Airless Packaging Market Overview

The Global Airless Packaging Market size was valued at $4.9 billion in 2020, and is projected to reach $8.7 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032. Rising demand for eco-friendly products, rapid consumption rates, and skincare growth in developing regions drive the airless packaging market. Expanding packaged food and beverage use in developed cities and innovative design trends offer growth opportunities. However, high production costs, low differentiation, and intense competition hinder overall market expansion.

Market Dynamics & Insights

- The airless packaging industry in Asia-Pacific held a significant share of over 35.3% in 2021.

- The airless packaging industry in Germany is expected to grow significantly at a CAGR of 4.0% from 2023 to 2032

- By packaging type, bottles and jars segment is one of the dominating segments in the market and accounted for the revenue share of over 62.7% in 2020.

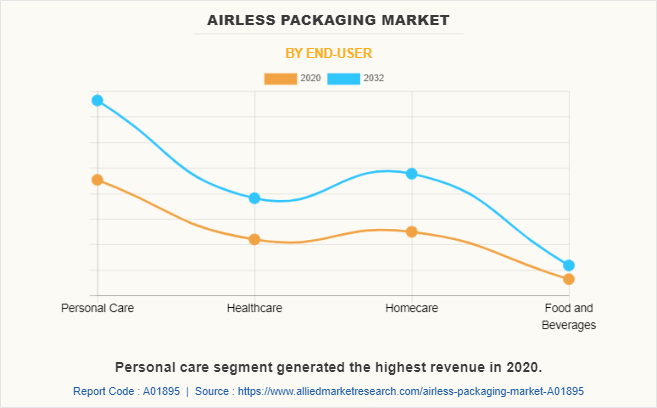

- By end-user, homecare segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $4.9 Billion

- 2032 Projected Market Size: $8.7 Billion

- CAGR (2023-2032): 4.9%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant by Airless Packaging

Airless packaging refers to a type of packaging design that is designed to protect and preserve the contents of a product by minimizing exposure to air. It is commonly used in industries such as cosmetics, skincare, homecare, pharmaceuticals, and food and beverages.

Airless Packaging Market Dynamics

Airless packaging is a premium solution used in beauty & cosmetics and medical industries, as airless dispensers are often used with luxury products. The use of airless technology in squeezable plastic tubes has grown, and is expected to continue to increase, thus boosting the demand for natural, organic, and premium skin care products. Increase in demand for high-end products in the developing countries drives the growth of the airless packaging market. Airless packaging refers to liquid dispensing packaging that inhibits air to come in contact with the formulations inside.

It requires less packaging material and prevents wastage of space and product. Thus, airless packaging systems are majorly used in the cosmetics industry. Moreover, they are used in the packaging of processed foods, as they prevent unnecessary exposure of food products to air. According to The Packaging Company, the shelf life of the product increases up to 15% or more with the use of airless technology. Moreover, airless pumps give access to almost 95% of the product in the container without the wastage, degradation, and impurity of the formulations. In addition, the backflow problem faced by conventional packing methods is resolved with the help of airless technology, thus driving the growth of airless packaging market.

Increase in demand for prestige products around the globe has accelerated the growth of the airless packaging market, owing to growing demand from the personal care sector. Africa and Middle East countries have witnessed increase in sale of beauty & haircare products in the recent years. Therefore, increase in sale of personal care products is expected to propel the growth of the airless packaging market. Moreover, modernization and increase in per capita income of the people in developing countries fuels the demand for homecare products, which in turn increases the demand for airless packaging technology.

In addition, factors such as need for better packaging and increase in adoption of airless packaging technology drive the market growth. Moreover, the shelf life of the product drastically increases with the use of airless packaging. Airless packaging offers various features such as product protection, enhanced formula stability, controlled dispensing, premium brand image, sustainability, and others, which are anticipated to boost the airless packaging market. In addition, the use of dispensing pumps and high-quality materials such as plastics & glass for packaging has improved the quality of the products.

The airless packaging market witnesses various restraints in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdown resulted in reduced industrial activities, eventually leading to reduced demand for airless packaging from various sectors such as home care. However, COVID-19 has subsided, and the major manufacturers such as Aptar Group and Quadpack Industries Inc. are performing well in 2023. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing airless packaging. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

Airless Packaging Market Segmental Overview

The airless packaging market is segmented into Packaging Type, Material Type, End-User, and Region. By packaging type, the market is categorized into bags & pouches, bottles & jars, tubes, and others (airless compacts, airless syringes, airless pens, and airless droppers. By material type, it is divided into plastic, glass, and others. By end user, it is divided into personal care, healthcare, homecare, and food & beverages. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

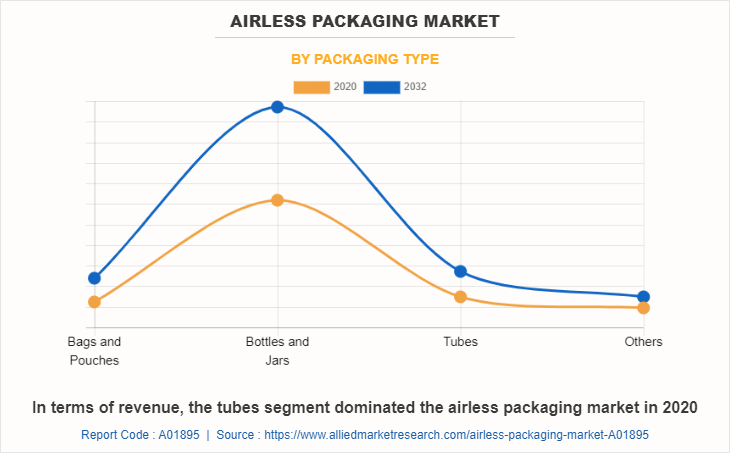

By Packaging Type:

The airless packaging market is divided into bags & pouches, bottles & jars, tubes, and others. In 2020, the bottles and jars segment dominated the airless packaging market, in terms of revenue, and bags & pouches is expected to grow at the highest CAGR during the forecast period. Bottles & jars serve as an ideal packaging choice for health & beauty products such as creams, lotions, and serums, as they offer shelf stability and optimum formula protection, and hence reduce the need for unnecessary chemical preservation.

They preserve the formulation and quality of the product by preventing the air to come in contact with the formulations. Airless jars & bottles are tamper-proof and they ensure about 95% of the product usage. They are suitable for body moisturizers, thick creams, ointments, and others, as they tend to avoid exposure to air, which results in the degradation of the product. In October 2022, Quadpack Industries launched a new refillable and recyclable version of the airless Regula Jar. It is a recyclable, refillable, mono-material, and easy-to-use jar, which is expected to boost the airless packaging market growth.

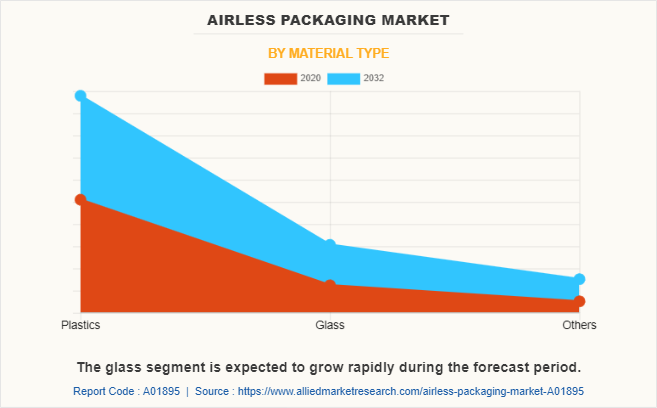

By Material Type:

The airless packaging market is classified into plastic, glass and others. The glass segment is expected to grow rapidly during the forecast period. Glass is used for airless packaging, as it offers multiple benefits such as safety, reusability, sterility, aesthetic looks, barrier properties, and others. Moreover, glass is almost 100% recyclable without any loss in purity or quality, and can be recycled within 30 days; hence, serves as an eco-friendly option. Furthermore, it prevents the interaction between product and packaging, as it is nonporous and damp-proof.

As glass can be molded into any desired size and shape, it is witnessing increasing popularity in the airless packaging market. Countries have enacted laws and regulations to standardize airless packaging recycling and management solutions for the development of airless packaging solutions. In addition, Lumson offers TAG (Techno Airless Glass) with a pouch developed in a glass bottle. It is available in diverse designs such as an additional thick base, which amplifies the look of a cylindrical glass bottle with an over cap and flush pump. An increase in demand for glass for its premium image and to keep the product preserved and fresh is expected to offer a lucrative opportunity for market expansion.

By End User:

The airless packaging market is categorized into personal care, healthcare, homecare, and food & beverage. Airless packaging is becoming more approachable for the personal care industry. The products that are covered in this industry are toothpaste, perfumes, lipsticks, moisturizers, shampoos, hair colors, and others. Using airless technology, the contents of the personal care product are protected from degradation (mainly oxidation), shelf life is increased, and almost 95% of the content could be utilized.

The personal care products are available in airless jars, airless bottles, airless pouches, airless tubes, and others. The increase in demand for personal care products such as cosmetics and hair care with the change in lifestyle and increase in modernization among people in developing countries are expected to provide lucrative opportunities for the personal care airless packaging market.

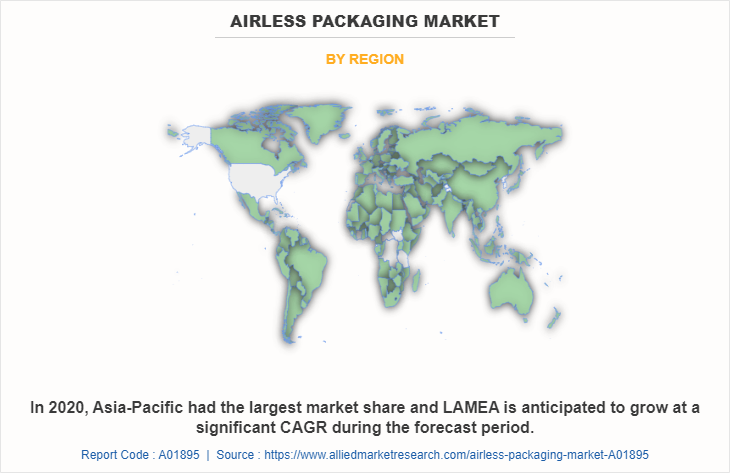

By Region:

The airless packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest airless packaging market share and is anticipated to grow at a significant CAGR during the forecast period, due to extensive demand in the personal care segment. Asia-Pacific is witnessing surge in demand for premium cosmetics and skincare products and is expected to increase the demand for airless packaging technology during the forecast period. Airless packaging helps preserve the integrity of high-value products by minimizing oxidation and degradation.

The growing e-commerce industry fuels the demand for efficient and secure packaging solutions. Airless packaging provides effective protection during transit, reducing the risk of leakage, breakage, and contamination. In addition, the rise in demand for sustainable packaging solutions has led to the adoption of airless packaging by various industries such as personal care, pharmaceuticals, home care, and food & beverages. Moreover, advances in airless packaging technology have made packaging more efficient, reliable, and cost-effective.

Innovations such as improved pumping mechanisms, barrier materials, and design improvements have led to widespread acceptance of airless packaging in the Asia-Pacific region. The easy-to-use, proper dosage, no contamination, and no wastage features of airless packaging systems have led to the increased adoption of airless packaging in Asia-Pacific. Quadpack offers foundations in the Slimline Jumbo series by Natio in Yonwoo’s Jumbo airless dispensers. Glass is used for its aesthetic looks and enhanced quality in Indonesia and China, thus increasing the demand for premium skin care products, which in turn impacts the airless packaging market opportunities in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major players in the airless packaging market are ABC Packaging Ltd., Albéa, Aptar Group, Inc., A Packaging Group, Cosme Packaging, HCP Packaging, Libo Cosmetics Company, Ltd., Lumson SPA, Quadpack Industries, and Silgan Dispensing Systems are provided in this report. Some important players in the market include Aptar Group Inc., Quadpack Industries, and Lumson SPA. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the airless packaging market.

Some examples of product launches in the market

- In October 2022, Quadpack Industries launched a new refillable and recyclable version of the Regula Jar, which is a recyclable, refillable, mono-material, and easy-to-use jar. This aims in improving the airless products portfolio.

- In June 2023, Lumson SPA launched XPAPER Airless Paper Packaging. It can be found in the material that bottle is made of cardboard, a sustainable yet totally customizable material.

- In November 2021, Libo Cosmetics launched a new range of sustainable packaging featuring post-consumer PET waste from ocean plastic. The series includes packaging for lipsticks, lip gloss, and compacts made with either recycled aluminum, PET, or FSC-certified paper.

Acquisitions in the market

- In February 2020, Aptar Group Inc., a global leader in consumer dispensing, active packaging, and drug delivery solutions announced its entry into a binding agreement to acquire FusionPKG, a leader in high-quality, prestige airless and color cosmetics packaging, and conception to launch turnkey solutions for the North American beauty market.

Expansion in the market

- In March 2022, A Packaging Group (APG), opened a new facility in Defiance, Ohio that will offer R&D, compounding and formulation, manufacturing (bottle blowing, dispenser and cap manufacturing, and custom molding), filling, and outer-package labels. This strategy aims in improving the presence in the market.

- In March 2022, Quadpack invested over 6 million at its Germany manufacturing facilities in Kierspe, which is expected to help in the creation of a decoration center and the expansion of its injection molding and assembly capacity. Quadpack’s Kierspe plant is being expanded, owing to an increase in demand for airless packaging.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging airless packaging market trends and dynamics.

- An in-depth airless packaging market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- An extensive analysis of the airless packaging market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The airless packaging market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the airless packaging market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the airless packaging industry.

Airless Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.7 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2020 - 2032 |

| Report Pages | 275 |

| By Packaging Type |

|

| By Material Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Lumson SPA, AptarGroup, Inc., Albéa Beauty Holdings S.A., HCP PACKAGING (SHANGHAI) CO. LTD, APackaging Group, Cosme Packaging, ABC Packaging Ltd., Libo Cosmetics Company, Ltd., Silgan Dispensing Systems, Quadpack Industries |

Analyst Review

The utilization of airless packaging is expected to increase due to rise in need to conserve the formulations of the products, which get damaged or contaminated in the presence of air. The beauty & personal care industry uses airless packaging systems to protect the formula of the creams or lotions, thus driving the growth of the market. Asia-Pacific is projected to be the highest revenue contributor, whereas LAMEA is expected to grow at a significant CAGR during the forecast period.

Rise in awareness of high-end personal care products, increase in the shelf life of products, technological advancements, less wastage of products, and lifestyle changes in the developing regions drive the market growth. However, high cost of manufacturing airless packaging systems and low product differentiation impede the growth of the airless packaging market. On the contrary, innovative designs offered by various manufacturers through technological advancements are expected to create lucrative opportunities for key players.

The global airless packaging market was valued at $4,915.0 million in 2020, and is projected to reach $8,668.7 million by 2032, registering a CAGR of 4.9% from 2023 to 2032.

The base year considered in the global Airless Packaging market report is 2022.

Bottles and jars are the leading packaging type in the Airless Packaging Market.

Asia-Pacific is the largest regional market for Airless Packaging.

The increase in demand for sustainable packaging is the upcoming trend in the Airless Packaging Market around the world.

ABC Packaging Ltd., Albéa, Aptar Group, Inc., A Packaging Group, Cosme Packaging, HCP Packaging, Libo Cosmetics Company, Ltd., Lumson SPA, Quadpack Industries, and Silgan Dispensing Systems are the top companies to hold the market share in Airless Packaging.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...

Loading Research Methodology...