Aircraft Electrical System Market Outlook 2032:

The global aircraft electrical system market size was valued at $16.9 billion in 2022, and is projected to reach $30.7 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032. The aircraft electrical system functions as a network of components dedicated to generating, transmitting, distributing, utilizing, and storing electrical energy. It plays a pivotal role in an aircraft, overseeing the generation, regulation, and dissemination of electrical power throughout the entire aircraft structure. This system encompasses two primary electrical sources: a battery and an alternator or DC generator. The battery serves as the main power source during periods when the engine is inactive, while the alternator or DC generator, powered by the engine, ensures a consistent supply of electricity to operate diverse electrical components and recharge the battery post-engine ignition.

Report Key Highlighters:

The aircraft electrical system market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The aircraft electrical system market share is moderately fragmented, with several players including Safran Group, Amphenol Corporation, General Electric, Collins Aersopace, Astronics Corporation, Crane Aerospace & Electronics, AMETEK.Inc, PARKER HANNIFIN CORP, Thales Group, and Honeywell International Inc. Key strategies such as contract, new product development, partnership, expansion, collaboration, partnership, investment, and other strategies of the players operating in the market are tracked and monitored.

Factors such as increase in demand for air travel, rise in development of electric and hybrid aircraft, and increase in integration of advanced avionics systems drive the the aircraft electrical system market growth. However, high initial investment and development cost, and constraints in the technologies related to aircraft batteries hinder the growth of the market. Furthermore, the increase in demand for lightweight electrical systems, and rise in demand for aircraft modernization and upgrades offer remarkable growth opportunities for the players operating in the aircraft electrical system market.

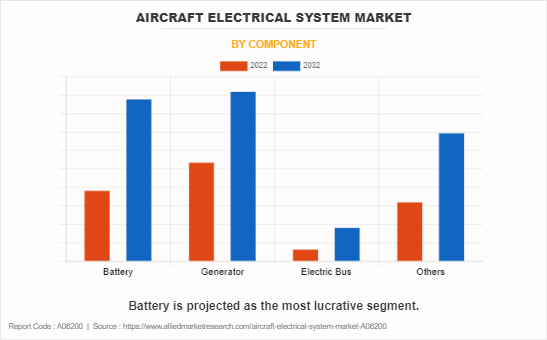

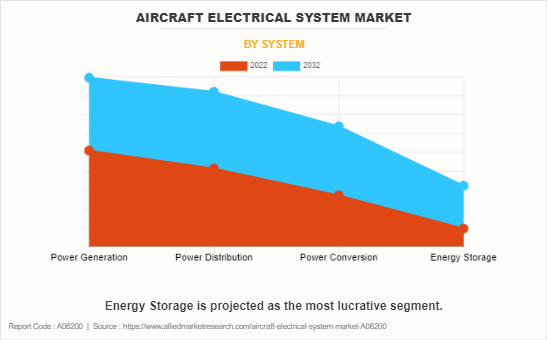

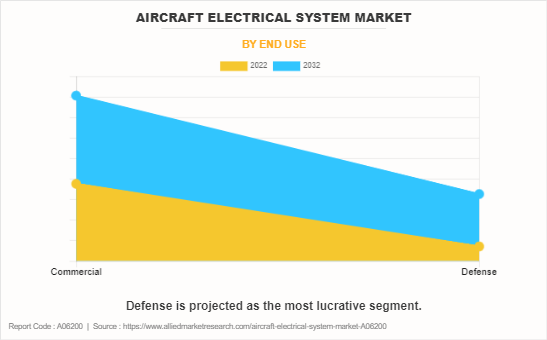

The aircraft electrical system market is segmented on the basis of component, system, end-user and region. By component, it is divided into battery, generator, electric bus, and others. By system, the market is classified into power generation, power distribution, power conversion, and energy storage. By end-user, it is bifurcated into commercial, and defense. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the aircraft electrical system market report include Safran Group, Amphenol Corporation, General Electric, Collins Aersopace, Astronics Corporation, Crane Aerospace & Electronics, AMETEK.Inc, PARKER HANNIFIN CORP, Thales Group, and Honeywell International Inc.

North America comprises U.S., Canada, and Mexico. The escalation in local air traffic is impacting the market for aircraft electrical systems, coinciding with the necessity for more sophisticated aircraft technology, including upgraded electrical and communication systems, among other components. As per the International Air Transport Association (IATA), there was a 75% upswing in passenger traffic in 2021 compared to the previous year, highlighting the demand for advanced aviation technologies.

In addition, there is an expected slowdown in the rise of passenger traffic, although it still exhibits a good trend, increasing by 16.5% from 2022 to 2023. Airlines are expedted to grow their fleets of aircraft to meet the increased demand for passenger and cargo transport due to the spike in air travel. Therefore, such rise in air travel is expected to present numerous opportunities for the growth of the aircraft electrical system market.

Moreover, aerospace companies across the globe form partnerships with electrical system manufacturers in the various countries of the region. For instance, in September 2021, EaglePicher, a U.S. based battery manufacturer was selected by Saab, a Swedish aerospace and defense company to design and produce a 24-volt lithium-ion battery for the Gripen E-series fighter aircraft.

The newly designed 24-volt, 36 amp-hour lithium-ion main and emergency batteries are expected to bring improvements to redundancy and robustness for the Gripen E-series. Therefore, such developments are expected to promote innovation and enhance aircraft performance, which drives the growth of the market during the forecast period.

Increase In Demand For Air Travel

The increase in the economy, the expansion of travel and tourism, enhanced affordability of air travel, and the impact of globalization have collaboratively led to a significant increase in the demand for air transportation services. Data from the International Air Transport Association (IATA) reveals a substantial 55.5% rise in total air traffic, measured in revenue passenger kilometers (RPKs), during February 2023 when compared to the corresponding period in 2022. On a global scale, the volume of traffic exceeded that of February 2019 by 84.9%.

Additionally, Eurostat reports a significant 34.9% increase in the number of passengers flying within the European Union (EU) in 2021, totaling 373 million individuals. This heightened demand is directly impacting the aircraft industry, creating a need for additional aircraft to accommodate the growing number of passengers.

Therefore, the escalating demand for air travel necessitates sophisticated electrical systems for each aircraft to power various components, systems, and avionics. Consequently, the growing demand for air travel serves as a key driver for the aircraft electrical system market, prompting the requirement for advanced and efficient electrical solutions to cater to the evolving needs of modern aviation.

Rise In Development Of Electric And Hybrid Aircraft

The aviation sector is increasingly focusing on sustainable and efficient alternatives to conventional propulsion, driving the surge in electric and hybrid aircraft development. Progress in electric propulsion systems, and lightweight materials empowers manufacturers to create aircraft with lower environmental footprints and operational expenses.

Growing research, financial investments, and industry collaborations foster continuous innovation, expanding the frontiers of electric and hybrid aviation technologies. For instance, in October 2023, a substantial subsidy of about $205 million was allocated for the development of hydrogen fuel cell systems and related equipment. Such initiative aims to support the progress of components essential for electric aircraft, with an aim to reduce carbon dioxide emissions.

Electric and hybrid aircraft utilize electric propulsion systems, generating a need for specific electrical components such as electric motors, power distribution units, and high-voltage systems. The transition from conventional combustion engines to electric propulsion requires advancements in aircraft electrical architectures.

Moreover, numerous companies invest in the development of components for hybrid and electric aircraft electrical systems due to the rise in demand for more sustainable and eco-friendly aviation solutions. For instance, in June 2022, Honeywell International Inc. conducted successful tests on a one-megawatt generator tailored for hybrid electric aircraft. The generator is 280 pounds and gives 97% efficiency with the c capacity to power an entire neighborhood block. With its compact design, low weight, and fuel efficiency, it is expected to offer sustainable benefits for hybrid-electric propulsion.

In addition, electric and hybrid aircraft demand effective energy storage solutions such as advanced batteries or hybrid power systems. Therefore, there is a surge in the development and delivery of state-of-the-art energy storage technologies specifically designed to meet the distinct needs of electric aviation. Such developments are expected to drive the growth of the aircraft electrical system market during the forecast period.

High Initial Investment And Development Cost

The development and testing of aircraft electrical systems necessitates thorough research and development endeavors. The expenses linked to the creation, testing, and enhancement of novel technologies significantly increase the overall investment. Aircraft electrical systems frequently demand specialized, tailor-made components adhering to aviation standards. The production and acquisition of these components further escalates the financial outlay.

Engaging in the advancement of cutting-edge aircraft electrical systems entails substantial costs related to research, development, and the procurement of specialized components tailored to aviation standards. Therefore, the high initial investment and development cost associated with the aircraft electrical system is expected to hamper the growth of the market during the forecast period.

Increase In Demand For Lightweight Electrical Systems

The increase in need for lightweight electrical systems in aircraft is propelled by the ongoing efforts of aviation sector to enhance fuel efficiency, lower operational expenses, and improve overall performance. The adoption of lightweight electrical systems plays a pivotal role in achieving weight reduction, a critical factor for enhancing fuel efficiency and adhering to stringent aviation standards.

Innovations in materials and design facilitate the creation of lighter components such as wiring, power distribution units, and avionics, maintaining functionality. This trend underscores the industry's dedication to optimizing aircraft efficiency, advancing fuel economy, and fulfilling sustainability objectives.

Moreover, there is an increase in development and design of efficient electrical systems in the aircraft industry. For instance, in October 2023, Raytheon Technologies (RTX) demonstrated a solid-state circuit breaker to support hybrid-electric propulsion systems in future aircraft. This solution aims to be lightweight and power-dense, addressing the increased power demands of next-generation hybrid-electric and all-electric platforms.

In addition, there is a rise in the demand for lightweight and power-dense design of electrical systems that align with the industry's demand for lighter components. Therefore, such developments to reduce the overall weight of aircraft and efficiency are expected to provide lucrative opportunities for the growth of the aircraft electrical system market.

Recent Developments In The Aircraft Electrical System Industry

- In September 2023, Safran partnered with Cuberg, a California-based subsidiary of Northvolt, a Swedish battery manufacturer. The partnership aims to leverage the combined expertise of the two companies for the development of energy storage solutions for electric and hybrid aircraft.

- In July 2023, Crane Aerospace and Electronics announced a collaboration with Heart Aerospace, a Swedish electric airplane maker, to define the Electrical Power Distribution System on Heart's ES-30 regional electric airplane.

- In April 2023, Honeywell International, Inc. signed a contract with FLYING WHALES QUEBEC for the integration and supply of Honeywell's 1-megawatt generator for its new hybrid-electric airship, the LCA60T.

- In March 2023, General Electric Aerospace partnered with Sikorsky to offer a CT7 turboshaft engine combined with 1MW-class generator and associated power electronics, building on hybrid electric propulsion systems being developed by GE Aerospace for both NASA and the U.S. Army.

- In September 2023, Collins Aerospace announced the development of a one-megawatt (1-MW) electric generator for the U.S. Air Force Research Laboratory (AFRL). This initiative is part of the Advanced Turbine Technologies for Affordable Mission-Capability program. The generator, characterized as a low-spool generator, is being designed with the intention of having diverse applications across a range of future military aircraft.

- In January 2022, Collins Aerospace received a contract from Boeing to upgrade the aircraft's electric power generation system (EPGS). The upgrade is part of the broader modernization initiatives undertaken by the U.S. Air Force to extend the operational life of the B-52 bomber, a strategic asset in the Air Force's fleet.

- In June 2022, Astronics Corporation announced a collaboration with the Lilium to develop and manufacture an electrical secondary power distribution unit (SPDUs) and charging power distribution units (CPDUs) for the Lilium Jet.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft electrical system market analysis from 2022 to 2032 to identify the prevailing aircraft electrical system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft electrical system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft electrical system market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Electrical System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 30.7 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 324 |

| By Component |

|

| By System |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Amphenol Corporation, General Electric, Honeywell International Inc., Crane Aerospace & Electronics, Collins Aersopace, PARKER HANNIFIN CORP, Astronics Corporation, Safran Group, Thales, AMETEK.Inc |

The global aircraft electrical system market was valued at $16,873.9 million in 2022, and is projected to reach $30,671.2 million by 2032, registering a CAGR of 6.2% from 2023 to 2032

The top companies to hold the market share in Aircraft Electrical System are Safran Group, Amphenol Corporation, General Electric, Collins Aersopace, Astronics Corporation, Crane Aerospace & Electronics, AMETEK.Inc, PARKER HANNIFIN CORP, Thales Group, and Honeywell International Inc.

The largest regional market for Aircraft Electrical System is North America.

The leading component of Aircraft Electrical System Market is generator.

The upcoming trends of Aircraft Electrical System Market in the world are increase in demand for lightweight electrical systems and rise in demand for aircraft modernization and upgrades.

Loading Table Of Content...

Loading Research Methodology...