Air-Cooled Generators Market Research, 2032

The global air-cooled generators market size was valued at $4.1 billion in 2022, and is projected to reach $7.0 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032. The surge in demand for portable power solutions coupled with the expansion in the renewable energy sector has significantly driven the demand for air-cooled generators. As the need for reliable and flexible power sources increases in remote or off-grid locations, air-cooled generators offer a convenient and efficient solution. These generators are favored for their portability, ease of maintenance, and ability to operate in diverse environmental conditions without requiring elaborate cooling systems.

Introduction

An air-cooled generator is a type of electrical generator that uses airflow to dissipate heat generated during operation. It utilizes fans or airflow mechanisms to remove heat from the generator components, typically the stator and rotor windings. This cooling method is commonly used in smaller-scale generators, portable generators, and some standby power systems where liquid cooling system is impractical or unnecessary. Air-cooled generators are preferred for their simplicity, lower maintenance requirements, and suitability for outdoor or remote applications.

Key Takeaways

- The global air cooled generators market has been analyzed in terms of value ($Billion). The analysis in the report is provided on the basis of type, system, end user, 4 major regions, and more than 15 countries.

- The global air-cooled generators market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the air-cooled generators market are Baker Hughes Company, Briggs & Stratton Corporation, Cummins Inc., GE Vernova, Generac Power Systems, Inc., Honda India Power Products Ltd., Kohler Co., Mitsubishi Heavy Industries, Ltd., Siemens Energy, TOSHIBA CORPORATION, Wartsila, and Yamaha Motor Co.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global air-cooled generators market.

Market Dynamics

The expansion of industries such as telecommunications, emergency services, and outdoor entertainment has increased the demand for portable power solutions powered by air-cooled generators. According to the India Brand Equity Foundation, India's 5G subscriptions to have 350 million by 2026 accounting for 27% of all mobile subscriptions. These industries operate in dynamic and challenging environments where access to grid power is limited or unavailable. As a result, there is a heightened emphasis on compact, reliable, and easy-to-transport generators that provide on-demand power whenever and wherever needed. In addition, the rise in frequency of outdoor events, construction projects, and recreational activities in remote or off-grid locations increase demand for air-cooled generators. These versatile power sources are essential for providing reliable electricity in areas where traditional grid connections are unavailable. All these factors are expected to drive the demand for air-cooled generators during the forecast period.

However, the limited cooling efficiency of air-cooled generators is a hindrance in applications requiring continuous or high-power operation. In situations where generators are subjected to heavy loads or extended use, the inability to efficiently dissipate heat results in overheating, reduced efficiency, and increased wear and tear on components. This leads to higher maintenance costs and downtime that impact on the overall reliability and performance of the generator. All these factors hamper the air-cooled generators market growth.

The surge in adoption of small-scale renewable energy systems presents significant opportunities for the air-cooled generator market. According to the International Energy Agency (IEA), the U.S. renewable energy expansion has almost doubled in the last five years. The IRA passed in August 2022 extended tax credits for renewables until 2032 that provide long-term visibility for wind and solar PV projects. As the countries focus on sustainability and reducing carbon emissions, there has been a notable surge in the deployment of decentralized renewable energy solutions such as solar panels, small wind turbines, and micro-hydro systems. These systems are installed in various settings such as residential buildings, commercial establishments, and rural communities to generate clean and reliable electricity. All these factors are anticipated to offer new growth opportunities for the air-cooled generator market during the forecast period.

Segments Overview

The air-cooled generators market is segmented on the basis of type, system, end user, and region. On the basis of type, the market is bifurcated into portable and stationary. On the basis of system, the market is divided into medium and high. On the basis of end user, the market is classified into residential, industrial and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

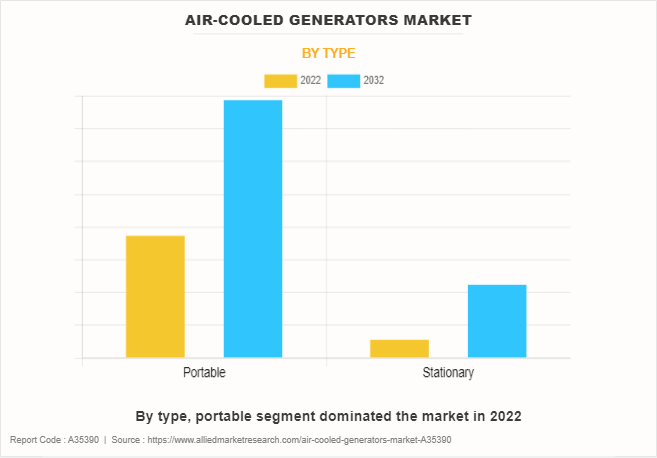

By type, the portable segment accounted for more than two-thirds of global air-cooled generators market share in 2022 and is expected to maintain its dominance during the forecast period. The expansion of the construction industry and infrastructure development projects drive the demand for portable air-cooled generators. According to the UN Environment Programme (UNEP), buildings energy demand increased by around 4 % to 135 EJ, the largest increase in the last 10 years. These generators are essential for powering construction tools and equipment at job sites where access to grid electricity is limited or unavailable. The growing trend of outdoor events such as concerts, festivals, and sports tournaments also drive the demand for portable generators to provide temporary power for lighting, sound systems, and other equipment.

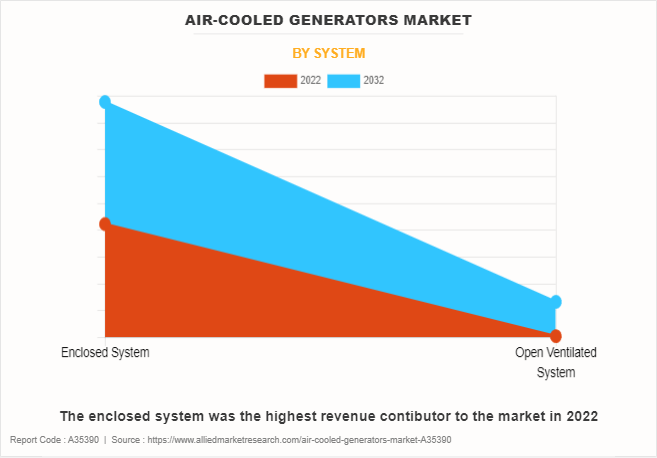

By system, the enclosed system segment accounted for three-fourths of global air-cooled generators market share in 2022 and is expected to maintain its dominance during the forecast period. Enclosed systems offer enhanced durability and longevity for air-cooled generators. The protective enclosure helps shield the generator unit from environmental factors such as moisture, humidity, and temperature fluctuations that degrade the performance and lifespan of the equipment. By maintaining optimal operating conditions and protecting critical components from corrosion and wear, enclosed systems contribute to prolonged service life and reduced maintenance requirements for air-cooled generators.

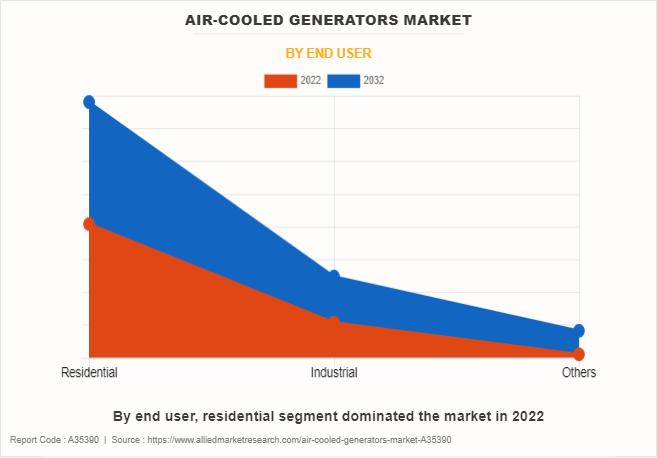

By end user, the residential segment accounted for more than three-fifths of global air-cooled generators market share in 2022 and is expected to maintain its dominance during the forecast period. Advancements in air-cooled generator technology, such as improved fuel efficiency, quieter operation, and compact designs, have made these generators more suitable for residential applications. For instance, Fuji Electric developed a series of 300 MVA air-cooled generators and up to 450 MVA indirectly hydrogen-cooled generators. These generators utilize the Global Vacuum Pressure Impregnated (VPI) insulation system which enhances their performance and reliability. In addition, homeowners are increasingly interested in air-cooled generators that are easy to install, operate, and maintain, without the need for complex cooling systems or extensive maintenance requirements.

Asia-Pacific accounted for less than half of the global air-cooled generators market share in 2022 and is expected to maintain its dominance during the forecast period. Asia-Pacific has witnessed rapid growth in the adoption of renewable energy technologies such as solar and wind power. According to the International Energy Agency, in India, new installations are set to double till 2032, which is led by solar PV and driven by competitive auctions implemented to achieve the government’s ambitious target of 500 GW of renewable power by 2030. While renewable energy sources offer clean and sustainable power generation, they are often intermittent and require backup power solutions to ensure continuous supply. Air-cooled generators complement renewable energy systems by providing backup power during periods of low or no renewable energy generation, thus supporting the integration and stability of the grid. The increase in deployment of renewable energy projects across the region creates additional opportunities for air-cooled generator manufacturers and suppliers.

Competitive Analysis

Key players in the air-cooled generators market include Baker Hughes Company, Briggs & Stratton Corporation, Cummins Inc., GE Vernova, Generac Power Systems, Inc., Honda India Power Products Ltd., Kohler Co., Mitsubishi Heavy Industries, Ltd., Siemens Energy, TOSHIBA CORPORATION, Wartsila, and Yamaha Motor Co. Apart from these major players, there are other key players in the air-cooled generators industry. These include Champion Power Equipment, Eaton Corporation, DeWalt, Westinghouse Electric Corporation, Ryobi Limited, Subaru Corporation, Ingersoll Rand, Techtronic Industries (TTI), Firman Power Equipment, and Subaru Industrial Power Products.

In the global air-cooled generators market, companies have adopted product launch strategies to expand the market or develop new products. For instance, in October 2023, Briggs & Stratton Corporation launched all new PowerProtect generators featuring NGMax technology. It offers more power at every level with 13kW, 18kW, 22kW, and 26kW PowerProtect home standby generators. The PowerProtect line is the most powerful lineup of air-cooled home standby generators. In July 2023, Kohler Co. launched a 26 kW home standby generator. This new model rounds out Kohler's air-cooled home generator provides homeowners, dealers, and partners with air-cooled backup power solutions from 6 kW through 26 kW. The 26RCA generator provides automatic operation utilizing home fuel sources (natural gas or propane). This offers the homeowner hassle-free security and peace of mind during the entire length of an outage, adding to the overall sense of wellbeing in the home.

Historical Trends of Air-cooled Generator:

- The early to mid-20th century marked the commercialization and widespread adoption of air-cooled generators in various industries such as construction, agriculture, and small-scale power generation. Companies such as Honda, Yamaha, and Briggs & Stratton emerged as key players, producing air-cooled generators for a range of applications, from portable power solutions to standby power backup.

- The 1970s witnessed significant advancements in air-cooled generator technology with the introduction of improved engine designs, alternator configurations, and cooling systems. This era saw the expansion of air-cooled generators into new markets such as outdoor events, recreational activities, and residential backup power.

- In the 1980s, air-cooled generator technology experienced further evolution with the integration of electronic ignition systems, voltage regulators, and muffler designs. This led to increased reliability, fuel efficiency, and noise reduction of air-cooled generators, driving their adoption in a broader range of applications such as camping, construction sites, and emergency preparedness.

- The 1990s marked a period of innovation in air-cooled generator design, focusing on enhancing power output, portability, and user-friendly features. Manufacturers introduced inverter technology to produce clean and stable power, making air-cooled generators suitable for sensitive electronic devices and recreational vehicles.

- The early 2000s saw a surge in demand for air-cooled generators driven by the rise in need for reliable backup power solutions in residential and commercial settings. Companies invested in research and development to produce generators with improved engine efficiency, noise levels, and compact designs to meet the evolving needs of consumers.

- By the 2010s, air-cooled generator technology evolved to incorporate advanced engine control systems, automatic voltage regulation, and parallel operation capabilities. This enabled better integration with renewable energy systems such as solar and wind power, supporting the global trend toward decentralized and off-grid energy solutions.

- In the 2020s, the air-cooled generators market continued to evolve with a focus on sustainability and energy efficiency. Innovations such as hybrid generator systems and intelligent load management features aimed to improve fuel efficiency and reduce environmental impact across various sectors such as construction, telecommunications, and outdoor events.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air-cooled generators market analysis from 2022 to 2032 to identify the prevailing air-cooled generators market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air cooled generators market statistics and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global air-cooled generators market trends, key players, market segments, application areas, and market growth strategies.

Air-Cooled Generators Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Type |

|

| By System |

|

| By End User |

|

| By Region |

|

| Key Market Players | GE Vernova, Wartsila, Yamaha Motor Co., Ltd., Kohler Co., Briggs & Stratton Corporation, Baker Hughes Company, TOSHIBA CORPORATION, Generac Power Systems, Inc., Cummins Inc., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Honda India Power Products Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the air-cooled generators market is expected to witness growth during the forecast period owing to surge in demand for portable power solutions, and expansion in renewable energy sector. The increased need for reliable power sources in remote locations and off-grid settings has driven the demand for air-cooled generators, which offer simplicity, cost-effectiveness, and ease of maintenance. These generators play a critical role in providing backup power in various applications such as construction sites, telecommunications infrastructure, and outdoor events. As industries evolve and adopt more advanced technologies, the demand for efficient and reliable air-cooled generators is expected to increase significantly.

Moreover, the expansion of data-driven technologies and the rise of electric vehicles contribute to the growth of the air-cooled generators market. Electric vehicles rely on generators for charging their batteries and powering onboard electronics that create a substantial demand for high-performance generator systems. In addition, the global shift toward sustainable energy solutions drives the demand for air-cooled generators in renewable energy applications. These generators are vital components in wind turbines, solar power systems, and other renewable energy setups, further contributing to the market growth.

The global air-cooled generators market was valued at $4.1 billion in 2022, and is projected to reach $7.0 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Increase adoption in small-scale renewable energy systems is the upcoming trends of Air-Cooled Generators Market in the world.

Surge in demand for portable power solutions, and expansion in renewable energy sector are the leading drivers of Air-Cooled Generators Market.

Asia-Pacific is the largest regional market for Air-Cooled Generators.

Asia-Pacific is the fastest growing region for the Air-Cooled Generators Market.

Portable is the leading type of Air-Cooled Generator.

Key players in the air-cooled generators market include Baker Hughes Company, Briggs & Stratton Corporation, Cummins Inc., GE Vernova, Generac Power Systems, Inc., Honda India Power Products Ltd., Kohler Co., Mitsubishi Heavy Industries, Ltd., Siemens Energy, TOSHIBA CORPORATION, Wartsila, and Yamaha Motor Co.

Loading Table Of Content...

Loading Research Methodology...