AI For Financial Services Market Research, 2032

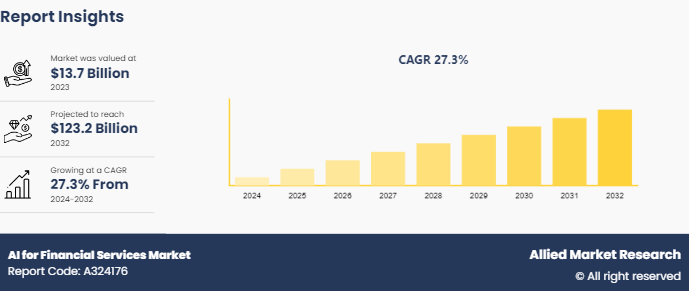

The global AI for financial services market was valued at $13.7 billion in 2023, and is projected to reach $123.2 billion by 2032, growing at a CAGR of 27.3% from 2024 to 2032. The market is driven by the industry's need for advanced data analytics, automation, and risk management solutions to enhance operational efficiency and improve customer experience. Rising adoption of AI for fraud detection, personalized financial advice, and predictive analytics further propels the market's growth as firms seek competitive advantages in an increasingly digital landscape.

Market Introduction and Definition

The AI in financial services market refers to the application of artificial intelligence technologies within the financial sector to enhance and streamline operations, improve decision-making, and provide innovative solutions. This market includes a broad range of AI applications designed to address various aspects of financial services, including banking, insurance, investment management, and regulatory compliance. AI technologies, such as machine learning (ML), natural language processing (NLP), and robotic process automation (RPA), are increasingly being integrated into financial services to drive efficiency and optimize processes. For example, in banking, AI is used to automate routine tasks like customer service through chatbots, enhance fraud detection systems, and improve credit scoring models. Similarly, in investment management, AI-powered tools analyze market data to inform trading strategies and manage portfolios more effectively.

Key Takeaways

The AI in financial services market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major AI in financial services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The AI in Financial Services Market is significantly propelled by several key drivers. Firstly, the increasing volume of data generated by financial transactions and customer interactions creates a strong demand for advanced AI technologies that can efficiently process and analyze this data. AI’s ability to handle large datasets and extract actionable insights enables financial institutions to make more informed decisions, enhance customer experiences, and optimize operations. Secondly, the growing focus on fraud detection and risk management is driving the adoption of AI. AI technologies, particularly machine learning algorithms, are highly effective at identifying suspicious patterns and anomalies, thus reducing the incidence of fraud and improving risk assessment processes. However, a major challenge is the high cost associated with implementing and maintaining AI technologies. The initial investment in AI infrastructure, along with ongoing costs for system upgrades and skilled personnel, can be substantial, particularly for smaller institutions. In addition, concerns regarding data privacy and security pose significant hurdles. Financial services deal with sensitive personal and financial data and ensuring that AI systems comply with stringent data protection regulations and do not become a target for cyberattacks is critical. Furthermore, one significant opportunity in the development of personalized financial products and services. AI’s capability to analyze individual customer data and preferences allows for the creation of tailored financial solutions, enhancing customer satisfaction and loyalty. Moreover, the rise of fintech startups is driving innovation in the market. These startups are leveraging AI to offer new and disruptive financial services, such as advanced robo-advisors and AI-driven investment platforms, which can attract a tech-savvy customer base.

Generative AI in Fintech

Fintech's use of generative AI is revolutionizing the delivery and optimization of financial services. Personalization, efficiency, and creativity are getting increased in the finance industry through the usage of generative AI, a subtype of artificial intelligence that focuses on producing new content or data based on information already available. Generative AI also plays a critical role in improving operational efficiency within fintech companies. For example, AI models can automate the creation of complex financial documents, such as reports, forecasts, and regulatory filings, by generating content based on predefined templates and data inputs. This automation reduces manual effort, minimizes errors, and speeds up document processing. In addition, generative AI can simulate various financial scenarios and market conditions, helping fintech firms to forecast trends and make more informed strategic decisions. Furthermore, product innovation is significantly accelerated by generative AI. Fintech companies use AI to design and test new financial products and services more rapidly. By generating multiple prototypes and simulations, companies easily explore various features and market responses without extensive manual effort or trial and error. This capability enables faster adaptation to market demands and raises the development of innovative financial solutions that address emerging consumer needs. For instance, in May 2024, BBVA took another significant step forward in the use of generative AI in its main markets. The bank prioritized around 100 projects to be developed with various tools employing this new technology. Furthermore, BBVA signed a strategic agreement with OpenAI, the creator of ChatGPT, to deploy this cutting-edge tool among its employees. As the first European bank to form an alliance with OpenAI, BBVA led the way in integrating disruptive technologies within the financial sector. This collaboration enabled OpenAI to share its expertise and helped BBVA unlock the full potential of generative AI, setting a benchmark for other financial institutions.

Market Segmentation

The AI in financial services market is segmented into component, application and region. On the basis of component, the market is divided into solutions and services. On the basis of application, the market is divided into fraud detection, virtual assistants, business analytics and reporting, quantitative and asset management, customer behavioral analytics and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. leads the market with its robust fintech ecosystem, extensive investment in AI research and development, and widespread implementation of AI for algorithmic trading, fraud detection, and personalized financial services. Whereas, the UK benefits from a strong financial sector and regulatory environment that supports innovation in AI applications, such as robo-advisors and compliance automation. Japan, with its advanced technology infrastructure and emphasis on integrating AI into traditional financial services, focuses on enhancing efficiency in banking operations and developing sophisticated financial forecasting tools. Together, these countries represent a major portion of the global AI in Financial Services market, each contributing to the growth and evolution of AI-driven financial solutions in unique ways.

In February 2022, U.S. Bank partnered with tech titan Microsoft as part of a significant investment in its technology infrastructure. Powering the majority of its infrastructure and application portfolio with cloud computing will allow U.S. Bank to modernize how it works in an increasingly digital world including the ability to rapidly access and analyze data, expediting time to market while more quickly scaling innovative products to customers and partners, and empowering its increasingly agile workforce.

In April 2022, Singapore-based Finbots.AI, an Artificial Intelligence-envisioned firm brought innovation to banks and financial institutions, it raised a successful Series A round of USD 3 Million. This round saw the participation of a single investor – Accel, which marks the first external investment Finbots.AI raised, and the first Southeast Asian investment Accel has made from its Fund VII.

In May 2022, ID-Pal, a leading identity verification provider, expanded its business by formally entering the UK market following six years of exponential growth. The Dublin-based technology company supports businesses of all sizes in more than 30 sectors, across Ireland, the US, EU and UK. Current clients include large enterprises such as Zurich International, as well as SMEs such as UK Adviser and Trust My Travel.

Industry Trends:

The leading trend in the AI in Financial Services Market is the growing integration of ML and NLP to significantly improve customer service and operational efficiency. ML algorithms analyze vast amounts of financial data to identify patterns, predict trends, and automate decision-making processes, which enhances the accuracy and speed of financial services. Meanwhile, NLP technologies enable more intuitive interactions between customers and financial institutions by processing and understanding human language. This combination allows for the development of advanced chatbots and virtual assistants that can handle a wide range of customer inquiries, provide personalized recommendations, and perform complex tasks like transaction management and account updates. For instance, in July 2024, JPMorgan deployed AI-based research analyst chatbot to enhance productivity among its workforce, with approximately 50, 000 employees using the tool. To enhance its research capabilities and increase efficiency, JPMorgan Chase implemented a state-of-the-art artificial intelligence (AI) chatbot that performs the duties of a research analyst. This innovative tool, which is currently used by about 50, 000 employees, leverages advanced large language model technology to provide comprehensive and accurate financial analysis.

Another key trend in the AI in Financial Services Market is the adoption of predictive analytics to improve risk management and fraud detection. Predictive analytics leverages advanced machine learning algorithms to analyze historical data and identify patterns that can forecast potential risks and fraudulent activities. By examining vast datasets and recognizing subtle indicators of unusual behavior or trends, financial institutions can proactively address issues before they escalate. For example, predictive models can detect anomalous transactions that deviate from normal patterns, enabling earlier intervention to prevent fraud. For May 2024, Mastercard expanded its AI-driven fraud detection system, "Decision Intelligence", leveraging machine learning algorithms to analyze transaction patterns and identify potential fraud with greater accuracy. Martercard uses generative AI, to double the speed at which it can detect potentially compromised cards, further protecting cardholders and securing the ecosystem.

Competitive Landscape

The major players operating in the AI in financial services market include FICO, SAS Institute, IBM, Microsoft, Google, Salesforce, NVIDIA, Palantir Technologies, TIBCO Software, Amazon Web Services. and others.

Recent Key Strategies and Developments

In August 2023, IBM partnered with TCS to offer the benefits of IBM’s expertise in cloud computing, artificial intelligence (AI) and analytics along with TCS’s experience in digital transformation, consulting and cloud-engineering services. This collaboration enables clients to leverage both technical capabilities and transformational services to solve complex problems and create additional value.

In April 2023, Wasabi Technologies, the hot cloud storage collaborated with IBM, to drive data innovation across AI in financial services environments. This collaboration aims to allow enterprises to run applications across any environment - on-premises, in the cloud or at the edge - and help enable users to cost efficiently access and utilize key business data and analytics in real time.

In August 2021, Equinix collaborated with IBM to help customers and partners integrate multiple cloud solutions in hybrid environments, solve digital transformation challenges, automate time-consuming work, and simplify collaboration. Together, we are working to make it easier for our joint customers to access IBM Cloud® services from their digital infrastructures on Platform Equinix® worldwide via direct and secure interconnection of hybrid IT infrastructures.

Key Sources Referred

Google Cloud

Built in

hpe.com

Datacamp

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ai for financial services market analysis from 2024 to 2032 to identify the prevailing ai for financial services market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the ai for financial services market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global AI for financial services market trends, key players, market segments, application areas, and market growth strategies.

AI for Financial Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 123.2 Billion |

| Growth Rate | CAGR of 27.3% |

| Forecast period | 2024 - 2032 |

| Report Pages | 216 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAS Institute, Palantir Technologies, IBM Corporation, Google, Microsoft, Salesforce, TIBCO Software, Amazon Web Services, FICO, NVIDIA |

The AI in financial services market was valued at $13.7 billion in 2023 and is estimated to reach $123.2 billion by 2032, exhibiting a CAGR of 27.3% from 2024 to 2032.

The rising need for data utilization and analysis and the increasing demand for operational efficiency are the upcoming trends of AI for the financial services market around the globe.

The expanding need for enhanced customer experience is the leading application of AI for the Financial Services Market.

North America is the largest regional market for AI for Financial Services.

FICO, SAS Institute, IBM, Microsoft, Google, Salesforce, NVIDIA, Palantir Technologies, TIBCO Software, and Amazon Web Services are the top companies to hold the market share in AI for Financial Services.

Loading Table Of Content...