Ambulatory Surgery Center Market Research, 2033

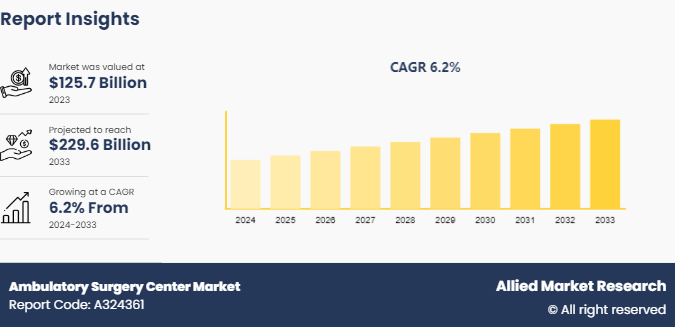

The global ambulatory surgery center market size was valued at $125.7 billion in 2023, and is projected to reach $229.6 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033. Technological advancements present a significant driver for the ambulatory surgery center market. Innovations in medical technology, such as minimally invasive surgical techniques, advanced imaging, and robotic-assisted surgeries, have expanded the range of procedures that can be safely performed in an outpatient setting.

Market Introduction and Definition

Ambulatory surgical centers (ASCs) are healthcare facilities focused on providing same-day surgical care, including diagnostic and preventive procedures, without the need for hospital admission. These centers offer a convenient, cost-effective alternative to traditional hospital-based surgeries. ASCs are equipped with advanced medical technology and staffed by specialized surgical teams, ensuring high-quality care. Common procedures performed in ASCs include orthopedic surgeries, endoscopies, ophthalmic surgeries, and cosmetic procedures. They enhance patient experience by reducing wait times and lowering infection risks associated with hospital stays. ASCs play a crucial role in the healthcare system by improving accessibility and efficiency in surgical care delivery.

Key Takeaways

- The ambulatory surgery center market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Ambulatory Surgery Center industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

One of the most significant drivers of the ambulatory surgery center market growth is cost efficiency. ASCs provide surgical procedures at a fraction of the cost of hospital-based surgeries. This cost-effectiveness stems from lower overhead costs, streamlined operations, and efficient resource utilization. ASCs avoid many of the expenses associated with inpatient care, such as hospital stays and extensive administrative processes. This efficiency translates into savings for patients, insurance companies, and the healthcare system at large. The financial advantages make ASCs attractive to both payers and patients, fostering market growth. Additionally, the rise of high-deductible health plans has made patients more cost-conscious, further driving the preference for ASCs.

However, despite the benefits, the ambulatory surgery center market forecast faces significant restraints, particularly related to regulatory and accreditation challenges. ASCs must comply with stringent regulations set by federal and state authorities, including the Centers for Medicare & Medicaid Services (CMS) and the Accreditation Association for Ambulatory Health Care (AAAHC) . These regulations ensure patient safety and quality care but also impose financial and administrative burdens on ASCs. Compliance requires significant investment in infrastructure, staff training, and continuous quality improvement programs. Smaller ASCs, in particular, may struggle with the costs and complexity of meeting these requirements, which can hinder their growth and operational efficiency. Furthermore, any changes in healthcare policies or reimbursement rates can impact the financial stability of ASCs, adding another layer of uncertainty.

In addition, technological advancement improve surgical outcomes, reduce recovery times, and enhance patient satisfaction. Additionally, advancements in anesthesia and pain management have made it possible to perform complex surgeries with minimal discomfort and quick discharge. ASCs that adopt these cutting-edge technologies can attract more patients and perform a broader array of procedures, thereby increasing their market share. Moreover, telehealth integration can further streamline pre-operative and post-operative care, enhancing the overall patient experience and operational efficiency of ASCs.

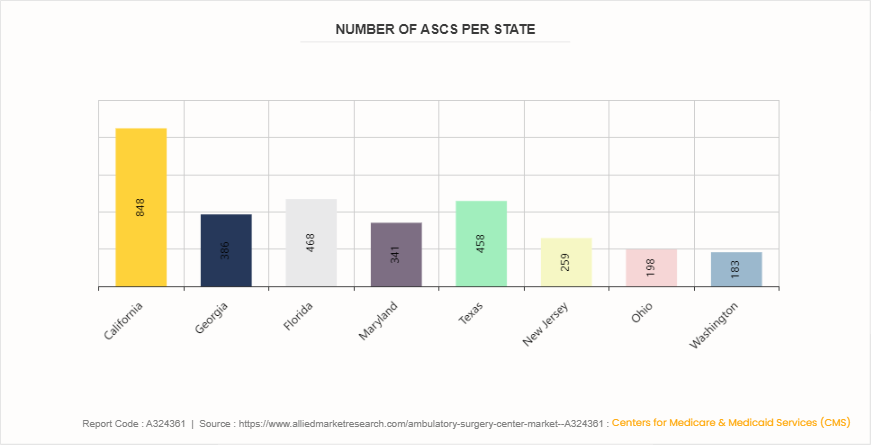

Number of ASCs per State for Ambulatory Surgery Center Market

According to Centers for Medicare & Medicaid Services (CMS) , December 2022. The data illustrates the number of ambulatory surgical centers (ASCs) in various U.S. states. California leads with 848 ASCs, indicating a significant presence of outpatient surgical facilities. Florida follows with 468 ASCs, and Texas has 458, highlighting these states' substantial investment in accessible surgical care. Georgia has 386 ASCs, while Maryland has 341, both indicating robust infrastructure for same-day surgeries. New Jersey, Ohio, and Washington have 259, 198, and 183 ASCs, respectively, showing a moderate but vital availability of ASCs. These numbers reflect regional differences in healthcare infrastructure and the growing trend towards cost-effective, outpatient surgical solutions.

Market Segmentation

The ambulatory surgery center market share is segmented into center type, application, modality and region. On the basis of center type, the market is categorized into single specialty centers, and multispecialty centers. On the basis of application, the market is segmented gastroenterology, ophthalmology, orthopedics, neurology, and others. On the basis of modality, the market is segmented into hospital based ambulatory surgical center, and freestanding ambulatory surgical center. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The ambulatory surgery center market size shows diverse regional and country-specific growth trends. In the United States, the market is highly developed, driven by cost-efficiency, technological advancements, and favorable insurance policies. Europe, particularly in countries like Germany and the UK, is witnessing steady growth due to increasing healthcare expenditures and a shift towards outpatient care. In the Asia-Pacific region, countries like China and India are emerging markets, fueled by growing healthcare infrastructure, rising medical tourism, and an expanding middle-class population. Overall, regional variations reflect differing healthcare systems, economic conditions, and regulatory environments, influencing the adoption and expansion of ambulatory surgery centers globally.

- In July 2022, Centura Mercy Hospital, the health care leader, announce it is partnering with local physicians to expand its commitment to high-quality care through the construction of a new ambulatory surgery center (ASC) in Durango, Colorado.

Industry Trends

- In February 2022, EMU Health, a multi-specialty outpatient medical facility in the Glendale section of Queens, celebrated its first total knee replacement surgery in an outpatient setting. The surgery was performed at EMU Health’s ambulatory surgery center by Dr. Ivan Madrid, a leading orthopedic surgeon who specializes in joint replacement surgery.

- In June 2023, according to ASC Data, the number of single-specialty ambulatory surgical centers in the U.S. were 3, 082 in number.

Competitive Landscape

The major players operating in the ambulatory surgery center market include CHSPSC, LLC., Edward-Elmhurst Health, Envision Healthcare Corporation, Healthway Medical Group, Nexus Day Surgery Centre, Pediatrix Medical Group, Prospect Medical Holdings, Inc., SurgCenter, Surgery Partners, and TH Medical. Other players in the ambulatory surgery center market include UNITEDHEALTH GROUP, Holding Dermapharm, Eifelhöhen-Klinik AG, and so on.

Recent Key Strategies and Developments

- In December 2023, MDsave, the leading healthcare services platform connecting providers, employers, and patients to transparent and transactable healthcare, announces its partnership with Fountain Point Surgery Center. Fountain Point Surgery Center is a multi-specialty ambulatory surgical facility in Norfolk, Nebraska that provides the highest quality care to patients in a professional setting that is comfortable, efficient, and cost-effective.

- In October 2021, United Surgical Partners International (USPI) announced partnership with Compass Surgical Partners for USPI for buying Compass Surgical Partner's management and ownership stakes in nine ambulatory surgery centers (ASCs) . This collaboration aims to expand USPI's ASC network and enhance their operational capabilities in healthcare services.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Accreditation Association for Ambulatory Health Care (AAAHC)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- Mental Health Foundation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ambulatory surgery center market analysis from 2024 to 2033 to identify the prevailing ambulatory surgery center market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ambulatory surgery center industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ambulatory surgery center market trends, key players, market segments, application areas, and market growth strategies.

Ambulatory Surgery Center Market , by Center Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 229.6 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Center Type |

|

| By Application |

|

| By Modality |

|

| By Region |

|

| Key Market Players | TH Medical, Surgery Partners, Edward-Elmhurst Health, Nexus Day Surgery Centre, Prospect Medical Holdings, Inc., Pediatrix Medical Group, Envision Healthcare Corporation, CHSPSC, LLC, Healthway Medical Group, SurgCenter |

The total market value of Ambulatory Surgery Center Market is $125.7 billion in 2023.

The forecast period for Ambulatory Surgery Center Market is 2024 to 2033

The market value of Ambulatory Surgery Center Market in 2033 is $229.4 billion

The base year is 2023 in Ambulatory Surgery Center Market .

Top companies such as Edward-Elmhurst Health, Envision Healthcare Corporation, Healthway Medical Group, Nexus Day Surgery Centre, held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The single specialty center segment is the most influencing segment in Ambulatory Surgery Center Market.

Loading Table Of Content...