Air Crane Helicopter Market Outlook, 2032

The global air crane helicopter market size was valued at $4.8 billion in 2022, and is projected to reach $10.8 billion by 2032, growing at a CAGR of 8.6% from 2023 to 2032. The air crane helicopter market refers to the global industry focused on providing specially designed rotorcraft with precision heavy lift capabilities through cable hook systems, used across civilian medium-to-heavy underslung load applications. Air crane helicopters are highly complex, customized aircraft that integrate heavy lift capabilities with aerial maneuverability. Air crane helicopters perform vertical lift operations for construction projects, firefighting, logging, oil & gas rigging, power line installation, disaster relief and other applications requiring aerial transportation or precision placement of heavy loads.

Key Takeaways of This Report:

The air crane helicopter market report studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($ billion) for the projected period 2022-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The air crane helicopter market companies share is moderately fragmented, with several players including Airbus SE, Aircrane, Inc., Columbia Helicopters, Erickson Incorporated, High Performance Helicopters Corp, Kaman Corporation, Lockheed Martin Corporation, Russian Helicopters, Textron Aviation Inc., and The Boeing Company.

Leading air crane models feature extensive aftermarket customizations that optimize aircraft stability and safety during underslung load movements. This includes reinforced structures, rear loading doors, supplementary fuel tanks. Operators also employ complex rigging equipment tuned to cargo specifics. The specialized capabilities of air cranes justify their high per-unit capital and maintenance costs.

Furthermore, major air crane helicopter market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in November 2022, SAF Aerogroup announced the acquisition of Starlite Aviation Group, an aviation company. Under the SAF Aerogroup banner, the combined entity encompasses extensive capabilities across medevac, helicopter operations, pilot training, and VIP transport.

With 500 staff across a global footprint of maintenance hubs and training facilities, SAF Aerogroup offers full-spectrum aerial logistics solutions. The 78-strong mission fleet, supplemented by 40 additional training aircraft, positions the group for continued leadership in sectors from emergency medical transport to critical infrastructure development projects requiring light and heavy vertical lift support. Such development further expands the air crane helicopter market share.

Factors such as the increase in demand for aerial firefighting capabilities, growth in construction projects, and surge in global energy production are driving the growth of the air crane helicopter market across the globe. However, strict aviation regulations and high upfront and maintenance costs act as barriers for the growth of the air crane helicopter market. Furthermore, increase in adoption in developing regions and technological advancements are expected to create ample opportunities for the growth of the market during the forecast period.

Segment Review

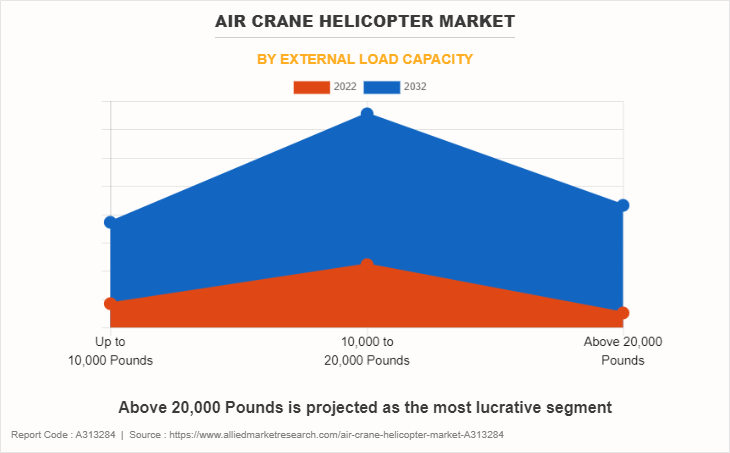

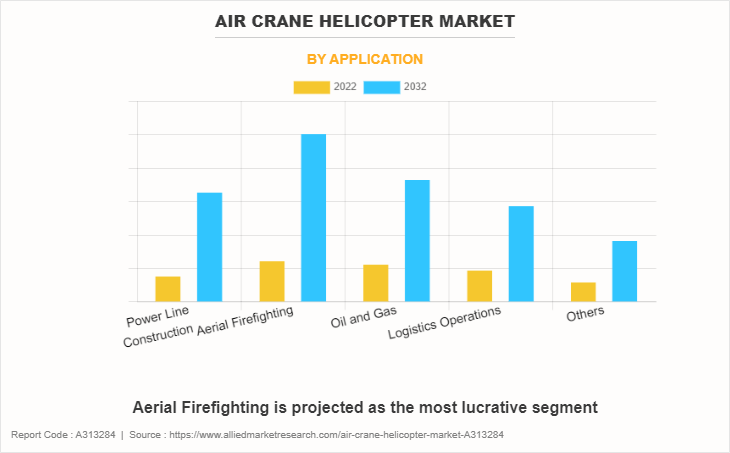

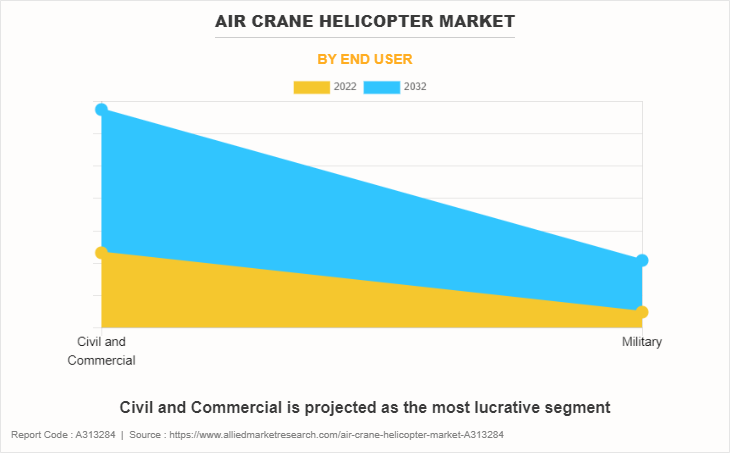

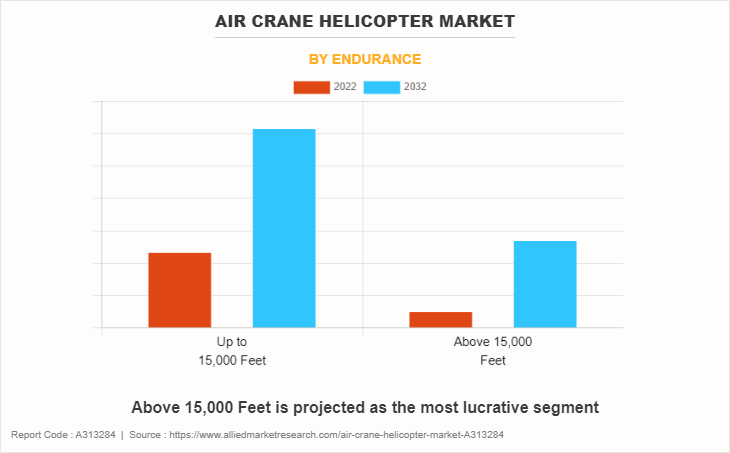

The air crane helicopter market is segmented on the basis of endurance, external load capacity, application, end user, and region. By endurance, it is divided into up to 15,000 feet, and above 15,000 feet. By external load capacity, the market is classified into up to 10,000 pounds, 10,000 to 20,000 pounds, and above 20,000 pounds. By application, the market is classified into power line construction, aerial firefighting, oil & gas, logistics operations, and others. By end user, it is bifurcated into civil & commercial and military. By region, the air crane helicopter market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the report include Airbus SE, Aircrane, Inc., Columbia Helicopters, Erickson Incorporated, High Performance Helicopters Corp, Kaman Corporation, Lockheed Martin Corporation, Russian Helicopters, Textron Aviation Inc., and The Boeing Company.

North America represents the largest regional air crane market. The U.S. drives most activity as both the home country of major manufacturer Lockheed Martin Corporation and one of the major consumers of heavy lift helicopter operations across commercial and government sectors. U.S. have major number of helicopters approximately 5,737 units. Market growth in North America has accelerated over the past decade driven by surging wildfire activity, recovering oil & gas drilling activity and steady utilization among construction firms. In 2022, there were approximately 68,988 wildfires that burned 7.6 million acres. Airbus Helicopters has also gained ground by marketing its Super Puma models for offshore energy sector heavy lifting.

Moreover, air crane helicopter industry players received contracts for advanced helicopters from North American companies. For instance, in October 2022, Kaman Air Vehicles, a subsidiary of Kaman Corporation secured a new order for the versatile K-MAX helicopter from North American Helicopter. The uniquely designed heavy-lift rotorcraft is expected to boost North American capabilities across utility sectors and defense operations requiring repetitive external cargo transport. K-MAX provides advanced lift capacity and high/hot performance with its counter-rotating dual rotor system, the low-maintenance, which can carry over 6,000 pounds.

Therefore, the market players have started adopting autonomous control for their fleet to reduce human risk and increase performance. For instance, in February 2021, Erickson Incorporated proposed an autonomous variant of its S-64F+ heavy lift helicopter to complement U.S. Army aviation capabilities. By integrating fly-by-wire controls and Sikorsky Matrix technology into the uniquely qualified Air Crane platform, the company aims to back key military rotorcraft including Boeing CH-47 Chinooks with an unmanned cargo solution optimized for logistics and training operations. Erickson envisions the system's autonomous flight being guided by sensors such as lidar and cameras paired with terrain mapping databases.

Increase in Demand for Aerial Firefighting Capabilities

Climate change is causing hotter, drier seasons in many regions, which is expanding risks of large wildfires across forests and grasslands. Air crane helicopters have unique capabilities to contain remote high-danger blazes. Their precision water/retardant dropping abilities make them a vital part of the firefighting aviation fleet. As more inhabited areas come under threat, public agencies are working to upgrade air attack and emergency response capabilities.

The increasing intensity and frequency of wildfires globally is creating more demand for aerial firefighting helicopters and associated capabilities. Air crane models are uniquely suited for precision water dropping, hotspot containment and large-scale fires in remote areas. Their heavy lift capacities, tank volumes and maneuverability outcomes make them a vital tool for incident commanders. With fire seasons worsening every year, state authorities continue to expand air attack fleets and operations budgets.

Air crane manufacturers have upgraded the water carrying capacity and its performance of helicopters to control water flow during firefighting scenarios. For instance, in March 2022, Erickson Incorporated, a premier provider of utility aircraft services, developed an innovative next generation water cannon for aerial firefighting. Designed for rapid installation on the company's S-64 helicopters, the electrically driven system is lightweight and offers better performance than existing hydraulic water cannons.

Erickson's engineers have crafted an aerial firefighting accessory that offers both improved fire suppression capacity and greater operational efficiency. It utilizes aircraft-generated power instead of separate hydraulic pumps. Such developments further support the growth of the air crane helicopter market value.

Growth in Construction Projects

Major construction initiatives for things such as bridges, dams, and high-rises rely on air cranes to lift and emplace heavy materials quickly. Their ability to access tight spaces in urban zones safely is unmatched. As governments announce significant amount in new infrastructure commitments post-pandemic, air crane utilization rates by civil engineers are expected to rise. Their supplementation of alternative lift machinery keeps project timelines on track. Major projects have complex logistics needs that helicopters can simplify.

Moreover, companies that offer air crane operations have partnered to expand their services and increase their air crane helicopter market presence. For instance, in September 2023, Erickson Incorporated, a major air crane operator entered a strategic partnership with Helicopter Express. This alliance aims to leverage the aircraft's specialized capabilities for new construction and firefighting customers across North America.

In October 2022, Helicopter Express acquired an S-64F model, becoming the first commercial operator to add the heavy-lift helicopter to its fleet. With Erickson's sustainment and modernization support, Erickson Incorporated plans to capitalize on rising demand by providing enhanced air crane services to existing and new clients globally.

Air crane helicopters allow construction crews to precision lift and place heavy beams, equipment, and modules to the most inaccessible points of complex builds. Their unique capabilities for supporting tall skyscrapers, long-span bridges, mega dams, and similar projects foster growing demand from large construction firms. Sikorsky S-64 Skycrane models and other air cranes models such as the Russian Mi-10K are experiencing increased usage alongside the global expansion of the construction industry.

Surge In Global Energy Production

Rise in energy needs globally have oil & gas firms investing more into production via offshore platforms and onshore wells. Air crane helicopters help transport drilling equipment, inspect pipelines, and hoist machinery into remote areas. Wind energy also depends on air cranes to erect tall towers.

Fossil fuels continue meeting the bulk of growing global energy needs. Expanding oil/gas extraction depends on air cranes to transport remote drilling equipment over pipelines and towers quickly. Their lift abilities simplify complex rigging operations. And renewable sources like wind and solar rely on helicopters to erect very tall structures. With energy as a key economic driver, air crane versatility makes air crane helicopters an enabling asset across the production value chain.

As developing economies grow and add higher energy capacity, oil, gas, and alternative energy projects have surged worldwide. Exploring and harvesting offshore oil & gas requires extensive, specialized equipment to erect drilling platforms, rigs, and related infrastructure. The scale of new offshore energy operations has increased exponentially in recent years. Air crane helicopters provide unmatched capabilities for lifting, transporting, and placing the heavy modules & equipment needed when assembling these offshore structures.

Building and maintaining offshore rigs on this scale would be impossible without air cranes. Their heavy vertical lift performance has proven indispensable for expansions in areas such as the Gulf of Mexico, North Sea, and South China Sea. Major operators rely extensively on-air crane helicopters from manufacturers such as Sikorsky, Erickson Incorporated, and others when undertaking billion-dollar offshore oil & gas projects.

In addition, renewable energy construction companies have adopted air cranes to transport equipment and reduce their carbon footprint. For instance, in September 2023, ENOWA, the water and electricity unit of NEOM, has pioneered an eco-friendly construction technique for high-voltage infrastructure. In recent trials, helicopters airlifted modular transmission tower parts to mountain sites, assembling them on-site. By eliminating trucking and heavy machinery, the innovative aerial logistics process helps advance NEOM’s renewable energy vision while supporting net zero commitments. The air crane helicopter market trends are on the rise owing to these initiatives.

High Upfront and Maintenance Costs

Air crane helicopters are highly complex, customized aircraft that integrate heavy lift capabilities with aerial maneuverability. Engineering these capabilities requires advanced aerodynamics, robust transmission and rotor systems, high-grade construction materials and precision avionics.

Moreover, maintaining and operating air cranes demands intensive maintenance, repair and overhaul (MRO) efforts to keep their many complex systems functioning properly. Frequent part replacements and upgrades are common. Pilots require specialized training to fly air cranes safely. Consequently, not only are air cranes expensive to acquire but they incur high ongoing operating expenses as well.

For many private aerial lift companies, these substantial capital and maintenance costs pose barriers to acquiring and maintaining their own air crane fleets. The high price tag restrains wider adoption for smaller operators. However, the unique capabilities that air cranes provide are expected to justify the costs where requirements exist. Some government funding programs now help subsidize purchases focused on things like firefighting and infrastructure development. Creative financing options can also overcome budget hurdles with wider adoption over time.

Strict Aviation Regulations

Air crane helicopters conduct intense, low-altitude heavy lift operations that require great precision and introduce serious risks if errors occur. As specialized commercial aircraft, they must adhere to stringent aviation regulations that govern maintenance protocols, weight limits, load securing, flight plans, pilot certifications and operating procedures. These strict oversight policies ensure safety but also limit operational flexibility for air crane owners. Moreover, the regulations create extensive permitting requirements, restrictions on operating locations/times and mandated equipment modifications.

As regulations have grown stricter in recent years, regulatory constraints have become a greater restraining factor for the air crane industry. Operators must dedicate substantial resources to remain compliant across different national & local jurisdictions. The regulatory burden adds significant fixed costs and restrains growth opportunities, especially for smaller aerial lift companies.

Increase in Adoption in Developing Regions

Many developing regions are seeing increased adoption opportunities for air crane helicopters, driven by various socioeconomic factors. For example, rapid urbanization across Africa, Asia-Pacific and Latin America is enabling larger investments into infrastructure modernization projects. Air cranes can supplement alternative lifting options as growing megacities undertake bridgework, high-rises, and transportation upgrades.

In addition, mining and resource extraction are foundational industries in emerging economies. Air cranes simplify moving heavy machinery required in difficult terrain for mining, oil/gas operations. Their versatility can enable expansion across remote deposits and offshore plays. Furthermore, while procurement budgets remain a challenge, policy shifts that allow creative financing of public aerial assets could drive developing world air crane acquisitions. Cost-sharing models across municipalities, public-private partnerships that split ownership, and lease structures can all expand access despite fiscal limitations.

Impact of Russia-Ukraine War on Air Crane Helicopter Industry

Russia and Ukraine frequently spend more on defense in order to strengthen their armed forces during times of war. Global defense supply chains are facing disruptions - sanctions have impeded Russia's military industrial cooperation with other nations. This can temporarily influence accessibility to heavy lift helicopter parts or maintenance capabilities that air crane operators depend on. However, most major OEMs seem to have diversified their vendor ecosystem.

More significantly, the conflict has heightened military modernization mandates across NATO members and allies. In light of global tensions, increased defense spending is being directed toward the upgrade of logistics/transport rotorcraft fleets. This ancillary demand can have a positive effect for companies also supplying civilian air crane platforms, in terms of bolstered revenue resources.

However, the crisis has also highlighted air cranes’ immense value for disaster response, refugee resettlement and infrastructure reconstruction. As Western nations direct more financial aid toward Ukraine’s recovery, contracts for heavy lift helicopter support can increase in the region over time. The crisis may catalyze stronger demand within Central Europe for air crane models from American and European manufacturers. Overall, the immediate impacts of the Ukraine crisis on air crane demand remain mixed. But the conflict has elevated geopolitical risks and economic troubles that can hinder global market growth potential if prolonged.

Recent Developments in the Air Crane Helicopter Industry

In December 2022, Erickson Incorporated delivered its eighth S-64 Air Crane helicopter to the Korea Forest Service, continuing a 20-year partnership providing critical firefighting rotorcraft. The latest order, fulfilling a contract signed in 2020, is outfitted with a 2,650-gallon tank and rapid snorkel fill system enabling precise water drops for round-the-clock fire attack. With the Air Crane's unique aerial lift capacity, the Korea Forest Service can deliver over 25,000 gallons per hour from nearby water sources to contain uncontrolled wildfires.

In December 2022, the U.S. Navy cleared the way for full scale manufacturing ramp up of CH-53K King Stallion helicopter of Sikorsky, a division of Lockheed Martin Corporation. After extensive testing and initial low-rate production deliveries to the U.S. Marine Corps, the CH-53K program received approval to enter full rate production. This milestone enables the platform's production tempo to accelerate, with larger procurement quantities expected to drive increased efficiencies and reduced per-unit costs. As the Marine Corps retires older heavy lift helicopters, the CH-53K—with triple the lift capacity is expected to become its premier asset for future amphibious assault and cargo missions ranging from troop transport to special operations support.

In March 2021, Erickson Incorporated renewed its critical firefighting agreements with Greece ahead of the 2021 wildfire season. For over two decades, Erickson's elite pilots and S-64 Air Crane helicopters have served as an indispensable asset supporting Greek authorities in times of crisis.

In May 2020, Sikorsky, part of the defense firm Lockheed Martin Corporation, showcased new progress in autonomous flight capabilities to the U.S. Army. Working alongside the Defense Advanced Research Projects Agency (DARPA), the company recently completed initial demonstrations of an optionally piloted UH-60A Black Hawk performing crucial missions such as cargo resupply and aircraft rescue without onboard crew. Utilizing sophisticated autonomy systems developed in partnership with DARPA, the uninhabited Black Hawk delivered internal/external loads and executed a full extraction of an isolated crew member, displaying safety and reliability on par with human-piloted operations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air crane helicopter market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Air Crane Helicopter Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.8 billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By External Load Capacity |

|

| By Application |

|

| By End User |

|

| By Endurance |

|

| By Region |

|

| Key Market Players | The Boeing Company, columbia helicopters, High Performance Helicopters Corp, Erickson Incorporated, Russian Helicopters, Kaman Corporation., Airbus SE, Lockheed Martin Corporation, Textron Aviation Inc., Aircrane, Inc. |

The global air crane helicopter market was valued at $4.8 billion in 2022, and is projected to reach $10.8 billion by 2032, growing at a CAGR of 8.6% from 2023 to 2032.

Largest regional market for Air Crane Helicopter is North America

Upcoming trends of Air Crane Helicopter Market are increase in adoption in developing regions and technological advancements

Leading application of Air Crane Helicopter Market is aerial firefighting

Airbus SE, Aircrane, Inc., Columbia Helicopters, Erickson Incorporated, High Performance Helicopters Corp, Kaman Corporation, Lockheed Martin Corporation, Russian Helicopters, Textron Aviation Inc., and The Boeing Company.

Loading Table Of Content...

Loading Research Methodology...