Aircraft Accessory Gearbox Market Research, 2033

The global aircraft accessory gearbox market was valued at $1.2 billion in 2023, and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Report Key Highlighters

- The aircraft accessory gearbox market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2022 to 2032.

- The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the aircraft accessory gearbox market.

- The aircraft accessory gearbox market share is marginally fragmented, with players such as Safran, Liebherr Group, The Timken Company, Triumph Group, Inc., Bharat Forge, Regal Rexnord Corporation, Northstar Aerospace, Collins Aerospace, General Electric Company, Kawasaki Heavy Industries, Ltd., and Aero Gear Inc. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Definition and Introduction

The aircraft accessory gearbox (AGB) is a key part of the engine that powers and controls essential systems. It drives components like the starter generator, fuel pump, fuel control unit, and Ng tachometer. In some aircraft, it also supports the air conditioning system. The AGB helps ensure smooth engine operation by distributing power to these critical accessories.

The rise in demand for air travel globally is one of the primary drivers for the growth of the aircraft accessory gearbox industry. Increasing passenger traffic leads to higher demand for new aircraft, which in turn drives the need for reliable and efficient aircraft accessory gearboxes. According to the International Air Transport Association (IATA), global air traffic is expected to continue growing, necessitating the expansion of airline fleets. The growing emphasis on fuel efficiency and reduced emissions is also contributing to a rise in demand for advanced aircraft accessory gearboxes. Modern aircraft are designed with more efficient propulsion systems that require optimized gearbox solutions to ensure seamless power transmission and enhanced performance. Manufacturers are focusing on developing lightweight and high-performance gearboxes to meet the evolving requirements of the next-generation aircraft cables.

Market Dynamics

Rise in need for new generation engines and transmission units

Rise in demand for new aircraft is driving the need for next-generation engines and advanced transmission systems, including aircraft accessory gearboxes (AGBs). These gearboxes play a key role in enhancing engine efficiency, reducing fuel consumption, and improving overall aircraft performance, making them essential for modern aviation. Modern aircraft are being designed with more efficient propulsion systems, including high-bypass turbofan engines, geared turbofans, and hybrid-electric powertrains, all of which require sophisticated transmission solutions to optimize power distribution. These advancements are directly contributing to the growth of the aircraft accessory gearbox market, as next-generation engines demand high-performance gearboxes capable of withstanding higher loads, reducing weight, and improving overall efficiency. In addition, airlines and military operators focus on upgrading their fleets with technologically advanced aircraft, the demand for durable and lightweight accessory gearboxes is expected to rise. This trend is further supported by ongoing investments in research and development aimed at enhancing gearbox design, materials, and manufacturing processes, ensuring that they meet the evolving needs of modern aviation.

In 2024, Rolls-Royce successfully initiated the flight test campaign for its latest business aviation engine, the Pearl 10X. The ground development program included rigorous testing of the new ultra-low emissions ALM combustor, which was compatible with 100% Sustainable Aviation Fuel (SAF), along with a new accessory gearbox that allowed for higher additional power extraction. The engine surpassed its target thrust levels during its initial test run and became the most powerful business aviation engine in the Rolls-Royce portfolio.

Technical issues associated with aircraft accessory gearbox

Aircraft accessory gearboxes can experience various issues that affect their performance and longevity, including spalling, frosting, and manufacturing defects. Spalling occurs when the surface of the gearbox components, such as gears and bearings, deteriorates due to excessive stress, leading to material flaking and reduced efficiency. Frosting is another concern, were microscopic surface damage results from continuous friction and inadequate lubrication, potentially causing premature wear. In addition, manufacturing defects, such as improper heat treatment, machining errors, or material inconsistencies, can compromise the durability and reliability of gearbox components. These issues can lead to increased maintenance costs, reduced operational efficiency, and potential safety risks, making regular inspections and advanced manufacturing techniques crucial for ensuring gearbox performance and longevity.

Increasing integration of aircraft accessory gearbox in airframe

Modern aircraft are incorporating lightweight, high-performance gearboxes that seamlessly integrate with airframe structures to optimize power transmission and enhance overall efficiency. This trend is particularly evident in nextgeneration commercial and military aircraft, where accessory gearboxes play a crucial role in powering hydraulic pumps, generators, and other essential systems. Also, as aircraft manufacturers focus on reducing weight and improving fuel efficiency, the demand for compact and advanced gearbox solutions is rising. The growing adoption of hybrid-electric propulsion systems and unmanned aerial vehicles (UAVs) further accelerates market expansion, creating significant opportunities for gearbox manufacturers to develop innovative, high-performance solutions that align with the evolving needs of the aerospace industry. Such factors will create lucrative growth opportunities for the aircraft accessory gearbox market growth.

Segment Review

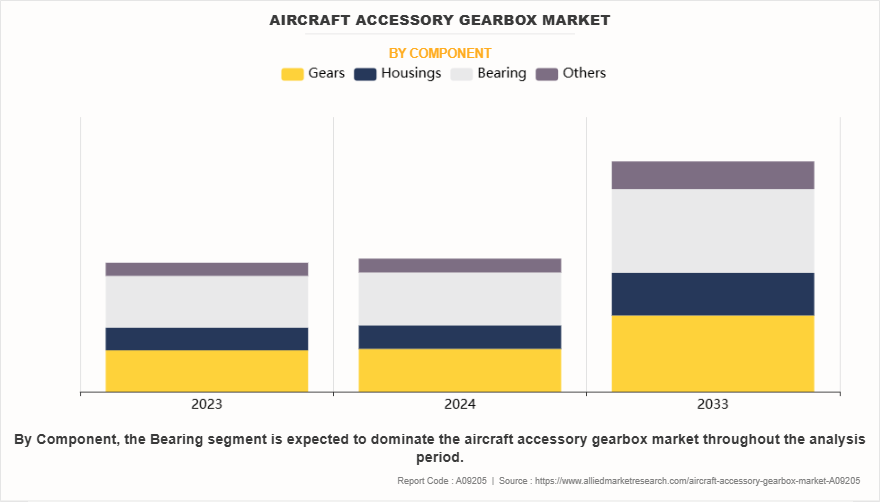

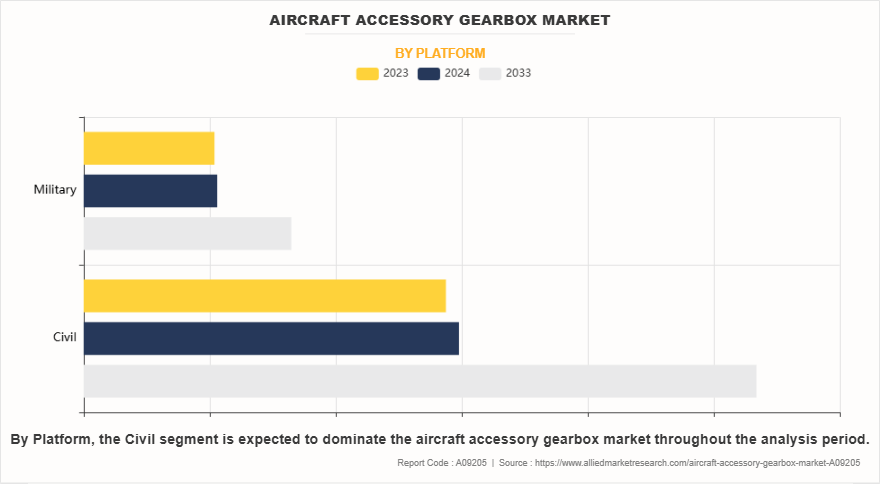

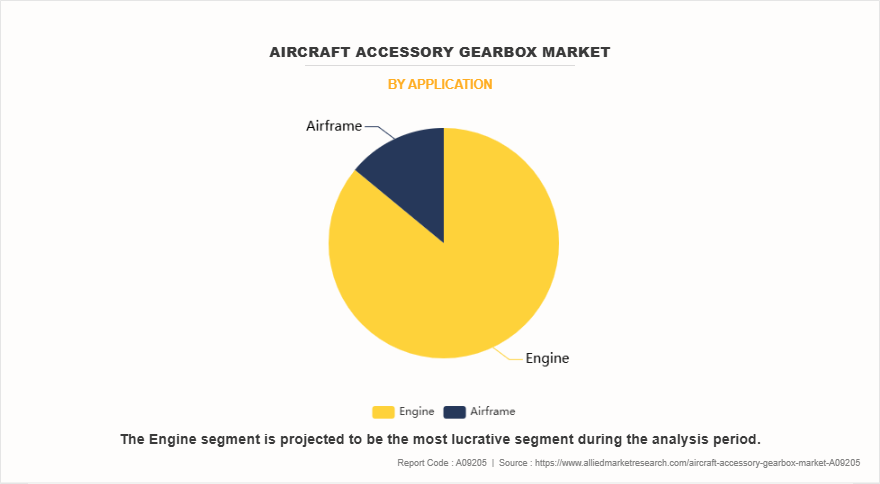

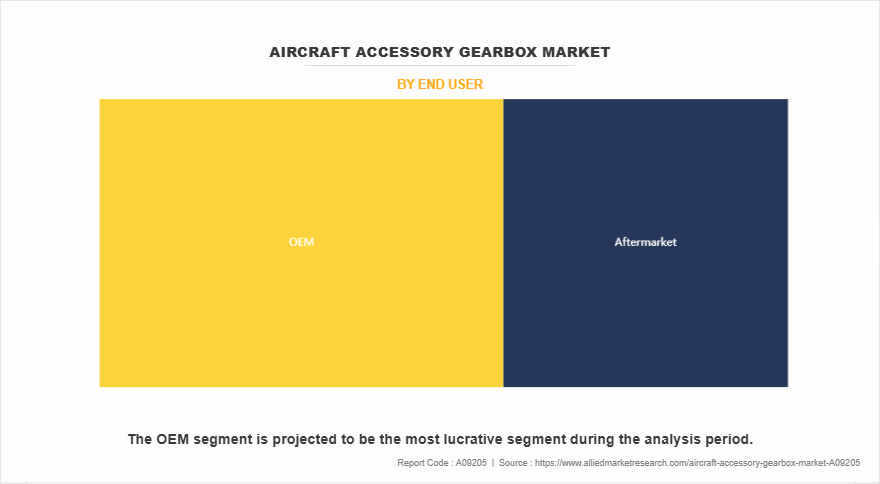

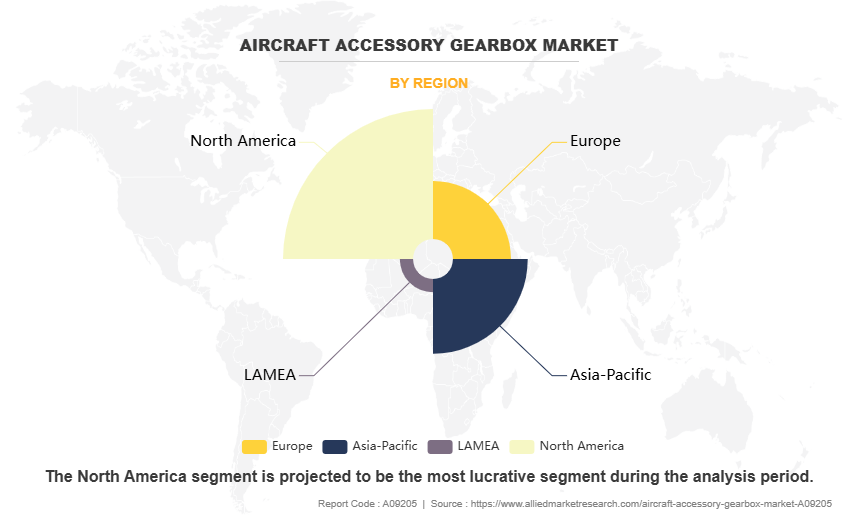

The aircraft accessory gearbox market segmentation is segmented into platform, component, application, end user, and region. By platform, the market is divided into civil and military. On the basis of component, the market is classified into gears, housings, bearing, and others. By application, the market is divided into engine and airframe. By end user, the market is divided into OEM and aftermarket. Region-wise, the aircraft accessory gearbox market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Region-wise, the aircraft accessory gearbox market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America segment generated the largest share in 2023. This dominance is driven by the presence of major aircraft manufacturers, engine OEMs, and key gearbox suppliers in the region. Strong investments in aviation infrastructure, technological advancements, and next-generation aircraft programs have further boosted market growth.

Competitive Analysis

Competitive analysis and profiles of the major global aircraft accessory gearbox market players that have been provided in the report include Safran, Liebherr Group, The Timken Company, Triumph Group, Inc., Bharat Forge, Regal Rexnord Corporation, Northstar Aerospace, Collins Aerospace, General Electric Company, Kawasaki Heavy Industries, Ltd., and Aero Gear Inc. The key strategies adopted by the major players of the global aircraft accessory gearbox market are product launch and mergers & acquisitions.

Top Impacting Factors

The global aircraft accessory gearbox market demand is expected to witness notable growth registering a CAGR of 6.28% from 2024 to 2033. The aircraft accessory gearbox market is expected to witness notable growth owing to rise in need for new generation engines and transmission units, growing adoption of lightweight aircraft components and increasing military expenditure and spending. Moreover, increasing integration of aircraft accessory gearbox in airframe and surge in aircraft fleet and technological advancements are expected to provide lucrative aircraft accessory gearbox market opportunities during the forecast period. On the contrary, technical issues associated with aircraft accessory gearbox and stringent aircraft components regulation limit the growth of the aircraft accessory gearbox market.

Historical Data & Information

The global aircraft accessory gearbox market is competitive, owing to the strong presence of existing vendors. Vendors in the global aircraft accessory gearbox market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in Aircraft Accessory Gearbox Market

- In July 2023, Regal Rexnord Corporation invested $13.5 million to open state-of-the-art manufacturing plant, located in the Bafar industrial and technological park, Mexico. Through this expansion, it focusses on producing critical components for aerospace safety, including connection mechanisms for the aerospace industry and helicopter stabilizers.

- In July 2024, General Electric Company, through its subsidiary GE Aerospace, signed a contract to provide the Auxiliary Gearbox for Triumph Group, Inc. The gearbox is majorly used in F404 after burning turbofan engine with potential future use on multiple applications, including the T7-A, T-50, and TAI Hurjet platforms.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global aircraft accessory gearbox market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global aircraft accessory gearbox market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2033 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in satellite services.

- The report includes the market share of key vendors and the global market.

Aircraft Accessory Gearbox Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 336 |

| By Component |

|

| By Platform |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | General Electric Company, Liebherr Group, Aero Gear Inc., The Timken Company, Kawasaki Heavy Industries, Ltd., Triumph Group, Safran, Bharat Forge, Regal Rexnord Corporation, Collins Aerospace, Northstar Aerospace |

Engine is the leading application of aircraft accessory gearbox market.

The upcoming trends of aircraft accessory gearbox Market include rise in need for new generation engines and transmission units, growing adoption of lightweight aircraft components.

North America is the largest regional market for aircraft accessory gearbox.

The aircraft accessory gearbox market was valued at $1.1 billion in 2023.

Safran, Liebherr Group, The Timken Company, Triumph Group, Inc., Bharat Forge, Regal Rexnord Corporation are the top companies to hold the market share in aircraft accessory gearbox.

Loading Table Of Content...

Loading Research Methodology...