Airborne Collision Avoidance System Market Research, 2033

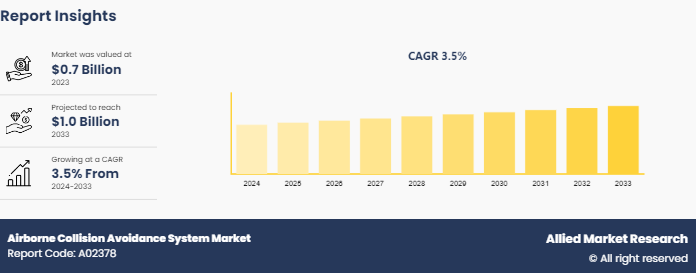

The global airborne collision avoidance system market was valued at $0.7 billion in 2023, and is projected to reach $1.0 billion by 2033, growing at a CAGR of 3.5% from 2024 to 2033.

Market Introduction and Definition

An airborne collision avoidance system is an advanced safety technology designed to prevent mid-air collisions between aircraft. Utilizing transponder signals, ACAS continuously monitors the airspace around an aircraft to detect potential collision threats. Upon identifying a risk, it provides pilots with timely advisories and resolution maneuvers to ensure safe separation from other aircraft. The system enhances situational awareness and decision-making in congested airspace, thus significantly improving flight safety. Common implementations include the Traffic Alert and Collision Avoidance System (TCAS) , which is widely mandated for commercial aviation and integrates with other avionics for optimal performance.

Upgrading older aircraft with modern collision avoidance systems is essential to enhance aviation safety and align with contemporary regulatory standards. These upgrades ensure older fleets remain competitive and operationally efficient, reducing the risk of mid-air collisions through advanced technology. As air traffic continues to grow, the demand for reliable, state-of-the-art safety systems becomes paramount. Retrofitting older aircraft extends their service life and boosts market opportunities for manufacturers and service providers. This proactive approach fosters assurance among passengers and airlines, driving increased sales and adoption of modern collision avoidance technologies across the aviation industry.

The surge in global air traffic significantly drives the need for advanced collision avoidance systems, fueling sales in the aviation safety market. As passenger and cargo flights increase, particularly in emerging markets, the demand for reliable safety solutions becomes paramount. Modern collision avoidance systems enhance situational awareness and mitigate mid-air collision risks, ensuring safe and efficient air travel. Airlines and aviation authorities prioritize equipping fleets with cutting-edge technology to manage the complexities of crowded airspaces. This growing emphasis on safety and efficiency in response to rising air traffic catalyzes the adoption of advanced systems, boosting market growth and sales.

Key Takeaways

- The airborne collision avoidance system market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major airborne collision avoidance system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- In December 2022, Collins Aerospace inaugurated new engineering and global operations centers in India to accelerate R&D and manufacturing innovations. As part of a substantial investment to enhance its engineering, digital technology, and manufacturing presence, Collins Aerospace, a unit of Raytheon Technologies Corp., officially opened its Global Engineering and Technology Center (GETC) and Collins India Operations Center in Bengaluru. These new facilities are integral to Raytheon Technologies' long-term growth strategy, aiming to foster collaboration and innovation, deliver cutting-edge solutions for customers, and create additional STEM-based opportunities in India.

- In September 2023, BAE Systems conducted successful flight tests for the next-generation Vehicle Management Computer (VMC) designed for the F-35 Lightning II. This innovative VMC from BAE Systems facilitates advanced control modes, enhancing mission efficiency and safety. With its distributed architecture, the aircraft operates reliably, ensuring improved mission effectiveness in challenging environments. The upgraded VMC not only addresses obsolescence concerns but also enhances safety, maintainability, and availability of the aircraft for the U.S. military and its allies.

Key Market Dynamics

The global airborne collision avoidance system industry is experiencing growth due to increasing air traffic, regulatory mandates, and expansion of UAV usage. However, complex integration and limited awareness in general aviation hinder market growth. Moreover, expanding aviation sectors in emerging regions and development & integration of next-generation technologies offer lucrative opportunities for the expansion of the global airborne collision avoidance system market forecast.

Innovations in sensor technology, data processing, and AI have revolutionized the airborne collision avoidance system market size, driving increased sales. Advanced sensors enhance detection capabilities, providing more accurate and reliable data. Cutting-edge data processing techniques enable real-time analysis, allowing for quicker and more effective decision-making. The integration of AI offers predictive insights and adaptive responses to potential collision threats, significantly improving flight safety. These technological advancements meet the growing demands of modern aviation, attracting airlines and aircraft manufacturers to invest in state-of-the-art collision avoidance systems. Consequently, these innovations not only elevate safety standards but also stimulate airborne collision avoidance system market share.

Collaborating with Air Traffic Management (ATM) systems creates lucrative airborne collision avoidance system market opportunity. Integrating these systems enhances overall airspace safety and efficiency, addressing the complexities of increasing air traffic. By synchronizing collision avoidance technologies with ATM, real-time data sharing and coordinated responses become possible, significantly reducing the risk of mid-air collisions. This synergy meets stringent regulatory requirements and attracts investment from airlines seeking to optimize their operations. Such collaborations foster innovation and open new revenue streams, driving airborne collision avoidance system market growth and positioning companies as leaders in aviation safety and technology advancements.

Upgrading older aircraft with modern collision avoidance systems is essential to enhance aviation safety and align with contemporary regulatory standards. These upgrades ensure older fleets remain competitive and operationally efficient, reducing the risk of mid-air collisions through advanced technology. As air traffic continues to grow, the demand for reliable, state-of-the-art safety systems becomes paramount. Retrofitting older aircraft not only extends their service life but also boosts market opportunities for manufacturers and service providers. This proactive approach fosters confidence among passengers and airlines, driving increased sales and adoption of modern collision avoidance technologies across the aviation industry.

Patent Analysis of Global Airborne Collision Avoidance System Market

In November 2023, General Dynamics was granted a patent for an aircraft collision avoidance system. The system includes laser rangefinders that generate laser beams laterally outward of the fuselage, and a detection circuit that alerts the pilot if an object is at risk of colliding with the main wing. This system is designed to enhance aircraft safety by providing real-time information to the pilot about potential collisions, allowing them to take appropriate action to avoid an accident.

The patent describes how the laser rangefinders scan the airspace around the aircraft, generating data on the distance and location of nearby objects. This information is then processed by the detection circuit, which can identify if an object poses a collision risk to the aircraft's main wing. If a potential collision is detected, the system is expected to alert the pilot, giving them the opportunity to maneuver the aircraft and avoid the obstacle.

This innovation is part of the broader Airborne Collision Avoidance System (ACAS) market, which encompasses various technologies and systems designed to enhance the safety of air travel. The ACAS market is driven by the increasing focus on aviation safety, advancements in technology, and regulatory requirements. General Dynamics' patent represents an important contribution to this field, providing a new tool for pilots to detect and avoid mid-air collisions.

Market Segmentation

The airborne collision avoidance system market is segmented into platform, component, type, sales channel, and region. On the basis of platform, the market is divided into fixed wing, rotary wing, and unmanned aerial vehicle (UAV) . As per component, the market is segregated into Processor, Mode S & C Transponder, and Display Unit. By type, it is classified into ACAS I & TCAS I, ACAS II & TCAS II, Portable Collision Avoidance System (PCAS) , and FLARM. By sales channel, it is categorized into Original Equipment Manufacturer (OEM) , and Aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The airborne collision avoidance system (ACAS) in the U.S. plays a crucial role in enhancing aviation safety. Over the past decade, the implementation of ACAS, particularly the TCAS II, has contributed to a 60% reduction in mid-air collision risks. Currently, more than 6, 000 commercial aircraft in the USA are equipped with ACAS, ensuring compliance with stringent FAA regulations. These systems are mandated for all commercial aircraft with more than 30 seats or a maximum takeoff weight of over 33, 000 pounds. In 2020, the FAA reported 30, 000 resolution advisories (RAs) generated by ACAS, highlighting its critical role in preventing potential collisions. Additionally, the GAO reported that the overall number of fatal mid-air collisions in the USA has decreased by 50% since the widespread adoption of ACAS. The increasing air traffic, with over 30, 000 flights operating daily in the US airspace, underscores the importance

- In November 2023, Thales Group expanded its footprint in India with a second office in Bengaluru. This facility reaffirms India as a strategic hub for Thales' innovation and growth. Thales strengthens its commitment to the Indian government's Aatmanirbhar Bharat vision. The new office, an extension of the Engineering Competence Centre (ECC) inaugurated in 2019, will support Thales' ambitious growth plans, aiming to double its engineering staff in India to over 1, 000 by 2027.

- In February 2024, Malaysia Airlines partnered with Thales to enhance its flight management and surveillance capabilities. Twenty Airbus A330neo aircraft equipped with Thales’ Flight Management System (FMS) and ACSS’ Traffic Collision Avoidance Systems (T3CAS®) . This optimal pairing offers innovative solutions for navigating challenging routes and ensuring passenger safety. This contract marks Malaysia Airlines' first selection of Thales’ Flight Management and Surveillance systems, underscoring the national carrier's commitment to advanced aviation technology.

Competitive Landscape

The major players operating in the airborne collision avoidance system market include BAE Systems Plc, FLARM Technology Ltd, Garmin Ltd, Honeywell International Inc, L 3 Technologies, Inc, Lockheed Martin Corporation, QinetiQ Group Plc, Rockwell Collins Inc., SAAB Group, and Thales Group.

Other players in airborne collision avoidance system market includes Leonardo S.p.A., General Electric Company (GE Aviation) , Boeing Company (Boeing Avionics) , and Airbus S.A.S.

Industry Trends

- In February 2021, Saab took the helm in leading the development of detect and avoid capabilities for remotely piloted aircraft systems in Europe. The European Commission has chosen the EUDAAS (European Detect and Avoid System) consortium, with Saab as the primary partner. This selection is part of the European Defence Industrial Development Programme, aimed at enhancing the capabilities of large military RPAS.

- In December 2022, MITRE and its collaborators developed and evaluated a novel airborne collision avoidance system, marking a significant stride in advancing innovation for unmanned aircraft systems (UAS) . Their groundbreaking work garnered the esteemed R&D100 innovation award, recognizing the system's pivotal contribution to enhancing UAS development and safety.

Key Sources Referred

- Federal Aviation Administration (FAA)

- European Union Aviation Safety Agency (EASA)

- International Civil Aviation Organization (ICAO)

- IATA (International Air Transport Association)

- GAMA (General Aviation Manufacturers Association)

- Aerospace Industries Association (AIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airborne collision avoidance system market analysis from 2024 to 2033 to identify the prevailing airborne collision avoidance system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airborne collision avoidance system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airborne collision avoidance system market trends, key players, market segments, application areas, and market growth strategies.

Airborne Collision Avoidance System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.0 Billion |

| Growth Rate | CAGR of 3.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Platform |

|

| By Component |

|

| By Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Garmin Ltd, Honeywell International Inc, Thales Group, BAE Systems Plc, FLARM Technology Ltd, QinetiQ Group Plc, SAAB Group, L3 Technologies, Inc, Lockheed Martin Corporation, Rockwell Collins Inc. |

Integration with Next-Generation Air Traffic Management Systems, Miniaturization and Improved Efficiency of ACAS Components, and Increased Adoption Due to Stricter Regulatory Requirements are the upcoming trends of Airborne Collision Avoidance System Market in the globe

Fixed wing is the leading platform of Airborne Collision Avoidance System Market

North America is the largest regional market for Airborne Collision Avoidance System

The estimated industry size of Airborne Collision Avoidance System is $ 1.01 billion in 2033

Processor is the leading component of Airborne Collision Avoidance System Market

Loading Table Of Content...