Alloys Market Research, 2033

The global alloys market size was valued at $301.7 billion in 2023, and is projected to reach $533.9 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Introduction

An alloy is a combination of two or more elements, where at least one is a metal, and the result is a material with enhanced properties compared to the individual components. Alloys are created to improve the mechanical, thermal, electrical, or corrosion-resistant characteristics of a base metal. They can include metals like iron, aluminum, copper, or nickel, combined with other metals or non-metals such as carbon or silicon. These combinations are achieved through various methods, including melting and mixing the constituent materials. The physical properties of alloys, such as strength, ductility, hardness, and resistance to wear, make them invaluable in a wide range of industries and applications.

Alloys have revolutionized modern engineering and manufacturing. Materials can be tailored for specific purposes by manipulating the composition and treatment of alloys. This versatility ensures that alloys are a critical component of numerous products and industries today, from construction to electronics, aerospace to medicine. Each industry depends on alloys that meet stringent specifications for durability, performance, and environmental resistance. In construction, alloys play a central role in ensuring the strength and longevity of structures. Steel is perhaps the most commonly used alloy in this sector, where its high tensile strength and flexibility make it ideal for reinforcing concrete in buildings, bridges, and dams. Stainless steel is used in cladding and roofing due to its rust-resistant properties, ensuring that structures can withstand environmental wear over time. In earthquake-prone regions, alloys with improved ductility, such as certain grades of steel, are used to build earthquake-resistant structures that can absorb and dissipate energy from seismic movements.

Key Takeaways

- The alloys market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global alloys market and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the alloys market are Baosteel Group Corporation, Aluminum Corporation of China Limited, Jindal Stainless Ltd, Rio Tinto Group., Nippon Steel Corporation, POSCO holdings Inc, Alcoa Corporation, Kobe Steel, Ltd., RUSAL, and ArcelorMittal S.A. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

The surge in demand for alloys in automotive and aerospace industries is expected to drive the growth of the alloys market during the forecast period. The automotive industry stands as one of the primary drivers for increase in alloy demand. Manufacturers are seeking lightweight materials that can enhance vehicle efficiency and performance with the advent of electric vehicles (EVs) and the global shift towards sustainable transportation solutions. Alloys, particularly aluminum and magnesium, are favored for their high strength-to-weight ratios. These materials help reduce the overall weight of vehicles, leading to improved fuel efficiency and extended battery life in electric models. The aerospace industry is another significant contributor to the growing alloys market. The demand for lightweight, high-strength materials is paramount in aerospace applications, where reducing weight can lead to substantial improvements in fuel efficiency and performance. Alloys such as titanium, aluminum, and nickel-based superalloys are extensively utilized in aircraft manufacturing and components, such as engine parts, structural frames, and landing gear.

However, environmental regulations of alloys is expected to restrain the growth of the alloys market. Stricter environmental regulations regarding mining and metallurgy present considerable challenges for the alloys market. As governments and regulatory agencies intensify their focus on sustainability and environmental protection, the extraction and processing of raw materials for alloy production are under increased scrutiny. Specifically, beryllium copper alloys face rigorous regulations due to the presence of beryllium, a toxic element. Although beryllium is not included in the Restriction of Hazardous Substances (RoHS) or End-of-Life Vehicles (ELV) directives, it is recognized as a priority hazardous air pollutant under the Air Pollution Control Act in various jurisdictions. Additionally, under the EU's Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) framework and Japan's Pollutant Release and Transfer Register (PRTR) system, beryllium is classified as a Class I chemical substance, necessitating reporting on its environmental releases.

Segments Overview

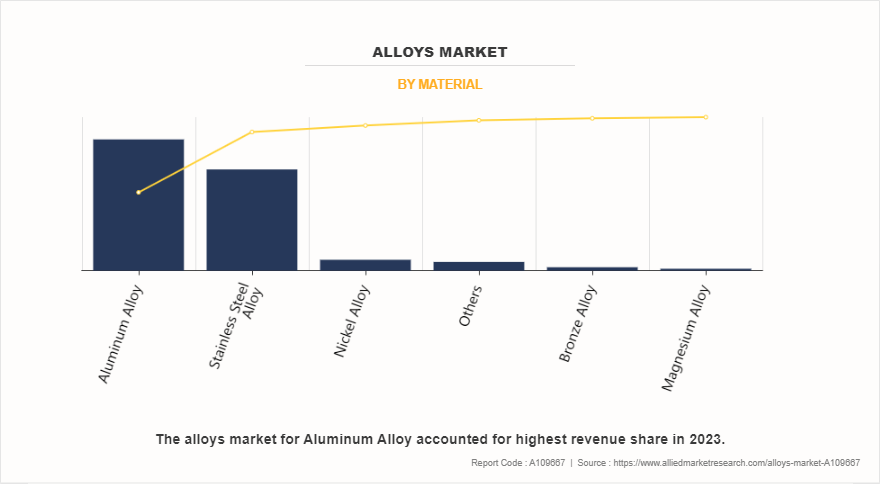

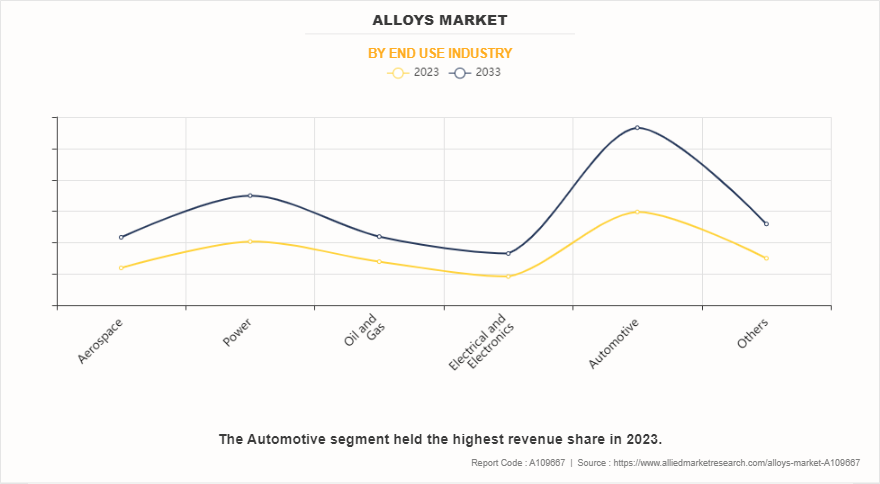

The alloys market is segmented into material, end-use industry, and region. On the basis of material, the market is classified into stainless steel alloy, aluminum alloy, nickel alloy, bronze alloy, magnesium alloy, and others. On the basis of end-use industry, the market is divided into aerospace, power, oil and gas, electrical and electronics, automotive, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of material, the aluminum alloy segment dominated the market in 2023. Aluminum alloys possess several beneficial properties that make them suitable for various applications. One of the most significant attributes is their lightweight nature, which is crucial in industries where weight reduction is essential. For example, in the aerospace and automotive sectors, reducing weight translates to improved fuel efficiency and reduced operational costs. Alloys such as 6061 and 7075 are popular for making structural components, wheels, and engine parts. The use of aluminum in vehicles not only contributes to better performance but also aids in meeting stringent environmental regulations.

On the basis of end-use industry, the automotive segment dominated the market in 2023. Aluminum alloys have seen an exponential rise in usage within the automotive industry, primarily due to their lightweight properties and excellent corrosion resistance. Weighing significantly less than steel, aluminum can reduce the overall weight of a vehicle, which is particularly beneficial for electric and hybrid vehicles, where weight reduction can extend battery range and enhance performance. The automotive sector utilizes various aluminum alloys, including wrought and cast forms, to fabricate components such as engine blocks, wheels, and body panels.

Region-wise, Asia-Pacific dominated the alloys market in 2023. The Asia-Pacific region is a significant player in the global market for alloys, driven by its robust industrial activities, expanding construction sectors, and increasing demand for high-performance materials across various applications. Countries such as China, India, Japan, South Korea, and Australia lead in alloy production and consumption, fueled by a diverse range of industries including automotive, aerospace, electronics, and construction. India is witnessing a substantial rise in alloy usage, propelled by its growing infrastructure projects and a booming automotive industry. The demand for steel alloys is particularly high due to extensive construction activities, including roads, bridges, and buildings. The Indian government’s initiatives, such as the “Make in India” campaign, have fostered local manufacturing capabilities, leading to innovations in alloy development.

Competitive Analysis

Key players in the alloys industry include Baosteel Group Corporation, Aluminum Corporation of China Limited, Jindal Stainless Ltd, Rio Tinto Group., Nippon Steel Corporation, POSCO holdings Inc, Alcoa Corporation, Kobe Steel, Ltd., RUSAL, and ArcelorMittal S.A. These players have adopted several strategies to make their market position strong.

Alloys Industry News

- In December 2022, SLM Solutions partnered with Elementum 3D to advance the production of high-performance parts using premium alloys for aerospace and space applications. This collaboration aims to expand the adoption of additive manufacturing, enhance the visibility of Elementum 3D materials, and accelerate the material portfolio development for the NXG XII 600. As a result, Elementum 3D's high-performance alloys are expected to become compatible with SLM technology starting in 2023.

- In January 2022, Desktop Metal announced the launch of DM HH Stainless Steel (DM HH-SS), a high-strength, corrosion-resistant alloy designed for additive manufacturing on its Production System platform. This advanced material is tailored for mass-producing durable components with exceptional wear and corrosion resistance, catering to industries such as oil & gas, automotive, consumer products, and medical devices.

- In January 2022, Alloy Wire International (AWI) introduced Inconel 617, a high-performance alloy comprising molybdenum, nickel, chromium, cobalt, and aluminum. This advanced material is specifically engineered for applications in the medical, aerospace, nuclear, and petrochemical industries.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alloys market analysis from 2023 to 2033 to identify the prevailing alloys market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alloys market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alloys market trends, key players, market segments, application areas, and alloys market growth strategies.

Alloys Market, by Material Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 533.9 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 309 |

| By Material |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Rio Tinto Group., Baosteel Group Corporation, ArcelorMittal S.A, Nippon Steel Corporation, Aluminum Corporation of China Limited, RusAL, Kobe Steel, Ltd., Jindal Stainless Ltd, POSCO Holdings Inc., Alcoa Corporation |

Analyst Review

According to the opinions of various CXOs of leading companies, the alloys market is expected to witness growth due to increase in demand for alloys in automotive and aerospace industries which is expected to drive the growth of the alloys market during the forecast period. In the automotive industry, the rising demand for lightweight alloys is driven by the need for improved fuel efficiency and lower emissions. Stricter fuel economy standards and emissions regulations worldwide are prompting automakers to explore innovative solutions to enhance vehicle performance while minimizing environmental impact. Lightweight materials, particularly aluminum and magnesium, have become essential in this effort. Aluminum, known for its high strength-to-weight ratio, corrosion resistance, and recyclability, has gained significant traction in automotive manufacturing. By integrating aluminum into vehicle designs, manufacturers can achieve weight reductions of up to 40%, resulting in fuel economy improvements of 6- 8% for every 10% reduction in weight. Additionally, aluminum's superior thermal conductivity aids in heat dissipation from engines and braking systems, further boosting vehicle performance.

However, fluctuating raw material prices is expected to restrain the growth of the alloys market during the forecast period. Fluctuating raw material prices significantly impact the alloys market, especially for essential metals like aluminum, copper, and nickel, which are vital in alloy production. Price volatility stems from various factors, including geopolitical tensions, supply chain disruptions, and shifts in global demand. For instance, political instability in key mining areas can lead to restrictions in supply and increase in prices. Additionally, rising energy costs can affect mining and refining expenses, complicating pricing structures.

The global alloys market was valued at $301.7 billion in 2023, and is projected to reach $533.9 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

The major prominent players operating in the alloys market include Baosteel Group Corporation, Aluminum Corporation of China Limited, Jindal Stainless Ltd, Rio Tinto Group., Nippon Steel Corporation, POSCO holdings Inc, Alcoa Corporation, Kobe Steel, Ltd., RUSAL, and ArcelorMittal S.A.

Asia=-Pacific is the largest regional market for alloys.

Aluminum alloy is the leading material of alloys market.

Increase in demand for sustainable alloys are the upcoming trends of alloys market in the globe.

Loading Table Of Content...

Loading Research Methodology...