Agriculture Biotech Market Summary

The global agriculture biotech market size was valued at $93.1 billion in 2021 and is projected to reach $214.6 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031. The branch of biotechnology that focuses on agricultural applications is called agricultural biotechnology. Agriculture biotech has been used for a very long time to improve agriculturally significant organisms through breeding and selection.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2021.

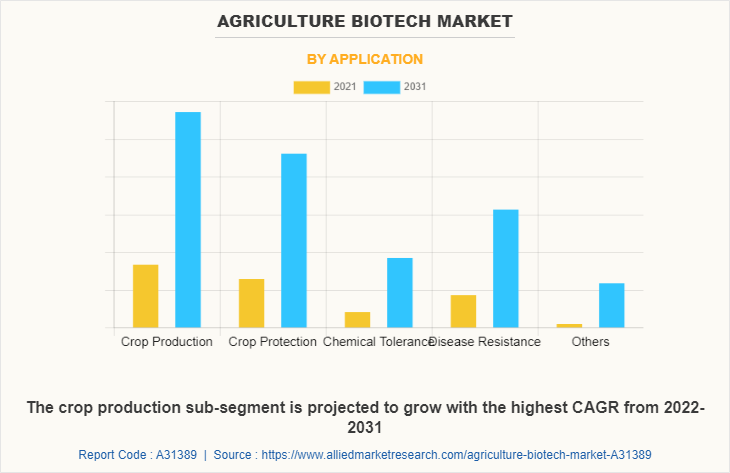

The global agriculture biotech market share was dominated by the crop production segment in 2021 and is expected to maintain its dominance in the upcoming years.

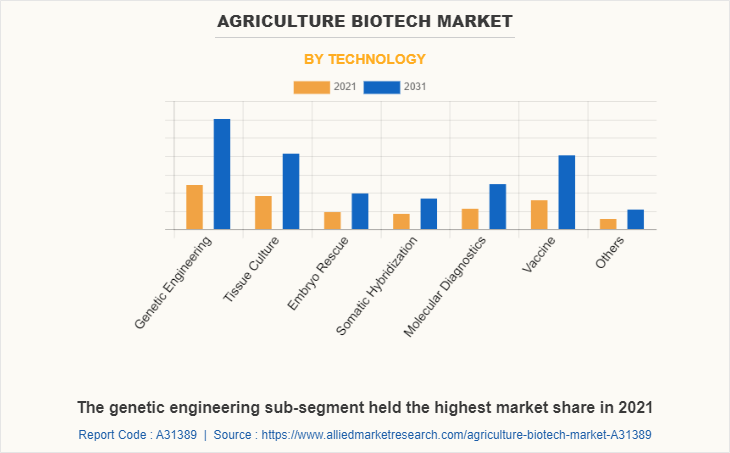

The genetic engineering segment is expected to witness the highest growth during the forecast.

Market Size & Forecast

- 2021 Market Size: USD 93.1 Billion

- 2031 Projected Market Size: USD 214.6 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 8.8%

- North America: Generated the highest revenue in 2021

Market Dynamics

Biotechnology also makes it easier to spread favorable features throughout plants and animals. For instance, it has been used to create animals with characteristics like quick growth and greater disease resistance. To boost milk output in dairy cows, the growth hormone gene in cattle can be cloned using biotechnology. During the forecast period, the agriculture biotech market is anticipated to grow because of the rapid adoption of biotechnology in transgenic crops. Crop genetic engineering aids plant breeders in enhancing plants and reducing significant problems with modern agriculture. These transgenic plants have outstanding resistance to pesticides, diseases, and insects.

In addition, rapid adoption of biotechnology in transgenic crops has significantly surged demand in the agriculture biotech market by providing solutions to critical agricultural challenges. Transgenic crops are genetically modified to possess traits such as resistance to pests, diseases, and herbicides, which help reduce crop losses and lower the need for chemical inputs. This genetic improvement increases crop productivity and efficiency, making farming more sustainable and cost-effective. Farmers across the globe are increasingly choosing these biotech crops to achieve higher yields and protect their crops from environmental stressors, driving market growth. The ability to enhance resistance and tolerance through genetic engineering appeals to large-scale and smallholder farmers alike, fueling widespread adoption.

Moreover, advancements in biotechnology have allowed for the development of crops with improved nutritional profiles and a better life, meeting rising consumer demand for healthier and longer-lasting food products. As global food demand rises due to population growth and changing dietary preferences, transgenic crops help bridge the gap by ensuring stable and enhanced food production. Regulatory approvals, government support, and increase in awareness regarding biotech benefits contribute further to adoption rates of agriculture biotech. This rising acceptance and use of genetically engineered crops are key factors driving the expansion of the agriculture biotech market worldwide.

However, insufficient budget allocation for R&D in developing economies and a lack of infrastructure for research, insufficient human resources, and expertise are anticipated to restrain market growth. Agricultural biotechnology is a sector of deep research that requires highly skilled human resources to achieve significant results. Many developing economies lack skilled human resources and where they are available, it is in short supply, or they don't get enough opportunities.

In addition, high complexity and cost associated with biotechnology research act as significant restraints on the agriculture biotech market demand. Developing genetically modified crops and animals involves advanced scientific techniques that require substantial investment in state-of-the-art laboratories, specialized equipment, and skilled personnel. The intricate processes of gene editing, transformation, and testing for safety and efficacy extend research timelines, leading to high operational expenses. These financial demands limit participation primarily to large corporations and well-funded institutions, creating barriers for smaller companies and research bodies. Consequently, the overall pace of innovation slows, reducing the availability of new biotech products that could meet diverse agricultural needs.

Simultaneously, regulatory approval processes for biotech products are stringent and costly. Comprehensive safety assessments, environmental impact studies, and compliance with various international standards add layers of complexity and expense. For many developing economies, these requirements become prohibitive owing to limited financial and technical resources. The high cost and complexity also discourage investment in research and development, restricting the ability of the market to introduce novel solutions that could boost productivity and sustainability. This situation limits the agriculture biotech market growth potential by curbing the supply of innovative products and slowing adoption rates in regions that could benefit most from biotechnology advancements.

Furthermore, growth in government initiatives and funding for agricultural biotech innovation is creating significant opportunities in the agriculture biotech market. Governments worldwide recognize the potential of biotechnology to address food security, sustainability, and climate resilience challenges. Many countries have launched dedicated programs and policies to support research, development, and commercialization of biotech crops and livestock. Increased funding enables advanced research projects, infrastructure development, and collaboration between public institutions and private companies. This support reduces financial barriers for biotech innovations and accelerates the introduction of new products that improve crop yields, resistance to pests and diseases, and tolerance to environmental stresses.

Moreover, government-backed initiatives often include training and capacity-building programs to develop skilled human resources necessary for the sector’s growth. By promoting regulatory frameworks that balance safety with innovation, governments create a more favorable environment for biotech adoption. These efforts encourage investments from global and regional players, expanding market reach and technological advancements. Supportive policies and funding also facilitate access to biotechnology in developing economies, where agricultural productivity gains are critical. Overall, growing government involvement and financial backing open pathways for innovation, commercialization, and wider adoption, driving growth opportunities in the global market.

SEGMENTAL OVERVIEW

The global agriculture biotech market is segmented on the basis of type, technology, application, and region. By type, the market is sub-segmented into hybrid seeds, transgenic crops, bio-pesticides and bio-fertilizers. By technology, the market is classified into genetic engineering, tissue culture, embryo rescue, somatic hybridization, molecular diagnostics, vaccine, and others. By application, the market is classified into crop production, crop protection, chemical tolerance, disease resistance, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

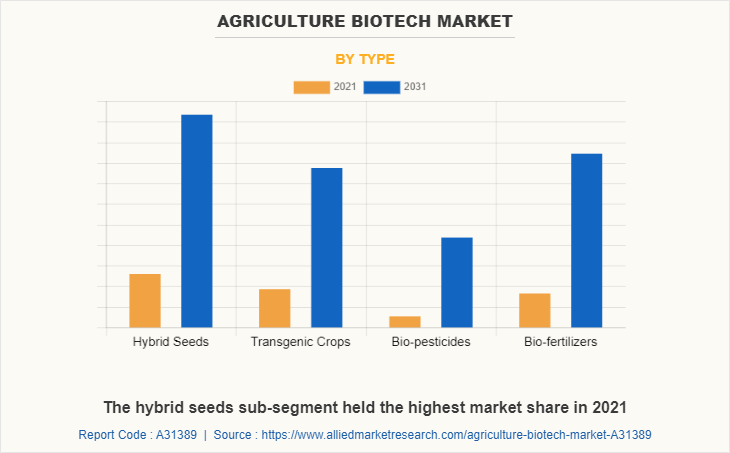

By Type

By type, the hybrid seeds sub-segment dominated the market in 2021. Hybrid seeds are produced for specific reasons such as increasing output, resistance to certain plant diseases, or a particular characteristic like form or color. Plants are now routinely subjected to targeted mutagenesis techniques, particularly CRISPR techniques that may produce desired changes quickly and easily. These are predicted to be the major factors affecting the agriculture biotech market share during the forecast period.

By Technology

By technology, the genetic engineering sub-segment dominated the global agriculture biotech market in 2021. The growth of this sub-segment can be attributed to the use of agriculture biotech for enhancing the medicinal and nutritional value of crops as genetic engineering increases global crop output. It helps scientists create plants that can survive harmful illnesses and challenging climatic conditions. Using genetic engineering, scientists can modify a plant's DNA to increase its pesticide resistance. The earth's ecosystem and agricultural production gain from designing plants to tolerate difficult climatic conditions. These are predicted to be the major factors affecting the market during the forecast period.

By Application

By application, the crop production sub-segment dominated the global market in 2021. Abiotic and biotic stresses pose a threat to the yield of crops including wheat, corn, and rice. Drought, extreme temperature, soil infertility, acidity, and alkalinity are some examples of abiotic stresses. Weeds, insects, and plant pathogens including fungi, viruses, and bacteria are examples of biological stresses. Biotechnology makes it feasible to integrate the genes in a manner that they are expressed once an insect begins to feed on the plant. Biotechnology enables plant scientists to understand the mechanisms that account for a plant’s natural tolerance or resistance to herbicides. As a result, scientists use this knowledge in crop production science.

By Region

By region, North America dominated the global agriculture biotech industry in 2021 and Asia-Pacific is projected to have the fastest-growing market during the forecast period. Many distinct governmental and economic systems, cultural traditions, and linguistic groups are found in this region. Within these, the agricultural sector differs, with India using simple techniques and Japan adopting high technical standards. Asia-Pacific accounts for about 40% of the world's arable land, making it a valuable market (nearly 600 million hectares). In addition, the area is distinguished by the significance of the rice crop and the dominance of small farmers.

COMPETITION ANALYSIS

The key players profiled in this agriculture biotech market forecast report include KWS SAAT SE & Co. KGaA, ChemChina, Bayer AG, Corteva, Nufarm, Limagrain, MITSUI & CO., LTD, Evogene Ltd., Valent BioSciences LLC., and Marrone Bio Innovations.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agriculture biotech market analysis from 2021 to 2031 to identify the prevailing agriculture biotech market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the agriculture biotech market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global agriculture biotech market trends, key players, market segments, application areas, and market growth strategies.

Agriculture Biotech Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 214.6 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Certis Biologicals, Corteva Agriscience, KWS SAAT SE & Co. KGaA, ADAMA, Bayer AG, Valent BioSciences, Marrone Bio Innovations, Inc., Limagrain, VILMORIN & CIE, ChemChina |

Analyst Review

Developing nations are the most important in the world for bringing about economic stability and prosperity. To satisfy rising food demands, increase disposable incomes, and safeguard the environment for future generations, agricultural productivity in these nations must increase rapidly. Agricultural biotechnology has the great potential to contribute significantly to this success. Farmers, producers, and consumers are increasingly benefitting from the use of biotechnology in agriculture. Insect pest control and weed management have both been made safer and simpler due to biotechnology. In addition, the protection of crops from diseases is also enhanced. All these factors are expected to drive the agriculture biotech market. Less R&D funding and awareness about biotechnology in developing economies is expected to hamper the agriculture biotech market. The need for increasing crop yield across the globe is expected to offer ample growth opportunities. Agricultural biotechnology has the potential to significantly increase crop yield by giving crops superior disease resistance and increased drought tolerance.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, Europe, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for leading position of North America and Asia-Pacific in the global agriculture biotech market.

The global agriculture biotech market size was valued at $93.1 billion in 2021, and is projected to reach $214.6 billion by 2031.

The global agriculture biotech market is projected to grow at a compound annual growth rate of 8.8% from 2022 to 2031 $214.6 billion by 2031.

KWS SAAT SE & Co. KGaA, ChemChina, Bayer AG, Corteva, Nufarm, Limagrain, MITSUI & CO., LTD, Evogene Ltd., Valent BioSciences LLC., and Marrone Bio Innovations and the major players in the agriculture biotech market.

On the basis of region, North America accounted for a major share of the agriculture biotech market in 2021

The agriculture biotech market is anticipated to grow as a result of the rapid adoption of biotechnology in transgenic crops. Genetic engineering in agriculture offers excellent benefits such as improvement in crop yields, decreased expenses for food production, less requirement for pesticides, improved nutrient composition and food quality, resistance to pests and disease, greater food security, etc. Biotechnology can also be used to help animals to more effectively use nutrients present in feed. This, in turn, is expected to offer ample opportunities to agriculture biotech market.

Loading Table Of Content...