Alternative Lending Market Research, 2033

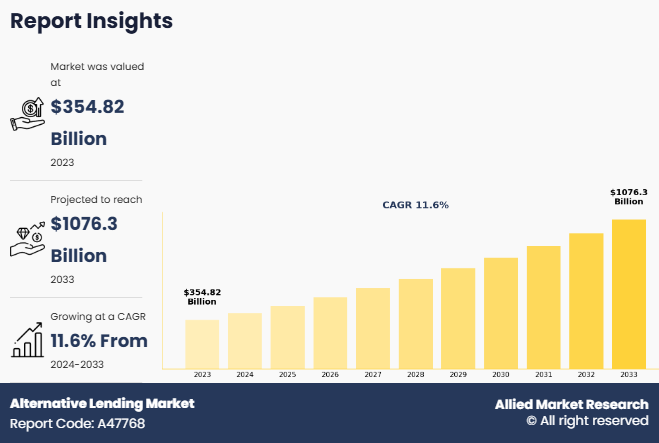

The global alternative lending market was valued at $354.8 billion in 2023, and is projected to reach $1,076.3 billion by 2033, growing at a CAGR of 11.6% from 2024 to 2033. Alternative lending refers to loan options available to consumers and businesses other than those options from traditional banks. Fintechs and non-banking companies are increasingly entering the alternative lending market to offer customized lending products designed for specific regions, demographic segments, or industries. Alternative lenders reshape the market with innovative technology-driven models that enable faster loan approvals, better pricing, and flexible terms. This includes peer-to-peer lending platforms, term loans, equipment loans, and other tech-based lending platforms. Alternative lending industry refers to loan options available to consumers and businesses other than those options from traditional banks. Fintechs and non-banking companies increasingly leverage technology to offer customized lending products designed for specific regions, demographic segments, or industries. Alternative lenders reshape the alternative lending market with innovative technology-driven models that enable faster loan approvals, better pricing, and flexible terms. This includes peer-to-peer lending platforms, term loans, equipment loans, and other tech-based lending platforms.

Factors such as increase in demand for flexible financing options and surge in favorable regulatory changes positively impact the growth of the alternative lending market. In addition, rise in peer-to-peer (P2P) lending and crowdfunding lending due to easier access to capital, lower borrowing costs, more inclusive financial services, and surge in trust in fast & transparent online platforms, is expected to fuel the growth of the market during the forecast period. Furthermore, the integration of AI, blockchain, and data analytics in lending platforms is expected to provide lucrative growth opportunities for the market in the upcoming years. Moreover, the development of technology to enhance loan decision-making, improve security, and streamline processes is anticipated to create lucrative opportunities for market growth, making solutions faster, more efficient, and more transparent.

Moreover, technological advancements and shift in consumer preferences toward more accessible and efficient lending solutions are expected to positively impact the growth of the market in the future. However, data privacy & security concerns, credit risk, and loan default are expected to hamper market growth. Furthermore, the expansion of lending platforms creates numerous opportunities in emerging markets by increasing access to credit, boosting financial inclusion and economic growth. Moreover, partnerships and collaboration between traditional banks and alternative lenders are expected to offer remunerative opportunities for the expansion of the global market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the alternative lending industry analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, the threat of substitutes, and bargaining power of buyers, on the alternative lending market.

Key Findings:

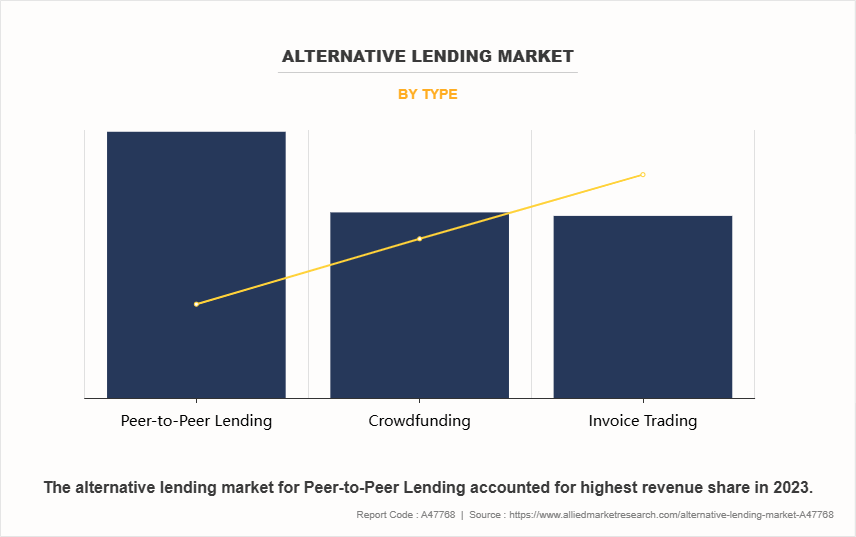

By type, the peer-to-peer lending segment accounted for the largest market share in 2023.

By tenure, the mid-term segment accounted for the largest market share in 2023.

By end users, the businesses segment accounted for the largest market share in 2023.

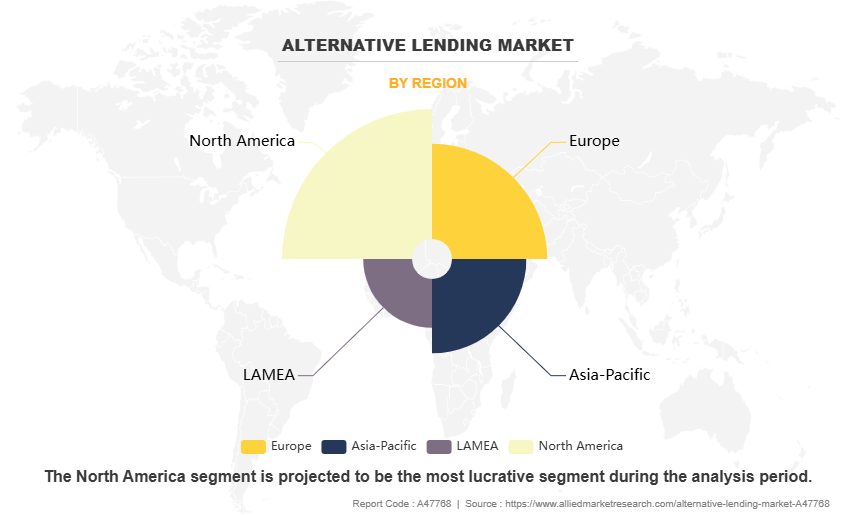

Region-wise, North America generated the highest revenue in 2023.

Segment Review

The alternative lending market is segmented into type, tenure, end user, and region. By type, the alternative lending market is segmented into peer-to-peer lending, crowdfunding lending, and invoice trading. By tenure, the market is segregated into short-term, mid-term, and long-term. By end user, the market is divided into individual and businesses. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the global alternative lending market share was dominated by the peer-to peer lending segment in 2023, and is expected to maintain its dominance in the upcoming years. This is due to increase in the adoption of P2P lending, which offers an accessible alternative for borrowing and lending. However, the crowdfunding lending segment is expected to experience the highest growth during the forecast period. This segment has experienced the integration of blockchain technology and tokenization in crowdfunding platforms, which is expected to provide remunerative opportunities for the market in this segment.

By region, North America dominated the market share in 2023, with the strong adoption of alternative lending owing to increase in adoption of blockchain and smart contracts, providing enhanced transparency, security, and faster transactions. However, the Asia-Pacific is projected to attain the highest CAGR during the forecast period. This growth is driven by the increasing popularity of security solutions in countries like China, South Korea, and Japan, where security culture is deeply embedded. The region is also witnessing significant investments in security infrastructure.

Competition Analysis:

The market players operating in the alternative lending market are Funding Circle Limited, Prosper Funding LLC, Affirm, Inc., Upstart, OnDeck, Bluevine Inc, Fundbox, capify, MoneyLion Inc, Biz2Credit, Clearco, Kiva, Crowd2Fund, Loanpad, American Express Company, Tala, LendingClub, LenDenClub, Bond Street Servicing, LLC, and Planethome Investment AG. These major players have adopted various key development strategies such as business expansion, new product launches, partnerships, among others which help to drive the growth of the alternative lending market globally.

Top Impacting Factors

Increasing demand for flexible financing options

Rise in demand for flexible financing options among consumers and small businesses significantly drives the alternative lending market growth by offering tailored loan products, faster approval processes, and more accessible funding solutions for underserved individuals and businesses. With surge in number of tailored loan products offered by alternative lenders, borrowers have the flexibility to choose loan options that best fit financial situation, such as adjusting repayment schedules, loan amounts, or interest rates. This adaptability is particularly advantageous for those with unique needs or operating in niche markets. In addition, the increase in the demand from borrowers for flexible loan terms, enables businesses to repay the funds over an extended period rather than in a single lump sum, making it easier to manage cash flow and stay within budget, is expected to drive the market growth. Furthermore, faster approval processes help borrowers to obtain funds within a few days, unlike weeks or months it might take with traditional lending options. This is especially advantageous for businesses needing quick access to capital, whether they are facing an urgent financial issue or seeking to invest in a new opportunity. For instance, in November 2024, Paychex launched Paychex Funding Solutions to provide small and medium-sized businesses (SMBs) with quick access to funds. This new fintech lending product offers capital through invoice factoring, helping B2B companies by providing capital based on customer creditworthiness to help them cover payroll, vendor payments, and growth needs. This is expected to streamline the financing process for SMBs, helping them meet urgent financial needs and grow quickly. The alternative lending market size continues to grow due to increased demand for quick and flexible financing solutions.

Data privacy and security concerns

The major challenge for the growth of the global alternative lending market is the significant concerns regarding data privacy and security. As the industry relies heavily on technology and data-driven platforms to assess creditworthiness, process loans, and handle sensitive financial information, cyberattacks and data breaches can expose borrowers’ confidential information, such as bank details, social security numbers, or credit histories, leading to identity theft, fraud, and financial loss. In addition, borrowers avoid sharing sensitive data due to privacy concerns, leading to a loss of customers and business for alternative lenders. Furthermore, managing and protecting complex data, especially when dealing with cross-border data transfers may require platforms to invest in additional compliance measures which hamper the market growth. Moreover, to maintain data privacy and security, alternative lending platforms need to invest in advanced security technologies, conduct regular security audits, and implement strict data protection policies. These additional operational costs can reduce profit margins, particularly for smaller platforms with limited resources. Thus, security and privacy concerns about consumer details and other confidential information cause unethical privacy, which is hindering the growth of the market.

Credit risk and loan default in alternative lending

Credit risk and loan defaults are significant challenges in the alternative lending market outlook. One of the significant risks in the embedded finance sector is the rising of high loan default rates. Many alternative lending platforms serve borrowers, with limited credit histories or higher risk profiles. This increases the chances of defaults. In addition, the borrowers and investors may lose confidence in the platform’s ability to assess creditworthiness or manage risk, which can harm its ability to attract new customers and investors. Furthermore, loan defaults can lock up funds, affecting the liquidity of the lending platform and potentially preventing investors from reinvesting or accessing their money. In addition, defaults can lead to a loss of capital, particularly in cases where loans are not backed by collateral. This can result in financial instability for individuals who rely heavily on the income generated from loan repayments. Moreover, as defaults increase, debt financing may become more conservative in lending practices. This could result in fewer loans being approved, especially for high-risk borrowers, further limiting access to credit for underserved populations, impeding the growth of the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alternative lending market analysis from 2023 to 2033 to identify the prevailing alternative lending market forecast opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the alternative lending market opportunity segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global alternative lending market trends, key players, market segments, application areas, and market growth strategies.

Alternative Lending Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.1 trillion |

| Growth Rate | CAGR of 11.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 204 |

| By Type |

|

| By Tenure |

|

| By End Users |

|

| By Region |

|

| Key Market Players | MoneyLion Inc., LendingClub, Biz2Credit, Prosper Funding LLC, Bond Street Servicing, LLC, Affirm, Inc., Funding Circle Limited, Bluevine Inc, Upstart Network, Inc., Clearco, OnDeck, Loanpad Limited, Crowd2Fund Limited, Tala, American Express Company, Kiva, Capify, PlanetHome Investment AG, LenDenClub, Fundbox |

Analyst Review

The alternative lending market has significantly evolved over the years to better meet the needs of borrowers and investors. Companies in this field are increasingly incorporating advanced technologies such as artificial intelligence (AI), big data analytics, and blockchain solutions to acquire larger market share. These technologies streamline various aspects of lending operations, from automated credit scoring and loan approvals to enhanced risk management and fraud detection. Business intelligence tools help lenders optimize everything from borrower interactions and personalized loan offerings to predictive analytics for future lending trends. Alternative lending firms offer more efficient, transparent, and secure services by embracing these innovations, ensuring they remain competitive in a rapidly changing market.

CXOs in the alternative lending market are positioned to gain a competitive edge as they leverage advanced technological and financial resources to meet growing market demands. With increase in adoption of artificial intelligence (AI), blockchain, and big data analytics, key players in the market are better equipped to address the evolving needs of both borrowers and investors. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key players. A rise in demand for flexible financing options is anticipated to propel the alternative lending market share during the forecast period. In addition, rise in the development of digital platforms, improved risk assessment tools, and the increase in the use of automated processes for loan origination and approval has fueled the market growth. Furthermore, the adoption of cloud-based solutions and blockchain technology has contributed to greater transparency, security, and operational efficiency, further driving growth in the alternative lending market.

Moreover, government policies and regulations aimed at promoting financial inclusion and supporting digital payments are driving the growth of the alternative lending market. In many regions, governments are supporting digital lending solutions to help underserved populations with easier access to credit to borrow finance, which in turn, drives greater market expansion. However, challenges persist, particularly around ensuring regulatory compliance and preventing fraud. Protecting consumer data and securing transactions remain key concerns for the industry.

The alternative lending market is experiencing significant transformation, driven by digitalization, AI-powered credit assessment, and increasing demand from SMEs and underserved borrowers.

Peer-to-peer lending is the leading type of the Alternative Lending Market.

North America was the largest regional market for Alternative Lending in 2023.

$1,076.3 billion is the estimated industry size of Alternative Lending in 2033.

Funding Circle Limited, Prosper Funding LLC, Affirm, Inc., Upstart, OnDeck, Bluevine Inc, Fundbox, capify, MoneyLion Inc, Biz2Credit, Clearco, Kiva, Crowd2Fund, Loanpad, American Express Company, Tala, LendingClub, LenDenClub, Bond Street Servicing, LLC, and Planethome Investment AG. are the top companies to hold the market share in Alternative Lending.

Loading Table Of Content...

Loading Research Methodology...