Aircraft Electric Motor Market Overview, 2032

The aircraft electric motor market size was valued at $6,475.0 million in 2022 and is estimated to reach $14,483.9 million by 2032, exhibiting a CAGR of 8.5% from 2023 to 2032. An aircraft electric motor is a type of electric motor specifically designed for use in aircraft propulsion systems. It converts electrical energy into mechanical energy to drive the aircraft's propellers or rotors. Aircraft electric motors are a key component of electric propulsion systems, which aim to reduce reliance on traditional combustion engines and transition to cleaner and more sustainable aircraft technologies. The aircraft electric motor market is driven by factors such as the surge in regulations on carbon emissions and environmental sustainability, advancements in electric motor technology, and government policies, incentives, and funding programs for aircraft services and replacement. However, the limited range and infrastructure and charging network of aircraft electrical systems hamper the aircraft electric motor market growth. Moreover, the rise of urban air mobility and air taxi services and regional and short-haul aviation create lucrative growth opportunities for the aircraft electric motor market.

Report Key Highlighters:

- The aircraft electric motor market study covers 14 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the aircraft electric motor market.

- The aircraft electric motor industry is highly fragmented, with several players including Ametek, Inc., EMRAX D.O.O., H3X Systems and Motors, Maxon, MGM Compro, Moog Inc., MagniX, Safaran, Woodward, Inc. and Windings Inc. Also tracked key strategies such as acquisitions, product launches, mergers, expansion, etc. of the players operating in the market.

In addition, there is a rise in awareness and concern about environmental issues in the aviation industry. This aircraft electric motor market trend has pushed the adoption of electric propulsion systems powered by electric motors as a means to reduce carbon emissions and improve sustainability. Rapid advancements in electric motor technology, battery technology, and power management systems drive the efficiency and performance of electric propulsion systems. These advancements contribute to market growth and the adoption of electric motors in aircraft. The aircraft electric motor market is segmented on the basis of type, output, application, and region.

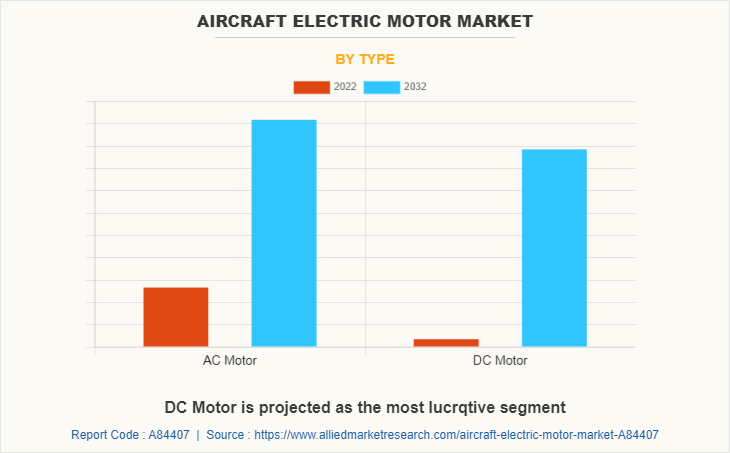

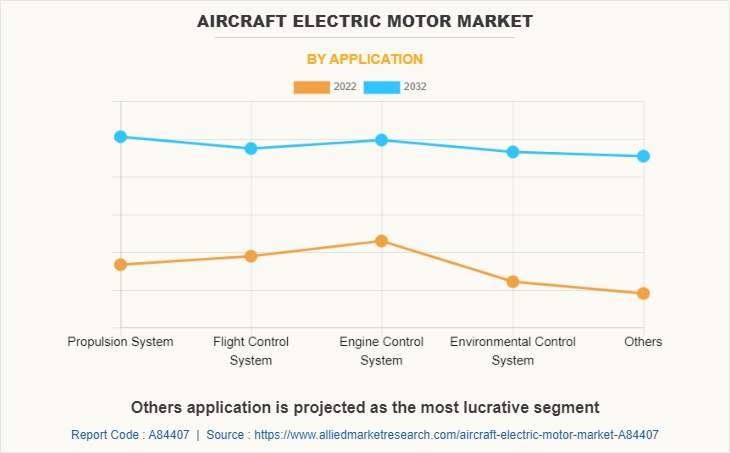

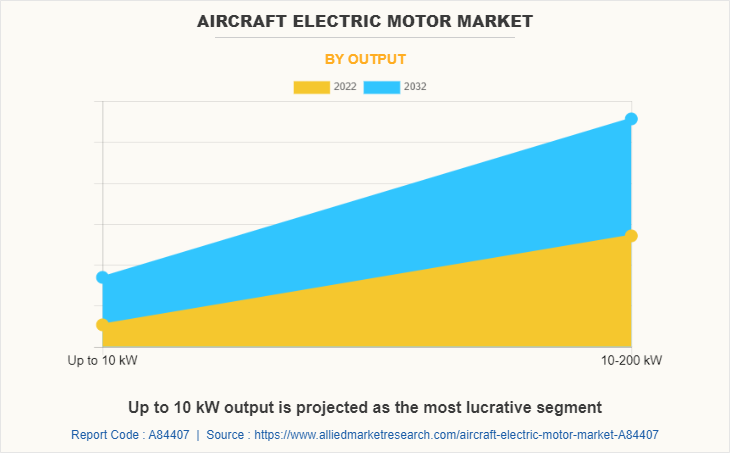

By type, the market is bifurcated into AC motors and DC motors. By output, the market is classified into Up to 10 kW and 10-200 kW. By application, the market is categorized into propulsion system, flight control system, engine control system, environmental control system, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region.

North America includes countries such as the U.S., Canada, and Mexico. The presence of major aviation companies in the region and the rise in demand for aircraft propel the growth of the aircraft electric motor market in North America during the forecast period. In addition, increasing electrification in aircraft propels the aircraft electric motor market share in the electric motor industry. This trend signifies the growing demand for electric motors specifically designed for aviation applications as the aviation industry embraces electric propulsion systems. The aircraft electric motor market is witnessing significant growth due to its crucial role in achieving greater efficiency, reduced emissions, and improved sustainability in the aviation sector.

The aviation industry has been actively exploring electric propulsion systems to reduce emissions and improve fuel efficiency. The surge in focus on sustainable aviation and the need to comply with environmental regulations drive the demand for electric motors in aircraft. For instance, MagniX and Harbour Air conducted the world's first successful flight of an all-electric commercial aircraft. The seaplane, a de Havilland DHC-2 Beaver, was retrofitted with an electric motor developed by magniX, replacing the original internal combustion engine. In addition, governments and regulatory bodies in North America have been implementing policies and offering incentives to encourage the adoption of electric aviation technologies. These measures include research funding, tax credits, and grants, which create favorable aircraft electric motor market conditions and encourage investments in the aircraft electric motor sector.

Key Developments

The leading aircraft electric motor market manufacturers are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In May 2022, Safran entered into a partnership with TCab Tech to equip the E20 full-electric eVTOL aircraft with ENGINeUS electric smart motors. The ENGINeUS product line includes a broad range of electric motors with power outputs from single digits to 500 kW.

- In September 2021, Wright Electric developed a 2 MW (~2,700 horsepower) motor for electric aircraft. It has a high-performance thermal system and operates at a higher voltage than normal for aerospace.

- In June 2021, MagniX developed two powerful electric motor MAGNI350 & 650 for high altitude aircraft. The motors operate at 2,300 rpm or less and are designed for 30,000 feet of altitude in unpressurized environments.

- In April 2021, Safran entered into an agreement with Bye Aerospace to equip eFlyer all-electric aircraft with ENGINeUS electric smart motors. The ENGINeUS includes electric motors with power outputs from up to 500 kW.

Environmental Regulations and Emissions Reduction

The aviation industry is increasingly focused on reducing carbon emissions and achieving sustainability goals. Electric motors offer a greener alternative to traditional combustion engines, as they have zero emissions during operation. This driver is exemplified by the ZeroAvia project, which aims to develop hydrogen-electric powertrains for commercial aircraft. ZeroAvia's work demonstrates the industry's drive toward sustainable aviation by leveraging electric motors for reduced emissions.

The Pipistrel Veris Electro, the world's first certified electric aircraft, demonstrates the impetus for environmental sustainability. As the Velis Electro flies with electric motors, it has zero carbon footprint, contributing to cleaner, greener aviation. . This driver is fueled by the industry's commitment to reducing the environmental impact of air travel and meeting sustainability targets.

Rise in demand for electrical components in aircraft

The increase in demand for electrical systems in aircraft is driven by increased efficiency, weight savings, and the growth of electrification in aviation. One major factor behind the development of electrical systems in aircraft is the increased efficiency and reliability of these systems. Advances in technology and materials have led to the development of more efficient electrical components, such as generators, motors, and power electronics.

These improvements have made it possible to deliver power to critical systems such as flight control, lighting, and entertainment with greater reliability and efficiency than traditional hydraulic and pneumatic systems. Manufacturers have developed electric motors with higher power outputs to meet the needs of larger. For instance, magniX, an electric aviation company, has developed the magni500, a high-power electric motor capable of delivering up to 750 horsepower. This motor is being used in various electric aircraft projects, including the eBeaver, a fully electric seaplane.

High voltage and thermal issues of aircraft electrical systems

Aircraft electrical motor systems often operate at high voltage levels to achieve efficient power transmission and minimize losses. However, high voltage brings certain challenges, including insulation requirements and electrical arcing risks. Ensuring proper insulation materials and techniques is crucial to prevent electrical breakdown and ensure safe operation. In addition, high-voltage systems require robust electrical protection mechanisms and safety protocols to mitigate the risks associated with high voltages. Effective thermal management strategies, such as cooling systems, heat sinks, and insulation materials with high thermal conductivity, are necessary to maintain optimal motor temperatures. Ensuring proper heat dissipation and managing temperature rise becomes even more critical in high-power electric motor systems. For instance, the E-Fan X is based on the Airbus BAe 146 regional airliner and features a hybrid propulsion system. It replaces one of the four jet engines with an electric motor powered by a battery pack and a gas turbine generator. The electric motor provides additional thrust during takeoff and climb, improving fuel efficiency and reducing emissions.

Expansion of alternative power sources

Alternating current (AC) generators are a secondary power source that can supply the electrical energy needed by the avionics equipment on an aircraft. To preserve the safe operation of aircraft and the comfort of the passengers, modern generators supply power to aircraft loads using alternative power sources such as hydrogen cells, biofuel, and other power sources. For instance, in March 2021, Honeywell announced the development of a 1-Megawatt generator power source that runs on aviation biofuel such as Honeywell Green Jet Fuel. The generator can be used to run high-power electric motors in drones, air taxis, and commuter aircraft, or to charge batteries. The equipment on board the aircraft is powered by these electrical generators that use alternate power sources.

For instance, in the Boeing 787 electrical power is used for driving several loads such as the engine starting system, environmental control system (ECS), and wing ice protection instead of the conventional pneumatic bleed system. Owing to the aforementioned causes, the integration of alternative power sources has increased. This development supports the use of aviation electrification technology by enhancing the aircraft's ability to carry more electrical load. The rise in the adoption of alternative power sources for powering multiple aircraft loads provides an opportunity for the growth of the aircraft electric motor market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft electric motor market analysis from 2022 to 2032 to identify the prevailing aircraft electric motor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft electric motor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft electric motor market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Electric Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.5 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Type |

|

| By Application |

|

| By Output |

|

| By Region |

|

| Key Market Players | H3X Technologies Inc., Moog Inc., Wright Electric, SAFRAN, Ametek, Inc., Maxon, MGM COMPRO, Woodward, Inc., EMRAX d.o.o., MagniX Corporation |

The top companies to hold the market share in Aircraft Electric Motor include Ametek, Inc., EMRAX D.O.O., H3X Systems and Motors, Maxon, MGM Compro, Moog Inc., MagniX, Safaran, Woodward, Inc. and Windings Inc.

The global aircraft electric motor market was valued at $6,475 million in 2022, and is projected to reach $14,483 million by 2032, registering a CAGR of 8.5%.

North America is the largest regional market for Aircraft Electric Motor.

By Motor Type, AC Motor is the leading application of Aircraft Electric Motor Market.

An increasing need for cleaner and quieter aircraft, the rise in demand for electrical components in aircraft, the advancement in electric aircraft propulsion systems, high voltage and thermal issues of aircraft electrical systems, and high capital requirements.

Loading Table Of Content...

Loading Research Methodology...