Air Transport MRO Market Research, 2033

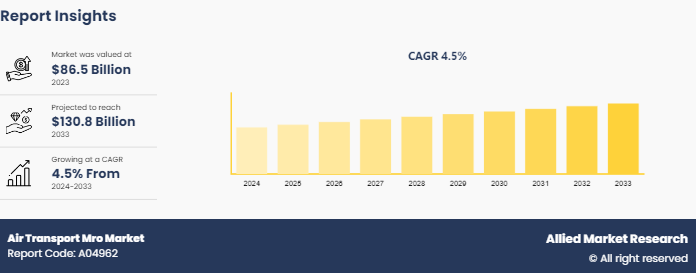

The global air transport mro market was valued at $86.5 billion in 2023, and is projected to reach $130.8 billion by 2033, growing at a CAGR of 4.5% from 2024 to 2033.

Market Introduction and Definition

The air transport MRO industry encompasses all activities related to the upkeep, restoration, and enhancement of aircraft used in commercial aviation. This sector ensures the airworthiness, safety, and operational efficiency of aircraft through scheduled maintenance, repairs, and upgrades. It includes services such as routine checks, engine overhauls, structural repairs, avionics updates, and parts replacements. MRO services are crucial for compliance with aviation regulations and standards set by authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) , ensuring that aircraft remain safe and reliable throughout their operational lifespan.

The growth in passenger and cargo air traffic is set to significantly boost sales in the aviation sector. As global economies recover and expand, the demand for air travel continues to surge, driven by increasing tourism, business travel, and e-commerce. This upward trend compels airlines to expand and modernize their fleets to accommodate the rising number of passengers and cargo volumes. Consequently, there is a heightened demand for new aircraft, advanced aviation technologies, and comprehensive maintenance services. The aviation industry is projected to witness robust growth, with airlines and cargo operators investing heavily in fleet expansion and optimization to meet the evolving needs of the market, ultimately driving substantial sales increase across the sector.

The adoption of digital tools and data analytics is expected to drive significant sales growth in the aviation industry. These advanced technologies enable airlines to optimize operations, enhance efficiency, and improve customer experiences. By leveraging big data and predictive analytics, airlines can perform proactive maintenance, reduce downtime, and ensure the reliability of their fleets. Additionally, digital tools such as mobile apps and personalized marketing enhance passenger engagement and satisfaction. The integration of these technologies not only streamlines operations but also opens new revenue streams through targeted services and improved operational efficiency. As a result, the aviation industry can expect increased sales and a competitive edge in a rapidly evolving market.

Key Takeaways

The air transport MRO market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major air transport MRO industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In January 2024, the Airbus Lifecycle Services Centre (ALSC) commenced operations in Chengdu, China, offering comprehensive solutions for managing the entire lifecycle of an aircraft. As the first facility of its kind, it provides a full range of services, including aircraft parking and storage, maintenance, upgrades, conversions, dismantling, and recycling for various aircraft types. Additionally, it manages the controlled distribution of used parts from dismantling. The Airbus Lifecycle Services Center in Chengdu is certified by both the European Union Aviation Safety Agency (EASA) and the Civil Aviation Administration of China (CAAC) .

In February 2022, Collins Aerospace announced a $27 million investment to significantly expand its MRO operations in Xiamen, China, and Selangor, Malaysia. The expansion will nearly double the size of the Xiamen facility and quadruple the footprint in Selangor. This increased capacity aims to provide faster turnaround times and more efficient service to Collins’ customers in the region.

Key Market Dynamics

The global air transport MRO market size is experiencing growth due to growth in passenger and cargo air traffic, aging aircraft fleets, innovations in aircraft technology, and expansion of airline networks and routes. However, high operational costs, and skilled workforce shortage hinder the market growth. Moreover, adoption of predictive maintenance and expansion into emerging market to create lucrative air transport MRO market opportunity.

The growing importance of aftermarket services is expected to drive significant sales growth in the aviation industry. As airlines seek to extend the lifespan of their fleets and enhance operational efficiency, the demand for air transport MRO market share is rising. Aftermarket services, including parts supply, component repair, and technical support, are crucial for ensuring aircraft reliability and performance. Additionally, these services help airlines manage costs by offering alternatives to new parts and reducing downtime. The emphasis on sustainability and cost-efficiency further boosts the demand for comprehensive aftermarket solutions. By investing in robust aftermarket services, aviation companies can attract more business, ensuring steady revenue growth and strengthening their market position.

The adoption of digital tools and data analytics is transforming the aviation industry, driving significant air transport MRO market growth. These technologies enable airlines to streamline operations, enhance maintenance efficiency, and deliver personalized customer experiences. Predictive analytics help identify potential issues before they arise, reducing downtime and maintenance costs. Additionally, data-driven insights allow for optimized route planning, fuel management, and resource allocation, improving overall operational efficiency. Digital tools also enhance passenger engagement through tailored services and real-time updates. By leveraging these advancements, airlines can operate more efficiently, offer superior service, and increase profitability. The integration of digital tools and data analytics is thus a key driver of sales growth and competitive advantage in the aviation sector.

Expanding into emerging markets presents lucrative opportunities for the aviation industry. Rapid economic growth in regions such as Asia, Africa, and Latin America is driving increased demand for air travel. As incomes rise and middle-class populations expand, more people can afford to fly, boosting passenger numbers. Additionally, improving infrastructure and favorable government policies support aviation growth in these markets. Airlines and aviation companies that establish a presence early can capitalize on these trends, securing market share and fostering brand loyalty. This expansion not only drives immediate revenue growth but also positions companies for long-term success as these markets continue to develop. Consequently, tapping into emerging markets is a strategic move that promises substantial financial rewards and market expansion.

Parent Market Overview for Air Transport MRO Market

The demand for aircraft is driven by increasing global air travel and expanding cargo transport needs. Economic growth, particularly in emerging markets, which boosts air travel as more people can afford to fly. Additionally, the growth of e-commerce requires more cargo aircraft to meet delivery demands. In the U.S., which holds more than 5, 000 aircraft, airlines are upgrading their fleets with newer, more efficient models to meet regulatory standards and reduce operational costs. Furthermore, advancements in aviation technology and a focus on sustainability are prompting airlines to invest in modern aircraft with better fuel efficiency and lower emissions. This surge in demand is fueling substantial growth in the aviation industry, prompting manufacturers to ramp up production and innovate continuously.

Market Segmentation

The air transport MRO market is segmented into aircraft type, organization type, service type, end use, and region. On the basis of aircraft type, the market is divided into narrow body aircraft, propeller aircraft, rotary aircraft, private jet, and wide body aircraft. As per organization type, the market is segregated into airline, Independent MRO, and OEM MRO. By service type, it is bifurcated into, engine overhaul, airframe maintenance, line maintenance, modifications, and components. By End Use, the market is classified into commercial aviation, business and general aviation, and military. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for air transport Maintenance, Repair, and Overhaul (MRO) services in the U.S. is experiencing significant growth, driven by several key factors. The expanding fleet of both commercial and private aircraft, coupled with an aging fleet, necessitates more frequent and comprehensive maintenance services. Increased air travel, both domestic and international, adds to the wear and tear on aircraft, underscoring the need for regular upkeep and advanced repair solutions. Additionally, stringent safety regulations and the push for improved operational efficiency are compelling airlines to invest heavily in air transport MRO market forecast. Notably, air transport holds more than 30% of the market share in the civil aviation fleet. This rising demand is creating substantial opportunities for MRO providers, fostering industry growth and innovation in the U.S. aviation sector.

In April 2024, AAR announced an expansion of its MRO facility in Oklahoma City. The new facility, designed to provide over 80, 000 square feet of additional hangar and warehouse space, will accommodate all 737 variants, including the 737-10. This expansion supports AAR’s recently extended maintenance commitment with Alaska Airlines, a valued customer for over 20 years. The new airframe MRO facility is expected to be operational by January 2026.

In September 2022, Rolls-Royce and Air China announced a new 50/50 joint venture (JV) for a maintenance, repair, and overhaul (MRO) facility in Beijing, China. The new facility, Beijing Aero Engine Services Company Limited (BAESL) , will provide MRO support for Rolls-Royce Trent 700, Trent XWB-84, and Trent 1000 aero engines, all of which are in Air China's fleet. At full capacity, expected by the mid-2030s, BAESL will support up to 250 shop visits annually. The facility will offer MRO services to Air China and other airline customers in Greater China and beyond. Currently, Rolls-Royce powers 60% of China’s widebody fleet, with over 550 aircraft in service or on order. Additionally, Trent 700 engines power 90% of China’s Airbus A330 fleet, and the Greater China fleet represents 20% of all Trent engines in operation today.

Competitive Landscape

The major players operating in the air transport MRO market include Deutsche Lufthansa AG, John Swire And Sons (H.K.) Ltd., Israel Aerospace Industries (IAI) , United Technologies Corporation (Pratt And Whitney Division) , Delta TechOps, Airbus S.A.S., GE Aviation, TIMCO Aviation Services, Inc., Collins Aerospace, and AAR Corporation.

Other players in the air transport MRO market include Rolls-Royce Holdings, ST Engineering Aerospace, MTU Aero Engines, Safran Aircraft Engines, and so on.

Industry Trends:

In December 2022, the International Air Transport Association (IATA) announced that Turkish Technic to join IATA’s MRO SmartHub platform. This addition reinforces MRO SmartHub’s status as a market-leading industry platform, developed by IATA and its technology partner, Opremic. IATA’s MRO SmartHub is a neutral, web-based platform that allows airlines, MRO providers, OEMs, and appraisers to gain greater transparency into the surplus aftermarket and provides real-time access to fair market values (FMV) for aircraft parts. The platform is expected to help airlines and MRO service providers reduce their material costs by approximately 10-15%.

In July 2021, IATA welcomed Rolls-Royce's commitment to adopting aftermarket best practices. Both organizations have aligned on four key principles that define Rolls-Royce's approach to the MRO ecosystem, as outlined in the official statement. Rolls-Royce will not prevent the development of legitimate non-OEM parts or repairs by MRO providers and independent parts manufacturers, provided they are approved by the appropriate airworthiness regulator.

Key Sources Referred

Federal Aviation Administration (FAA)

European Union Aviation Safety Agency (EASA)

International Air Transport Association (IATA)

Aerospace Industries Association (AIA)

Civil Aviation Administration of China (CAAC)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air transport MRO market analysis from 2024 to 2033 to identify the prevailing air transport MRO market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air transport MRO market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes analysis of the regional as well as global air transport MRO market trends, key players, market segments, application areas, and market growth strategies.

Air Transport Mro Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 130.8 Billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Aircraft Type |

|

| By Organization Type |

|

| By Service Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Airbus S.A.S., Deutsche Lufthansa AG, TIMCO Aviation Services, Inc., AAR Corporation, John Swire And Sons (H.K.) Ltd., Collins Aerospace, Israel Aerospace Industries (IAI), United Technologies Corporation (Pratt And Whitney Division), Delta TechOps, GE Aviation |

Adoption of Predictive Maintenance Technologies, Increased Use of Big Data and Analytics, and Expansion of Digital Twin Technology are the upcoming trends of Air Transport MRO Market in the globe

Engine overhaul is the leading Service Type of Air Transport MRO Market

North America is the largest regional market for Air Transport MRO

The estimated industry size of Air Transport MRO is $ 130.8 billion in 2033

Narrow Body Aircraft is the leading Aircraft Type of Air Transport MRO Market

Loading Table Of Content...