Agricultural Films Market Research, 2031

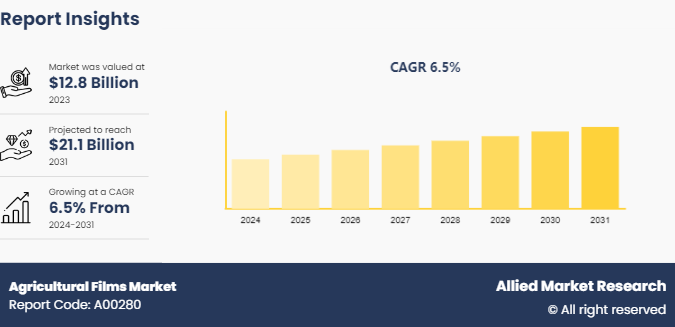

The global agricultural films market was valued at $12.8 billion in 2023, and is projected to reach $21.1 Billion by 2031, growing at a CAGR of 6.5% from 2024 to 2031.

Market Introduction and Definition

Agricultural films are a category of polymeric materials designed specifically for agricultural use. They include mulching films, greenhouse films, silage films, tunnel films, and irrigation films. Mulching films are spread over the soil to conserve moisture, regulate soil temperature, and suppress weed growth. Greenhouse films cover structures that create a microclimate for crop production, providing protection against extreme weather and pests while optimizing light transmission and heat retention. Silage films are used to wrap and store fodder, maintaining its nutritional value and preventing spoilage. Tunnel films are similar to greenhouse films but are used on smaller scale structures called low tunnels or cloches.

In horticulture, greenhouse and tunnel films are extensively used to cultivate a wide variety of crops, including vegetables, fruits, and flowers. These films create a controlled environment that promotes optimal growth conditions, such as adequate light, temperature, and humidity levels. In livestock farming, silage films are crucial for the preservation of animal feed. Ensuring high-quality silage through effective wrapping techniques helps maintain the nutritional content of the fodder, which is essential for the health and productivity of livestock. These films also prevent the growth of mold and spoilage, reducing feed wastage and ensuring food security for the animals.

Key Takeaways

- The agricultural films market industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global agricultural films market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the agricultural films market size.

- The agricultural films market share is highly fragmented, with several players including Exxon Mobil Corporation, BASF SE, Berry Global Inc., Dow, RKW Group, Trioworld, Coveris, Plastika Kritis S.A., Armando Alvarez Group, and Novamont S.p.A.

Segment Overview

The agricultural films market is segmented into material type, application, end-use, and region. On the basis of material type, the market is divided into low-density polyethylene (LDPE) , linear low-density polyethylene (LLDPE) , high-density polyethylene (HDPE) , and others. On the basis of application, the market is segmented into greenhouse films, mulch films, and silage films. By end-use, the market is classified into horticulture, grain farming, animal husbandry, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

An increase in demand for crop protection is expected to drive the growth of the agricultural films market during the forecast period. Agricultural films protect crops from adverse weather conditions, which can be a major cause of crop loss. Films used in greenhouses or as row covers help maintain a stable microclimate around the plants, safeguarding them from extremes of temperature, heavy rainfall, hail, and strong winds. This controlled environment ensures that crops can grow in optimal conditions, which is particularly crucial in regions with unpredictable weather patterns. By mitigating the impact of these adverse conditions, agricultural films help in maintaining consistent crop yields and quality. In May 2022, Syngenta launched Victrato, a seed treatment through its seed care segment, which targets nematodes and significant soil-borne fungi, improving the quality and productivity of various crops such as soybeans, corn, cereals, cotton, and rice.

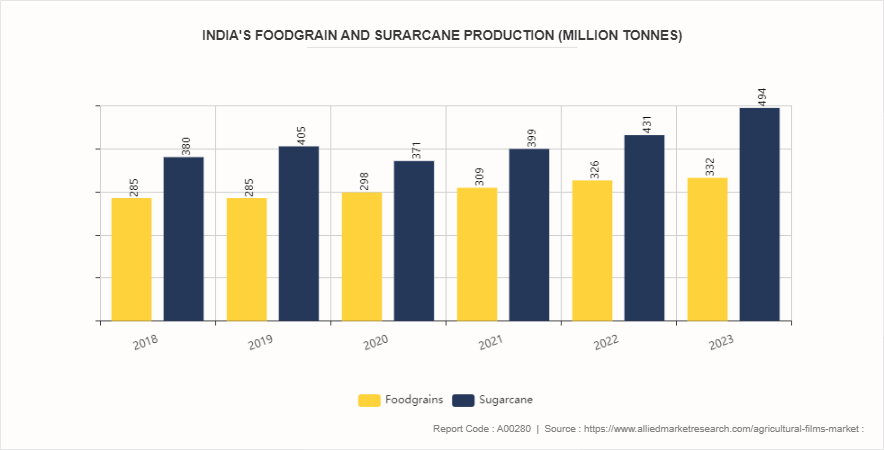

Moreover, the protective benefits of agricultural films extend to preventing the spread of plant diseases. Many plant pathogens are spread through direct contact with soil, water, or other plants. Mulching films, for example, cover the soil around the plants, reducing the risk of soil-borne diseases. Greenhouse films, on the other hand, create a barrier that minimizes the entry of airborne pathogens. By reducing the incidence of diseases, agricultural films not only protect the current crop but also help maintain soil health and reduce the need for crop rotation due to disease management, thus contributing to long-term agricultural sustainability. During 2022-23, India’s tea production stood at 1, 374.9 million tonnes. Coffee production during the same period was 352.0 million tonnes. while other products such as rice, wheat, maize, pulses, mustard, and sugarcane reached a record high production. The top crop-producing states in India are West Bengal, Uttar Pradesh, Punjab, Gujarat, Haryana, Madhya Pradesh, Assam, Andhra Pradesh, Karnataka and Chhattisgarh. Most of the wheat produced in the country comes from Uttar Pradesh, Punjab, Haryana, Madhya Pradesh, Rajasthan, Bihar, and Gujarat. Uttar Pradesh is the largest producer of sugarcane in India contributing about 48%, followed by Maharashtra and Karnataka at 23% and 9% of the total production respectively.

However, the availability of alternatives is expected to restrain the growth of the agricultural films market during the forecast period. One of the primary alternatives is the use of organic mulches, such as straw, wood chips, and compost, which are gaining popularity among farmers, especially those practicing organic farming. Organic mulches offer the advantage of improving soil health by adding organic matter as they decompose, enhancing soil fertility and microbial activity. In addition, these natural alternatives do not contribute to plastic pollution, addressing one of the major environmental concerns associated with traditional agricultural films. The prominent alternative is the adoption of advanced irrigation technologies, such as drip irrigation and precision irrigation systems. These systems not only conserve water but also reduce the need for mulching films by delivering water directly to the plant roots, thereby minimizing evaporation and soil erosion. The integration of these irrigation techniques with modern agricultural practices is becoming widespread, providing a sustainable solution that reduces reliance on plastic films.

Furthermore, integration with smart agriculture technologies is expected to provide lucrative opportunities for the agricultural films market during the forecast period. Smart agriculture technologies can monitor critical parameters such as soil moisture, temperature, humidity, and light levels in real time. By embedding sensors within the soil or installing them in strategic locations within greenhouses or fields, farmers can gather precise data on environmental conditions. This information helps in fine-tuning the deployment and management of agricultural films. For instance, sensors can detect soil moisture levels and indicate when and where to apply or adjust mulching films to conserve water, preventing both over-irrigation and drought stress. The Brazilian Precision Agriculture Research Network (Embrapa) , under the Brazil Agricultural Research Corporation, has developed tools for various crops like soybean, maize, wheat, rice, cotton, and more. Precision agriculture in Brazil, supported by Embrapa, has enhanced crop yields and environmental conservation. In collaboration with São Paulo State University, Embrapa conducted a study at Terras Altas winery in Ribeirão Preto, SP, focusing on precision farming techniques such as double pruning systems to produce high-quality wine.

The use of IoT devices in conjunction with agricultural films allows for more efficient resource utilization. Smart irrigation systems connected to soil moisture sensors can automatically adjust water delivery based on real-time data, ensuring that crops receive the optimal amount of water. This not only conserves water but also reduces the need for fertilizers and pesticides by maintaining optimal growing conditions. In addition, temperature sensors can help manage greenhouse films, ensuring that the internal environment remains conducive to plant growth, which can extend growing seasons and improve crop yields.

Competitive Analysis

Key market players in the agricultural films market include Exxon Mobil Corporation, BASF SE, Berry Global Inc., Dow, RKW Group, Trioworld, Coveris, Plastika Kritis S.A., Armando Alvarez Group, and Novamont S.p.A.

Industry Trends

In April 2024, Governor Hochul unveiled a significant investment of $28.75 million in Agricultural Stewardship Programs, marking a record allocation. This funding encompasses on-farm projects under the Climate Resilient Farming Grant Program. Under the Governor’s guidance, the Fiscal Year 2025 Budget has earmarked $81.8 million via the Environmental Protection Fund, reflecting a $4 million increase from the previous year. These funds support various agricultural programs including agricultural films and initiatives, including the Climate Resilient Farming grant, aimed at assisting farms in adopting environmentally sustainable practices and addressing the challenges of climate change.

In February 2024, The California Film Commission (CFC) announced a significant boost to California’s entertainment industry economy with the addition of five big-budget projects and ten independent films into Film and Television Tax Credit Program. These fifteen productions, spanning a diverse range of budgets and narratives, are projected to bring close to $408 million into California’s economy through qualified in-state expenditures. These projects provide a substantial boost to local employment and economic activity with an estimated 2, 252 crew, 598 cast, and 16, 800 background performers poised to work across a combined 579 filming days.

In November 2023, the U.S. Department of Agriculture, led by Deputy Secretary Xochitl Torres Small, committed $27.9 million to support 45 organizations focused on educating and training new farmers and ranchers. This investment encompasses initiatives tailored for U.S. veterans transitioning into agricultural professions and launching their own farming enterprises.

In May 2021, Reyenvas, a subsidiary of Armando Alvarez Group, introduced Reyfilm Bio, a biodegradable mulching film designed to break down naturally on the ground, reducing removal costs through microbial assimilation.

Regional Market Outlook

Region-wise, the agricultural films market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In the Asia-Pacific region, agricultural film usage is influenced by a combination of factors including population growth, urbanization, and changing dietary preferences. Countries such as China and India are witnessing a surge in demand for agricultural films as farmers seek solutions to improve productivity and mitigate climate-related risks. Moreover, government initiatives promoting modern farming techniques and infrastructure development contribute to the expansion of the agricultural film market in this region.

Chinese farmers rely on a range of films for mulching, greenhouse cultivation, and soil protection. The government's push for modernization and efficiency in agriculture, coupled with initiatives to improve food security, further fuels the adoption of advanced agricultural film technologies. China's demand for mulching film exceeds 1.4 million metric tons, as reported by BASF, a prominent German chemical manufacturer. This substantial consumption underscores the significant role mulching film plays in agricultural practices within the country.

Technological Trend Analysis

Agricultural plastics are becoming increasingly important on the global stage as research into "plasticulture" reveals both its benefits and drawbacks. Reports from organizations like the Food and Agriculture Organization (FAO) and the United Nations Environment Programme (UNEP) highlight the significant impacts of agricultural plastics, leading to discussions at high-level forums such as the FAO Committee on Agriculture's 28th Session. With the United Nations Environment Assembly (UNEA) set to negotiate a global agreement on plastic pollution, initiated in March 2022, the spotlight on agricultural plastics is expected to grow even brighter.

The expansion of plasticulture is driven by its numerous agricultural advantages. Plastics offer a cost-effective and readily available solution compared to sustainable alternatives. They have the potential to reduce food loss and waste, minimize the use of agrochemicals, extend the growing season, enhance water efficiency, and boost crop yields. These benefits could significantly bolster food system resilience and address challenges posed by water scarcity, population growth, and climate change.

Key Benefits For Stakeholders

Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

Analyze the key strategies adopted by major market players in agricultural films market.

Assess and rank the top factors that are expected to affect the growth of agricultural films market.

Top Player positioning provides a clear understanding of the present position of market players.

Detailed analysis of the agricultural films market segmentation assists to determine the prevailing market opportunities.

Identify key investment pockets for various offerings in the market.

Agricultural Films Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 21.1 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2031 |

| Report Pages | 300 |

| By Material Type |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Armando Alvarez Group, Exxon Mobil Corporation, Coveris, Berry Global Inc., RKW Group, Dow, Novamont S.p.A., Trioworld, BASF SE, Plastika Kritis S.A. |

Loading Table Of Content...