Amphoteric Surfactant Market Research, 2030

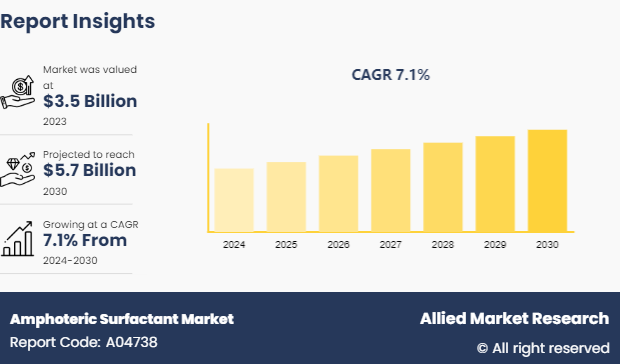

The global amphoteric surfactant market was valued at $3.5 billion in 2023, and is projected to reach $5.7 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030.

Introduction

Amphoteric surfactants are versatile surface-active agents that can function as both acids and bases depending on the pH of the solution. This unique characteristic allows them to be used in a variety of applications. They are commonly found in personal care products such as shampoos, conditioners, and body wash due to their mildness and compatibility with skin and hair. They are also used in household cleaners, industrial cleaning agents, and in the oil and gas industry for enhanced oil recovery processes. The types of amphoteric surfactants available for commercialization include betaine-based surfactants, imidazoline derivatives, and amino acid-based surfactants, each offering specific benefits such as mildness, excellent foaming properties, and biodegradability.

Amphoteric surfactants are poised for significant growth in the evolving landscape of sustainable personal care products. Surfactants play a pivotal role as consumer demand for eco-friendly options intensifies, driven by environmental concerns and a preference for natural ingredients. Major brands like Procter & Gamble and Unilever are publicly committing to ambitious sustainability goals by 2030, driving the adoption of biobased alternatives. Quantitatively, this shift is reflected in a growing market for amphoteric surfactants, which offer both mildness and efficacy in meeting stringent environmental standards and consumer preferences.

Market Dynamics

The surge in awareness of personal hygiene and grooming standards globally has significantly boosted the demand for personal care products, driving the growth of the amphoteric surfactant market. These surfactants are widely used in shampoos, conditioners, and body washes due to their mildness and effectiveness in various pH conditions. In addition, amphoteric surfactants are highly effective in industrial cleaning applications due to their ability to function in both acidic and alkaline environments. This versatility makes them a preferred choice in the formulation of heavy-duty cleaning agents used in industries such as automotive, manufacturing, and food processing, thereby driving the market growth.

Despite the robust growth drivers, the complex manufacturing process and the need for high-quality raw materials result in elevated production costs for amphoteric surfactants. These costs can be prohibitive, limiting the market growth, especially when smaller manufacturers struggle to compete with established players. The production and disposal of surfactants are subject to stringent environmental regulations aimed at minimizing ecological impact. Compliance with these regulations often involves additional costs and can pose challenges for manufacturers, thereby acting as a restraint on the market.

Moreover, emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities for amphoteric surfactants due to increase in urbanization, rise in disposable incomes, and growth in consumer awareness. These factors contribute to the expanding demand for personal care and cleaning products, driving market growth. The increase in demand for environment-friendly and sustainable products is driving the development and adoption of bio-based amphoteric surfactants. These surfactants, derived from renewable resources, offer a greener alternative to traditional petrochemical-based surfactants, opening new avenues for market growth.

Segment Overview

The amphoteric surfactant market is segmented into type, application, and region. By type, the market is classified into betaine, amine oxide, amphopropionates, amphoacetates, and sultanies. By application, the market is divided into personal care, residential and industrial cleaning, oil field chemicals, agrochemicals, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

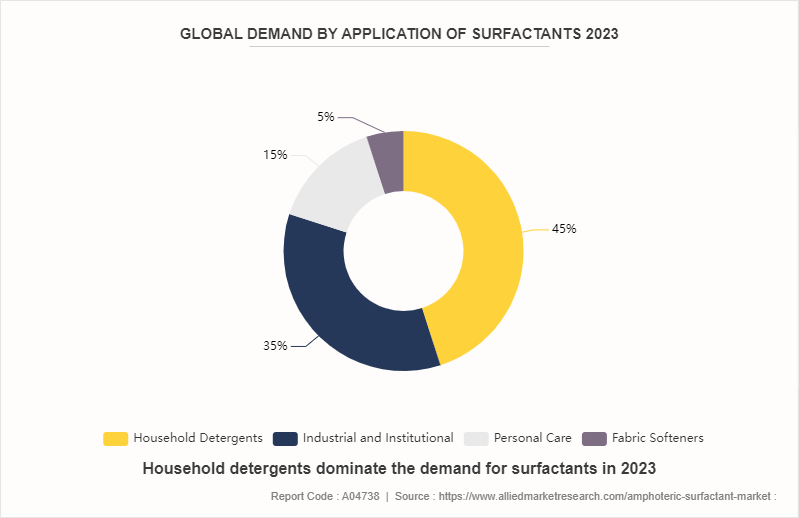

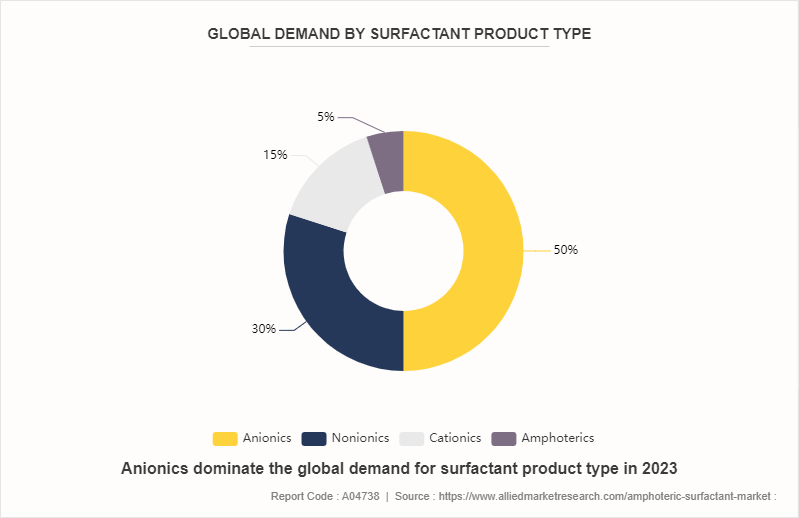

The global surfactant market is dynamic, driven by increasing consumer demand for diverse and sustainable products. In 2023, global demand reached 20.8 million metric tons, with a market value of $45 billion. Household detergents are the largest application segment, while personal care products show higher-than-average growth at 3.1%. Anionic surfactants dominate the market, but milder non-ionic and amphoteric surfactants are growing at rates of 2.9% and 4.2% respectively. Key factors influencing the market include growth in developing nations, product sophistication, sustainability focus, raw material volatility, and regulatory demands.

Amphoteric surfactants, known for their mildness and versatility, are experiencing significant growth within the surfactant market. They are particularly favored in personal care products such as shampoos and conditioners due to their gentle nature and effectiveness across a range of pH levels. With a growth rate of 4.2%, they are one of the fastest-growing product types. This growth is fueled by increasing consumer awareness of product safety and environmental sustainability, along with advancements in formulation technologies.

Competitive Analysis

Key market players in the amphoteric surfactant market include Akzo Nobel N.V., BASF SE, Clariant AG, Croda International PLC, Evonik Industries AG, Lonza Group AG, The Lubrizol Corporation, Oxiteno, Solvay S.A, and Stepan Company.

Key Regulations

Key regulations on surfactant chemicals from major developed and developing countries:

- In the U.S., surfactants are regulated primarily by the Environmental Protection Agency (EPA) under statutes like the Toxic Substances Control Act (TSCA) and the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) . These regulations require testing and registration of new chemicals, ensuring they meet safety and environmental standards. The Food and Drug Administration (FDA) oversees surfactants in cosmetics and personal care products under the Federal Food, Drug, and Cosmetic Act (FD&C Act) , ensuring consumer safety and product efficacy.

- In the European Union, surfactants fall under the REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals) , which mandates registration, evaluation, and authorization of chemicals before market entry. The Cosmetic Products Regulation (EC) No 1223/2009 imposes safety and labeling requirements for surfactants used in cosmetics, ensuring they do not pose risks to human health.

- China's State Administration for Market Regulation (SAMR) oversees surfactants through regulations such as the Measures for the Administration of Cosmetics (MAC) and the Regulation on the Safe Management of Hazardous Chemicals. These require registration and approval for cosmetic products containing surfactants, ensuring safety and quality standards are met before market access.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates surfactants in cosmetics under the Pharmaceutical and Medical Device Act, setting standards for safety, efficacy, and labeling to protect consumers.

- India's Central Drugs Standard Control Organization (CDSCO) regulates surfactants in cosmetics and pharmaceuticals under the Drugs and Cosmetics Act and Rules, ensuring safety, efficacy, and quality through mandatory registration and approval processes.

- Brazil's National Health Surveillance Agency (ANVISA) regulates surfactants in cosmetics and personal care products under resolutions like Resolution RDC No. 481/2021, which sets standards for safety, efficacy, and labeling to protect public health and ensure product quality.

These regulations across different countries aim to safeguard human health and the environment by ensuring that surfactants are safe, effective, and manufactured in ways that minimize environmental impact, thereby maintaining market access and consumer confidence.

Industry Trends

- Increase in demand for eco-friendly and biodegradable surfactants in household detergents, driven by rising environmental awareness and sustainability efforts. Post-pandemic hygiene emphasis continues to boost demand for amphoteric surfactants.

- Surge in preference for bio-based and green surfactants in commercial and industrial cleaning due to increased hygiene and sustainability standards. Economic recovery and new workplace safety protocols are further driving market growth.

- Increase in consumer preference for natural, mild, and sulfate-free surfactants in personal care products. Innovations in bio-surfactants are meeting the demand for sustainable and gentle formulations.

- Rise in demand for eco-friendly fabric softeners as consumers seek sustainable textile care solutions. The growth of the textile industry and consumer preference for comfort drive this trend.

Key Sources Referred

- S&P Global

- Colinhouston

- Intechopen

- MDPI

- Kline Group

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the amphoteric surfactant market analysis from 2024 to 2030 to identify the prevailing amphoteric surfactant market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the amphoteric surfactant market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global amphoteric surfactant market trends, key players, market segments, application areas, and market growth strategies.

Amphoteric Surfactant Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 5.7 Billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2024 - 2030 |

| Report Pages | 330 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Solvay S.A., Clariant AG., Akzo Nobel N.V., The Lubrizol Corporation, BASF SE, oxiteno, Croda International Plc, Lonza Group AG, Evonik Industries AG, Stepan Company |

$5.7 Billion is the estimated industry size of Amphoteric Surfactants market by 2030.

Expansion in pharmaceutical applications, increasing research and development activities, rising demand for green surfactants, are the upcoming trends of Amphoteric Surfactant Market in the globe.

Residential and industrial cleaning is the leading application of Amphoteric Surfactant Market.

Asia-Pacific is the largest regional market for Amphoteric Surfactant

Akzo Nobel N.V., BASF SE, Clariant AG, Croda International PLC, Evonik Industries AG, are the top companies to hold the market share in Amphoteric Surfactant

Loading Table Of Content...