Air Combat Maneuvering Instrumentation Market Research, 2033

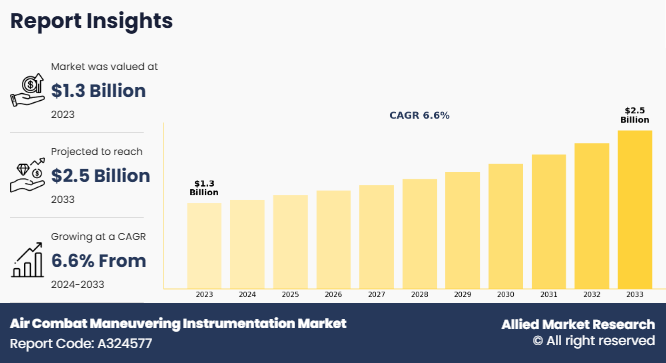

The global air combat maneuvering instrumentation market size was valued at $1.3 billion in 2023, and is projected to reach $2.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Air Combat Maneuvering Instrumentation (ACMI) refers to a specialized system used in military aviation training to monitor, record, and analyze the movements, maneuvers, and performance of aircraft during combat training exercises. ACMI systems are designed to provide real-time data on various flight parameters, including position, speed, altitude, and engagement actions, which helps pilots and instructors gain insights into tactical effectiveness and improve combat skills.

The global air combat maneuvering instrumentation market is heavily influenced by rise in defense budgets and increase in the prevalence of armed conflicts, which drives the need for advanced pilot training and combat readiness. For instance, the U.S. Department of Defense (DoD) spent approximately $916 billion in the 2023 fiscal year, marking a historical peak in defense funding. Of this budget, a significant portion has been dedicated to advanced technology and training, including ACMI, to maintain global air superiority and meet evolving threats.

For instance, the U.S. recently increased its defense spending, committing to investments in training technologies that include ACMI systems, to ensure combat readiness amidst growing security concerns. For instance, in May 2023, Collins Aerospace, a division of Raytheon Technologies, announced it will fulfill a full-rate production contract for the U.S. Navy's Tactical Combat Training System Increment II (TCTS II), an Air Combat Training System (ACMI). This contract covers both airborne and ground subsystems to support training requirements at multiple U.S. Navy ranges.

The TCTS II system, tested on F/A-18 and EA-18G aircraft, enables long range, air-to-air, and air-to-ground data exchanges in real time. Thus, this rise in defense budgets and investments in ACMI further propels the air combat maneuvering instrumentation market growth.

Factors such as rise in geopolitical tensions and defense spending, increased focus on cybersecurity in ACMI for secure combat training, and technological advancements in ACMI systems drive the growth of the air combat maneuvering instrumentation market. However, high initial and maintenance costs and complex system integration are expected to hamper market growth. In addition, the increase in focus on live, virtual, and constructive (LVC) training and the expansion of ACMI capabilities to support 5th generation aircraft present significant opportunities for market development.

Recent Developments in the Air Combat Maneuvering Instrumentation Industry

- In September 2024, ELBIT SYSTEMS LTD. received a contract from Asian air force for the supply of an EHUD Air Combat Maneuvering Instrumentation (ACMI)system. The new system feature interoperability with an existing Elbit Systems training system that the customer is already operating.

- In September 2024, Cubic Defense announced its first production order for an encrypted Air Combat Maneuvering Instrumentation (ACMI) upgrade from the U.S. Air Force. This upgrade allows 4th Generation aircraft to train seamlessly alongside 5th Generation aircraft, significantly improving the operational readiness of the Combat Air Force. By enabling encrypted, secure data exchange, this modernization supports joint training exercises that better prepare pilots for modern combat scenarios involving mixed-generation aircraft.

- May 2023, RTX, through its business division Collins Aerospace, received a contract from the U.S. Navy to deliver Tactical Combat Training System Increment II (TCTS II) and Air Combat Training System (ACMI). The TCTS long-range, air-to-air, and air-to-ground networking capability supports real-time data exchanges and was validated by flight tests on F/A-18 Super Hornet and EA18G Growler jets.

- In June 2021, Leonardo S.p.A. was awarded a contract from Cubic Mission and Performance Solutions (CMPS), a division of Cubic Corporation, to deliver additional P5 Combat Training Systems (P5CTS) for the F-35 Lightning II. Through this contract, Leonardo DRS delivered two more production lots of its P5CTS internal subsystems for Lockheed Martins F-35 Air Combat Maneuvering Instrumentation (ACMI)system.

Market Overview

Rise in geopolitical tensions and defense spending

The global air combat maneuvering instrumentation market is heavily influenced by rise in defense budgets and increase in the prevalence of armed conflicts, which together heighten the demand for advanced pilot training and enhanced combat readiness. For instance, the U.S. Department of Defense (DoD) spent approximately $ 916 billion in the 2023 fiscal year, marking a historical peak in defense funding.

In 2023, there were four major armed conflicts with 10,000+ fatalities each, up from three in 2022. These conflicts included the civil wars in Myanmar and Sudan, along with the Israel Hamas and Russia Ukraine wars. In 2023, Russias military spending saw a significant increase of 24%, reaching an estimated $109 billion, which marks a 57% rise since 2014, the year Russia annexed Crimea. Ukraine also recorded a substantial surge in military expenditure, becoming the eighth-largest military spender globally with a 51% increase, bringing its defense budget to $64.8 billion.The air combat maneuvering instrumentation market forecast indicates a steady rise in adoption, supported by government investments in defense modernization programs.

Moreover, in 2023, the 31 NATO members collectively accounted for $1,341 billion, or 55% of global military spending, highlighting NATO's significant share in defense expenditures. Of this budget, a significant portion has been dedicated to advanced technology and training, including ACMI, to maintain global air superiority and meet evolving threats. For instance, the U.S. recently increased its defense spending, committing to investments in training technologies that include ACMI systems, to to ensure readiness for potential conflicts and rapidly evolving security threats.

For instance, in May 2023, Collins Aerospace, a division of Raytheon Technologies, announced it will fulfill a full-rate production contract for the U.S. Navy's Tactical Combat Training System Increment II (TCTS II), an Air Combat Training System (ACMI). This contract covers both airborne and ground subsystems to support training requirements at multiple U.S. Navy ranges. The TCTS II system, tested on F/A-18 and EA-18G aircraft, enables long- range, air-to-air, and air-to-ground data exchanges in real time. Thus, this rise in defense budgets and investments in ACMI further propels the air combat maneuvering instrumentation market growth.

Increased focus on cybersecurity in ACMI for secure combat training

In recent years, there has been a growing focus among military forces worldwide on enhancing training and combat readiness. As geopolitical tensions rise and the complexity of modern warfare increases, defense agencies are investing heavily in training solutions that prepare personnel for real-world combat scenarios. Realistic combat training is crucial for developing the skills and tactics necessary to handle advanced threats. This is driving the demand for advanced simulation systems such as air combat maneuvering instrumentation (ACMI). Military training has evolved beyond traditional methods, with greater emphasis on data-driven and immersive environments that mimic actual combat conditions.

For instance, ACMI systems track aircraft in real-time, record maneuvers, and provide feedback on tactics, making them a valuable tool for air forces seeking to enhance pilot performance. In parallel, cybersecurity has become a critical consideration within these systems, as ACMI technology captures and transmits sensitive, real-time data that must be protected from potential cyber threats. Nations such as the U.S. are prioritizing training and cybersecurity investments.

For instance, in May 2022, Cubic was awarded a contract by the U.S. Air Force to enhance the P5 Air Combat Training System with a cybersecurity update, valued at up to $90.6 million over 6 years. The work, based in San Diego, will focus on integrating a Type 1 encryptor that provides a National Security Agency-certified control interface. This interface will secure the P5 system by managing and restricting data access and transfer across different security domains, bolstering the system's cybersecurity capabilities in training environments. This emphasis on cybersecurity within ACMI systems highlights the importance of secure, advanced combat training solutions to enhance both readiness and data protection in modern military operations.

Technological advancements in ACMI systems

Modern ACMI systems have evolved to include a range of advanced features that enhance both the accuracy and effectiveness of air combat training. Improved data transmission capabilities now allow for real-time tracking and feedback, which provides pilots and trainers with immediate information on performance, positioning, and maneuvers. This real-time data helps adjust tactics in-flight and is crucial for refining skills in a realistic training environment. Furthermore, ACMI systems have incorporated high-resolution GPS tracking and more sophisticated sensors that provide precise details about aircraft speed, altitude, and engagement actions. These advancements create a more immersive training experience, enabling pilots to train under conditions that closely mirror real combat scenarios.

In addition, major players such as Leonardo DRS demonstrated ACMI systems with advanced technology to expand their market presence. For instance, in November 2022, Leonardo DRS, a major company in multi-domain defense technology participated in the Interservice/Industry Training, Simulation and Education Conference (I/ITSEC) at the Orange County Convention Center in Orlando, Florida. Leonardo DRS showcased advanced combat training solutions, including Air Combat Maneuvering Instrumentation Pods and Subsystems. Increasing air combat maneuvering instrumentation market demand is attributed to the rising need for enhanced pilot training and operational readiness.

Featured products include the P5 Combat Training System, Tactical Combat Training System Increment II, and the Joint Strike Fighter P5 Combat Training System Internal Subsystem. These systems enable realistic and secure training environments, supporting mission readiness through advanced simulation and instrumentation technologies. Therefore, these advancements are driving demand in the air combat maneuvering instrumentation market by providing more realistic, secure, and effective training solutions for modern air combat readiness.

High initial and maintenance costs

High initial and maintenance costs are significant barriers in the air combat maneuvering instrumentation market. ACMI systems require substantial investment in specialized hardware, including tracking pods, ground stations, GPS, and high-resolution sensors, which are essential for capturing real-time data on aircraft maneuvers and positions during training. The setup costs also extend to software licenses and the integration of data analytics tools, which together create a high entry cost for organizations looking to adopt ACMI technology.

These high upfront and ongoing costs can be challenging for smaller defense forces or nations with limited budgets, as they may lack the resources to fully invest in and maintain ACMI systems. Even well-funded defense agencies must weigh the long-term costs and benefits, potentially slowing adoption as budget allocations are carefully planned.

Segment Review

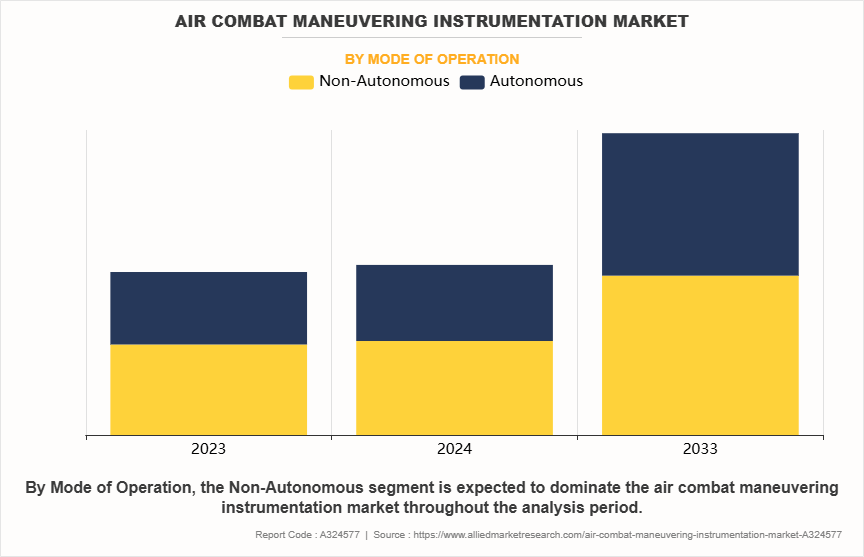

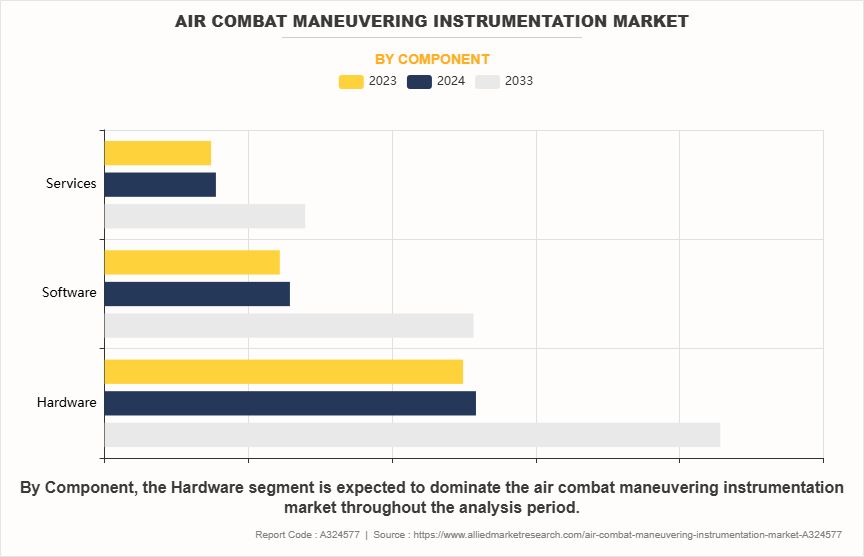

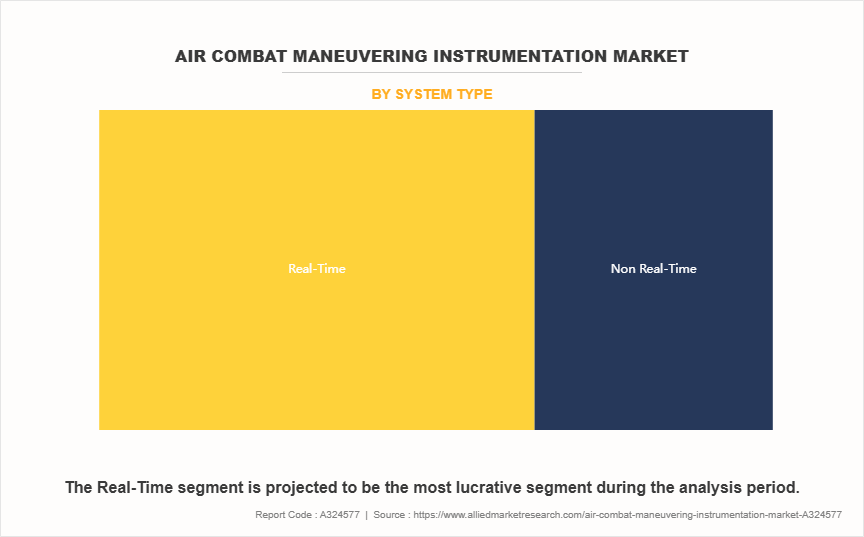

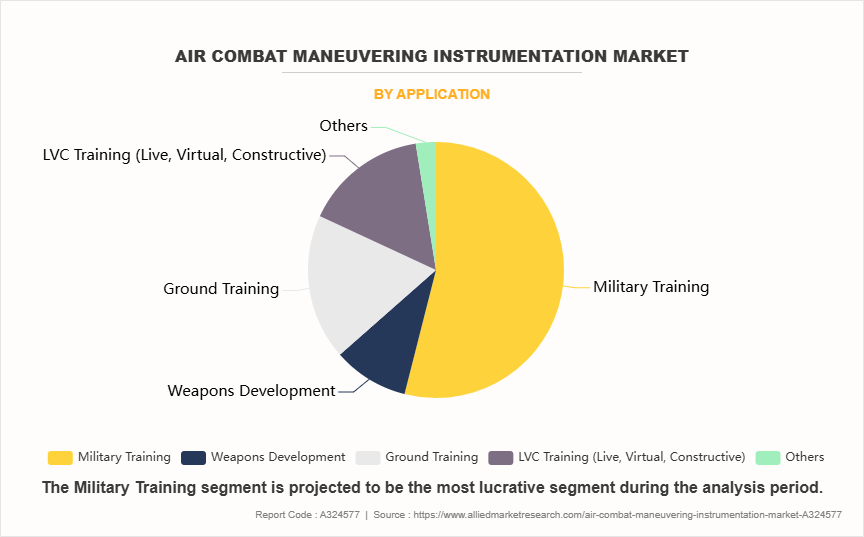

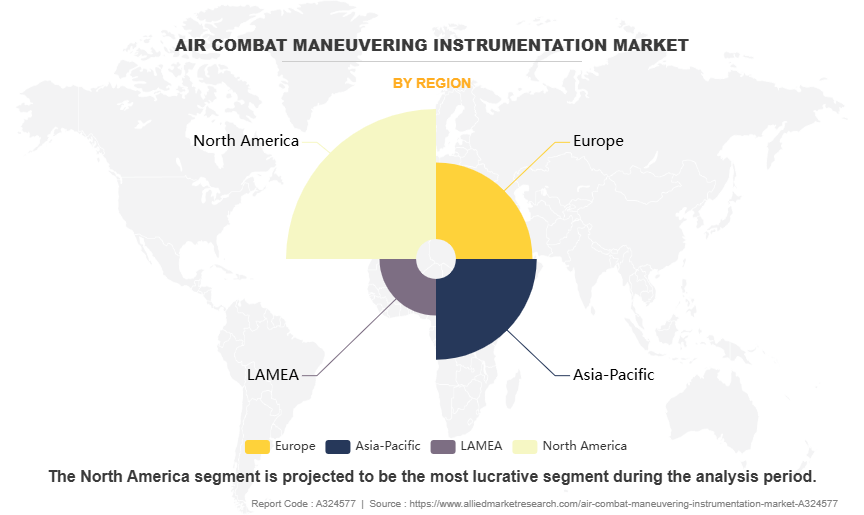

The air combat maneuvering instrumentation market is segmented by mode of operation, component, system type, application, and region. By mode of operation, the market is divided into non-autonomous and autonomous systems. In terms of component, the market is categorized into hardware, software, and services. By system type, the market is segmented into real-time and non-real-time systems. By application, the market is divided into military training, weapons development, ground training, LVC training (live, virtual, constructive), and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Mode of Operation

On the basis of mode of operation, the non-autonomous segment generated the highest revenue in 2023, primarily driven by their established reliability and lower initial implementation costs. Military organizations worldwide still prefer these systems for their direct control capabilities and proven track record in training scenarios.

By Component

On the basis of component, the hardware segment generated the highest revenue in 2023, driven by the need for rugged, reliable, and precise components that can withstand harsh operational environments. As defense forces around the world modernize their air combat training infrastructure, the demand for state-of-the-art ACMI hardware has risen.

By System Type

On the basis of system type, the real-time segment generated the highest revenue in 2023, its driven by the need for immediate feedback and in-the-moment analysis during combat training exercises. Real-time systems allow for the instant transmission of data from the aircraft to ground stations, enabling instructors and trainees to monitor flight parameters such as speed, position, altitude, and maneuvers as they occur.

By Application

On the basis of application, the military training segment generated the highest revenue in 2023, driven by increasing global defense budgets and modernization initiatives. The market shows significant investment in systems that can replicate advanced threat environments and complex combat situations. Military organizations worldwide are upgrading their training infrastructure to include more realistic simulation capabilities and enhanced performance monitoring tools.

By Region

By region, North America generated maximum revenue in 2023, fueled by rise in defense budgets, particularly in the U.S., alongside the integration of AI and machine learning in military training solutions. The North American air combat maneuvering instrumentation (ACMI) market is positioned for steady growth, driven by significant defense investments and modernization efforts.

Competitive Analysis

The leading players operating in the air combat maneuvering instrumentation market are Prescient Systems & Technologies Pte Ltd., RTX, Leonardo S.p.A., L3Harris Technologies, Inc., Arotech Corporation, Elbit Systems Ltd., Cubic Corporation, IAI (Israel Aerospace Industries), AEROTREE Group, SDT Space & Defence Technologies Inc., Saab AB, ADCOR MAGnet Systems, and Diehl Stiftung & Co. KG. Analysis of the air combat maneuvering instrumentation market share reveals a competitive landscape with key players focusing on product innovation and strategic partnerships.

Key Takeaways

- On the basis of mode of operation, the non-autonomous segment held the largest share in the air combat maneuvering instrumentation industry in 2023.

- On the basis of component, the hardware segment held the largest share in the air combat maneuvering instrumentation market in 2023.

- On the basis of system type, the real-time segment held the largest share in the air combat maneuvering instrumentation market in 2023.

- On the basis of application, the military training segment held the largest share in the air combat maneuvering instrumentation market in 2023.

- By region, North America held the largest share in the market in 2023.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air combat maneuvering instrumentation market analysis from 2023 to 2033 to identify the prevailing air combat maneuvering instrumentation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air combat maneuvering instrumentation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global air combat maneuvering instrumentation market trends, key players, market segments, application areas, and market growth strategies.

Air Combat Maneuvering Instrumentation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.5 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 365 |

| By Mode of Operation |

|

| By Component |

|

| By System Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | L3Harris Technologies, Inc., IAI (Israel Aerospace Industries), ADCOR MAGnet Systems, Prescient Systems & Technologies Pte Ltd., Cubic Corporation, SDT Space & Defence Technologies Inc., Saab AB, Arotech Corporation, Elbit Systems Ltd., RTX, Diehl Stiftung & Co. KG, AEROTREE Group, Leonardo S.p.A. |

Upcoming trends of Air Combat Maneuvering Instrumentation Market are the increase in focus on live, virtual, and constructive (LVC) training and the expansion of ACMI capabilities to support 5th generation aircraft

Leading application of Air Combat Maneuvering Instrumentation Market is military training.

Largest regional market for Air Combat Maneuvering Instrumentation is North America

According to the report, the "air combat maneuvering instrumentation market" was valued at $1.3 billion in 2023, and is estimated to reach $2.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

The leading players operating in the air combat maneuvering instrumentation market are Prescient Systems & Technologies Pte Ltd., RTX, Leonardo S.p.A., L3Harris Technologies, Inc., Arotech Corporation, Elbit Systems Ltd., Cubic Corporation, IAI (Israel Aerospace Industries), AEROTREE Group, SDT Space & Defence Technologies Inc., Saab AB, ADCOR MAGnet Systems, and Diehl Stiftung & Co. KG.

Loading Table Of Content...

Loading Research Methodology...