Aluminum Extrusion Market Research, 2033

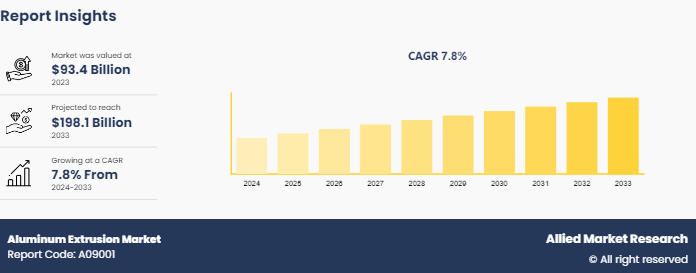

The global aluminum extrusion market size was valued at $93.4 billion in 2023, and is projected to reach $198.1 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

Market Introduction and Definition

Aluminum extrusion is a method of forcing aluminum alloy material through a die having a particular cross-sectional profile. Aluminum extrusion is found in three shapes, namely hollow, semi-hollow, and solid. Aluminum extrusions are widely used in building & construction, automotive & transport, and electrical industries. In building and construction, they are used for framing, window and door systems, curtain walls, and structural components. In automotive and transport, aluminum extrusions are utilized in vehicle frames, body structures, and various components to reduce weight and improve fuel efficiency. In the electrical industry, they are employed for heat sinks, busbars, and other electrical components due to their excellent conductivity and thermal properties.

Key Takeaways

- Over 1, 500 product literatures, industry releases, annual reports, and various documents from major aluminum extrusion industry participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The aluminum extrusion market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Market Dynamics

The aluminum extrusion industry is expanding due to rise in demand for durable and lightweight extruded goods. Aluminum extrusions are often utilized in a broad range of sectors, including construction, automotive, aerospace, electronics, and consumer products. Aluminum has a high strength-to-weight ratio, making it an attractive material for uses requiring weight reduction, such as in the automotive and aerospace sectors.

Moreover, aluminum is increasingly being used in traditional internal combustion automobiles as well as electric vehicles (EVs) , which is contributing to the market growth. In traditional internal combustion engine (ICE) vehicles, the automotive industry has been incorporating more aluminum to enhance performance and fuel efficiency. Aluminum’s high strength-to-weight ratio allows manufacturers to reduce the overall weight of vehicles, which in turn improves fuel efficiency and reduces emissions. This is particularly important as regulations become more stringent globally, demanding lower CO2 emissions and higher fuel economy standards. Components such as engine blocks, transmission cases, wheels, suspension parts, and body panels are now commonly made from aluminum. Its excellent thermal conductivity also aids in more efficient cooling of engines and brakes, contributing to the vehicle’s overall performance and longevity.

Automobile producers face increasing hurdles in meeting legislative demands regarding their environmental footprint automobiles. The National Highway Traffic Safety Administration (NHTSA) , the California Air Resource Board (CARB) , and the United States Environmental Protection Agency (EPA) issue rules and regulations governing greenhouse gas emissions. Compliance with emissions-related rules is critical in the U.S. For example, the NHTSA's emission requirements raised stringency in terms of fuel efficiency and CO2 emissions by 1.5% between 2021 and 2026. As a result, aluminum consumption is expected to increase in automobiles as it improves vehicle efficiency and performance.

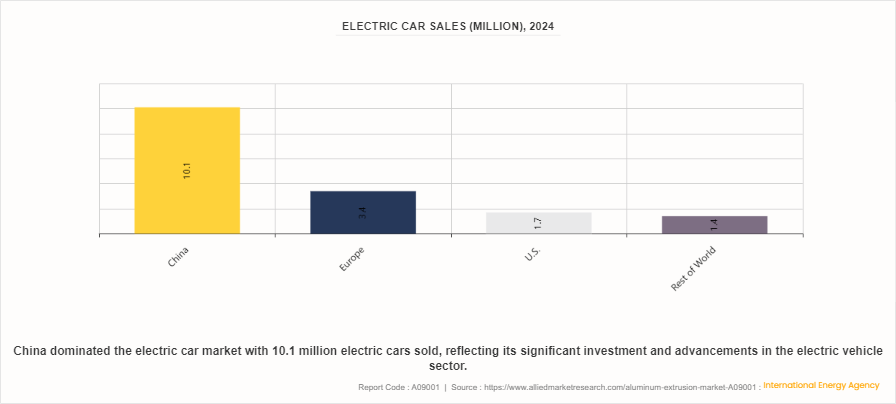

Further, rise of electric vehicles (EVs) has accelerated the demand for aluminum extrusions. EV manufacturers face unique challenges, such as the need to maximize battery life and vehicle range while minimizing weight. Aluminum plays a crucial role in addressing these challenges due to its lightweight nature, which helps offset the weight of heavy battery packs. In addition, aluminum’s thermal conductivity is advantageous for battery enclosures and heat dissipation systems, ensuring efficient thermal management and enhancing battery performance and safety. As per the International Energy Agency, electric vehicle sales in 2023 were 3.5 million greater than in 2022, representing a 35% year-on-year growth. This is more than six times more than in 2018. In 2023, there were over 250, 000 new registrations every week, higher than the yearly total in 2013. Electric vehicles accounted for approximately 18% of all automobiles sold in 2023, up from 14% in 2022 and only 2% in 2018. These trends imply that growth will continue to be robust as electric car markets grow, thereby propelling the demand for aluminum extrusion in the coming years.

Electric Car Industry Facts

Market Segmentation

The aluminum extrusion market is segmented into type, end-use industry, and region. By type, the market is categorized into mill-finished, anodized, and powder coated. On the basis of end-use industry, the market is classified into building & construction, electrical & electronics, automotive and transportation, industrial, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Asia-Pacific region is a major manufacturer and user of aluminum extrusions, with China producing the largest quantity in the world. The rapid development of the region's construction and automotive sectors, along with rise in need for lightweight and high-strength materials, has been a major driver of the aluminum extrusion market in Asia-Pacific. Rise in urbanization and population expansion in countries such as China and India have led to rise in the demand for construction materials such as aluminum extrusions.

Furthermore, rise in use of electric cars in the region is boosting demand for lightweight aluminum extrusions in the automotive industry. For instance, according to the International Energy Agency, in China, new electric car registrations reached 8.1 million in 2023, rising 35% from 2022. Increasing electric vehicle sales were the primary driver of growth in the global auto market, which decreased by 8% for conventional (internal combustion engine) cars however scaled by 5%, showing that electric car sales will continue to perform as the industry develops.

Competitive Landscape

Key players in the aluminum extrusion market include Bahrain Aluminium Extrusion Co. (BALEXCO) , JINDAL ALUMINUM LIMITED, Hindalco Industries Limited, GALCO GROUP, China Zhongwang, Kaiser Aluminum, Arconic Corporation, CENTURY EXTRUSIONS LIMITED, Aluminium Products Company (ALUPCO) , and Constellium N. V.

Key Companies Overview

- Hindalco Industries Ltd. offers a diverse range of extruded goods and has expanded its business by increasing the number of manufacturing units in various locations via investments, collaborations, and strategic alliances. Furthermore, it has achieved economies of scale in mass manufacture of aluminum extruded items.

- Constellium specializes in the production of innovative and high-value aluminum products and solutions for a variety of sectors, including aerospace, packaging, automotive, and industrial uses. It has three business units such as automotive structures and industry, aerospace and transportation, and packaging and rolled products. It manufactures aluminum extrusions, sheets, plates, and coils, as well as automotive structures, hard and soft alloys, and aerospace parts.

- Norsk Hydro is a Norwegian corporation, which specializes in aluminum production, with activities covering the whole value chain from bauxite mining to completed aluminum product manufacturing. Norsk Hydro has four business areas including primary metal, bauxite & alumina, rolled products, and extruded solutions. The primary metal business manufactures and processes primary aluminum. The bauxite & alumina division is in charge of bauxite extraction and alumina production, both of which are raw materials required in the manufacturing of aluminum. The rolled products and extruded solutions divisions specialize in developing aluminum products and solutions for a variety of sectors, including building and construction, automotive, and packaging.

Recent Developments

- Norsk Hydro ASA announced in December 2022 the acquisition of Hueck's Aluminum in Germany. To broaden its European business range, the Norwegian market leader acquired the German producer of aluminum extrusion and window, façade, and door systems. The acquisition will strengthen Norsk's position in the German market and help both firms to expand jointly.

- Hindalco Industries Ltd. and Metra SpA signed a collaboration agreement in September 2023 to produce aluminum rail carriages in India. Hindalco intends to develop a greenfield factory with biggest extrusion press of India to produce items for high-speed aluminum rail coaches. This setup is part of a proposed $241.1 investment. The factory will include over 20-meter-long extrusions that will be utilized to create side panels, floor panels, and other products, as well as welding and machining equipment. It is also in negotiations with many railway original equipment manufacturers (OEMs) to provide extruded aluminum. The Italian business is expected to aid the Indian producer with the latest aluminum extrusion technology for producing railway carriages. Metra SpA, an Italian manufacturer of complex extruded aluminum profiles, will help develop large-scale aluminum extrusion and fabrication technologies for high-speed aluminum rail coaches in India. Hindalco aims to use Metra's cutting-edge technology and experience in aluminum manufacturing to promote the ambitious upgrade initiative of Indian Railways, which operates one of the world's largest rail networks.

Public Policies

- In the U.S., the Occupational Safety and Health Administration (OSHA) plays a crucial role in ensuring safe and healthy working conditions within the aluminum extrusion industry. OSHA sets and enforces standards related to workplace safety, such as proper handling of hazardous substances, safe operation of machinery, and maintaining ergonomic work environments. Compliance with OSHA regulations helps to minimize workplace accidents and health risks for employees involved in the extrusion process.

- Environmental regulations are critical in managing the ecological footprint of the aluminum extrusion industry. The Environmental Protection Agency (EPA) in the U.S. enforces regulations under the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act to control emissions, manage waste, and promote sustainable practices. In the European Union, environmental directives such as the Integrated Pollution Prevention and Control (IPPC) Directive and the Emissions Trading System (ETS) regulate industrial emissions and encourage energy efficiency. These regulations aim to reduce the environmental impact of aluminum extrusion by controlling pollutants and promoting resource conservation.

- Quality standards ensure the consistency and reliability of aluminum extrusion products. ASTM International develops and publishes voluntary consensus standards for materials, including those for aluminum extrusions, which specify the mechanical properties, dimensions, and quality control measures necessary for production. The International Organization for Standardization (ISO) also provides global standards, such as ISO 6361, which cover the specifications for wrought aluminum and aluminum alloy extruded profiles. Adherence to these standards helps manufacturers produce high-quality extrusions that meet industry requirements and customer expectations.

Key Sources Referred

- Aluminum Association

- Aluminum Extruders Council

- European Aluminum

- Aluminum Federation

- International Aluminum Institute

- Japan Aluminum Association

- China Nonferrous Metals Industry Association

- Aluminum Extruders' Council of India

- Aluminum Stewardship Initiative

- Gulf Aluminum Council

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum extrusion market analysis from 2024 to 2033 to identify the prevailing aluminum extrusion market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum extrusion market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum extrusion market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Extrusion Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 198.1 Billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | GALCO GROUP, Arconic Corporation, Aluminium Products Company (ALUPCO), Hindalco Industries Limited, China Zhongwang Holdings Ltd, Bahrain Aluminium Extrusion Co. (BALEXCO), Kaiser Aluminum Corporation, CENTURY EXTRUSIONS LIMITED, JINDAL ALUMINUM LIMITED, Constellium N. V. |

The construction sector is a major driver for aluminum extrusions due to the material's lightweight, durability, and corrosion resistance, making it ideal for windows, door frames, curtain walls, and roofing.

Building and construction segment is expected to lead during the forecast period.

Asia-Pacific is the largest regional market for Aluminum Extrusion.

The global aluminum extrusion market size was valued at $93.4 billion in 2023, and is projected to reach $198.1 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

Key players in the aluminum extrusion market include Bahrain Aluminium Extrusion Co. (BALEXCO), JINDAL ALUMINUM LIMITED, Hindalco Industries Limited, GALCO GROUP, China Zhongwang, Kaiser Aluminum, Arconic Corporation, CENTURY EXTRUSIONS LIMITED, Aluminium Products Company (ALUPCO), and Constellium N. V.

Loading Table Of Content...