Aircraft Paint Market Research, 2032

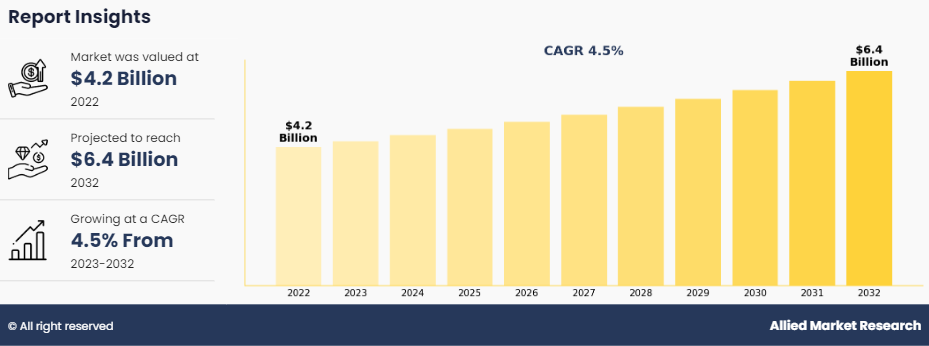

The global aircraft paint market was valued at $4.2 billion in 2022, and is projected to reach $6.4 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032.

Aircraft operate in a variety of environments, including high-altitude conditions, exposure to different weather elements, and often corrosive atmospheres. The paint helps protect the metal surfaces of the aircraft from corrosion caused by moisture, salt, and other environmental factors. The type and application of paint has an impact on the aerodynamics of the aircraft. Smooth, well-applied paint contributes to the overall smoothness of the aircraft's surface, reducing drag and improving fuel efficiency. Moreover, aircraft paint is often used for branding and identification purposes. Airlines typically have unique paint schemes and logos on their aircraft, making them easily recognizable. Military aircraft have specific paint patterns for camouflage or identification.

The growth in global air travel has led to an increase in demand for new aircraft. Airlines often use the exterior of their aircraft as a canvas for branding and marketing. In addition, unique and visually appealing paint schemes enhance the brand image and make the aircraft easily recognizable. This drives airlines to invest in high-quality, custom aircraft paint. Aircraft are exposed to various environmental elements during flights, including high-altitude exposure, temperature variations, and precipitation. Corrosion is a significant concern for the longevity and safety of aircraft. Quality paint systems act as a protective layer, preventing corrosion and maintaining the structural integrity of the aircraft. The exterior surfaces of an aircraft need to withstand harsh conditions, including UV radiation, temperature extremes, and aerodynamic forces during flight. Durable and long-lasting paint systems are essential to ensure that the aircraft maintains its performance and appearance over its operational lifespan. Aviation authorities often have strict regulations regarding the materials and coatings used in aircraft manufacturing. Furthermore, aircraft paint meets these regulatory standards to ensure the safety and airworthiness of the aircraft. As aircraft production increases, the adherence to these standards becomes even more crucial. The growth of low-cost carriers, which often operate with high-frequency schedules, contributes to increased wear and tear on aircraft exteriors. This, in turn, leads to a higher frequency of repainting cycles, boosting the demand for aircraft paint.

Aircraft paint meets stringent quality standards to ensure durability, corrosion resistance, and aesthetic appeal. Achieving and maintaining these standards often involves the use of advanced materials & technologies, which increase the overall cost of the paint. Smaller manufacturers or operators find it challenging to invest in these high-quality materials and processes while staying within budget constraints. Developing aircraft paint that meets or exceeds industry standards requires significant R&D efforts. The costs associated with testing and improving formulations to ensure they meet the necessary specifications is substantial. For smaller players in the market, allocating resources for extensive R&D is financially challenging. Moreover, they do not have the same bargaining power, leading to higher costs for materials and components, impacting the overall cost of aircraft paints. Larger aircraft manufacturers often benefit from economies of scale, allowing them to negotiate better deals with suppliers and reduce per-unit production costs. These are the major factors anticipated to hamper the aircraft paint market growth.

The development of low-VOC formulations aligns with increasing environmental regulations. Governments and international bodies are placing more stringent restrictions on emissions and pollutants. Manufacturers that produce aircraft paints with lower VOC content cater to the demand for eco-friendly solutions, meeting regulatory requirements and appealing to environmentally conscious customers. UV-cured coatings offer faster curing times and enhanced durability compared to traditional coatings. This led to increased efficiency in aircraft manufacturing processes, reducing turnaround times. In addition, manufacturers adopting UV-cured coatings position themselves as leaders in efficiency and sustainability. Advanced corrosion-resistant paints contribute to the longevity and performance of aircraft. As airlines and operators seek to extend the lifespan of their fleets and reduce maintenance costs, the demand for durable coatings is anticipated to rise. Manufacturers investing in technologies that enhance durability and protect against corrosion capture this market segment. Furthermore, advancements in paint technologies provide opportunities for enhanced customization and aesthetics. Airlines and private aircraft owners seek unique & visually appealing paint options. Manufacturers capitalize on this demand by developing innovative coatings that offer functional benefits and a wide range of design possibilities. These are the major factors projected to offer growth opportunities for key players operating in the market during the forecast period.

The key players profiled in this report include DowDuPont Inc, Chromalloy Gas Turbine LLC, Praxair S.T. Technology Inc, OC Oerlikon Corporation AG., AandA Thermal Spray Coatings, TURBOCAM Inc, PPG Industries Inc., Indestructible Paint Limited, United coatings Group, and APS Materials Inc. Investment and agreement are common strategies followed by major market players. For instance, January 2022: Sherwin-Williams Aerospace Coatings, a US-based manufacturer of high-quality exterior and interior paint & coating systems, launched the aircraft color visualizer platform, an online 3D color visualizer tool that allows users to experiment with different color schemes for their aircraft. The aircraft color visualizer is a fully interactive desktop tool that lets users design color schemes for six different types of aircraft. It includes kit planes, single and twin-turboprops, light & heavy-duty business jets, and helicopters.

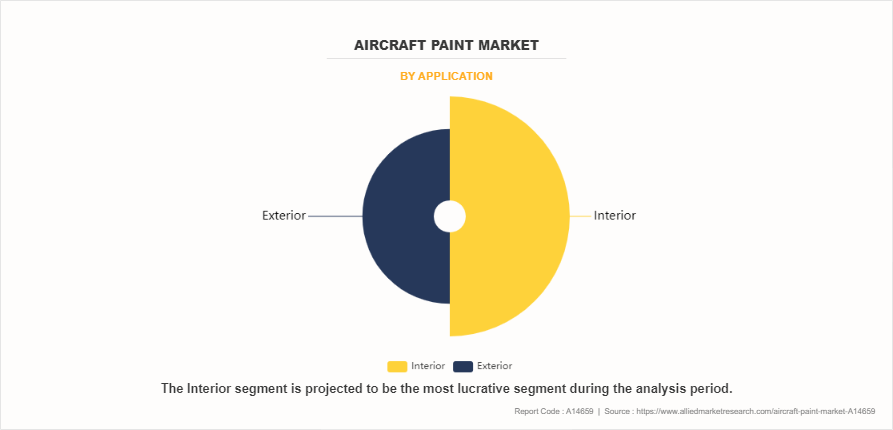

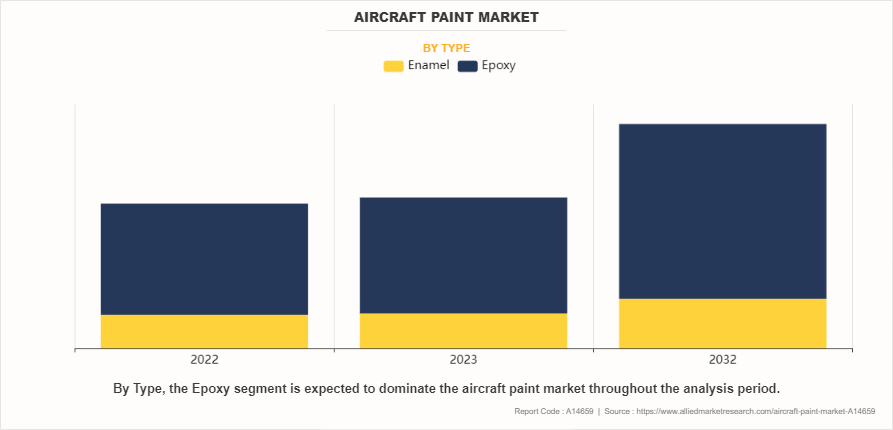

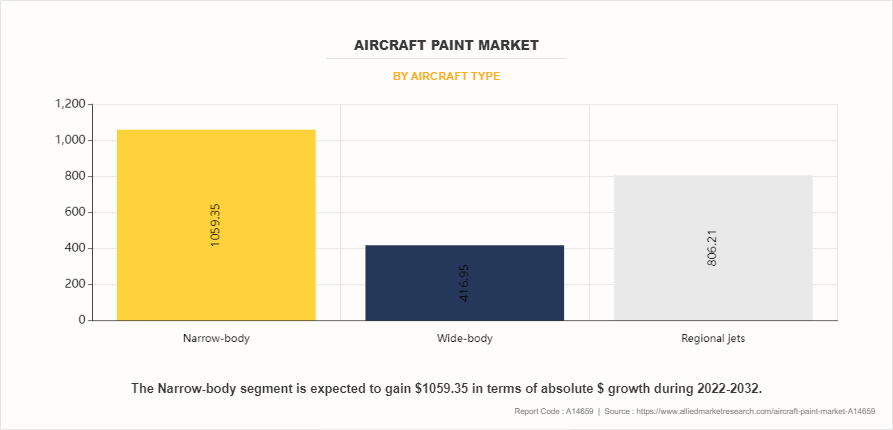

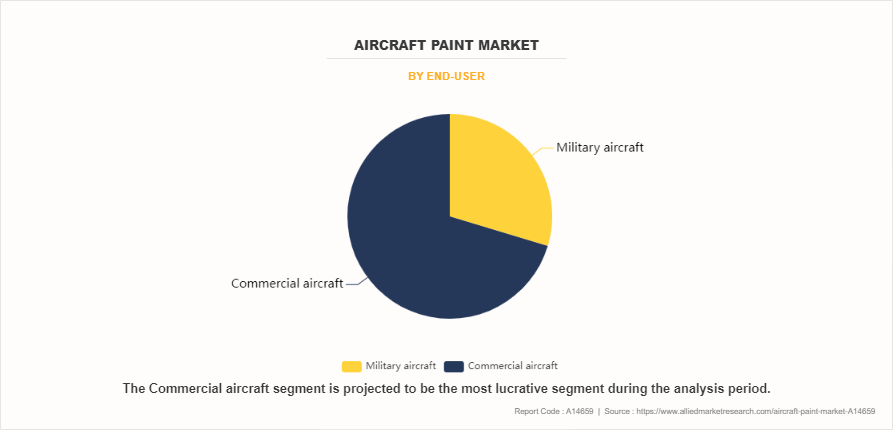

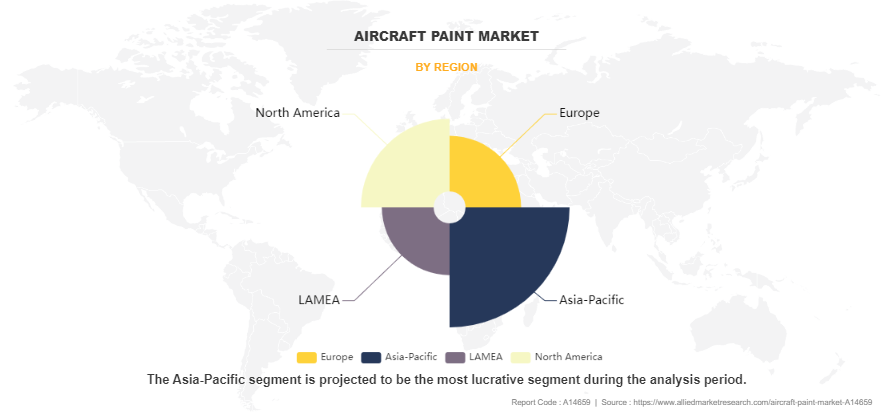

The aircraft paint market is segmented based on application, type, aircraft type, end user, and region. By application, the market is divided into interior and exterior. Depending on type, it is classified into enamel and epoxy. According to aircraft type, the market is divided into narrow-body, wide-body, and regional jets. As per end user, it is classified into military aircraft, commercial aircraft. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The aircraft paint market is segmented into Application, Type, Aircraft Type and End-User.

By application, the interior sub-segment dominated the market in 2022 airlines often seek unique and visually appealing interior designs to enhance their brand image. This drives the demand for customized and aesthetically pleasing aircraft interior paints. Aircraft interiors face substantial wear and tear due to factors such as passenger traffic, cleanliness, and maintenance procedures. Durable interior paints that withstand these conditions are in demand to reduce maintenance costs & downtime. Stringent regulations and standards in the aviation industry drive the demand for specialized interior aircraft paints that meet safety, durability, and environmental requirements. Advances in paint technology, including the development of coatings with improved resistance to chemicals, abrasion, and UV radiation, drive the adoption of newer and more advanced interior aircraft paint. Interior paints that are low in volatile organic compounds (VOCs) and meet health & safety standards are increasingly preferred. This is in response to growing awareness of the importance of air quality within the aircraft cabin. The development of innovative materials, such as nano-coatings or self-healing coatings, drive interest in new interior aircraft paint solutions that offer enhanced performance and longevity. These are predicted to be the major factors driving the aircraft paint market size during the forecast period.

By type, the epoxy sub-segment dominated the global aircraft paint market in 2022. Stringent environmental regulations and standards often drive innovation in the aircraft paint industry. Manufacturers develop new coatings that comply with environmental regulations, such as those related to volatile organic compounds (VOCs) or hazardous materials. Advances in coating technologies, such as the development of more durable and heat-resistant coatings, are significant drivers in the aircraft paint market. Coatings that offer improved protection against corrosion, UV radiation and other environmental factors are expected to be in demand. The demand for aircraft maintenance and repainting is influenced by factors such as age of the aircraft fleet, airline strategies, and economic conditions. As airlines invest in maintaining & updating their fleets, there is increased demand for high-performance and long-lasting coatings. Manufacturers are continually looking for ways to reduce the weight of aircraft to improve fuel efficiency. Innovations in lightweight coatings contribute to achieving this goal and coatings that offer protection while minimizing weight is expected to witness increased adoption.

By aircraft type, the narrow-body sub-segment dominated the global aircraft paint market opportunities in 2022. As airlines expand their fleets or replace older aircraft with new narrow-body models, there is a growing demand for aircraft paint to coat these new planes. Fleet modernization efforts often involve the application of new, more advanced paint technologies. Aviation authorities impose strict regulations regarding the type of paint used on aircraft. Compliance with these regulations, which are designed to ensure safety, durability, and environmental sustainability, drives the demand for specialized and compliant aircraft paint. Moreover, airlines often invest in the exterior appearance of their aircraft for branding and aesthetic purposes. This includes custom paint schemes, logos, and designs. As airlines seek to differentiate themselves and create a unique brand image, they invest in custom paint jobs for their narrow-body fleets. Aircraft are exposed to harsh environmental conditions during flight, including temperature extremes and corrosive elements. High-quality paint is essential for protecting the aircraft's structure from corrosion and maintaining its overall durability. The need for effective corrosion protection is a significant driver in the aircraft paint market. Airlines are increasingly focused on improving fuel efficiency to reduce operating costs and environmental impact. Advanced paint technologies that aid in reducing weight are expected to be appealing to airlines that are looking to improve fuel efficiency in their narrow-body aircraft.

By end-user, the commercial aircraft sub-segment dominated the global aircraft paint market share in 2022. Military aircraft operate in diverse and often harsh environments. High-quality paint and coatings are essential for protecting the aircraft from corrosion caused by exposure to elements such as saltwater, humidity, and pollutants. Some military aircraft require special coatings to enhance their stealth capabilities. These coatings are designed to reduce radar cross-section and infrared signatures, making the aircraft more difficult to detect by enemy sensors. Moreover, it requires frequent repainting or touch-ups based on operational needs. This includes changes in mission requirements, theater of operations, or camouflage patterns. Military aircraft adhere to stringent safety and regulatory standards. The use of specific types of paints and coatings are mandated to meet these requirements. Furthermore, military aircraft often feature distinctive paint schemes for identification purposes or to align with a specific branch or unit. These aesthetic considerations drive demand for custom paints.

By region, Asia-Pacific dominated the global aircraft paint market in 2022. Airlines invest in expanding their fleets or upgrading existing aircraft to meet regulatory standards or improve fuel efficiency. This is driving the demand for high-performance coatings to protect and enhance the appearance of aircraft. Stringent environmental and safety regulations governing the aerospace industry drive the adoption of specific types of coatings that comply with regulatory requirements. This is especially important for reducing environmental impact and ensuring passenger & crew safety. Advances in coating technologies, such as environmentally friendly and durable coatings, are drivers for the market. Companies that offer innovative solutions gain a competitive edge. The MRO sector is crucial for the ongoing maintenance and upkeep of aircraft. As aircraft age, they require repainting for both aesthetic and protective purposes, contributing to the demand for aircraft paints. Economically developing nations and growth in airlines' and military budgets, impacting their ability and willingness to invest in new aircraft or repaint existing fleets. The global nature of the aerospace industry means that factors influencing the global supply chain, such as raw material costs and availability, affect the aircraft paint market in Asia-Pacific.

Impact of COVID-19 on the Global Aircraft Paint Industry

- The COVID-19 pandemic has had a significant impact on the aircraft paint market with the global lockdowns, travel restrictions, and decrease in passenger demand, airlines faced significant financial challenges. Many airlines reduced their operations, grounded a portion of their fleets, or delayed new aircraft deliveries. This, in turn, has affected the demand for aircraft paint, as fewer new planes were manufactured or repainted.

- During the pandemic, consumer spending patterns shifted significantly. The pandemic led to disruptions in global supply chains, affecting the production and distribution of various products, including aircraft components. This has impacted on the supply of aircraft paint and related materials.

- Airlines faced financial constraints due to decline in revenue and increase in the operational costs related to health and safety measures. This has led to budget constraints for non-essential services, such as repainting aircraft for aesthetic or branding purposes.

- With a reduction in new aircraft purchases, airlines have prioritized maintenance and upgrades for existing fleets over the acquisition of new planes. This potentially impacts the demand for paint used in routine maintenance and repainting. The recovery of the aviation industry is closely tied to the overall economic recovery and the successful containment of the pandemic. As air travel gradually resumes, airlines revisit their fleet management strategies, potentially leading to increased demand for aircraft paint services.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft paint market analysis from 2022 to 2032 to identify the prevailing aircraft paint market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft paint market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft paint market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Paint Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.4 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Aircraft Type |

|

| By End-User |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | DuPont, PPG INDUSTRIES, INC, Mankiewicz Gebr. & Co., Akzo Nobel NV., Mapaero Coatings, BASF SE, Hentzen Coatings, Inc., IHI Ionbond AG, Kansai Paint Co., Ltd., Masco |

The growing demand for aircraft paint is closely tied to the production and delivery rates of new aircraft. As the aviation industry experiences growth and more planes are manufactured and delivered, there is an increased need for paint for these new aircraft, which is estimated to generate excellent opportunities in the aircraft paint market.

The major growth strategies adopted by aircraft paint market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global aircraft paint market in the future.

TURBOCAM Inc, DowDuPont Inc, United coatings Group, PPG Industries Inc., Praxair S.T. Technology Inc, Chromalloy Gas Turbine LLC, AandA Thermal Spray Coatings, Indestructible Paint Limited, OC Oerlikon Corporation AG., and APS Materials Inc are the major players in the aircraft paint s market.

The commercial aircraft sub-segment of the type acquired the maximum share of the global aircraft paints market in 2022.

Airlines and aircraft manufacturers sectors are the major customers in the global aircraft paint market.

The report provides an extensive qualitative & quantitative analysis of the current trends and future estimations of the global aircraft paint s market from 2022 to 2032 to determine the prevailing opportunities.

Aircraft are exposed to harsh environmental conditions, including extreme temperatures and varying altitudes. The paint used on aircraft serves an aesthetic purpose and acts as a protective layer against corrosion & other environmental damage. As aircraft age, the need for maintenance, including repainting, increases, which is estimated to drive the adoption of aircraft paints.

Aircraft go through regular maintenance cycles, and part of this process involves repainting to ensure the structural integrity & safety of the aircraft. The frequency of maintenance & repainting cycles impacts the demand for aircraft paint and is a significant driver for the aircraft paint s adoption.

Loading Table Of Content...

Loading Research Methodology...