Aluminum Smelting Market Research, 2030

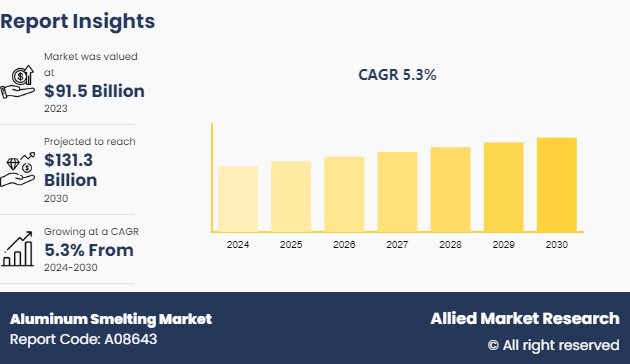

The global aluminum smelting market was valued at $91.5 billion in 2023, and is projected to reach $131.3 Billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030.

Key Takeaways

- The aluminum smelting market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Introduction

Aluminum smelting is the industrial process of extracting aluminum from its oxide, alumina, typically derived from bauxite ore. The most common method used is the Bayers, and Hall-Heroult process, which involves dissolving alumina in molten cryolite and then passing an electric current through the solution to separate pure aluminum metal from oxygen. The primary stage of the process includes refining bauxite to obtain alumina, followed by the electrolysis in a smelting cell where aluminum is deposited at the cathode and oxygen is released at the anode. This extracted aluminum is cast into ingots, billets, or wire rods for various applications.

Aluminum smelting finds widespread applications across multiple industries such as transportation, construction, electrical industry, and packaging. In transportation, it is used to manufacture lightweight components for automobiles, airplanes, and ships. In construction, aluminum is a key material for structural frameworks and cladding. In the electrical industry, it is used for transmission lines and electrical conductors. In consumer goods, aluminum is utilized for packaging, household items, and electronic devices due to its favorable properties like high strength-to-weight ratio, corrosion resistance, and conductivity.

Market Dynamics

The increased economic activities and infrastructure developments led to a higher demand for aluminum in construction and industrial applications, significantly boosting the market growth. Innovations in smelting technologies also play a crucial role by enhancing efficiency and reducing production costs, which make aluminum production more economical and environmentally friendly. Furthermore, the automotive sector's increasing use of aluminum to reduce vehicle weight, improve fuel efficiency, and lower emissions contributes substantially to market demand.

Stringent environmental laws regarding emissions and waste management pose significant challenges to the development of the market. The increase in operational costs and limiting expansion opportunities for aluminum smelting operations in various industries. In addition, the high energy consumption associated with aluminum smelting is a major restraint, as fluctuations in energy prices significantly impact production costs and profitability. The fluctuations in raw material costs, geopolitical factors, and global economic conditions add another layer of uncertainty, affecting the investment decisions of the investors within the industry.

Despite these challenges, the aluminum smelting market offers significant opportunities. There is an increase in focus on aluminum recycling, which is more energy-efficient and environmentally friendly than primary smelting. This emphasis on sustainability and circular economy principles opens up substantial growth prospects in the recycling sector. Moreover, new applications of aluminum in emerging sectors such as electric vehicles, renewable energy systems, and advanced manufacturing technologies such as inert anodes, and mechanical vapor recompression provide promising growth prospects, driven by the material's lightweight, durability, and conductivity properties. Furthermore, rapid industrialization and urbanization in developing countries such as India, China, and Brazil drive the demand for aluminum in construction, transportation, and infrastructure projects, providing substantial growth opportunities for the development of the aluminum smelting market.

Segment Overview

The aluminum smelting market is segmented into type, process, end-use, and region. On the basis of type, the market is classified into ingots, billets, wire rods, and others. On the basis of process, the market is segregated into primary aluminum smelting and secondary aluminum smelting. On the basis of end-use, the market is categorized into aircraft & aerospace, automotive, buildings & construction, electronics & appliances, packaging, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Key market players in the aluminum smelting market include Alcast Company, Aloca Corporation, Consolidate Metco, Inc., Dynacast, Ryobi Limited, Martinrea International Inc., Gibbs, Aluminum Corporation of China Limited, Rio Tinto, Rockman Industries Limited, China Hongqiao Group, and Century Aluminum Company.

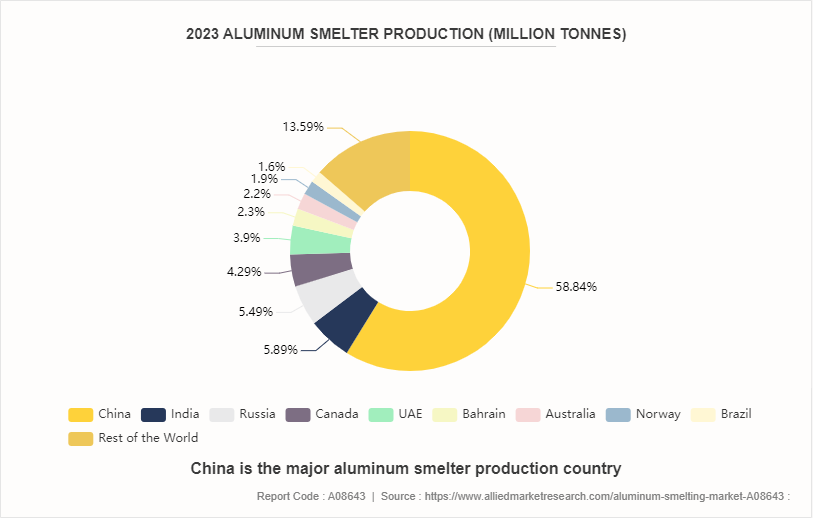

Global Production for Aluminum Smelting, 2023

In 2023, global aluminum smelting production was significantly dominated by China, which produced 41 million tons, accounting for 58.94% of the total global output. This far surpassed the production levels of other major producers. India, with 4.1 million tons, contributed 5.89%, while Russia produced 3.8 million tons, making up 5.46% of the global production. Other notable producers included Canada with 3 million tons (4.31%) , the UAE with 2.7 million tons (3.88%) , and Bahrain with 1.6 million tons (2.30%) . Australia and Norway also made significant contributions, producing 1.5 million tons (2.16%) and 1.3 million tons (1.87%) , respectively. Brazil's production stood at 1.1 million tons, constituting 1.58% of the global total. The rest of the world collectively produced 9.46 million tons, representing 13.60% of the total aluminum smelting production. This data highlights the heavy concentration of aluminum smelting capabilities in China and underscores the strategic importance of diversifying production to ensure a stable supply chain.

Global Greenhouse Gas Emissions in Aluminum Industry

The aluminum industry, responsible for about 2% of global greenhouse gas emissions, equivalent to roughly 1.1 billion tons of CO? annually, is under significant pressure to decarbonize. As global demand for aluminum is projected to rise by up to 80% by 2050, manufacturers are focusing on developing low-carbon production methods.

Direct emissions from the smelting process, primarily due to the use of carbon anodes, constitute approximately 30% of the sector's total emissions, while the electricity used in refining and smelting contributes over 60%. Countries like Canada, which rely on hydroelectric power, exhibit lower emissions compared to China, which uses coal-fired plants. Innovations such as inert anodes, carbon capture, utilization, and storage (CCUS) , and the adoption of hydrogen and mechanical vapor recompression (MVR) technologies are pivotal in reducing emissions.

In addition, the shift towards secondary aluminum production, which requires significantly less energy, and advancements in recycling technology, are crucial strategies. Companies like ELYSIS are leading efforts to commercialize carbon-free aluminum smelting, aiming to demonstrate viable technologies and substantially cut emissions shortly.

Industry Trends

- In the automotive industry, the rise of electric vehicles is driving increased aluminum usage to achieve lightweight solutions that enhance vehicle efficiency and performance. Similarly, aerospace applications continue to rely heavily on aluminum, with advancements in aluminum composites and additive manufacturing technologies further solidifying its role in modern aircraft manufacturing. The focus on recyclability and sustainability enhances aluminum's appeal in the transportation sector, with ongoing efforts to develop new alloys and technologies for a more sustainable and efficient future.

- In North America, the building and construction sector consumed about 1.74 million tons of aluminum in 2018, making up 12.3% of the total aluminum demand. Globally, the construction industry accounted for a quarter of the total demand for aluminum in 2023. The increase in preference for aluminum in green building projects highlights its importance as a sustainable material, earning it the nickname "the green metal". Projections suggest a significant growth in aluminum usage in residential construction, with an expected increase of 51% by 2025. This trend underscores aluminum's growing role in promoting environmental consciousness and structural integrity in construction.

- Aluminum conductors play a significant role in the electrical industry due to their advantageous properties and widespread usage. Despite having about 61% of the electrical conductivity of copper, aluminum is favored for many applications because it is lighter, weighing about 30% less than copper. This makes it especially suitable for overhead power cables and other uses where weight is a critical factor. Furthermore, aluminum's cost-effectiveness and low electrical resistance enhance its appeal in electrical installations. Approximately 14% of the world's aluminum production is dedicated to electrical materials, with the U.S. using aluminum in about 35% of its wires. The electrical market for aluminum has grown substantially, increasing by over 28% from 2010 to 2023. This growth highlights the material's importance and efficiency in the energy sector, making it a viable alternative to copper for various electrical applications.

- Aluminum is a crucial material in various consumer goods sectors such as the packaging industry, consumer electronics, and consumer durables, due to its lightweight, corrosion-resistant, and recyclable properties. In the packaging industry, aluminum constitutes approximately 16% of total production, being extensively used in cans, foils, and containers. The electrical engineering and electronics sector utilizes about 11% of aluminum, primarily in consumer electronics, wiring, and other components. Consumer durables, including appliances, furniture, and household goods, account for roughly 4.5% of aluminum usage. This widespread use indicates aluminum's versatility and its role in enhancing the functionality and sustainability of consumer goods.

Key Sources Referred

- International Aluminum

- Mining.com

- Aluminium.org.au

- EcoMENA

- BaleForce

- Natural Resources Canada

- IEA

- American Doughlas Metal (ADM)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum smelting market analysis from 2024 to 2030 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum smelting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum smelting market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Smelting Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 131.3 Billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2024 - 2030 |

| Report Pages | 340 |

| By Type |

|

| By Process |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Dynacast International Inc., China Hongqiao Group Limited, Alcast Company, Rio Tinto, Century Aluminum Company, Consolidate Metco, Inc., Aluminum Corporation of China Limited, Rockman Industries Limited, Martinrea International Inc., Aloca Corporation |

Loading Table Of Content...