Aloe Vera Gel Market Research, 2033

The global aloe vera gel market was valued at $309.7 million in 2023, and is projected to reach $603.5 million by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Market Introduction and Definition

Aloe vera gel is a clear, viscous substance extracted from the inner leaf of the Aloe vera plant, widely recognized for its soothing, moisturizing, and healing properties. Rich in vitamins, minerals, enzymes, and amino acids, it is renowned for its anti-inflammatory and antioxidant properties, which help alleviate skin irritations, burns, and wounds. The gel's high water content provides intense hydration, making it a popular ingredient in skincare and cosmetic products.

It also contains polysaccharides that promote skin repair and regeneration, while its antimicrobial properties protect against infections. In addition, aloe vera gel is used in oral care products for its ability to support oral health and reduce dental plaque. Its natural composition and versatile benefits make it a staple in both traditional and modern medicine, contributing to its widespread use in health and beauty industries.

Key Takeaways

- The aloe vera gel market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major aloe vera gel industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The expansion of the cosmetics and personal care industry is significantly propelling the growth of the aloe vera gel market. Aloe vera gel, renowned for its soothing, moisturizing, and anti-inflammatory properties, is increasingly being incorporated into a wide range of beauty and skincare products. This trend is driven by the growing consumer preference for natural and organic ingredients in personal care items, as well as the increasing awareness of aloe vera's benefits for skin health. The surge in demand for multifunctional products that offer both cosmetic and therapeutic advantages further fuels the market expansion. In addition, the rising popularity of DIY skincare solutions and homemade beauty remedies is boosting the use of aloe vera gel in various formulations. In 2021, China ranked as the third-largest global importer of cosmetics, with imports valued at approximately $18.5 billion. Following closely, Hong Kong emerged as the leading cosmetics importer in the Asia-Pacific region, with skincare and cosmetic imports exceeding $7.3 billion in the same year. As the cosmetics sector continues to innovate and evolve, the aloe vera gel market is poised to experience sustained growth, driven by its versatile applications and the ongoing shift towards more natural and effective personal care solutions.

High production costs are a significant challenge for the aloe vera gel market, potentially impeding its growth. The production of high-quality aloe vera gel involves several expensive steps, including the cultivation of aloe vera plants, careful extraction processes, and stringent quality control measures. The cost of maintaining and harvesting aloe vera plants, especially in regions with less favorable growing conditions, adds to the overall expense. In addition, advanced processing techniques to ensure purity and efficacy of the gel require specialized equipment and technology, further driving up costs. These high production expenses can lead to increased prices for consumers, which might reduce demand and limit market expansion. Companies operating in the aloe vera gel market must navigate these cost challenges while striving to deliver high-quality products at competitive prices to sustain growth and capture a larger market share.

Product innovation and diversification present significant growth opportunities for the aloe vera gel market. As consumer preferences evolve, there is increasing demand for novel aloe vera formulations that cater to various needs, from skincare and haircare to health supplements. Companies investing in research and development to create innovative products, such as aloe vera gels infused with additional vitamins or natural extracts, can tap into niche markets and attract a broader customer base. Diversification into related product lines, like aloe vera-based cosmetics and wellness products, further enhances market potential. In addition, the trend towards natural and organic ingredients in personal care and health products drives growth in this segment. By leveraging these opportunities, companies can differentiate themselves in a competitive market and achieve sustainable growth.

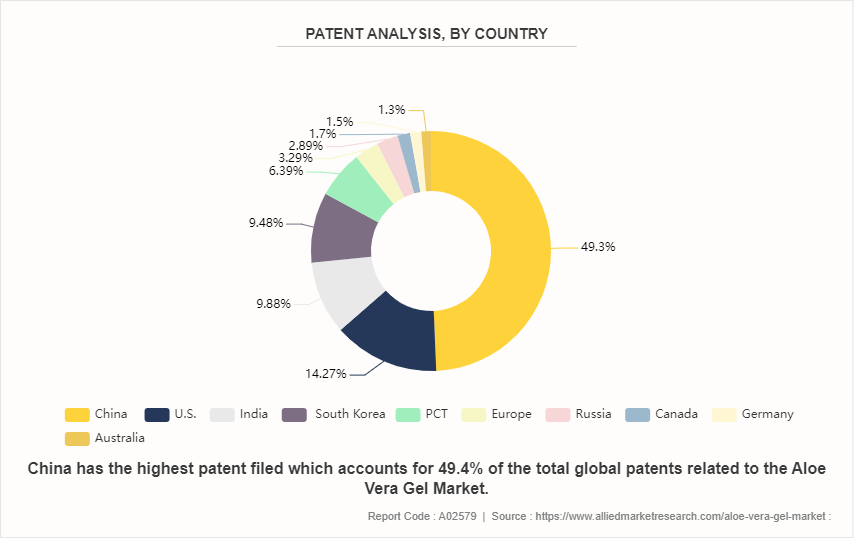

Patent Analysis of the Global Aloe Vera Gel Market

In the aloe vera gel market, patent activity shows a significant concentration in China, holding 49.4% of the global patent share, indicating robust innovation and protection of new technologies. The U.S. follows with 14.3%, reflecting a strong focus on aloe vera applications and formulations. India and South Korea hold notable shares at 9.9% and 9.5%, respectively, highlighting their growing involvement in the sector. Other regions, such as Europe (3.3%) and Russia (2.9%) , have smaller, yet substantial contributions. This distribution suggests that while China leads in patenting, other countries are also advancing in aloe vera innovations, impacting global market dynamics.

Market Segmentation

The aloe vera gel market is segmented into product type, end-use industry, and region. Based on product type, the market is classified into conventional and organic. By end-use industry, the market is divided into cosmetic and personal care, food and beverages and pharmaceutical. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the aloe vera gel market include Aloecorp Inc., Forever Living Products, Terry Laboratories, Inc., Lily Of The Desert, Natural Aloe Costa Rica S.A., Aloe Laboratories Inc., Herbalife International of America, Inc., Aloe Vera of Australia, Real Aloe Solutions Inc., and Green Leaf Naturals.

Recent Key Strategies and Developments

- In August 2022, CHI Haircare launched the aloe vera gel and the CHI Naturals with Hyaluronic Acid Collection. This range offers hydration and nourishment through aloe vera and hyaluronic acid, helping to lock in moisture, enhance shine, and soften both skin and hair.

- In July 2022, Organic Harvest introduced a new line of organic aloe vera gel. This range includes four different variations of the product, emphasizing its natural formulation.

- In August 2021, Ceremonia released an oil mist featuring aloe vera, blending powerful Latin American ingredients into a micro-mist solution. This mist hydrates and adds shine to hair without the heaviness of traditional oils. Enriched with aloe vera and Mexican chia seed oil, it revitalizes, conditions, and strengthens hair, making it suitable for all hair types.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The growing cosmetic industry in the Asia-Pacific region is significantly boosting the demand for aloe vera gel. As consumers increasingly seek natural and organic ingredients in skincare products, aloe vera gel has become a popular choice due to its soothing, hydrating, and healing properties. This surge in consumer preference is driven by rising awareness about the benefits of aloe vera, coupled with the expanding beauty and personal care sector in countries like China, India, and Japan. Consequently, the growing inclination towards herbal and organic cosmetic products is propelling the growth of the aloe vera gel market in the Asia-Pacific region.

- Increasing purchasing power is a significant driver of market growth. According to World Bank data, consumer expenditure in India rose from $1.9 trillion in 2018 to $2.4 trillion in 2022, boosting market demand. The growing interest in color cosmetics is largely due to more individuals incorporating these products into their daily makeup routines. The shift in lifestyle among millennials and younger generations, driven by the heightened influence of social media platforms, is further fueling the demand for color cosmetics in the country.

- The global and Indian markets for cruelty-free and vegan beauty products have seen tremendous growth in recent years. Cosmetic brands are increasingly choosing natural and eco-friendly ingredients for their products. This trend towards 'green cosmetics' is driving the demand for sustainable and clean beauty items.

- Both manufacturers and third-party e-retailers are keen to include clean beauty products in their offerings. For example, in June 2023, the e-commerce platform Purplle introduced the UK's clean beauty brand Dr. PAWPAW to the Indian market, featuring multi-tasking lip and skincare products.

- Additionally, the Ministry of Health and Family Welfare of India has enacted a ban on cosmetic testing on animals. The new regulation, "148-C. prohibition of testing of cosmetics on animals, " stipulates that no individual or entity shall use animals for cosmetic testing.

- With Gen Z driving the market for color cosmetics in India, their preference for experimentation and their commitment to eco-friendly practices are expected to increase the demand for eco-friendly, natural, organic, and clean color cosmetic products in the future.

- Therefore, Asia-Pacific is projected to emerge as a dominant force in the aloe vera gel market throughout the forecast period.

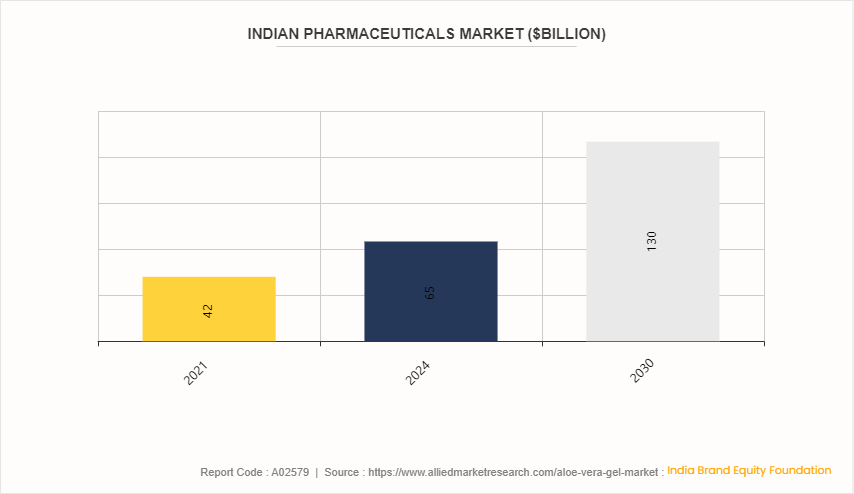

The Growth of the Aloe Vera Gel Market is likely to be Driven by the Expansion of the Indian Pharmaceuticals Industry

The expansion of the Indian pharmaceuticals industry is set to drive significant growth in the aloe vera gel market. As the demand for natural and herbal ingredients rises, aloe vera gel, known for its medicinal and cosmetic benefits, is increasingly incorporated into pharmaceutical and skincare products. Indian pharmaceutical companies are leveraging the plant's properties to develop a variety of health and wellness products, thereby boosting its market demand. In addition, India's rich biodiversity and favorable climatic conditions support large-scale aloe vera cultivation, further contributing to the market's growth and the country's position as a key player in the global aloe vera industry.

The Indian pharmaceutical industry is projected to reach $65 billion by 2024, approximately $130 billion by 2030, and $450 billion by 2047. Government data indicates that the current market value is around $50 billion, with exports contributing over $25 billion. India accounts for about 20% of global generic drug exports. In FY23, the Indian hospital market was valued at $98.98 billion and is expected to grow at a CAGR of 8%, reaching $193.59 billion by FY32.

Industry Trends

- The aloe vera gel market is witnessing significant growth, driven by rising consumer awareness of its health and skincare benefits. One of the prominent trends is the increasing demand for organic and natural products. Consumers are becoming more health-conscious and are looking for products free from synthetic chemicals and additives. For instance, brands like Forever Living and Aloecorp are focusing on organic certifications and clean labeling to attract a health-savvy clientele.

- Another key trend is the growing use of aloe vera gel in the cosmetics and personal care industry. This segment is expanding rapidly as aloe vera is recognized for its moisturizing, soothing, and anti-inflammatory properties. Companies such as L'Oréal and The Body Shop incorporate aloe vera gel into a range of products, from face creams to after-sun lotions, catering to the rising demand for natural skincare solutions.

- The food and beverage industry are also embracing aloe vera gel, capitalizing on its health benefits, including digestion support and immune system enhancement. Products like Aloe Vera drinks and supplements are becoming mainstream. For example, brands like OKF and AloeCure have launched various aloe-based beverages, appealing to consumers looking for functional drinks that offer more than just hydration.

- E-commerce and direct-to-consumer (DTC) channels are increasingly important in the aloe vera gel market. The convenience of online shopping and the ability to reach a broader audience have led companies like Herbalife and Lily of the Desert to strengthen their online presence and direct sales strategies.

- In addition, sustainability and ethical sourcing are crucial trends shaping the market. Consumers are increasingly aware of the environmental impact of their purchases, prompting companies to adopt sustainable practices. Brands are focusing on eco-friendly packaging and responsible farming practices to reduce their carbon footprint, as seen with companies like Green Leaf Naturals and NaturSense.

Key Sources Referred

- World Bank

- India Brand Equity Foundation

- Ministry of Health and Family Welfare of India

- Invest India

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aloe vera gel market analysis from 2024 to 2033 to identify the prevailing aloe vera gel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aloe vera gel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aloe vera gel market trends, key players, market segments, application areas, and market growth strategies.

Aloe Vera Gel Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 603.5 Million |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Product Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Aloecorp Inc., Terry Laboratories, Inc., Real Aloe Solutions Inc., Forever Living Products, Aloe Vera of Australia, Natural Aloe Costa Rica S.A., Herbalife International of America, Inc., Green Leaf Naturals, Aloe Laboratories Inc., Lily of the Desert |

The aloe vera gel market was valued at $309.7 million in 2023 and is estimated to reach $603.5 million by 2033, exhibiting a CAGR of 6.9% from 2024 to 2033.

Asia-Pacific is the largest regional market for Aloe Vera Gel.

The cosmetic & personal care is the leading end-use industry of Aloe Vera Gel Market.

Aloecorp Inc., Forever Living Products, Terry Laboratories, Inc., Lily Of The Desert, Natural Aloe Costa Rica S.A., Aloe Laboratories Inc., Herbalife International of America, Inc., Aloe Vera of Australia, Real Aloe Solutions Inc., and Green Leaf Naturals are the top companies to hold the market share in Aloe Vera Gel.

Rising demand for natural and organic products and expanding applications across industries are the drivers of Aloe Vera Gel Market in the globe.

Loading Table Of Content...