Alzheimer’s Therapeutics Market Research, 2031

The global Alzheimer’s therapeutics market size was valued at $6.1 billion in 2021, and is projected to reach $13 billion by 2031, growing at a CAGR of 8.1% from 2022 to 2031. Alzheimer's disease is a neurological disorder that causes the brain to shrink (atrophy) and brain cells to die. It is the most common cause of dementia that leads to continuous decline in thinking, behavioral and social skills that affects the ability of a person to function independently. The early signs of the disease include forgetting recent events or conversations. A person with Alzheimer's will develop severe memory impairment and lose the ability to carry out everyday tasks as the disease progresses.

Growth of the global Alzheimer’s therapeutics market size is majorly driven by rise in prevalence of Alzheimer’s disease across both developed and emerging countries. In addition, the growth in occurrence of consciousness of the disease across the world and few of the aspects such as increase in number of diagnosed patients has upsurged the need to develop therapeutics for Alzheimer’s disease. Furthermore, the availability of drugs such as Aricept, Exelon, Memantine, and Razadyne for the treatment of Alzheimer’s disease drives the growth of the market. Moreover, as per the article published by NCBI 2019, around 121,499 deaths were recorded from Alzheimer’s disease in the U.S. The rise in number of cases of Alzheimer’s disease, thus lead to rise in demand for therapeutics which significantly drives the Alzheimer's therapeutics market growth.

In addition, for instance, in June 2022, Genetech which is a member of Roche Group collaborating with Banner Alzheimer’s Institute, the University of Antioquia in Colombia announced the results from Alzheimer’s Prevention Initiative known as the Autosomal Dominant Alzheimer’s Disease Colombia Trail. The study evaluated the potential usage of Crenezumab to prevent Alzheimer’s disease. Thus, constant focus of market players to adopt growth strategies to launch new drugs is expected to boost the market growth. In addition, according to Pan American Health Organization, data published in 2020, around 8.2 million people lived with central nervous system disorder which causes disability; out of which 3.1 million were men, and 5.1 million were women. The increase in number of central nervous system disorders in the near future is hence anticipated to augment the growth of the Alzheimer’s therapeutics market. Furthermore, in July 2019, UCB announced license agreement with Roche and Genetech for the development of UCB0107 to treat Alzheimer’s disease. This patient centric development approach by key players views toward the unmet needs for an effective anti-Tau antibody in the treatment of Alzheimer’s disease which drives the market growth.

The Alzheimer’s therapeutics market has shown significant growth due to the advancements in treatment, and drug discovery techniques, over the years. Moreover, increase in demand for effective treatment of Alzheimer’s disease and therapeutic options encourages major pharmaceutical companies to invest in R&D, thus creating future growth opportunities. In addition, rise in awareness regarding treatment of Alzheimer’s disease boosts the growth of the global Alzheimer’s therapeutics market. Furthermore, presence of strong pipeline drugs is one of the factors which is projected to offer huge growth opportunities in the future.

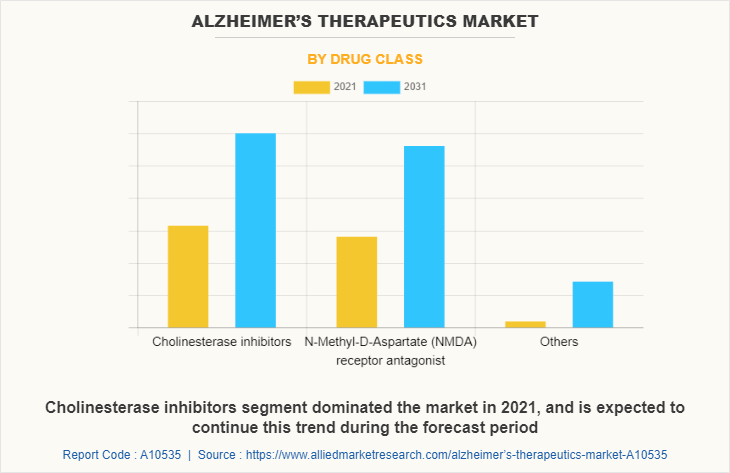

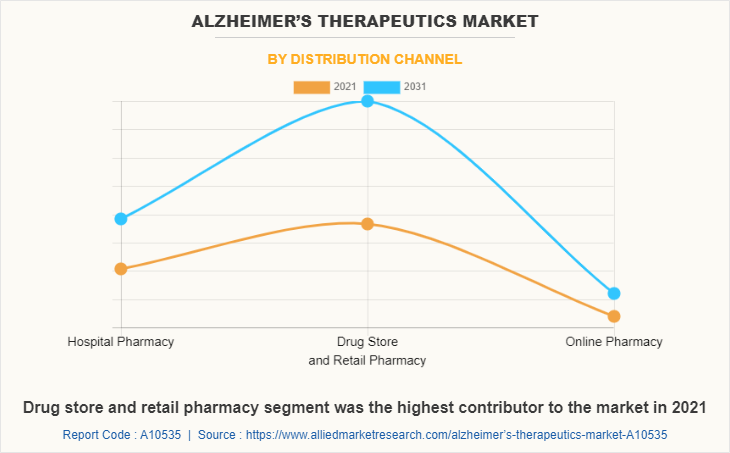

The alzheimer’s therapeutics market is segmented into Drug Class and Distribution Channel. On the basis of drug class, it is categorized into cholinesterase inhibitors, N-methyl D-aspartate antagonist receptors, and others. On the basis of distribution channel, it is divided into hospital pharmacy, drug store & retail pharmacy, and online pharmacy.

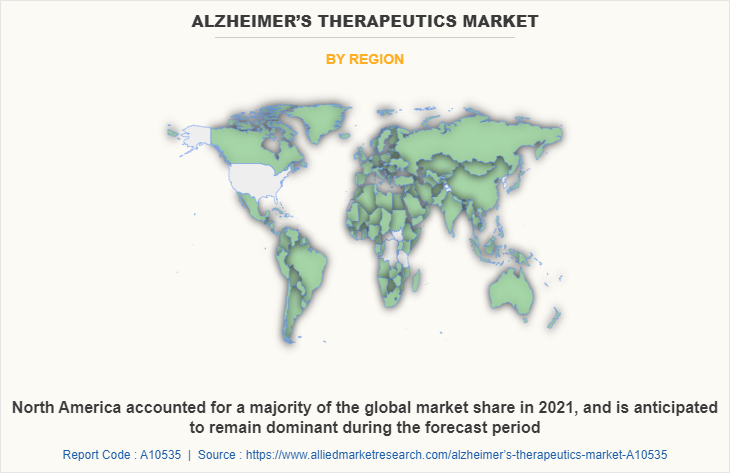

On the basis of region, the Alzheimer's therapeutics industry is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

Segment Review

On the basis of drug class, the cholinesterase inhibitors segment dominated the market in 2021, owing to popularity of this drug class among healthcare providers. However, the others segment is expected to witness considerable growth during the forecast period, owing to rise in demand for drugs from patients to treat Alzheimer’s disease, and owing to impending product launch of multiple disease modifying therapies.

On the basis of distribution channel, the drug store & retail pharmacy segment dominated the market in 2021 owing to rise in demand for drugs such as cholinesterase inhibitors, N-methyl D-aspartate antagonist receptors which is easily available in retail pharmacies. Furthermore, the online pharmacy segment is expected to witness considerable growth during the forecast period, owing to rise in number of patients with Alzheimer’s disease and surge in usage of online pharmacy as it is convenient way of buying medicine for old age people, physically challenged and working professionals. Moreover, surge in usage of internet, ease of ordering medications through online platform, and increase in online services globally.

On the basis of region, North America contributed for the major Alzheimer's therapeutics market share in 2021, and is expected to continue to dominate during the forecast period owing to increase in number of product approvals by U.S FDA. Moreover, growth in number of research activities to develop novel drugs in developed countries of North America positively impacted the market growth. However, Asia-Pacific is expected to register the highest CAGR during Alzheimer's therapeutics market forecast, owing to rise in number of new technologies assisting for the treatment of Alzheimer’s disease.

The key players that operate in the Alzheimer's therapeutics industry include AbbVie Inc., Biogen Inc., Merck & Co. Inc., Novartis AG, Eisai Co. Ltd., H.Lundbeck A/S, Daiichi Sankyo Company Ltd., Teva Pharmaceuticals Industries Ltd., Eli Lilly and Company, and Lupin.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alzheimer’s therapeutics market analysis from 2021 to 2031 to identify the prevailing alzheimer’s therapeutics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alzheimer’s therapeutics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alzheimer’s therapeutics market trends, key players, market segments, application areas, and market growth strategies.

Alzheimer’s Therapeutics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 172 |

| By Drug Class |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Biogen, H. Lundbeck A/S, Eli Lilly and Company, Lupin Ltd, DAIICHI SANKYO COMPANY, LIMITED, Novartis AG, Merck & Co. Inc., Eisai Co. Ltd., AbbVie Inc., Teva Pharmaceuticals Industries Ltd. |

Analyst Review

This section provides the opinions of the top level CXOs in the Alzheimer’s therapeutics market. According to the CXOs, Alzheimer’s disease is a neurologic disorder that causes infection to the brain. The disease is beginning with mild memory loss.

As per the CXOs, the Pharmaceutical industry is undertaking rapid and exceptional measures to bring more innovative products for patients and has opened new approaches in the pharmaceutical industry. According to National Plan of Alzheimer’s Disease, in 2021, it has launched National Alzheimer’s Project Act. This act has aim to prevent and treat the Alzheimer’s Disease and related Dementias by 2025, enhance public awareness and engagement, and accelerate action to promote healthy aging and reduce risk factors for Alzheimer’s disease. Thus, rise in number of initiatives taken by private organization for the management of Alzheimer’s disease significantly drives the growth of the market.

The CXOs further added that cholinesterase inhibitors segment holds the largest share in the market, owing to strong availability of the Alzheimer’s therapeutics among large number of key players in the market. Moreover, North America is expected to offer lucrative opportunities to the market during the forecast period, owing to rise in geriatric population in the region led to increase in the demand for Alzheimer’s therapeutics across the region. However, Asia-Pacific registered the fastest growth rate during the forecast period, owing to developments in healthcare infrastructure, rise in disposable incomes, and well-established presence of domestic companies in the region.

Rise in prevalence of Alzheimer’s disease, increase in number of diagnosed patients, and presence of robust drug candidates in pipeline are some of the major driving factors of the market.

Among drug class, the cholinesterase inhibitors segment dominated the market in 2021

North America is the largest regional market for Alzheimer’s Therapeutics

The estimated industry size of Alzheimer’s Therapeutics was $6.12 billion in 2021

AbbVie Inc., Merck & Co. Inc., and Eisai Co. Ltd., are some of the top companies to hold the market share in Alzheimer’s Therapeutics

Loading Table Of Content...