The global aircraft oxygen system market size was valued at $2.3 billion in 2022, and is projected to reach $4.7 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Aircraft oxygen systems are essential in ensuring the safety and well-being of passengers and crew at high altitudes, where oxygen levels are insufficient for human respiration. These systems are designed to provide a controlled and reliable supply of oxygen during emergencies or when cabin pressure is compromised. The two primary types of aircraft oxygen systems are continuous flow and demand flow systems. Continuous flow systems deliver a constant stream of oxygen, while demand flow systems supply oxygen only when the user inhales. Passengers receive oxygen through masks that automatically deploy during emergencies, ensuring rapid access to a breathable atmosphere.

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the global aircraft oxygen system market trends along with the market forecast.

- The report elucidates the market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the market growth.

Aircraft oxygen is typically stored in gaseous or liquid form, and the system includes pressure regulators to maintain a consistent flow. Crew members undergo rigorous training to manage and troubleshoot these systems, emphasizing the importance of passenger safety. Regular maintenance and stringent safety standards govern the installation and operation of aircraft oxygen systems, ensuring their reliability in challenging situations. As aviation technology advances, continuous improvements in oxygen delivery systems contribute to enhanced passenger safety and emergency response capabilities.

The surge in passenger aircraft numbers is poised to significantly increase the demand for aircraft oxygen systems. As the aviation industry experiences a noteworthy increase in the quantity of passenger planes, there arises a corresponding need for advanced and efficient oxygen systems to ensure the safety and well-being of travelers and crew members onboard. These systems play a critical role in providing breathable air at high altitudes where oxygen levels are lower, safeguarding against hypoxia and other potential health risks. With the rising demand for air travel, aircraft manufacturers and operators are likely to prioritize the integration of robust oxygen systems to comply with safety regulations and enhance in-flight safety measures.

This trend reflects the aviation industry's commitment toward passenger welfare and adherence to stringent safety standards. Consequently, the aircraft oxygen system market is expected to experience a proportional growth trajectory, driven by the increasing global fleet of passenger aircraft. This increased demand highlights the significance of continual innovation and investment in aviation safety technologies to meet the evolving needs of the expanding air travel sector.

The aviation industry faces a potential obstacle to its growth owing to the constrained production capacity of aircraft oxygen systems. This limitation has widespread implications, affecting the ability of airlines and aircraft manufacturers to meet the increasing demand for air travel. The shortage in production capacity compromises safety standards, due to the critical role that oxygen systems play in ensuring the well-being of passengers and crew at high altitudes. The impact of this constraint extends beyond immediate safety concerns, potentially resulting in disruptions to flight schedules and increased operational costs. Moreover, the constrained supply also hindered the development and deployment of innovative aircraft technologies, impacting the overall efficiency and competitiveness of the aviation sector.

Addressing this limitation requires strategic initiatives, such as increased investment in production facilities, streamlined regulatory processes, and collaboration among industry stakeholders to overcome challenges and sustain the growth of the aviation industry. As the industry navigates these hurdles, stakeholders need to prioritize the enhancement of production capabilities to meet the rising global demand for air travel safely and efficiently.

The aviation industry is experiencing a transformative shift with the latest innovations in aircraft oxygen system industry poised to drive market growth in the future. These advancements focus on enhancing safety, efficiency, and passenger experience, marking a significant shift forward in aerospace technology. The major innovation in the sector is the development of next-generation oxygen generation systems (OGS) that offer improved reliability and performance. These systems utilize advanced materials and technologies to generate oxygen on-demand, ensuring a continuous and efficient supply for both crew and passengers.

This innovation not only enhances safety during emergency situations but also contributes to weight reduction, thereby improving fuel efficiency and reducing overall operational costs. Furthermore, smart oxygen delivery systems equipped with advanced sensors and real-time monitoring capabilities are gaining prominence. These systems optimize oxygen flow based on individual passenger needs, ensuring a personalized and efficient delivery of oxygen. This not only enhances passenger comfort but also contributes to resource optimization, reflecting a commitment toward sustainability within the aviation sector. In addition, innovations in composite materials and manufacturing processes are being incorporated into the design of oxygen storage and delivery components. This results in lightweight yet durable systems, contributing to overall aircraft weight reduction and fuel efficiency.

Competitive Landscape

The key players profiled in aircraft oxygen system industry report are Aerox, Technodinamika, Rockwell Collins, Inc, Cobham plc, Diehl Stiftung & Co. KG, Aviation Oxygen Systems Inc, Adams Rite Aerospace Inc, Safran, Essex Industries, Inc, and Precise Flight, Inc. Acquisition and strategic partnership are common strategies followed by major market players owing to aircraft oxygen system market demand. For instance, in June 2022, Diehl Aviation a prominent German aviation product supplier, successfully developed its own emergency oxygen generator, known as the UOa‚‚G. The product was officially unveiled at the Aircraft Interiors Expo (AIX) in Hamburg from June 14 to 16, 2022.

For the successful launch of the product, Diehl Aviation established a dedicated development environment at its Gilching site, focusing on building internal chemical expertise. The UOa‚‚G is a safety-critical system designed to meet stringent standards for safety, functionality, and durability. It is the sole oxygen generator suitable for installation and retrofitting in all aircraft belonging to the Airbus A320 family and the Boeing 737 series.

The emergency oxygen generator comprises two key elements, a precision-welded stainless-steel housing and a chemical core. When cabin pressure drops, an automatic chemical reaction is initiated, releasing bonded oxygen. This initiates an ignition process that safely burns down the sodium chlorate-based chemical core, resembling a controlled candle. Combustion produces sufficient oxygen to supply passengers for up to 15 minutes, leaving only sodium chloride (common salt) as a residual substance. Diehl Aviation's innovative UOa‚‚G represents a significant advancement in aviation safety, offering a reliable and adaptable emergency oxygen solution for a wide range of aircraft, ensuring passenger well-being during critical situations.

Segment Overview

The aircraft oxygen system market is segmented on the basis of component, system, aircraft type, end-use, and region. By component, the market is classified into oxygen storage system, oxygen delivery system, and oxygen mask. By system, the market is divided into passenger oxygen system and crew oxygen system. By aircraft type, the market is classified into narrow body aircrafts, wide body aircrafts, and others. By end-use, the market is divided into commercial aviation, military aviation, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The aircraft oxygen system market is segmented into Aircraft Type, End-Use, Component and System.

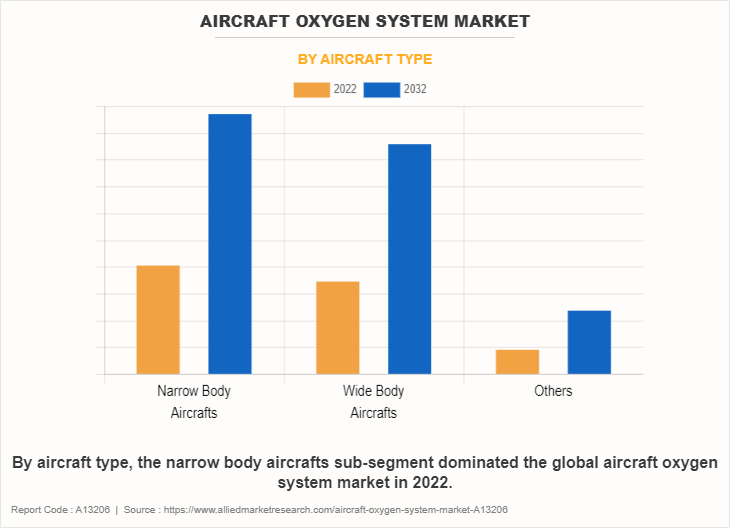

By aircraft type, the narrow body aircrafts sub-segment dominated the global aircraft oxygen system market in 2022. Narrow-body aircraft, comprising single-aisle airplanes, have emerged as the major contributor in shaping the dynamics of the market. This dominance can be attributed to several factors, including the widespread use of narrow-body aircraft for short to medium-haul flights, which necessitates efficient and reliable oxygen systems for passenger safety. The prevalence of narrow-body aircraft, such as popular models like the Boeing 737 and Airbus A320 families, highlights the significance of oxygen systems in ensuring the well-being of passengers and crew during flights. The demand for advanced and technologically advanced oxygen systems is particularly noticeable in this sub-segment, as it aligns with the aviation industry's commitment toward enhancing safety standards.

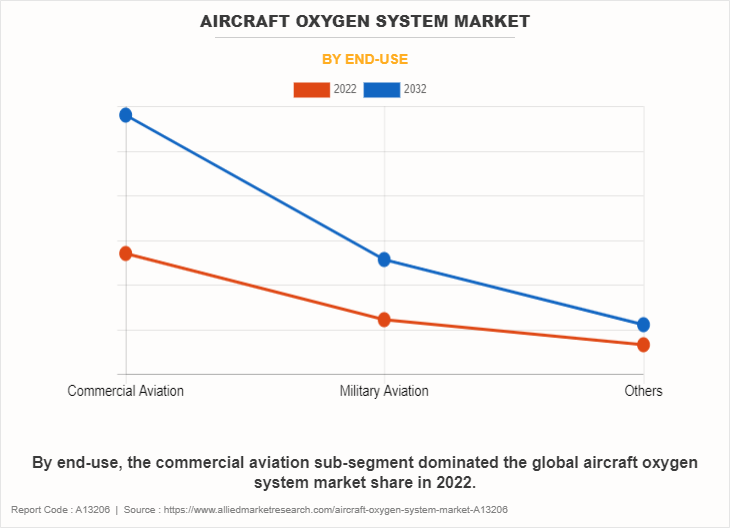

By end-use, the commercial aviation sub-segment dominated the global aircraft oxygen system market share in 2022. This sector plays an important role in shaping the overall landscape of aircraft oxygen systems worldwide. The prevalence of this dominance signifies the considerable reliance on these systems within commercial aviation operations. The commercial aviation sub-segment's dominance focuses the extensive utilization of aircraft oxygen systems in large passenger aircraft, emphasizing the critical importance of maintaining a controlled and breathable environment at high altitudes. The competitive edge of this sub-segment can be attributed to the volume of passengers and flights in commercial aviation, necessitating efficient oxygen systems to meet safety standards and regulatory requirements. As a result, the global market for aircraft oxygen systems is significantly influenced by the dynamics and demands of the commercial aviation sector.

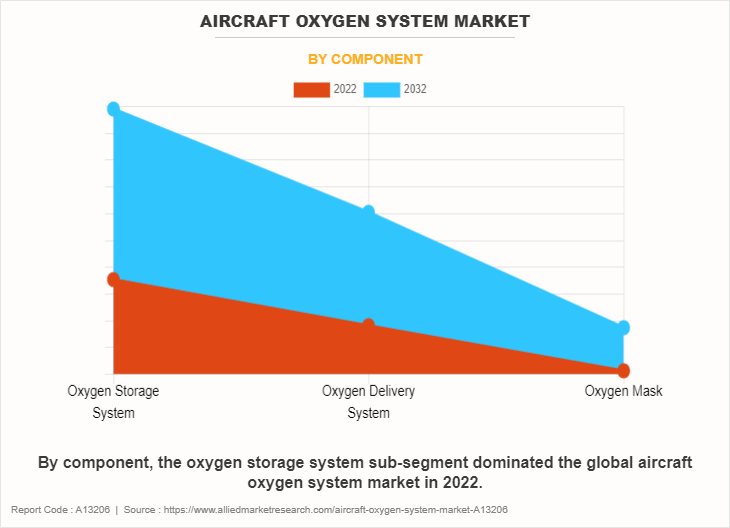

By component, the oxygen storage system sub-segment dominated the global aircraft oxygen system market in 2022. Oxygen storage systems have emerged as dominant components within aircraft oxygen systems, playing a major role in ensuring the safety and well-being of passengers and crew members. These systems are designed to store and supply breathable oxygen in the event of an emergency, such as cabin depressurization at high altitudes.

The dominance of oxygen storage systems can be attributed to their reliability, efficiency, and compact design, which is crucial for integration into the limited space available on aircraft. These systems utilize advanced technology to store oxygen in a compressed or liquid form, ensuring a sustained and controlled release when needed. The efficient utilization of space is critical in aviation, and oxygen storage systems cater to this demand by offering compact solutions without compromising on safety standards. Their prominence in aircraft oxygen systems highlights the significance of maintaining a secure and reliable oxygen supply, especially during critical phases of flight.

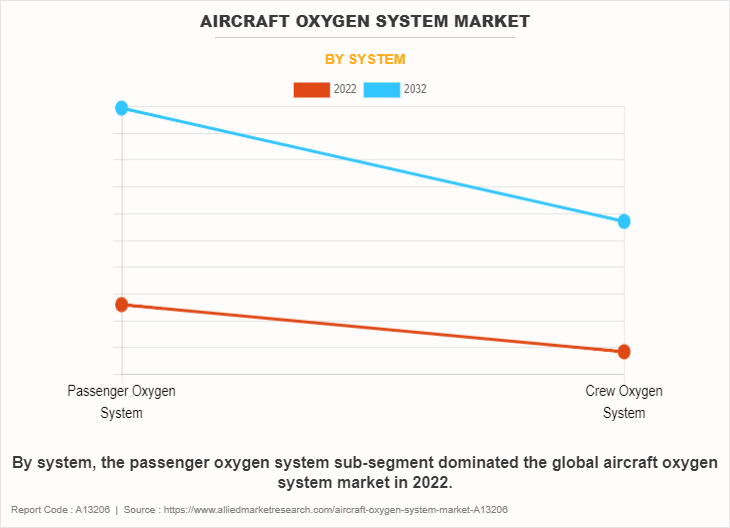

By system, the passenger oxygen system sub-segment dominated the global aircraft oxygen system market in 2022. The passenger oxygen system (POS) ensures the safety and well-being of passengers during flights. This component plays a major role in providing a controlled and reliable supply of oxygen in the event of emergencies such as cabin depressurization. The POS is particularly designed to meet stringent aviation safety standards, offering an efficient deployment of oxygen masks to passengers when needed. In the event of an emergency, the POS activates automatically and releases oxygen masks from overhead compartments. This ensures rapid accessibility for passengers, allowing them to breathe safely at high altitudes where oxygen levels may be insufficient. The system is engineered with precision to facilitate a smooth and quick response, prioritizing passenger safety and minimizing the risks associated with hypoxia.

By region, North America dominated the aircraft oxygen system market in 2022, owing to the significant presence of key aircraft manufacturers like Boeing and Bombardier. The strategic positioning of these companies contributes to the dominance of North America in the global market. Continuous investment by major companies in expanding commercial, military, and regional aircraft fleets has led to an increase in the product demand. This proactive approach also aligns with the region's commitment toward maintaining an innovative aviation sector. North America not only serves as a hub for aircraft production but also boosts the need for advanced oxygen systems to ensure safety and efficiency in diverse aviation applications. The combination of established industry players, technological innovation, and ongoing investments positions North America as a key influencer in shaping the trajectory of the global market demand.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft oxygen system market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Oxygen System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.7 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 295 |

| By Aircraft Type |

|

| By End-Use |

|

| By Component |

|

| By System |

|

| By Region |

|

| Key Market Players | Precise Flight, Inc., Essex Industries, Inc, Technodinamika, Adams Rite Aerospace Inc, COBHAM PLC, Diehl Stiftung & Co. KG, Aviation Oxygen Systems Inc, Safran, Rockwell Collins, Inc., Aerox |

The global aircraft oxygen system market was valued at $2.3 billion in 2022, and is projected to reach $4.7 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Aerox, Technodinamika, Rockwell Collins, Inc, Cobham plc, Diehl Stiftung & Co. KG, Aviation Oxygen Systems Inc, Adams Rite Aerospace Inc, Safran, Essex Industries, Inc, and Precise Flight, Inc. are the major players in the aircraft oxygen system market.

North America will provide more business opportunities for the global aircraft oxygen system market in the future.

The surge in the number of passengers travelling through aircraft is expected to influence the aircraft oxygen system market in the upcoming years.

The increase in commercial aircrafts across the globe is raising demand for aircraft oxygen system. In addition, the surging development of military aircrafts is also anticipated to support the market growth.

Loading Table Of Content...

Loading Research Methodology...