Aircraft Propulsion System Market Research, 2033

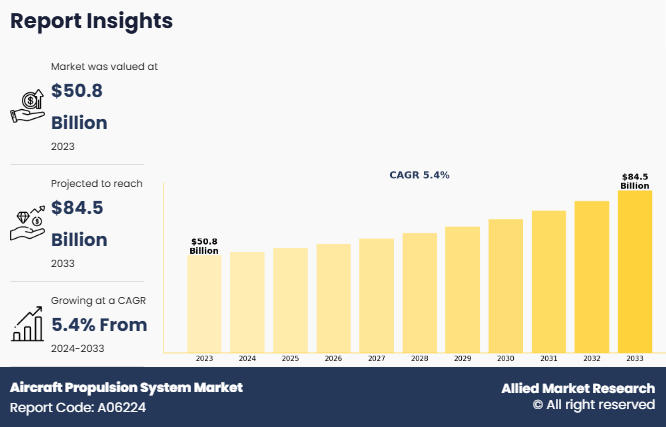

The global aircraft propulsion system industry was valued at $50.8 billion in 2023, and is projected to reach $84.5 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Report Key Highlighters:

- The aircraft propulsion system industry study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the aircraft propulsion system industry.

- The aircraft propulsion system market share is highly fragmented, into several players including Rolls-Royce Holdings plc., General Electric Company, Pratt & Whitney, Hanwha Group, Kawasaki Heavy Industries, Ltd., CFM International, Safran SA, Honeywell International Inc., MTU Aero Engines AG, Busek Co. Inc, Northrop Grumman, 3W International GmbH, Lockheed Martin Corporation., Williams International, and IHI AEROSPACE Co., Ltd. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An aircraft propulsion system is a combination of engines and related components, which are designed to generate the necessary thrust to overcome aerodynamic drag and lift the aircraft into flight. An aircraft propulsion system achieves the thrust by converting energy from fuel, electricity, or other sources into mechanical or reactive force, which propels the aircraft forward.

Propulsion systems allow pilots to control the speed of the aircraft during different phases of flight, such as take off, cruising, and landing. Advanced propulsion systems also aid in precision manoeuvring, which is crucial in both commercial and military aviation. There are different type of propulsion systems such as turbofan, turboprop, piston engine, and others, which are designed to cater to various types of aircraft, such as passenger planes, fighter jets, cargo planes, and drones.

Factors such as rise in advancement in the electric and hybrid aircrafts, increase in air travel, and growing orders of new aircraft from developing countries are driving the growth of the market. However, stringent government regulations, and high maintenance cost hinder the growth of the market. On the contrary, factors such as modernization of military aircrafts, and increase in sales of personal aircrafts provide lucrative opportunities for the growth of the market across the globe.

In recent years, there has been growing advancement in the electric and hybrid aircrafts technology as they have lower operational costs, and improved fuel efficiency. Moreover, government and regulatory bodies are further promoting the use of electric and hybrid aircrafts. In addition, the growing aviation industry is now focusing on sustainability and development of electric propulsion systems, to achieve this they are utilizing lightweight materials which allows manufacturers to create aircraft with lower environmental footprints.

In addition, growing focus on sustainability and increasing progress in electric propulsion systems, such as use of lightweight materials, allow manufacturers to create aircraft with lower environmental footprints. Growing research, increasing financial investments, and industry collaborations foster continuous innovation, expanding the frontiers of electric and hybrid aviation technologies. For instance, in October 2023, a substantial subsidy of about $205 million was allocated for the development of hydrogen fuel cell systems and related equipment. Such initiative aims to support the progress of components essential for electric aircraft.

Moreover, in June 2023, Airbus SE and STMicroelectronics signed an agreement for the development of technologies related to hybrid and electric aircrafts. The company also announced that the collaboration is expected to cater to advancement in research on the next generation of semiconductors, which will be extensively used in hybrid and fully electric aircraft such as the ZEROe demonstrator and CityAirbus NextGen.

Similarly, in June 2022, Honeywell International Inc. conducted successful tests on a one-megawatt generator tailored for hybrid electric aircraft. The generator is 280 pounds and gives 97% efficiency, which is capable of powering an entire neighbourhood block. The new generator offers compact design, low weight, and increased fuel efficiency.

In addition, electric and hybrid aircrafts demand for effective energy storage solutions such as advanced batteries or hybrid power systems. Therefore, there is surge in the development of state-of-the-art energy storage technologies, specifically designed to meet the distinct needs of electric aviation industry. Such developments are expected to drive the growth of the market during the forecast period.

Key Developments in the Aircraft Propulsion System Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On November 1, 2024 General Electric Company developed hybrid electric propulsion system rated at one megawatt under a $5.1 million research and development contract from the U.S. Army Combat Capabilities Development Command (DEVCOM) Army Research Laboratory (ARL). This strategy focused on advancing technologies applicable to future Army air vehicle propulsion and military electrified ground vehicles.

- On December 1, 2022 Pratt & Whitney & its parent company RTX developed & tested hybrid-electric flight engine. The propulsion system of newly developed hybrid-electric flight engine integrated with 1 MW electric motor. This motor is developed by Collins Aerospace with a highly efficient fuel-burning engine that specially adapted for hybrid-electric operation.

- On August 1, 2023 Northrop Grumman opened Hypersonic Propulsion Systems Manufacturing Facility at Elkton, Maryland, to produce advanced propulsion solutions for hypersonic missiles exceeding Mach 5. The HCC, a factory-of-the-future, established the infrastructure needed to cost-effectively manufacture hypersonic propulsion at scale, supporting the U.S. Department of Defense (DoD) increasing demands for long-range, rapid-response weapons.

Segmental analysis

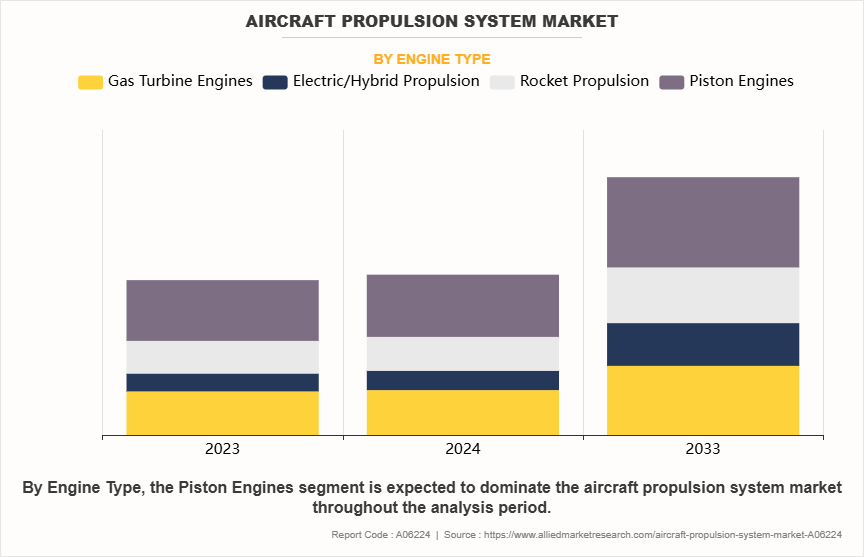

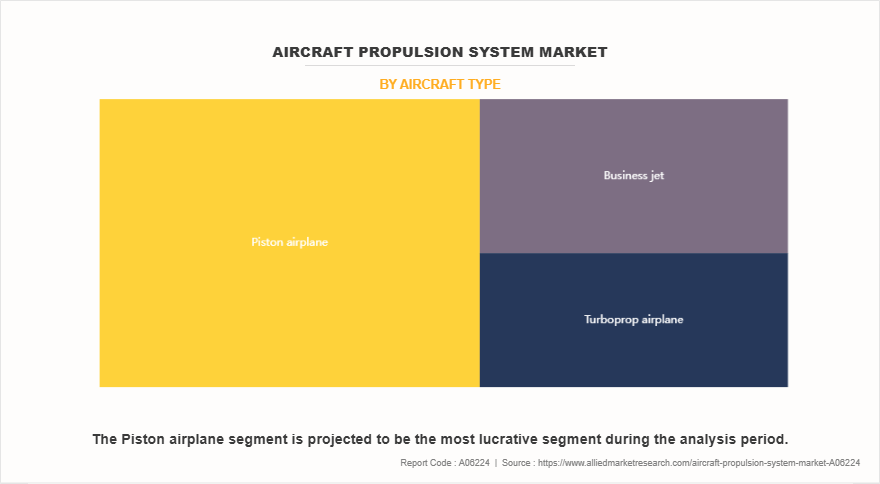

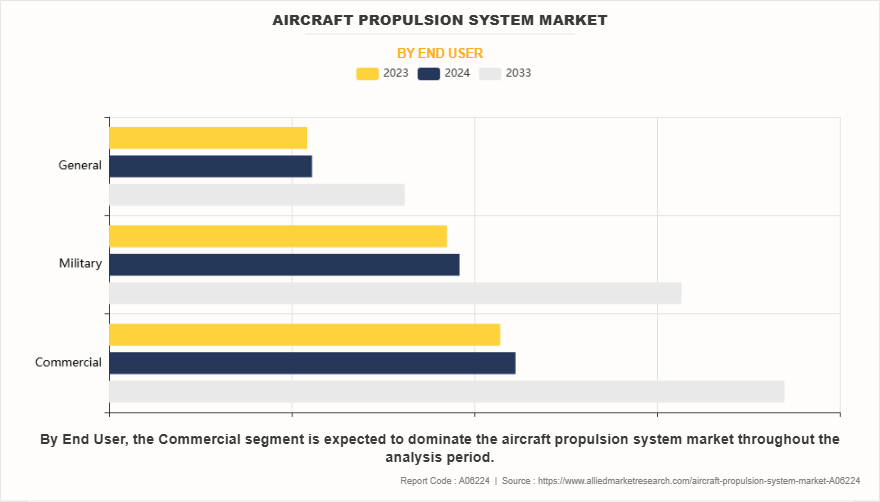

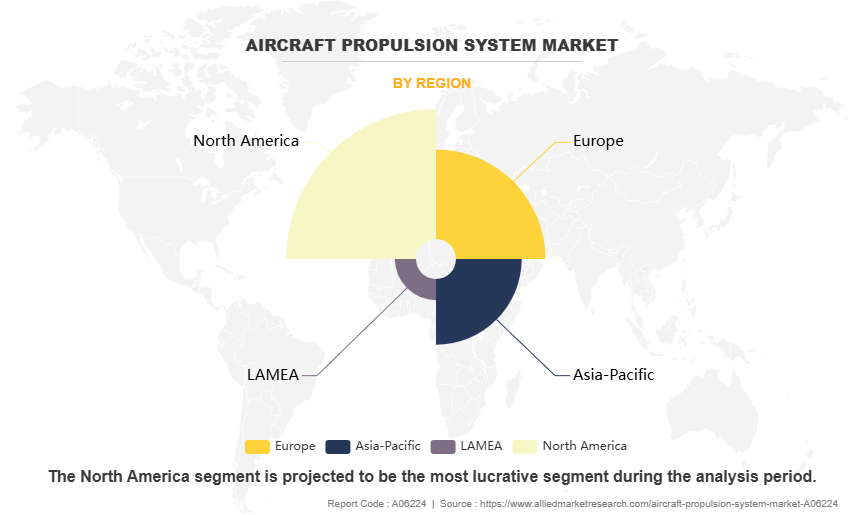

The aircraft propulsion system market size is segmented into engine type, aircraft type, end user, and region. By engine type, the market is segmented into gas turbine engines, electric/hybrid propulsion, rocket propulsion, and piston engines. By aircraft type, the market is divided into piston airplane, turboprop airplane, and business jet. Based on end user, the market is segmented into commercial , military, and general. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Engine Type

By engine type, the aircraft propulsion system market growth is categorized into gas turbine engine, electric/hybrid propulsion, rocket propulsion and piston engine. The piston engine segment dominated the aircraft propulsion system market in 2023, owning to aircraft piston engines are internal combustion engines, which utilize pistons to convert the chemical energy of fuel into mechanical energy and drive a propeller, in order to generate thrust. They operate on a four-stroke or two-stroke cycle and are commonly used in smaller aircraft due to their simplicity, reliability, and cost-effectiveness. Piston engines are generally less expensive to manufacture, maintain, and repair than jet engines. This makes them an attractive choice for small, general aviation aircraft, flight schools, and recreational pilots.

By Aircraft Type

By aircraft type, the aircraft propulsion system market forecast is segmented into piston airplane, turboprop airplane and business jet. The piston aircraft segment accounted for a dominant market share in 2023, owning to piston aircraft are more affordable to purchase, operate, and maintain, as compared to jets and turboprops, making them attractive to private owners and small aviation businesses.

By End User

Based on end user, the aircraft propulsion system market report is segmented into commercial, military, and general. The commercial segment accounted for a dominant market share in 2023, owning to the growth in commercial aviation sector globally due to factors such as economic recovery, increased globalization, and rise in disposable incomes. To tackle the growing demand for commercial aviation, major airline operators are investing more on propulsion system. For instance, on December 15, 2023, Rolls-Royce announced that Turkish Airlines had ordered 100 XWB-84 and 40 XWB-97 propulsion engines. This order complements the airline's existing fleet of 66 Trent engines, bringing the total to nearly 210.

By Region

Region wise the global market is analyzed into North America, Europe, Asia-Pacific, and LAMEA. The North America region dominated the aircraft propulsion system market in 2023 owning to the growth of aircraft propulsion system market in North America due to increase in military spending in the U.S., Canada, and Mexico. Rise in geopolitical tension has lead to increased investment in modernizing military aircrafts. Moreover, the U.S. and Canda have pledged their allegiance to NATO, and also looks after United Nations peace keeping mission and arctic security, which has resulted in increased need for modern fighter jets.

For instance, on December 20, 2024, Lockheed Martin Corp. and the U.S. Navy signed a contract for the production and delivery of 18 F-35A aircraft for the Air Force; 16 F-35B aircraft, 5 F-35C aircraft for the Marine Corps; and 14 F-35C aircraft for the Navy. Moreover, on September 13, 2024, the U.S. government announced the sale of 32 F-35A lightning II fighter jets to Romania. According to the agreement, the sales deed will offer significant enhancement in Romania defense capabilities and further help in strengthening the strategic partnership between the U.S. and Romania. Moreover, the U.S. government will also provide maintenance and technical support for the 32 F-35A fighter jets, thus helping improve the security of Romania, which is also a NATO Ally and an important region for maintaining political and economic stability in Europe.

Increase in Air Travel

The global aviation industry has witnessed unprecedented growth over the past few decades, owing to growth in globalization, technological advancements, and increasing affordability of air travel. Increase in demand for air travel resulted in increased the demand for new aircrafts.

The growing use of new aircraft for air travel is driving the demand for aircraft propulsion systems. According to a data published from the International Air Transport Association (IATA) in February 2023, there was a substantial of 55.5% increase in total air traffic globally, measured in revenue passenger kilometers (RPKs), as compared to 2022. There is rapid growth in air travel in developing countries, specially in the Asia-Pacific region, owing to increase in disposable income and increase in need for air travel for business and leisure travels.

For instance, in 2024, according to the data by Government of India, Press Information Bureau, the number of operational airports in India doubled from 74 in 2014 to 157 in 2024, and the country is aiming to increase it by 350-400 by 2047. During the same year, India was the third-largest domestic aviation market. The aviation sector in the country has shown substantial growth, with a 13% YoY increase in total air passengers for domestic travel, and increase of 22% for international passenger traffic. The demand for air travel is expected to continue to grow in coming decade, thus driving the growth of the aircraft propulsion system analysis.

Growing Advancement in Electric and Hybrid Aircraft

The growth in air travel and fleet modernization program in the developing countries has resulted in increased demand for new aircrafts. The demand for new aircrafts is particularly driven by economic growth, expanding middle-class populations, and growing focus on improving regional and international connectivity. Similarly, governments in developing countries are also focusing on developing new airport and modernization of older airports, which can handle more flights. Rise in demand for new aircrafts is driving the growth of the aircraft propulsion system market.

For instance, on December 9, 2024, Air India announced its agreement with Airbus SE for the orders of 10 A350 widebody, and 90 A320 narrowbody family of newer aircraft to be added to its fleet. Also, in 2023, Air India announced the order of 470 aircraft, out of which 250 were with Airbus SE. The latest order is expected to increase the total number of aircraft that Air India ordered from Airbus SE in 2023 from 250 aircraft to 350 currently. Air India has also announced that it has done an agreement with Airbus SE for services and component to support the maintenance requirements of its growing A350 fleet.

Modernization of Military Aircrafts

In recent years, due to escalating conflicts in various regions around the world and the need to maintain strategic superiority and adapt to evolving defense situations, countries worldwide are increasingly investing in the modernization of their military aircraft. In addition, modern military aircraft are now equipped with advanced avionics systems such as active electronically scanned array, radars, infrared sensors, advanced cameras and so on. The integration of these modern hardware further increases the overall cost of military aircrafts.

On July 3, 2024 the U.S. government Department of Defense, in partnership with the Government of Japan, announced its plan to upgrade U.S. tactical aircraft laydown across multiple military installations in Japan. According to the agreement, modernization plan will be implemented over the next several years, and the total investment will reach around US$10 billion to enhance the U.S.-Japan Alliance, and further bolster regional strength, and peace and stability in the Indo-Pacific region. The U.S. Air Force will upgrade its presence at Kadena Air Base by deploying 36 F-15EX aircraft to replace 48 F-15C/D aircraft as part of the modernization program. The joint force between the two countries will continue to maintain their presence with 4th and 5th generation tactical aircraft at Kadena Air Base throughout this transition. Additionally, the U.S. Air Force will also upgrade its presence at Misawa Air Base from 36 F-16 aircraft to 48 F-35A aircraft, leading to greater tactical aircraft capacity and capability in the region.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft propulsion system market analysis from 2023 to 2033 to identify the prevailing aircraft propulsion system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft propulsion system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft propulsion system market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Propulsion System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 84.5 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Engine Type |

|

| By Aircraft Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | MTU Aero Engines AG, Kawasaki Heavy Industries, Ltd. , IHI AEROSPACE Co., Ltd., General Electric Company, 3W Modellmotoren, Pratt & Whitney, Safran, Rolls-Royce Holdings plc., CFM International, Williams International, Lockheed Martin Corporation., Northrop Grumman |

Growing adoption of electric and hybrid powertrain are the upcoming trend in the aircraft propulsion system market.

Commercial aviation is the leading end user of aircraft propulsion system.

North America is the largest region for aircraft propulsion system market.

The global aircraft propulsion system market was valued at $50.77 billion in 2023 and is projected to reach $84.52 billion by 2033, registering a CAGR of 5.4 % from 2024 to 2033.

Rolls-Royce Holdings plc., General Electric Company, Pratt & Whitney, Hanwha Group, Kawasaki Heavy Industries, Ltd., CFM International, Safran SA, Honeywell International Inc., MTU Aero Engines AG are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...