contain harsh chemicals that can harm the environment and pose risks to human health. As consumers and regulators increasingly demand greener alternatives, the agricultural sector is seeking innovative and eco-friendly disinfection solutions to maintain crop health and ensure food safety. Eco-friendly agricultural disinfectants, derived from natural ingredients or employing sustainable technologies, are gaining momentum as they reduce the environmental footprint while effectively controlling diseases and pests.

With the agricultural sector embracing sustainable practices to meet these demands, companies specializing in eco-friendly disinfectants stand to benefit significantly, tapping into a market driven by both ecological responsibility and economic viability. Thus, the growing awareness and concern for environmental sustainability have spurred a significant surge in interest in eco-friendly solutions across various industries, including agriculture. This trend is expected to present highly lucrative opportunities for the agricultural disinfectants market.

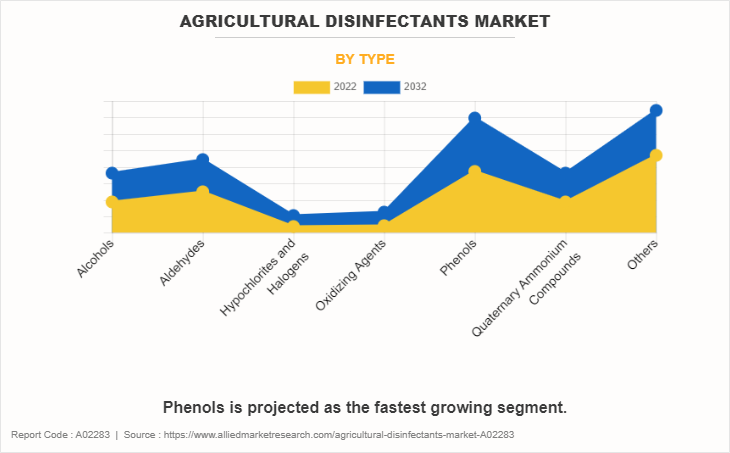

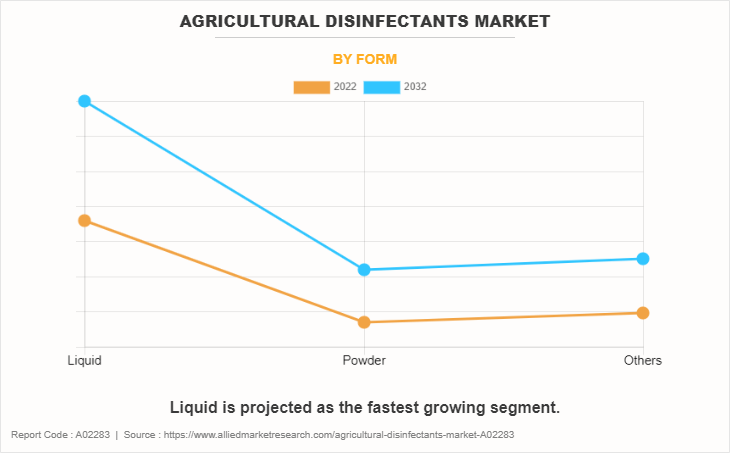

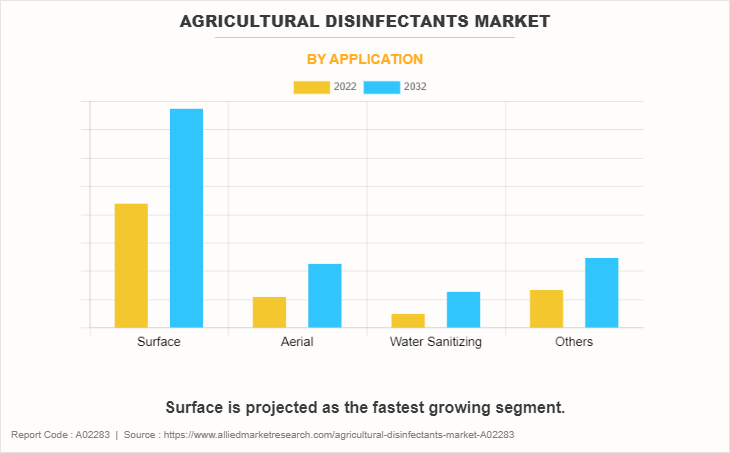

The agricultural disinfectants market is segmented on the basis of type, form, application, and region. By type, the market is divided into alcohols, aldehydes, hypochlorites and halogens, oxidizing agents, phenols, quaternary ammonium compounds, and others. Depending on the form, it is categorized into liquid, powder, and others. On the basis of application, it is categorized into surface, aerial, water sanitizing, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The other segments which include peroxygens, formaldehyde, chlorine compounds, iodine compounds, and glutaraldehyde accounted for the largest share in 2022 accounting for more than one-fourth of the global agricultural disinfectants market revenue. The agricultural disinfectants market has seen significant growth in the usage of peroxygen-based disinfectants. Peroxygens, such as hydrogen peroxide and peracetic acid, have gained popularity due to their effectiveness in eliminating pathogens, and organic matter, and their environmentally friendly properties. This growth is driven by increasing awareness of sustainable and eco-friendly farming practices, as well as stringent regulations on chemical use in agriculture. The peroxygen-based agricultural disinfectants market is expected to continue expanding as farmers seek safer and more sustainable solutions for disease control and farm hygiene.

Phenols is expected to register the highest CAGR of 5.4%. Phenols have witnessed significant growth in the agricultural disinfectants market due to their effectiveness in controlling pathogens and maintaining crop health. Their broad-spectrum antimicrobial properties, coupled with increasing awareness of sustainable agricultural practices, have led to a rising demand for phenol-based disinfectants among farmers and agricultural professionals, contributing to market expansion.

The liquid segment accounted for the largest share in 2022 accounting for more than one-fourth of the global agricultural disinfectants market revenue and is expected to register the highest CAGR of 4.9%. The agricultural disinfectants market has witnessed significant growth in the liquid form segment due to its ease of application and effectiveness in controlling pathogens and pests. Farmers increasingly prefer liquid formulations for crop and livestock protection, contributing to the expanding market share of liquid agricultural disinfectants. This trend is likely to continue as agriculture continues to modernize and prioritize efficient and sustainable farming practices.

The surface segment accounted for the largest share in 2022 accounting for more than two-fifths of the global agricultural disinfectants market revenue and is expected to register the highest CAGR of 5.0%. Surface applications in the agricultural disinfectants market have experienced significant growth due to their effectiveness in preventing the spread of diseases and pathogens. Farmers are increasingly adopting surface disinfection techniques to maintain clean and disease-free environments, ensuring healthier crops and livestock. This trend is expected to continue as the agriculture industry prioritizes biosecurity and sustainability.

Asia-Pacific garnered the largest share in 2022 accounting for more than two-fifths of the global agricultural disinfectants market revenue. The agricultural disinfectants market in the Asia-Pacific region has witnessed significant growth in recent years, driven by increasing awareness of the importance of crop protection and the adoption of modern farming practices. Rising concerns about crop diseases, pests, and contamination have spurred the demand for agricultural disinfectant products, which are increasingly being used to ensure the safety and quality of agricultural produce. This market expansion is expected to continue as farmers in the Asia-Pacific region seek effective solutions to enhance their crop yields and mitigate risks associated with agricultural diseases.

Competitive Landscape:

The players operating in the global agricultural disinfectants market are Acuro Organics Limited, LANXESS, Stepan Company, Neogen Corporation, Ceva, Bayer AG, Nufarm Limited, PROQUIMIA S.A., Corteva, and Sanosil Ltd. The unique technologies and innovative approaches of the abovementioned companies contribute to the advancement of the agricultural disinfectants market.

Acuro Organics Limited: Acuro Organics is a chemical company that offers a range of disinfectant and cleaning products for various industries, including agriculture. Their products are used for cleaning and sanitizing equipment, facilities, and water in agricultural settings.

LANXESS: LANXESS is a global specialty chemicals company. They produce various chemicals and materials, including disinfectants and hygiene products for agricultural applications. They focus on sustainable solutions for agricultural disinfection.

Stepan Company: Stepan Company manufactures a wide range of specialty chemicals, including agricultural disinfectants. Their products are used for cleaning and disinfecting surfaces, equipment, and environments in the agriculture sector.

Neogen Corporation: Neogen Corporation is known for its products in food and animal safety, including agricultural disinfectants. They offer solutions for cleaning and sanitation to ensure the safety and health of livestock and crops.

Ceva: Ceva is a global veterinary pharmaceutical company. While they primarily focus on animal health, they may offer disinfectant solutions for agricultural settings, especially in relation to animal husbandry.

Bayer AG: Bayer is a multinational pharmaceutical and life sciences company. They offer a wide range of products related to agriculture, including crop protection and pest control solutions, which may include disinfectants for agricultural use.

Nufarm Limited: Nufarm is an agricultural chemical company that provides crop protection products, including herbicides, fungicides, and insecticides. They may also offer disinfectants and sanitizers for use in agricultural settings.

PROQUIMIA S.A.: PROQUIMIA is a chemical company that offers various cleaning and disinfection solutions for different industries, including agriculture. Their products may be used for equipment and facility sanitation in agricultural applications.

Corteva: Corteva Agriscience is a leading agricultural solutions provider, specializing in seeds, crop protection, and digital agriculture. While their primary focus is on crop protection, they may offer disinfectant solutions for agriculture, particularly in seed and crop production facilities.

Sanosil Ltd: Sanosil is known for its disinfection products, including those designed for agricultural use. They offer a range of disinfectants and biocides for various applications within the agriculture sector.

Other players include Zoetis, BASF SE, Ecolab, Syngenta, The Chemours Company, Evonik, Entaco NV, Quat-Chem Ltd., The Dow Chemical Company, Thymox Technology, SDS Biotech K.K., and ShamDong DaMing Sciand & Technology Co., Ltd.

Key development strategies undertaken by key players

In February 2021, Ceva and INRAE Technologies signed an agreement to strengthen their animal health collaboration. This collaboration mainly focused on the health of people, animals, and the environment and paid special attention to improving animal welfare and preventing infectious diseases of animal origin.

In April 2021, Lanxess AG acquired a disinfection and hygiene solutions provider, Theseo. With the acquisition, LANXESS significantly increased the range of its product portfolio for the developing animal husbandry industry, which includes a wide variety of hygiene and disinfection products. The technical expertise and broad portfolio strengthen the position of Lanxess AG in the growth of animal hygiene.

In March 2022, Neogen Corporation launched a ready-to-use formulation Synergize disinfectant to its biosecurity portfolio. This product launch boosted the product portfolio of Neogen Corporation.

Impact Of Russia Ukraine War On the Agricultural Disinfectants Market:

The conflict has disrupted supply chains in the region, which can affect the production and distribution of agricultural disinfectants. Many key raw materials and chemicals used in the manufacturing of these products may have been sourced from Ukraine or Russia, leading to potential shortages or price increases.

Ongoing conflict can lead to economic instability in the affected regions, including Ukraine and nearby countries. This can impact the purchasing power of farmers and agricultural businesses, potentially leading to reduced spending on agricultural inputs, including disinfectants.

As a result of the conflict, there may be restrictions on the export and import of goods, including agricultural disinfectants. This can disrupt international trade and impact the availability of these products in neighboring countries and global markets.

Conflict can lead to displacement of populations, damage to infrastructure, and changes in land use. This may result in shifts in agricultural activities, with some areas seeing decreased agricultural production and others experiencing an increase. The demand for disinfectants can vary accordingly.

In regions directly affected by the conflict, there may be increased biosecurity measures on farms to protect livestock and crops from disease outbreaks. This could potentially lead to higher demand for agricultural disinfectants.

Geopolitical tensions can have indirect impacts on markets. For example, trade sanctions or diplomatic disputes may influence market dynamics, including access to certain products and markets.

The Russia-Ukraine conflict can have ripple effects on the global agricultural disinfectants market. Price fluctuations, supply disruptions, or shifts in demand in these conflict-affected regions can impact global prices and availability.

Public Policies:

Environmental Protection Agency (EPA) in the U.S.: In the U.S., agricultural disinfectants, as well as all pesticides, are regulated by the EPA under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). The EPA evaluates and registers agricultural disinfectants, ensuring that they meet safety and efficacy standards. The agency establishes maximum residue levels (MRLs) for pesticide residues on agricultural products, including those treated with disinfectants.

Labeling and Usage Restrictions: The EPA mandates that all agricultural disinfectant products must have proper labeling that includes instructions for safe and effective use, as well as potential risks. Usage restrictions, such as application rates and safety precautions, are typically specified on product labels.

EU Pesticides Regulation (EC) No 1107/2009: This regulation governs the approval and use of pesticides, including disinfectants used in agriculture, within the European Union. It sets strict criteria for the approval of active substances and plant protection products (including disinfectants) and establishes maximum residue limits for pesticides on food and feed. The regulation also includes provisions for risk assessment, labeling, and sustainable use of pesticides.

Biocidal Products Regulation (EU) No 528/2012: This regulation covers the authorization, sale, and use of biocidal products, which include disinfectants used in agriculture. Biocidal products must undergo a rigorous approval process, and their use is subject to strict regulatory controls to ensure their safety for human health and the environment.

Sustainable Use of Pesticides Directive (2009/128/EC): This directive aims to promote the sustainable use of pesticides in agriculture across the EU member states. It encourages the use of integrated pest management (IPM) practices, which focus on minimizing the use of pesticides, including disinfectants, and reducing their environmental impact.

National Regulations: While EU regulations provide a framework for agricultural disinfectants, individual EU member states may have their own national regulations and policies that further regulate the sale and use of these products. These regulations may vary from one country to another.

Environmental and Safety Standards: Agricultural disinfectants are subject to strict environmental and safety standards. These standards cover issues such as packaging and labeling, safe handling and storage, disposal, and environmental impact assessments.

Research and Innovation: European governments often fund research and innovation initiatives related to agriculture and pest control, which can influence the development and adoption of new disinfectant products and technologies in the agricultural sector.

Monitoring and Enforcement: Regulatory agencies in EU member states are responsible for monitoring and enforcing compliance with pesticide and biocide regulations. This includes conducting inspections, assessing product registrations, and taking enforcement actions when necessary.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agricultural disinfectants market analysis from 2022 to 2032 to identify the prevailing agricultural disinfectants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the agricultural disinfectants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global agricultural disinfectants market trends, key players, market segments, application areas, and market growth strategies.

Agricultural Disinfectants Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.5 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bayer AG, LANXESS, PROQUIMIA S.A., ACURO ORGANICS LIMITED, Ceva, Sanosil LTD., Corteva, Stepan Company, Neogen Corporation, Nufarm Limited |

Analyst Review

According to the insights of the CXOs of leading companies, the increasing concerns about food safety and the need to combat crop diseases and pathogens have propelled the demand for agricultural disinfectants. Growing global populations and changing consumption patterns have led to intensified agricultural production, necessitating stringent biosecurity measures, thereby boosting market growth. In addition, the adoption of modern farming practices and the rising awareness of the benefits of disinfection in preventing disease outbreaks in livestock and crops contribute significantly to market expansion.

However, stringent regulations and restrictions related to the use of disinfectants in agriculture pose a challenge for market players. Environmental concerns and potential adverse effects on non-target organisms further hinder market growth.

The CXOs further added that the ongoing shift toward sustainable agriculture practices has opened doors for eco-friendly disinfectant solutions, presenting a lucrative growth avenue. Moreover, advancements in R&D are leading to the introduction of novel, more efficient disinfection products. Furthermore, the expanding global agricultural sector in developing regions presents untapped markets, while the increasing adoption of precision farming technologies offers complementary growth opportunities for agricultural disinfectants.

The agricultural disinfectants market attained $2.3 billion in 2022 and is projected to reach $3.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

The Agricultural Disinfectants Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for Agricultural Disinfectants.

Growing consumer demand for safe and contamination-free food and increasing need to safeguard crops from pests and diseases are the driving factor of the Agricultural Disinfectants Market.

Growth in the occurrence of disease outbursts among livestock is the upcoming trend of Agricultural Disinfectants Market in the world.

Acuro Organics Limited, LANXESS, Stepan Company, Neogen Corporation, Ceva, Bayer AG, Nufarm Limited, PROQUIMIA S.A., Corteva, and Sanosil Ltd., are the top companies to hold the market share in Agricultural Disinfectants.

Surface is the leading application of Agricultural Disinfectants Market.

Loading Table Of Content...

Loading Research Methodology...