Aircraft Battery Market Research, 2033

The global aircraft battery market size was valued at $531.9 million in 2023, and is projected to reach $2 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033.

An aircraft battery is a crucial component that provides electrical power for starting the engines, supplying emergency backup power, and supporting essential systems when the main power sources are unavailable. Typically, aircraft batteries are either lead-acid or nickel-cadmium, with lithium-ion variants gaining popularity due to their lightweight and high energy density. These batteries help power avionics, lighting, and communication systems during ground operations and in-flight emergencies. They also play a role in stabilizing voltage and absorbing power fluctuations. Proper maintenance, including regular inspections and capacity testing, is essential to ensure reliability and safety.

Key Takeaways

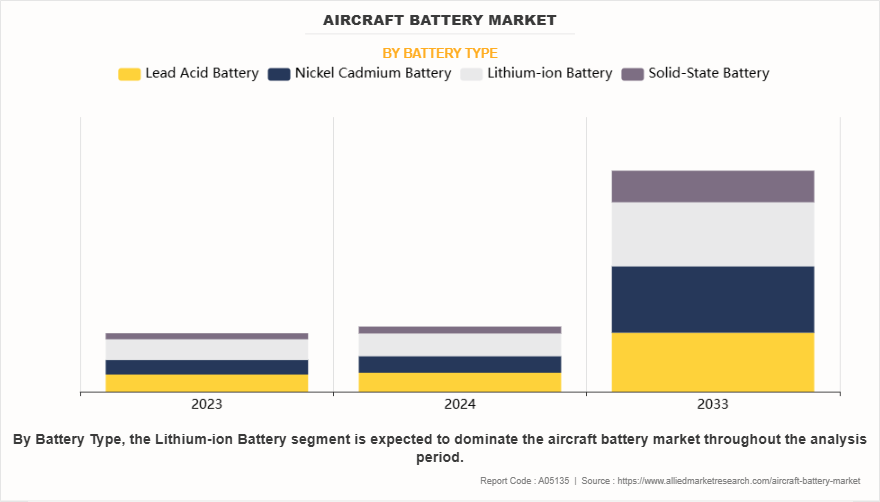

- On the basis of battery type, the lithium-ion battery segment held the largest share in the aircraft battery market in 2023.

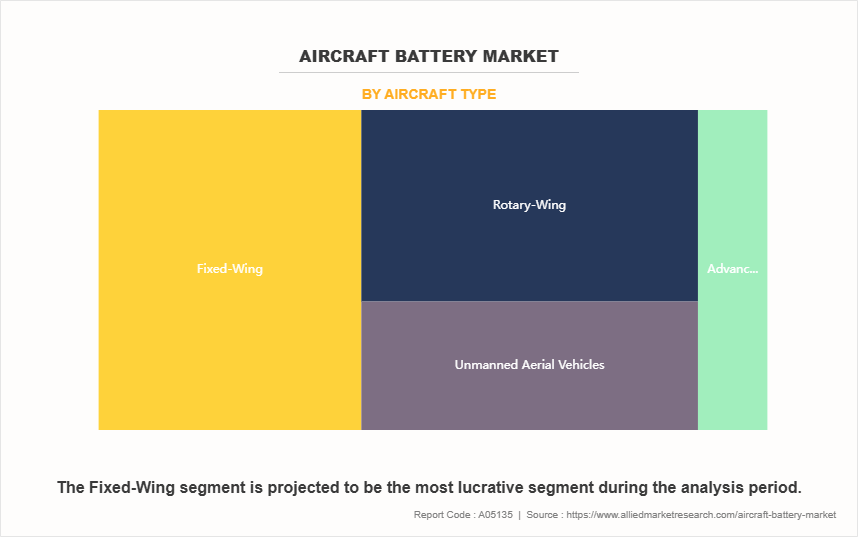

- By aircraft type, the fixed-wing segment was the major shareholder in 2023.

- By sales channel, the OEM segment dominated the market, in terms of share, in 2023.

- On the basis of application, the auxiliary power unit segment dominated the market, in terms of share, in 2023.

- Region wise, North America held the largest market share in 2023.

In addition, over time, factors such as temperature extremes, discharge cycles, and improper charging can affect battery performance. Modern aircraft use advanced battery management systems to monitor voltage, temperature, and charge levels, enhancing operational efficiency. The selection of an aircraft battery depends on factors like aircraft type, power requirements, and regulatory standards to ensure optimal performance and safety.

For instance, in January 2025, Upgrade Energy partnered with Amprius to develop high-energy-density battery packs for drone operations, focusing on extending flight endurance and improving operational efficiency. Through this partnership, Amprius utilizes advanced silicon anode technology; these batteries provide higher energy storage and faster charging. Similar to aircraft batteries, they enhance power reliability, ensuring stable performance for critical applications in commercial and industrial drone operations.

Moreover, in March 2023, BAE Systems partnered with Heart Aerospace to develop a battery system for the ES-30 regional electric airplane, focusing on advancing energy efficiency and sustainable aviation. This partnership aims to optimize battery performance, ensuring reliable power for extended regional flights while supporting the aviation industry's shift toward lower-emission, energy-efficient air travel solutions.

The rise in demand for electric and hybrid-electric aircraft is driving significant growth in the aircraft battery market share. As the aviation industry shifts toward sustainable solutions, airlines and manufacturers are investing in advanced battery technologies to power next-generation aircraft. Hybrid-electric systems require high-performance batteries for energy storage, engine start, and backup power, increasing market demand. Regulatory pressure to reduce carbon emissions and advancements in battery efficiency are accelerating adoption. The expansion of urban air mobility, including eVTOL aircraft and electric regional planes, further boosts battery requirements, making energy-dense, lightweight, and reliable battery solutions essential for future aviation. Furthermore, advancement in battery technology and rise in demand for commercial and military aircraft have driven the demand for aircraft battery market growth.

However, high initial costs are restraining the growth of the aircraft battery market, as advanced battery technologies require significant investment in research, development, and production. The cost of raw materials, such as lithium and nickel, along with complex manufacturing processes, increases overall expenses. Stringent certification requirements add to development costs, making adoption challenging for smaller operators. Airlines and manufacturers face financial constraints in transitioning to electric and hybrid-electric aircraft, slowing battery demand despite growing interest in sustainable aviation solutions. Moreover, limited energy density is major factors that hamper the growth of the aircraft battery market trends.

On the contrary, the development of solid-state batteries presents a lucrative opportunity for the aircraft battery market by offering higher energy density, improved safety, and longer lifespan compared to traditional lithium-ion batteries. These batteries eliminate liquid electrolytes, reducing the risk of thermal runaway and enhancing reliability in aviation applications. Their lightweight design supports the growing demand for electric and hybrid-electric aircraft, enabling extended flight range and efficiency. As research advances and production costs decrease, solid-state batteries are expected to revolutionize aircraft energy storage, driving innovation and sustainability in the aviation industry.

Segment Review

The global aircraft battery market is segmented on the basis of battery type, aircraft type, sales channel, application and region. On the basis of battery type, the market is segmented into lead acid battery, nickel cadmium battery, lithium-ion battery, and solid-state battery. By aircraft type, the market is divided into fixed-wing, rotary-wing, unmanned aerial vehicles, and advanced air mobility. On the basis of sales channel, the market is bifurcated into OEM, and sales channel. By application, the market is divided into auxiliary power unit, emergency power, propulsion, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Battery Type

On the basis of battery type, the lithium-ion battery segment attained the highest market share in 2023. This is due to its high energy density, lightweight properties, and longer cycle life compared to traditional lead-acid and nickel-cadmium batteries. These batteries offer improved power efficiency, faster charging, and better performance, making them ideal for modern aircraft, including electric and hybrid-electric models. The growing demand for sustainable aviation and advancements in battery management systems have further accelerated their adoption, solidifying their dominance in the market.

By Aircraft Type

On the basis of aircraft type, the fixed-wing segment acquired the highest market share in 2023. This is due the growing demand for commercial, military, and general aviation aircraft. The increasing adoption of electric and hybrid-electric aircraft further contributed to the demand for advanced battery solutions, enhancing energy efficiency and reducing emissions. Technological advancements in lithium-ion and solid-state batteries have improved energy density and performance, supporting longer flight durations and operational reliability. Rise in air passenger traffic and fleet expansion by airlines worldwide have fueled the need for efficient power storage solutions, solidifying the fixed-wing segment's dominance in the aircraft battery market.

By Region

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the aircraft battery market. This is due to the presence of major aircraft manufacturers, such as Boeing, and leading battery technology providers. Strong defense investments, a well-established aviation industry, and the early adoption of electric and hybrid-electric aircraft further drive demand. Strict regulatory standards and increasing R&D initiatives for sustainable aviation solutions contribute to market dominance, making North America a key region for aircraft battery advancements and large-scale adoption.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to rising air travel demand, increasing airline fleet expansion, and strong government initiatives for sustainable aviation. Countries such as China, India, and Japan are investing heavily in electric and hybrid-electric aircraft development. growing defense budgets and the expanding unmanned aerial vehicle (UAV) sector further fuel market growth. Rapid technological advancements, coupled with increasing foreign investments in aviation infrastructure, contribute to the region’s accelerated adoption of advanced battery solutions.

The report focuses on growth prospects, restraints, and trends of the Aircraft Battery market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Aircraft Battery market.

Competitive Analysis

The report analyzes the profiles of key players operating in the aircraft battery market such as Concorde Battery Corporation, Teledyne Technologies Incorporated, Saft Groupe SAS, GS Yuasa Group, HBL Power Systems Limited, AMETEK, Inc., Eagle-Picher, Boeing, Airbus, and EnerSys. These players have adopted various strategies to increase their market penetration and strengthen their position in the aircraft battery market.

Rise in Demand of Electric and Hybrid-Electric Aircraft

The rise in demand for electric and hybrid-electric aircraft is significantly driving growth in the aircraft battery market demand. As the aviation industry moves toward sustainability, airlines and manufacturers are increasingly investing in advanced battery technologies to power next-generation aircraft. Electric and hybrid-electric aircraft rely on high-performance batteries for energy storage, propulsion support, and backup power, creating a surge in demand. For instance, in November 2024, Electra launched its EL9 ultra-short hybrid-electric aircraft, integrating advanced battery and hybrid propulsion technology to enhance efficiency and sustainability. The aircraft utilizes high-performance batteries alongside fuel-based systems to enable short takeoff and landing capabilities, making it ideal for urban and regional air mobility. By leveraging advanced aircraft battery solutions, Electra aims to reduce emissions, improve energy efficiency, and support the transition to cleaner, more accessible aviation solutions. Moreover, the expansion of urban air mobility, including eVTOL aircraft and electric regional planes, further increases battery requirements. Technological advancements in lithium-ion and solid-state batteries enhance energy density, reliability, and safety, making them ideal for modern aviation applications. As research and development efforts continue to improve battery performance, the aircraft battery market is expected to grow, supporting the broader shift toward cleaner and more efficient air transportation solutions.

Advancement in Battery Technology

Advancements in battery technology are significantly driving demand in the aircraft battery industry by improving energy density, efficiency, and safety. Modern lithium-ion and emerging solid-state batteries offer higher power output with reduced weight, making them ideal for electric and hybrid-electric aircraft. These innovations enhance aircraft performance by enabling longer flight durations, faster charging, and increased reliability. For instance, in 2023, Safran Electrical & Power partnered with Cuberg to develop an advanced aviation energy storage system, aiming to enhance battery performance for future fully electric and hybrid aircraft. This partnership focuses on industrial, technical, and commercial cooperation to improve energy density, safety, and efficiency, supporting the aviation industry's transition toward sustainable and high-performance electric propulsion solutions.

Moreover, as the aviation industry focuses on reducing carbon emissions, the need for advanced batteries to support electrification is growing. Enhanced battery management systems also improve monitoring, stability, and overall lifespan, making battery-powered aviation more viable. Additionally, research into next-generation materials, such as silicon anodes and solid electrolytes, is further improving battery capabilities. Furthermore, the rise of urban air mobility, including eVTOL and unmanned aerial vehicles, also fuels demand for high-performance batteries. With continuous R&D efforts and regulatory support, battery technology advancements will play a crucial role in shaping the future of sustainable aviation.

Rise in Demand for Commercial and Military Aircraft

The rise in demand for commercial and military aircraft is significantly driving growth in the aircraft battery industry. As global air traffic increases, airlines are expanding their fleets, leading to a higher need for advanced battery systems to support engine starts, emergency backup power, and avionics. The shift toward more-electric aircraft, which rely on batteries for various functions, further boosts demand. In addition, the increasing adoption of hybrid-electric and electric aircraft in commercial aviation is accelerating the need for high-energy-density battery solutions. for instance, in January 2025, BAE Systems expanded its aircraft battery products by supplying advanced battery systems for Airbus' hybrid aircraft project, supporting the development of more efficient and sustainable commercial aircraft. This expansion aims to enhance energy storage capabilities, reduce emissions, and improve fuel efficiency, aligning with the aviation industry's goal of transitioning toward hybrid-electric propulsion for cleaner and more cost-effective air travel.

Moreover, in the military sector, modern aircraft and unmanned aerial vehicles (UAVs) require reliable and efficient power sources for mission-critical operations. Advanced lithium-ion and solid-state batteries are being developed to enhance performance, durability, and safety in extreme conditions. Governments and defense organizations are also investing in battery technology to improve operational efficiency and reduce reliance on traditional fuel sources. This growing demand makes aircraft batteries essential for both commercial and military aviation.

High Initial Cost

High initial costs are a significant challenge hampering the growth of the aircraft battery market. Advanced battery technologies, such as lithium-ion and solid-state batteries, require expensive raw materials, including lithium, nickel, and cobalt, which drive up production costs. In addition, complex manufacturing processes and stringent safety regulations add to the overall expense. Aircraft batteries must meet strict certification requirements, further increasing development and testing costs before they can be integrated into commercial and military aircraft.

Moreover, for airlines and aircraft manufacturers, the high upfront investment in battery technology can be a barrier to large-scale adoption, especially for hybrid-electric and fully electric aircraft. Smaller operators may struggle with affordability, delaying their transition to advanced battery-powered systems. Maintenance and replacement costs remain concerns, as battery lifespan and performance degradation impact long-term cost-effectiveness. Despite these challenges, ongoing research and economies of scale are expected to reduce costs over time, making advanced batteries more accessible.

Limited Energy Density

Limited energy density is a major factor hampering the growth of the aircraft battery market, as current battery technologies struggle to match the energy output of traditional fuel-based systems. Aircraft require high power for extended flight durations, but existing lithium-ion batteries have limitations in storing sufficient energy while maintaining a lightweight structure. The heavier the battery, the more it impacts overall aircraft efficiency and range, making it less viable for long-haul flights.

Moreover, this challenge is particularly critical for commercial and military aviation, where endurance and reliability are essential. Hybrid-electric and fully electric aircraft need advanced battery solutions with higher energy density to compete with conventional propulsion systems. In addition, frequent charging requirements and slow charging speeds add operational constraints. Although solid-state batteries and other next-generation technologies offer potential improvements, their commercial viability is still under development. Until significant advancements are made, limited energy density will continue to restrict widespread battery adoption in aviation.

Development of Solid-state Batteries

The development of solid-state batteries presents a lucrative opportunity for the aircraft battery market by addressing key limitations of existing battery technologies. Solid-state batteries offer significantly higher energy density, improved safety, and longer lifespan compared to traditional lithium-ion batteries. By replacing liquid electrolytes with solid materials, these batteries reduce the risk of thermal runaway and fire hazards, making them ideal for aviation applications where safety and reliability are critical. For instance, in April 2024, Amprius Technologies, a leader in next-generation lithium-ion batteries with its Silicon Anode Platform, partnered with Stafl Systems to deliver high-performance battery solutions for unmanned aerial vehicles (UAVs) and urban air mobility (UAM). Under this alliance, Amprius will supply its advanced SiCore™ battery cells, while Stafl Systems will integrate them into innovative battery packs. This partnership aims to drive innovation, expand market reach, and accelerate the adoption of next-generation battery technology in advanced aerial applications.

In addition, to enhanced safety, solid-state batteries are lighter and more compact, allowing aircraft to achieve greater efficiency and extended flight range. This makes them a promising solution for hybrid-electric and fully electric aircraft, as well as unmanned aerial vehicles (UAVs) and urban air mobility (UAM) applications. As research and development efforts accelerate, advancements in manufacturing and cost reduction will further drive adoption. The potential for increased performance and sustainability makes solid-state battery technology a key driver for the future of electric aviation.

Expansion of Electric and Hybrid Aircraft

The expansion of electric and hybrid aircraft presents a lucrative opportunity for the aircraft battery market, as the aviation industry increasingly focuses on sustainability and fuel efficiency. Airlines and manufacturers are investing in hybrid-electric and fully electric propulsion systems to reduce carbon emissions and operating costs. This shift drives demand for advanced battery technologies that offer high energy density, improved safety, and longer lifespan. For instance, in June 2024, magniX launched a revolutionary battery line designed to enhance the performance and feasibility of electric aviation. This new battery technology aims to provide higher energy density, improved efficiency, and longer flight range, addressing key challenges in electric aircraft development. By advancing battery capabilities, magniX seeks to accelerate the adoption of sustainable aviation solutions and support the transition to zero-emission air travel.

Moreover, electric and hybrid aircraft, including regional planes, eVTOLs, and unmanned aerial vehicles (UAVs), rely on efficient battery systems for propulsion, energy storage, and auxiliary power. As regulatory bodies push for greener aviation solutions, the need for reliable and lightweight battery solutions continues to grow. in addition, advancements in solid-state and lithium-ion battery technology are making electric aviation more feasible. With increasing R&D efforts and investments in battery innovation, the expansion of electric and hybrid aircraft is expected to create significant growth opportunities in the aircraft battery market forecast.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft battery market analysis from 2023 to 2032 to identify the prevailing aircraft battery market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Aircraft Battery market segmentation assists to determine the prevailing market opportunities.

Aircraft Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 459 |

| By Battery Type |

|

| By Aircraft Type |

|

| By Sales Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | Boeing, Eagle-Picher, Ametek, Inc., Saft Groupe SAS, HBL Power Systems Limited, Concorde Battery Corporation, AIRBUS, EnerSys, GS Yuasa Group, Teledyne Technologies Incorporated |

The global aircraft battery market is growing due to advancements in electric and hybrid-electric aircraft, rising demand for lightweight, high-energy-density batteries, and the shift to lithium-ion technology. Increased UAV adoption, solid-state battery research, improved thermal management, and a focus on sustainable aviation, including battery recycling, are key trends.

Auxiliary Power Unit is the leading application of Aircraft Battery Market

North America is the largest regional market for Aircraft Battery

$2012 million is the estimated industry size of Aircraft Battery

Concorde Battery Corporation, Teledyne Technologies Incorporated, Saft Groupe SAS, GS Yuasa Group, HBL Power Systems Limited, AMETEK, Inc., Eagle-Picher, Boeing, Airbus, and EnerSys.

Loading Table Of Content...

Loading Research Methodology...