Agricultural Parametric Insurance Market Research, 2033

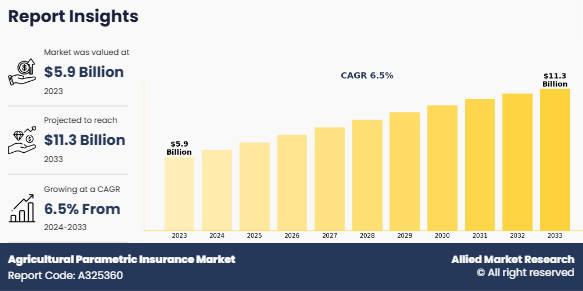

The global agricultural parametric insurance market was valued at $5.9 billion in 2023, and is projected to reach $11.3 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033. Agricultural parametric insurance is an innovative risk management tool that provides financial protection to farmers and agricultural enterprises against weather-related risks and other unforeseen events. This insurance uses objective data from weather stations, satellites, or other reliable sources to trigger payouts when predetermined conditions are met. For instance, if rainfall falls below or exceeds a certain level during a critical growth period, the policyholder automatically receives compensation. This offers faster claim settlements and reduces administrative complexities, making it particularly beneficial for regions with high climate volatility. Parametric insurance supports farmers in mitigating income loss, maintaining operational stability, and investing in future agricultural activities by ensuring timely financial relief, fostering resilience against climate-induced uncertainties.

Key Takeaways

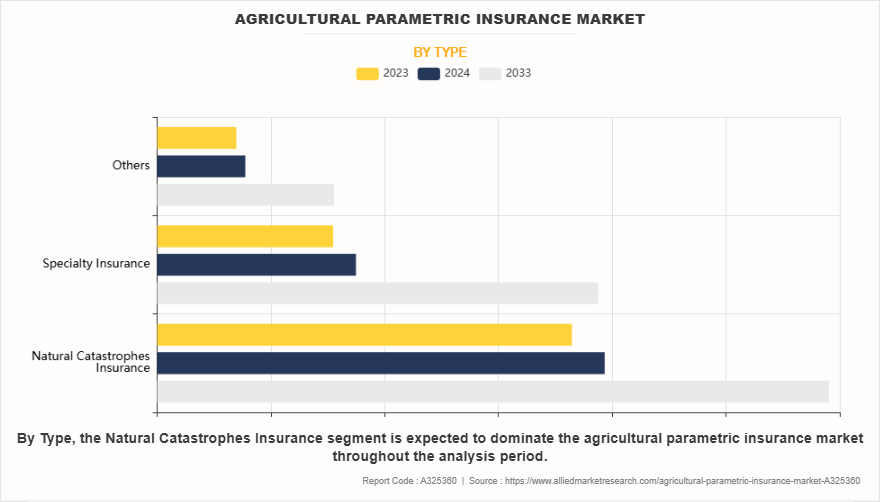

By type, the natural catastrophes insurance segment held the largest share in the agriculture parametric insurance market for 2023.

By provider channel, the insurance provider companies segment held the largest share in the agricultural parametric insurance market size for 2023.

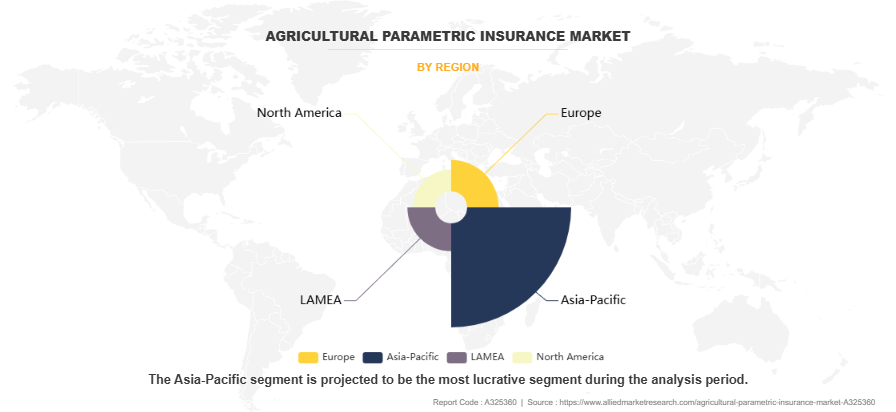

Region-wise, Asia-Pacific held largest agricultural parametric insurance market share in 2023.

Segment Overview

The agricultural parametric insurance market is segmented on the basis of type, provide channel, and region. By type, the market is divided into natural catastrophes insurance, specialty insurance, and others. By provider channel, the market is fragmented into brokers and insurance provider. By region, the market trends are analyzed across North America, Europe, Asia-Pacific and LAMEA.

On the basis of type, the agriculture parametric insurance market share was dominated by the natural catastrophes segment in 2023 and is expected to maintain its dominance in the upcoming years owing to increase in frequency of natural disasters and climate-related risks, ensuring rapid payouts and addressing unique agricultural challenges effectively. However, the specialty insurance segment is expected to witness the highest growth due to the growing need for tailored insurance solutions that address specific agricultural risks beyond natural catastrophes.

On the basis of region, Asia-Pacific dominated the market share in 2023 for the agricultural parametric insurance market. This is attributed to the region's vulnerability to extreme weather events, such as floods, droughts, and cyclones, which has led to a higher demand for agricultural insurance services. However, LAMEA is expected to exhibit the highest growth during the agricultural parametric insurance market forecast period. This is attributed to the expanding agricultural sector, increased awareness of climate change risks, and the need for risk mitigation strategies in countries across Latin America, the Middle East, and Africa.

Competition Analysis

The market players operating in the agricultural parametric insurance industry are AXA XL, SCOR SE, Hannover Rück SE, Munich Re, Sompo Holdings, Inc., Assicurazioni Generali S.p.A., Arbol, Liberty Mutual Reinsurance, Chubb Limited,Swiss Re, Allianz, Descartes Inc., Willis Towers Watson PLC., and Arthur J. Gallagher & Co. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships,which help to drive the growth of the agricultural parametric insurance industry.

Top Impacting Factor

Government Support and Policy Initiatives

Increased government support aimed at protecting farmers from income volatility, price fluctuations, and yield uncertainties has expanded the range of parametric risk solutions, which is driving the growth of the market. The key agricultural nations such as the U.S. and India, where farming is a critical economic pillar, are increasingly adopting innovative solutions such as parametric insurance to mitigate the risks posed by climate change. In addition, to address the challenges, many governments have introduced policies that encourage the adoption of risk mitigation tools such as agriculture parametric insurance. For instance, the U.S. Department of Agriculture (USDA) provides premium incentives for farmers planting cover crops, which helps reduce the financial burden during adverse weather events. Such initiatives enhance farmers' resilience and promote the uptake of parametric insurance solutions, which provide faster and more efficient payouts based on specific, measurable climatic parameters. Further, the government policies play important role in the expansion of the market by offering more tailored and accessible coverage options for farmers who are facing the increasing unpredictability of agricultural risks.

Demand for Faster Claims Processing

Increase in demand for faster and more efficient claims processing drives the growth of market. Traditional insurance models often involve lengthy claim assessments and paperwork, causing delays in compensating farmers. Agriculture parametric insurance, which relies on predefined parameters such as weather conditions or yield data, enables quick payouts, significantly reducing farmers’ financial vulnerabilities. This efficiency is crucial for agricultural stakeholders who face growing risks from climate change and unpredictable weather patterns. For instance, in case of flooding, parametric insurance policy holders receive a pre-determined payout immediately as the flood occurs. This serves as an emergency source of finance that helps farmers to cope with unexpected losses, which drives market growth. For instance, in August 2023, the Tripartite project successfully developed and piloted a sovereign parametric insurance solution that covered over 10,000 smallholder farmers against floods and droughts in Mexico. The coverage was triggered twice during the pilot test, and over 1,400 producers received a direct payment to make their livelihoods and communities more resilient against climate change, thereby propelling the growth of the market owing to the fast claiming process

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agricultural parametric insurance market analysis from 2023 to 2033 to identify the prevailing agricultural parametric insurance market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network and agricultural parametric insurance market outlook.

In-depth analysis of the market segmentation assists to determine the prevailing agricultural parametric insurance market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global agricultural parametric insurance market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the agricultural parametric insurance market players.

The report includes the analysis of the regional as well as global agricultural parametric insurance market trends, key players, market segments, application areas, and agricultural parametric insurance market growth strategies.

Agricultural Parametric Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 11.3 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 285 |

| By Type |

|

| By Provider channel |

|

| By Region |

|

| Key Market Players | Swiss Re, Arthur J. Gallagher & Co., Chubb Limited, Munich Re, Allianz, Sompo Holdings, Inc., Assicurazioni Generali S.p.A., Liberty Mutual Reinsurance, AXA XL, Arbol, Hannover Rück SE, Descartes Inc., Willis Towers Watson PLC., SCOR SE |

Analyst Review

The agriculture parametric insurance is emerging as a smart solution for managing weather related risks in farming. Unlike traditional insurance, which requires assessing physical damage before making payouts, parametric insurance is based on measurable weather events, such as rainfall, temperature, or soil moisture. If these conditions reach predefined levels, the insurance payout is triggered, helping farmers receive compensation quickly without the need for long damage assessments. With climate change causing more unpredictable and extreme weather patterns, traditional insurance is often not enough for farmers. Parametric insurance addresses this gap, which offers an efficient and cost-effective way to manage risks such as droughts, floods, or temperature extremes. For instance, if rainfall falls below a certain threshold during a growing season, parametric insurance provides compensation, helping farmers recover losses more quickly. Recent advancements in satellite technology, weather stations, and data analysis have made parametric insurance more accurate and affordable, which drives market growth. In addition, insurers now use better data and models to offer policies tailored to specific crops and regions, making it a more customized option for farmers. Agricultural parametric insurance is expected to address other challenges in agriculture, such as market price fluctuations or pest-related crop damage. Insurers are creating more tailored solutions for the agricultural industry by leveraging big data and advanced technology. The leading companies in the agriculture parametric insurance market, including Allianz, AXA XL, Chubb, and Munich Re, are developing new offerings to meet the growing demand for the agriculture coverage. By improving their services and embracing new technologies, these companies are positioning themselves as key players in the industry.

The agricultural parametric insurance market was valued at $5,889.6 million in 2023 and is estimated to reach $11,340.3 million by 2033, exhibiting a CAGR of 6.5% from 2024 to 2033.

Government support and policy initiatives and demand for faster claims processing are the upcoming trends of the Agricultural Parametric Insurance Market in the globe.

High growth potential in emerging countries is the leading application of the Agricultural Parametric Insurance Market.

Asia-Pacific is the largest regional market for Agricultural Parametric Insurance.

AXA XL, SCOR SE, Hannover Rück SE, Munich Re, Sompo Holdings, Inc., Assicurazioni Generali S.p.A., Arbol, Liberty Mutual Reinsurance, Chubb Limited, Swiss Re, Allianz, Descartes Inc., Willis Towers Watson PLC., and Arthur J. Gallagher & Co. are the top companies to hold the market share in Agricultural Parametric Insurance.

Loading Table Of Content...

Loading Research Methodology...