AI In Oil And Gas Market Size & Insights:

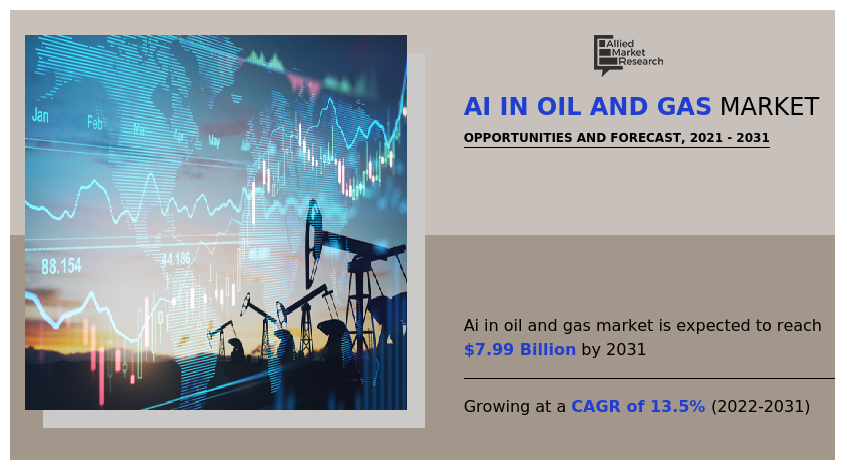

The global AI in oil and gas market was valued at USD 2.32 billion in 2021 and is projected to reach USD 7.99 billion by 2031, growing at a CAGR of 13.5% from 2022 to 2031.

AI in Oil and Gas Industry aids in improving oil and gas output through predictive maintenance and machinery inspection, quality control, dwelling, exploration, tank and reservoir monitoring, and other methods as well as increases profit in the oil and gas industry. Artificial intelligence consists of a variety of tools such as machine learning, artificial neutral networks, fuzzy logic, and expert systems that aid in the transformation of data into useful information that can then be applied at various stages of the lifecycle's exploration and production.

The oil and gas industry is beginning to see the incredible impact that AI can have on every sector in the value chain. The opportunities for AI strike directly at the greatest challenges in today’s oilfield. Companies that effectively leverage AI are expected to have a distinct advantage over other operators that lack accurate understanding of their reservoirs, operating processes, and producing assets.The AI in oil and gas market is segmented into Component and Operation.Depending on component, the market is bifurcated into solution and services. On the basis of operation, the market is divided into upstream, midstream, and downstream. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

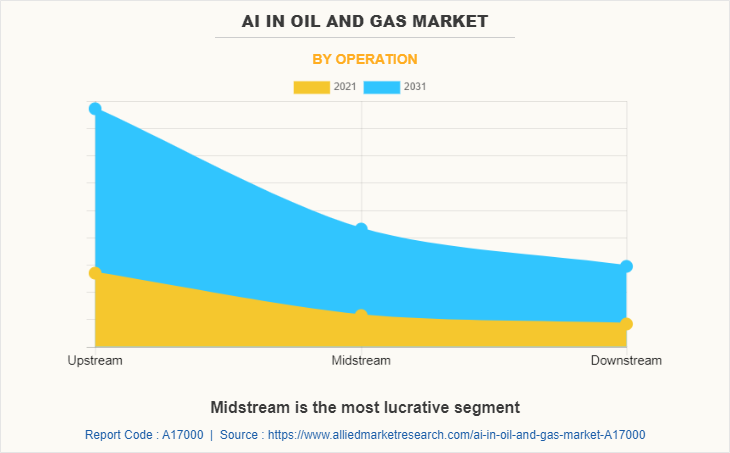

On the basis of operation, the upstream segment dominated the AI in oil and gas market share in 2021, and is expected to maintain the dominance in the upcoming years. It includes searching for potential underground or underwater crude oil and natural gas fields, drilling exploratory wells, and subsequently drilling and operating the wells used to lift the crude oil or raw natural gas to the surface. However, the midstream is expected to witness the highest growth rate during the AI in oil and gas market Forecast period, midstream activities include the storage, processing, and transportation of petroleum products. These may include companies that specialize in operating tanker ships, pipelines, or storage facilities.

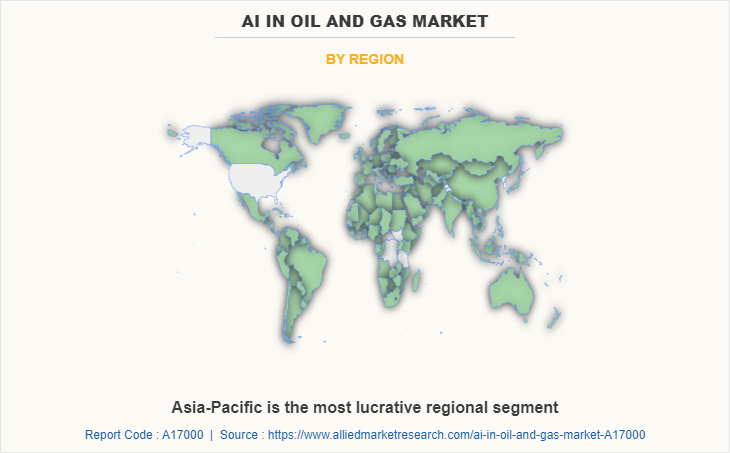

On the basis of region, the North America dominated the AI in Oil and Gas Industry in 2021, and is expected to continue this trends during the forecast period. factors such as the strong economy, the high adoption rate of AI technologies across the oilfield operators and service providers, a robust presence of prominent AI software and system suppliers, and combined investment by government and private organizations for the development and growth of R&D activities are projected to drive the demand for AI in the oil and gas sector in the region. However, the Asia-Pacific region is expected to witness highest AI in oil and gas market growth in the upcoming years, owing to meet the growing demand for fuel due to the increase in passenger cars in the region.

Top Impacting Factors:

Reduced production and maintenance cost

After extraction, oil and gas are stored in a central repository. From there, they are dispersed through pipelines. As a result of varying temperatures and weather, oil and gas components corrode and degrade, which can weaken the state of the pipeline and cause threading to become faded. This is one of the major concerns of the industry. Thus, the oil and gas industry needs to take care of these issues proactively to avoid disastrous situations. The integration of AI solutions can help the industry to prevent the occurrence any such incidents. Technologies such as AI and IoT can detect early signs of any such damage by analyzing the data recorded for various parameters. Various algorithms are sent into AI solutions that use knowledge graphs and predictive intelligence to predict the possibility of corrosion and send alerts to supervisors to address the issue before it takes place. Companies can also plan their maintenance activities and avoid any downtime occurring due to equipment failure.

Fast fault detection and quality improvement

The oil and gas industry faces a lot of challenges in recognizing inappropriate threading in pipelines and faults in mechanisms that are error-prone. The defects that are not detected in the upstream, are later realized in the production line. This leads to bigger losses and damage and incurs a heavy cost to a company. But when an organization adopt AI and deploy a computer-vision-based system, it becomes easy to check the quality of production. It also provides detailed information about defects in analytics. The adoption and integration of AI-powered defect detection solutions are economical and it saves the organization a lot of money, which makes it worthwhile in comparison to the existing process.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the AI in oil and gas market analysis from 2021 to 2031 to identify the prevailing AI in oil and gas market opportunities.

- The AI in oil and gas market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the AI in oil and gas market segmentation assists to determine the prevailing AI in oil and gas market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global AI in oil and gas market trends, key players, market segments, application areas, and market growth strategies.

AI in Oil and Gas Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Operation |

|

| By Region |

|

| Key Market Players | Intel Corporation, Google LLC, Cloudera, Inc., Cisco Systems, Inc., NVIDIA Corporation, IBM, C3.AI, Oracle, FuGenX Technologies Pvt. Ltd , Inc., Microsoft Corporation |

Analyst Review

In accordance with the insights by the CXOs of leading companies, the oil and gas industry is setting up to transform and create more efficient, sustainable, and competitive products and processes through digitalization and automation. The artificial intelligence and internet of things offer a competitive edge that enables oil & gas producers and manufacturers to escalate the well and field productivity. The artificial intelligence and internet of things in the oil & gas industry has been trending over the past five years. The applications of AI and IoT are used to improve oil & gas system procedures and processes and automate them to meet digital needs.

In the digital era where artificial intelligence and internet of things have taken over the world, there seems to be a comparatively less growth rate of AI in oil and gas market than digital marketing. It has been observed that AI systems are used to automate and optimize the initial stages of the exploration and production lifecycle. This includes geology, seismology, petrophysics, drilling, production, and reservoir. They have the potential to enhance productivity, minimize operational costs, and reduce risks. Ability to identify drilling locations and precise targeting helps to maximize the ROI on any drilling activity. Oil and gas is a sector with dynamic landscape. It includes exploration and production, midstream and refining, along with oil field services and equipment.

In addition, the oil & gas industry is suffering from a skilled labor shortage. The shallow talent pool has made it complicated for oil & gas companies to hire new employees with the technical skills required to work on new energy sources. Moreover, stress with the oil prices declining over 2020, in the wake of COVID-19 & price war between Saudi Arabia and Russia, is expected to drive the oil-producing companies to improve their production efficiency and drive the demand in the sector.

The AI in oil and gas market size is estimated to grow from $2,324.6 million in 2021, and is projected to reach $7,991.2 million by 2031, registering a CAGR of 13.5%.

Midstream

Increase in investments for AI in oil and gas solution across developing countries

North America dominated the AI in oil and gas industry in 2021

C3.AI, Cloudera, FuGenX Technologies Pvt. Ltd, Inc., Google. Llc, General Vision, Hortonworks, Infosys Limited, International Business Machine Corporation (IBM), Intel Corporation, Microsoft Corporation, Inbenta, NVIDIA Corporation, NeuDax, Oracle Corporation, Numenta, Shell Plc., Sentient technologies

Loading Table Of Content...