Aluminum Scrap Recycling Market Research, 2033

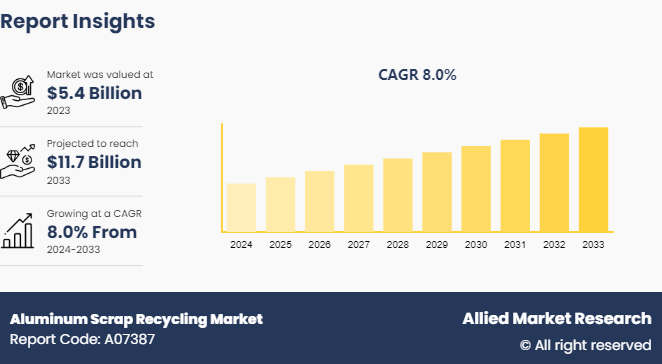

The global aluminum scrap recycling market size was valued at $5.4 billion in 2023, and is projected to reach $11.7 billion by 2033, growing at a CAGR of 8% from 2024 to 2033.

Market Introduction and Definition

Aluminum scrap recycling is the process of reprocessing used aluminum materials such as cans, foils, and other aluminum products into new aluminum products. This process is crucial for the aluminum industry owing to the significant environmental and economic benefits. Aluminum is melted down and reused repeatedly without losing its quality or properties. This makes aluminum scrap recycling a highly sustainable practice, reducing the need for primary aluminum production, which is energy-intensive and environmentally impactful. Recycling aluminum scrap conserves natural resources and saves a substantial amount of energy. Producing aluminum from recycled materials requires only about 5% of the energy needed to produce primary aluminum from bauxite ore. This energy savings translates into lower greenhouse gas emissions and a reduced carbon footprint for the aluminum industry.

Key Takeaways

- The aluminum scrap recycling market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major aluminum scrap recycling industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Recycling of aluminum reduces the need for primary production from bauxite ore, which is energy-intensive and contributes significantly to greenhouse gas emissions. By recycling aluminum scrap, manufacturers significantly lower their carbon footprint and energy consumption. This reduction in environmental impact aligns with global sustainability goals and regulatory requirements aimed at mitigating climate change and promoting sustainable development. Moreover, the economic benefits of aluminum scrap recycling are substantial. It offers cost advantages over primary aluminum production, as recycling consumes less energy and incurs lower operational costs. This cost efficiency appeals to industries looking to optimize their manufacturing processes while meeting environmental standards. All these factors are expected to drive the growth of the aluminum scrap recycling market during the forecast period.

However, challenges in sorting and separation significantly hinder the growth of the aluminum scrap recycling market. Effective recycling of aluminum scrap relies heavily on the ability to accurately sort and separate various alloys and contaminants. Moreover, contaminants present in aluminum scrap such as paints, coatings, and other metals complicate the recycling process. These contaminants affect the quality of recycled aluminum and increase processing costs and energy consumption. Removing contaminants requires sophisticated separation techniques, which are not economically viable or technologically feasible, particularly for smaller recycling operations. All these factors hamper the growth of the aluminum scrap recycling market.

Innovations in smelting and refining technologies have enabled the recycling of a wider range of aluminum scraps such as complex alloys and mixed materials. Processes such as rotary furnaces and secondary smelting techniques have become more energy-efficient and environmentally friendly, contributing to lower carbon footprints and reduced emissions compared to primary aluminum production. These advancements align with sustainability goals and offer economic benefits by providing a more cost-effective alternative to sourcing virgin materials. Moreover, advancements in material science and metallurgy have led to the development of new methods for recycling aluminum that preserve the material's properties and performance characteristics. All these factors are anticipated to offer new growth opportunities for the global aluminum scrap recycling market during the forecast period.

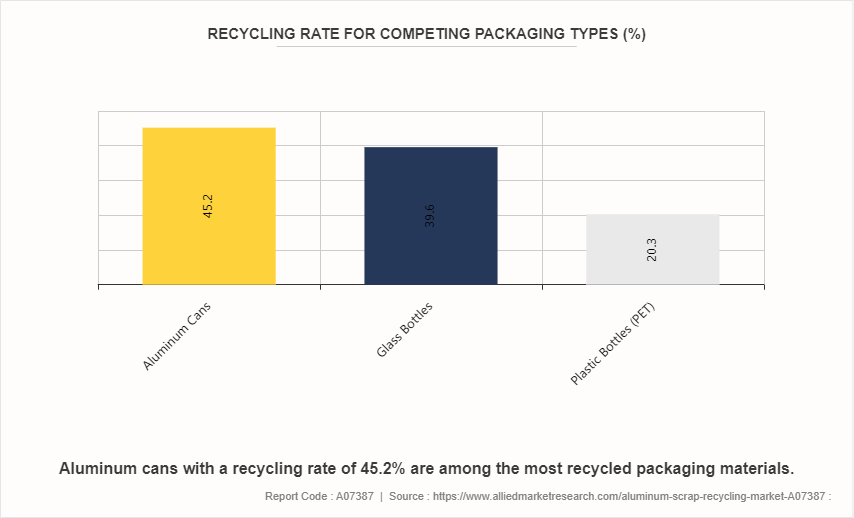

Consumer Recycling Rate for Competing Packaging Types

The recycling rate of different packaging types significantly impacts the overall aluminum scrap recycling landscape. Aluminum cans, with a recycling rate of 45.2%, are among the most recycled packaging materials. This high recycling rate is due to several factors such as the ease of recycling aluminum, the economic value of aluminum scrap, and widespread consumer participation in recycling programs. The relatively high recycling rate of aluminum cans contributes positively to the aluminum scrap recycling industry, ensuring a steady supply of high-quality scrap material that is reprocessed into new products.

Market Segmentation

The aluminum scrap recycling market is segmented into scrap type, alloy type, end-use industry and region. By scrap type, the market is bifurcated into new scrap and old scrap. By alloy type, the market is classified into wrought alloy, and casting alloy. By end-use industry, the market is categorized into automotive, aerospace and defense, building and construction, electrical and electronics, packaging, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

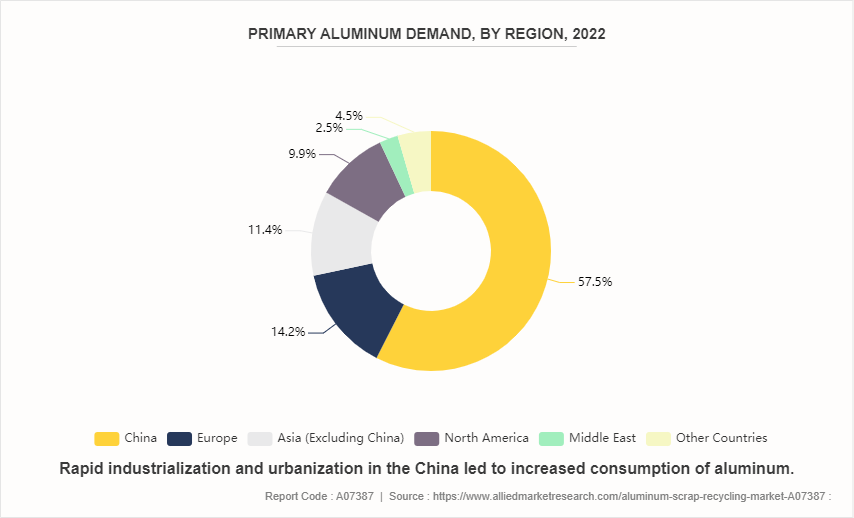

Rapid industrialization and urbanization in the Asia-Pacific region led to increased consumption of aluminum in sectors such as construction, automotive, packaging, and electronics. As a result, there is a growing supply of end-of-life products, manufacturing scrap, and post-consumer aluminum waste, creating a robust feedstock base for recycling activities. Moreover, environmental regulations and sustainability initiatives in Asia-Pacific are encouraging industries to adopt recycling practices. Governments are promoting recycling through policies that incentivize or mandate the use of recycled materials, impose landfill taxes, or enforce stringent waste management regulations. This regulatory framework promotes resource conservation and reduces landfill pressures and mitigates environmental pollution associated with aluminum production from primary sources.

- As industrialization and urbanization continue to grow across Asia-Pacific countries, the demand for aluminum scrap as a feedstock for production is increasing. This is driven by sectors such as automotive, construction, and electronics, which are significant consumers of aluminum.

- Governments in Asia-Pacific are implementing stricter environmental regulations, pushing industries to adopt more sustainable practices. Aluminum recycling is seen as a crucial component of achieving sustainability goals due to its energy-saving benefits compared to primary aluminum production.

- Ongoing investment in recycling infrastructure across the region, particularly in countries with high industrial output such as China, Japan, and South Korea. This infrastructure development supports the collection, processing, and recycling of aluminum scrap more efficiently.

Competitive Landscape

The major players operating in the aluminum scrap recycling market include Matalco Inc., Novelis Inc., Speira GmbH, Norsk Hydro ASA, Alcoa Corporation, AMAG Austria Metall AG, Constellium, REAL ALLOY, Stena Metall AB, and Ye Chiu Group.

Industry Trends

- There is an increase in the demand for recycled aluminum due to its lower energy consumption compared to primary aluminum production. The automotive and packaging industries are significant consumers, pushing for more sustainable and eco-friendly materials.

- Innovations in sorting, shredding, and processing technologies are improving the efficiency and quality of recycled aluminum. Automation and AI are being integrated to enhance sorting precision and reduce contamination.

- Governments and companies are setting ambitious sustainability goals, driving the adoption of recycled materials. Policies and regulations promoting recycling and circular economy principles are becoming more prevalent worldwide.

- Fluctuating prices of primary aluminum and the cost advantages of recycling are influencing market dynamics. Recycled aluminum often provides a cost-effective alternative, particularly when raw material prices are high.

Key Sources Referred

- International Trade Administration

- Internation Energy Agency (IEA)

- Invest India

- Aerospace Industries Association (AIA)

- The Aluminum Association

- International Aluminum Institute

- European Aluminum

- Aluminum Association of India

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum scrap recycling market analysis from 2024 to 2033 to identify the prevailing aluminum scrap recycling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum scrap recycling market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum scrap recycling market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Scrap Recycling Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 11.7 Billion |

| Growth Rate | CAGR of 8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 440 |

| By Scrap Type |

|

| By Alloy Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Constellium, Ye Chiu Group, Stena Metall AB, AMAG Austria Metall AG, Norsk Hydro ASA, Novelis Inc., Matalco Inc., REAL ALLOY, Speira GmbH, Alcoa Corporation |

The global aluminum scrap recycling market was valued at $5.4 billion in 2023, and is projected to reach $11.7 billion by 2033, growing at a CAGR of 8% from 2024 to 2033.

Asia-Pacific is the largest regional market for Aluminum Scrap Recycling.

Automotive is the leading application of Aluminum Scrap Recycling Market.

Technological advancements in recycling processes are the upcoming trends of Aluminum Scrap Recycling Market in the globe.

The major players operating in the aluminum scrap recycling market include Matalco Inc., Novelis Inc., Speira GmbH, Norsk Hydro ASA, Alcoa Corporation, AMAG Austria Metall AG, Constellium, REAL ALLOY, Stena Metall AB, and Ye Chiu Group.

Loading Table Of Content...