Aluminum Sulfate Market Research, 2033

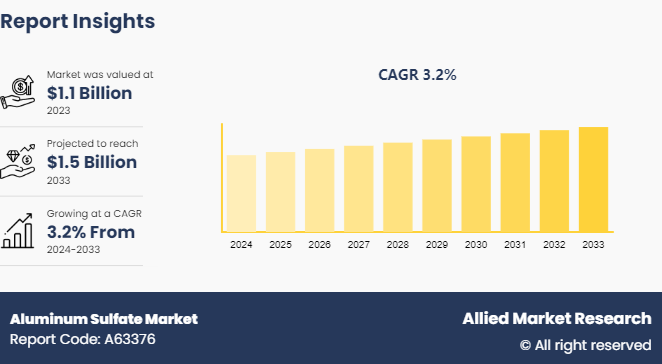

The global aluminum sulfate market size was valued at $1.1 billion in 2023, and is projected to reach $1.5 Billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Market Introduction and Definition

Aluminum sulfate is a chemical compound with the formula Al₂(SO₄)₃. It is a white crystalline solid that is soluble in water and has a variety of industrial and commercial applications. It is mainly used in the purification of drinking water and in the treatment of wastewater. In these processes, aluminum sulfate acts as a coagulant that helps to clump impurities and suspended particles together so that they are filtered out easily. In addition to its role in water treatment, aluminum sulfate is used in the paper manufacturing industry. It serves as a key ingredient in the sizing of paper, which is a process that improves the paper's ability to resist water and ink penetration. This application is critical for producing high-quality paper products, such as writing and printing paper.

Key Takeaways

The aluminum sulfate market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major aluminum sulfate industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

As populations grow and industrial activities expand, the pressure on water resources intensifies, leading to greater contamination and pollution concerns. In response, municipalities, industries, and communities worldwide are investing in robust water treatment infrastructure to ensure the supply of clean and safe water. According to a report published by the National Institution for Transforming India (NITI Aayog) , in February 2021, India's wastewater treatment plants market stood at $2.4 billion in 2019 and is projected to reach $4.3 billion by 2025, owing to increase in demand for municipal and sewage water treatment plants across the country. Furthermore, stringent regulations and standards regarding water quality and environmental protection are driving the adoption of advanced water treatment solutions. All these factors are expected to drive the demand for the global aluminum sulfate market during the forecast period.

However, the growth of the aluminum sulfate market is increasingly hindered by stringent environmental regulations and safety standards imposed by regulatory authorities globally. As concerns over environmental pollution and human health escalate, governments are implementing more rigorous regulations to mitigate the adverse impacts of industrial activities, including the production and use of chemical substances such as aluminum sulfate. Furthermore, the production and handling of aluminum sulfate entails certain safety risks, including the potential for chemical spills, releases of hazardous gases, and worker exposure to toxic substances. All these factors hamper the global aluminum sulfate market growth.

Aluminum sulfate with its versatile chemical properties and wide-ranging applications, plays a pivotal role as a raw material, catalyst, or intermediate in various chemical synthesis processes across industries. Moreover, aluminum sulfate serves as a precursor to produce several other chemicals, including aluminum hydroxide, alum, and sodium aluminate. Aluminum hydroxide, derived from aluminum sulfate, finds extensive use in the manufacturing of flame retardants, ceramics, and pharmaceuticals. All these factors are anticipated to offer new growth opportunities for the global aluminum sulfate market during the forecast period.

Global Waster Water Volume

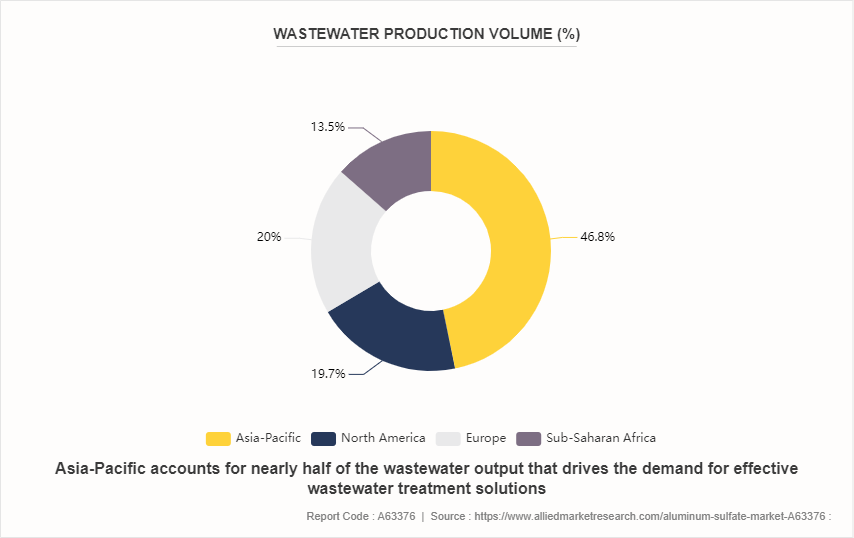

Asia-Pacific accounts for nearly half of the global wastewater output that drives the demand for effective wastewater treatment solutions in this region. Aluminum sulfate, widely used as a coagulant in wastewater treatment, is likely to see substantial demand growth in Asia. This is driven by the need to address the significant volume of wastewater generated by rapid urbanization, industrialization, and population growth. In addition, North America and Europe, which produce 19.7% and 20.0% of wastewater respectively, also represent important markets for aluminum sulfate, though their growth may be influenced by stringent environmental regulations and advanced treatment technologies. These regions prioritize compliance with high environmental standards, pushing for consistent quality and effectiveness in water treatment chemicals, including aluminum sulfate.

Market Segmentation

The aluminum sulfate market is segmented into grade, form, application, and region. By grade, the market is classified into standard grade, low iron grade, and iron free grade. By form, the market is bifurcated into solid and liquid. By application, the market is categorized into water treatment, paper manufacturing, dyeing, pharmaceutical, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The expansion of industrial sectors in the Asia-Pacific regions such as textiles, paper and pulp, chemicals, and pharmaceuticals, are driving the demand for aluminum sulfate as a key raw material or processing aid. In the textile industry, aluminum sulfate is used in dyeing and printing processes to enhance color fixation and improve dye penetration. In the paper and pulp industry, it serves as a sizing agent and paper coagulant, contributing to improved paper quality and production efficiency. In addition, aluminum sulfate has applications in chemical manufacturing processes as a catalyst, pH adjuster, or precipitating agent that help in the production of various chemicals and specialty products.

The Asia-Pacific region is experiencing rapid population growth and urbanization, leading to increased concerns about water quality and scarcity. As a result, there is a growing demand for effective water treatment solutions to ensure access to clean and safe drinking water.

Emerging economies in the Asia-Pacific region, such as China, India, and Southeast Asian countries, present significant growth opportunities for the aluminum sulfate market. Rapid industrialization, urbanization, and infrastructure development in these countries are driving the demand for water treatment solutions and industrial chemicals, including aluminum sulfate.

Waste management and sanitation remains a problem in developing Asia. Most Asian cities do not have effective wastewater treatment systems. In the Philippines only 10% of wastewater is treated while in Indonesia 14%, in Vietnam, 4%, and in India, 9%. All these factors create new opportunities for the aluminum sulfate market in Asia-Pacific.

Competitive Landscape

The major players operating in the aluminum sulfate market include American Elements, Hawkins, Kishida Chemical Co., Ltd., NIKE CHEMICAL INDIA, Chemtrade Logistics, Henan Fengbai Industrial Co., Ltd., Merck KGaA, USALCO, NACALAI TESQUE, INC., and AFFINITY CHEMICAL.

Other players in the aluminum sulfate market include RAHA GROUP, Vizag Chemical International, Vishnupriya Chemicals Pvt. Ltd., PCIPL, Oasis Fine Chem, and DUBI CHEM MARINE INTERNATIOAL.

Industry Trends

Aluminum sulfate finds applications across a diverse range of industries, including textiles, paper and pulp, chemicals, pharmaceuticals, and agriculture. As these industries evolve and expand, the demand for aluminum sulfate as a raw material, processing aid, or additive is expected to increase, driving market growth and diversification.

The demand for aluminum sulfate in water treatment applications continues to grow, driven by increasing concerns over water quality and scarcity. Municipalities, industries, and communities are investing in advanced water treatment solutions, boosting the demand for aluminum sulfate as a coagulant and flocculant in the purification of drinking water and wastewater treatment.

According to the NITI Aayog India, 380 billion m3 of wastewater is generated annually across the world. Based on the rate of population growth and urbanization, the daily wastewater generated is expected to increase by 24% (470 billion m3) by the end of 2030 and 51% (574 billion m3) by 2050.

Key Sources Referred

World Urbanization Prospects

United Nations Development Programme

Organization for Economic Co-operation and Development

UN Water

Asian Development Bank

National Institutes of Health

Food and Agriculture Organization

UNICEF

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum sulfate market analysis from 2024 to 2033 to identify the prevailing aluminum sulfate market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the aluminum sulfate market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aluminum sulfate market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Sulfate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.5 Billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 420 |

| By Grade |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hawkins, Henan Fengbai Industrial Co., Ltd., USALCO, Merck KGaA, NIKE CHEMICAL INDIA, Chemtrade Logistics, Kishida Chemical Co.,Ltd., AFFINITY CHEMICAL, NACALAI TESQUE, INC., American Elements |

The global aluminum sulfate market size was valued at $1.1 billion in 2023, and is projected to reach $1.5 Billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Utilization in chemical manufacturing processes is the upcoming trends of aluminum sulfate market in the globe

Water treatment is the leading application of aluminum sulfate market.

Asia-Pacific is the largest regional market for aluminum sulfate.

The major players operating in the aluminum sulfate market include American Elements, Hawkins, Kishida Chemical Co., Ltd., NIKE CHEMICAL INDIA, Chemtrade Logistics, Henan Fengbai Industrial Co., Ltd., Merck KGaA, USALCO, NACALAI TESQUE, INC., and AFFINITY CHEMICAL.

Loading Table Of Content...